A Masterclass in Financial Engineering

This is a fascinating account of how a company is set up so that public investors only own 8% economic interest and 20% voting interest in the actual money-making company.

When you buy a company’s stock, the general expectation is that you’d own a proportional piece of the company. In other words, your voting power and economic interest in the company should be proportional to the number of shares you own relative to the total number of shares out there.

You might be wondering, “FinanceTLDR, this is basic stock market knowledge, what’s your point?”

Well… sometimes, buying shares in a company gets you way less than what you thought you were getting because of clever financial engineering by the company.

Rocket Companies (ticker: RKT) is a great example of a public company where public shareholders get significantly less of the company than what is generally expected.

The company isn’t doing anything wrong, in a strict sense, but it certainly bucks the trend and uninformed investors could easily misunderstand what they are buying.

This newsletter issue describes how RKT public shareholders only get 8% economic interest and 20% voting interest in the actual money-making company while being at constant risk of severe dilution.

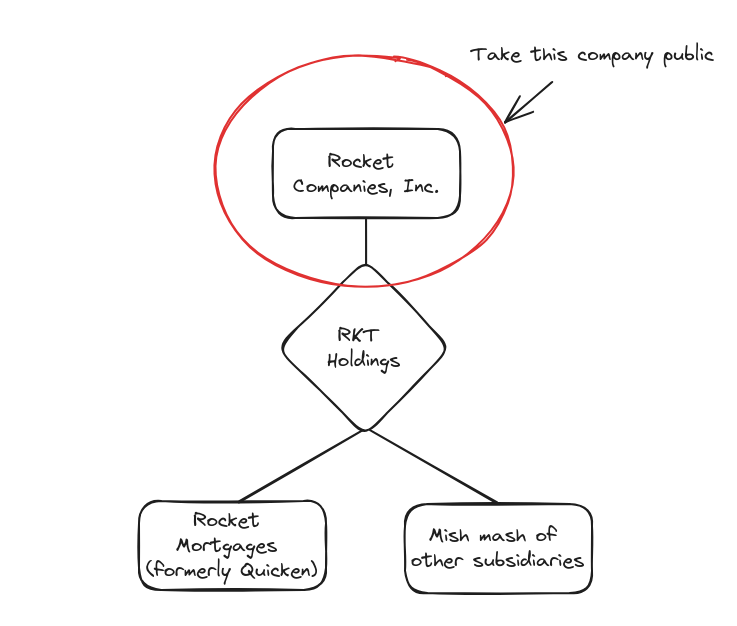

A Quick Intro to Rocket Companies

Rocket Companies is a holding company for various mortgage, real estate and financial service businesses. It’s most well known and largest subsidiary is a company formerly known as Quicken Loans.

You may have heard of Quicken Loans (it rebranded to Rocket Mortgages in 2021). It’s the largest mortgage lender in the US and its speciality is refinancing mortgages. Refinancing a mortgage just means changing the interest rate on the loan. This is typically done by a mortgage lender buying out the old mortgage and issuing a new one to the home owner at a new interest rate.

Rocket Companies IPO’d in August 2020 and the company rode a massive pandemic boom upwards as the Federal Reserve dropped interest rates causing everyone to refinance their mortgages to a lower interest rate.

Now that interest rates have been rising instead of falling, the refinancing business has been tepid but the company is hanging in there and diversifying into other revenue streams.

A Masterclass in Financial Engineering

To understand the nuances of Rocket Companies’s financial engineering, let’s start with the question: how does one financially engineer a complex IPO that disproportionately benefits the company’s owners over public investors?

First, make a new company that you’ll IPO, give it an exciting name fit for a public company, and put it in front of the actual money-making company.

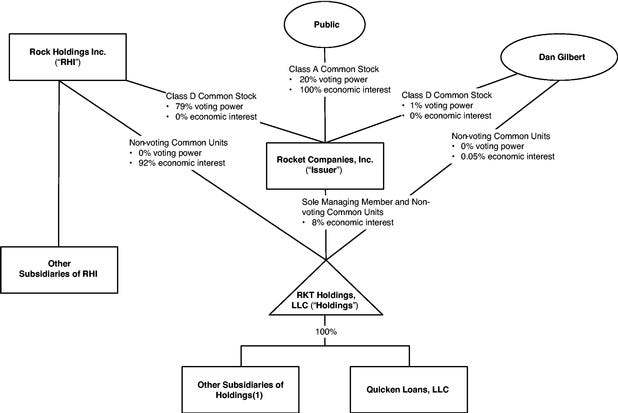

Next, create two different share classes: Class A goes to the public and Class D is exclusively for you. Class A has 20% voting power and 100% economic interest in Rocket Companies; Class D only has 80% voting power. Issue 100 million Class A shares to the public and 1.8 billion (billion with a b!) Class D shares to yourself.

At face value, Class D shares seem harmless enough. You get 80% of the voting power and 0% of the economic interest in Rocket Companies. That is, until you add a new rule where Class D shares can be converted to Class A shares anytime you want. You now have the power to severely dilute the public’s puny number of 100 million Class A shares with your 1.8 billion Class D shares. Perfect!

With the Class D share structure created in your favor, there’s one last problem to tackle: Class D shares get 0% economic interest in Rocket Companies but money is key. Owning 1.8 billion Class D shares is not enough.

To fix this, you add a couple more ownership rules to your corporate mélange.

Give Rocket Companies only 8% economic interest in RKT Holdings (the holding company owning all the money-making companies) and give yourself the remaining 92% economic interest in RKT Holdings.

Now you have voting power, economic interest AND the power to dilute public shareholders anytime you want.

Don’t believe it? This corporate structure diagram below came directly from Rocket Companies IPO S-1 form. It’s a bit more complicated than my diagrams above (Dan Gilbert wholly owns Rock Holdings) but the idea is the same: the public owns 8% economic interest and 20% voting power in the underlying money-making companies while being at risk of dilution by Class D stock.

Fin

Rocket Mortgages is a great company but you’re probably getting less than what you bargained for when you invest in its stock. It’s a great example of financially engineering a complex investment vehicle that’s not what it seems at face value. Stocks generally don’t give public shareholders only 8% economic interest and 20% voting power in the underlying money-making company.

Although Rocket Companies’s corporate structure is complex and obscure, it’s not legally wrong. This is yet another reminder that when it comes to money, it’s always better to read the fine print.