This Is Amazon - A Deep Dive

In 11 minutes, understand Amazon: where the company is at, its valuation, and where it's headed.

In 11 minutes, understand Amazon: where the company is at, its valuation, and where it's headed.

✯ Amazon Today

✯ An AI Story - Three-Layered Framework

✯ An AWS Story - Microsoft Threat

✯ An Advertising Story

✯ A Cost-Cutting Story

✯ Other Innovations

✯ Where’s the Stock Headed?

Amazon Today

Today’s Amazon is a story about cost-cutting, AI catch-up, and large company agility.

The onset and passing of the pandemic rocked Amazon’s finances. During the pandemic, the company significantly increased its capital expenditures (capex) to boost its e-commerce infrastructure, thinking that the lock-downs catalyzed a major retail structural shift from brick-and-mortar to e-commerce. This proved to be an overreaction as the pandemic subsided because (1) people went out again in droves and (2) the Fed rapidly hiked interest rates, making frivolous spending very difficult to justify.

As such, the company focused on aggressive cost-cutting over the past year.

While the cost-cutting story unfolded, the company was again caught flat-footed by OpenAI’s launch of ChatGPT. ChatGPT brought the magical powers of Large Language Models (LLMs) to the public which jump-started a frantic private sector race for AI. At the start, Amazon wasn’t prepared for this race but recognized the urgency and brought all its guns to bear on this new target. The company is now considered one of the top AI companies to invest in next to Microsoft and Google.

It’s not easy to pivot a 1.5-million person company as quickly as Amazon has over the past two years. This is a testament to the long-term thinking and world-class company building of Jeff Bezos (and Andy Jassy) and it’s also perhaps why Amazon is rapidly outgrowing its retail competitors.

Let’s dig into the details.

An AI Story - Three-Layered Framework

Although Amazon was originally caught flat-footed by ChatGPT’s launch in November last year, the company’s subsequent rapid response to the AI boom has been nothing short of spectacular. Within a year, Amazon…

Launched its own LLM called Titan

Launched in April

Launched an LLM-as-a-service called AWS Bedrock

Beta in April, full launch in September

Secured a strategic partnership with top OpenAI competitor Anthropic + $4 billion investment for a minority stake

Announced in September

Pivoted Alexa to focus on a conversational generative AI integration (which unfortunately also resulted in significant layoffs this quarter)

Announced in September

Announced an gen AI corporate assistant tool called Q

Announced in November

Sped up development of its in-house AI chips Trainium and Inferentia and secured strategic industry partnerships for the adoption and improvement of both chips. Trainium and Inferentia give Amazon a cost-effective alternative to Nvidia’s absurdly expensive AI graphics cards

Inferentia2 launched in 2022. Trainium2 announced in November

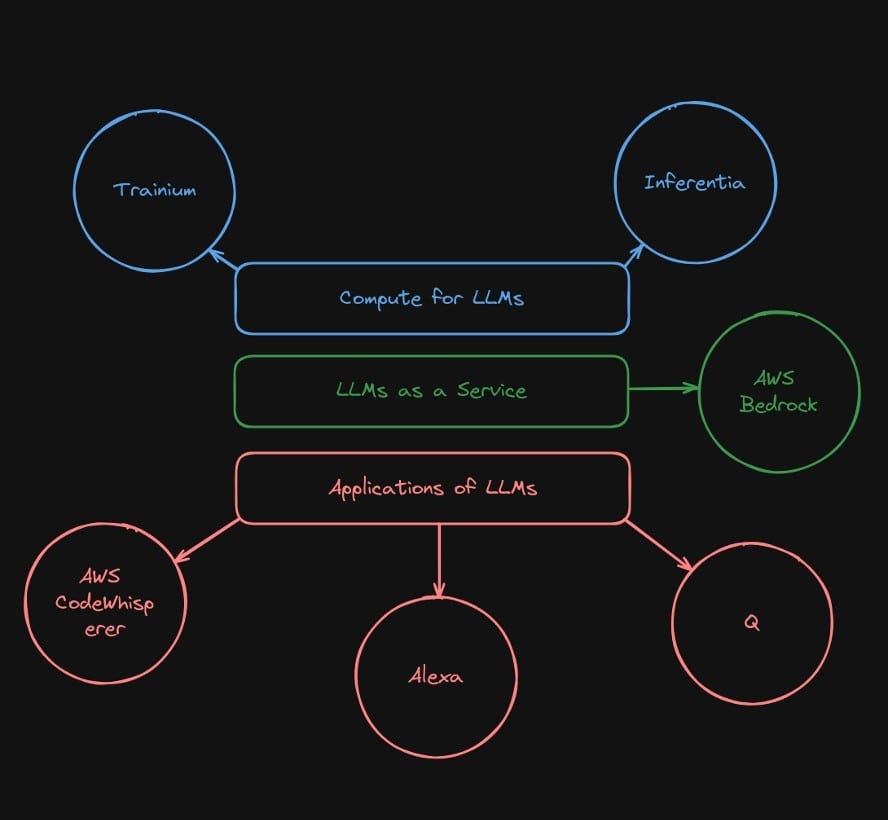

All these initiatives fall into a three-layered AI initiative framework that Amazon has oft discussed in its recent earnings calls:

Compute for LLMs: the hardware that powers AI, aka the Trainium and Inferentia chips

LLMs as a Service: AWS Bedrock

Applications of LLMs: AWS CodeWhisperer, Alexa, and Q

Amazon’s major weakness in AI is its lack of a cutting-edge LLM (the technology powering gen AI). OpenAI, Anthropic, Google, and even Meta have LLMs that are leagues ahead of Titan. To adapt, the company has correctly adopted a strategy of investing and commoditizing. Specifically, the partnership and investment in Anthropic alongside the quick development of AWS Bedrock, a platform that pits many LLMs against each other behind a single coherent API, was very strategic in the face of a major LLM technological shortfall.

If you can’t compete, invest and commoditize.

AWS Bedrock is seeing significant adoption momentum. From the company’s recent Q3 earnings call: “The number of companies building generative AI apps in AWS is substantial and growing very quickly, including Adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few”.

An AWS Story - Microsoft Threat

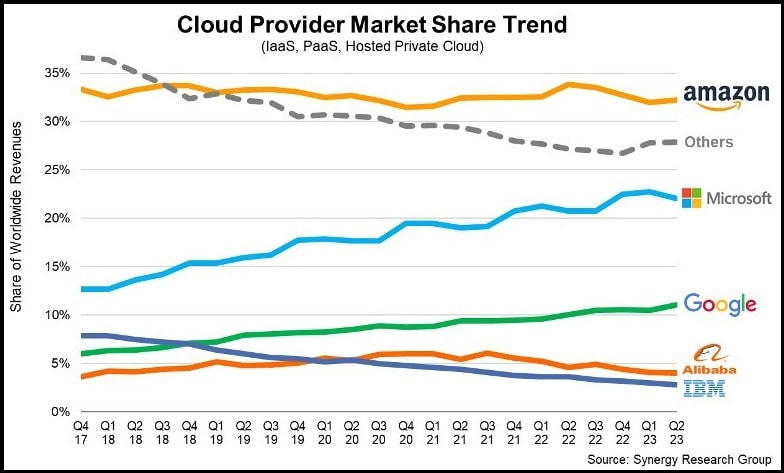

AWS has long been the profit-generating workhorse of Amazon while retail and other businesses have been loss-leading. It faces major competition from Microsoft (Azure) and Google (Google Cloud), with Azure being the greatest threat.

In the recent Q3 earnings cycle, Microsoft Azure’s revenue grew by 29% (soared above analyst expectations at 26%) while AWS only grew by 12% (very slightly under-performed analyst expectations). Many attribute Azure’s accelerated growth to companies using its new OpenAI-powered AI services.

AWS is a step behind Azure in terms of AI offerings and just fully launched AWS Bedrock at the end of Q3 so we’ll see how enterprise cloud AI spend changes in Q4 and beyond. Nevertheless, the market appears optimist that AWS is responding correctly to Azure’s head-start in AI offerings.

An Advertising Story

One of Amazon’s most exciting sub-businesses is advertising. Amazon’s ads revenue has consistently outgrown Google and Meta’s over the past few years, albeit from a smaller base ($12B for Amazon vs $33B and $59B for Google and Meta). The huge potential and remarkable execution of this business cannot be understated. When Google and Meta both saw zero or negative ads revenue growth in 2022, Amazon ads continued to grow at 20% year-over-year!

Insider Intelligence reports that Amazon ads now accounts for 7.5% of the global digital ad market.

There are two main reasons for Amazon ads’s meteoric rise.

First, it’s a relatively new digital ad platform that’s highly effective because it’s as close to a customer’s buying habits as you can get. This allows it to quickly pull ad spend that would otherwise go to Google or Meta. It’s also easy to get high growth from a small base. Second, Amazon was able to pull an unexpectedly large amount of ad spend in 2022 from Meta after the 2021 iOS privacy update that hurt the latter’s ability to target and attribute ads on mobile.

It’s clear that Amazon ads still has significant room for growth, both from taking ad spending from incumbents and from the steady expansion of the overall digital ad market. In the company’s recent Q3 earnings call, Jassy said they have “barely scraped the surfaced” of many aspects of the ads business.

Ads is a particularly bright spot for Amazon today given the company’s critical need for an alternative profit driver to AWS.

A Cost-Cutting Story

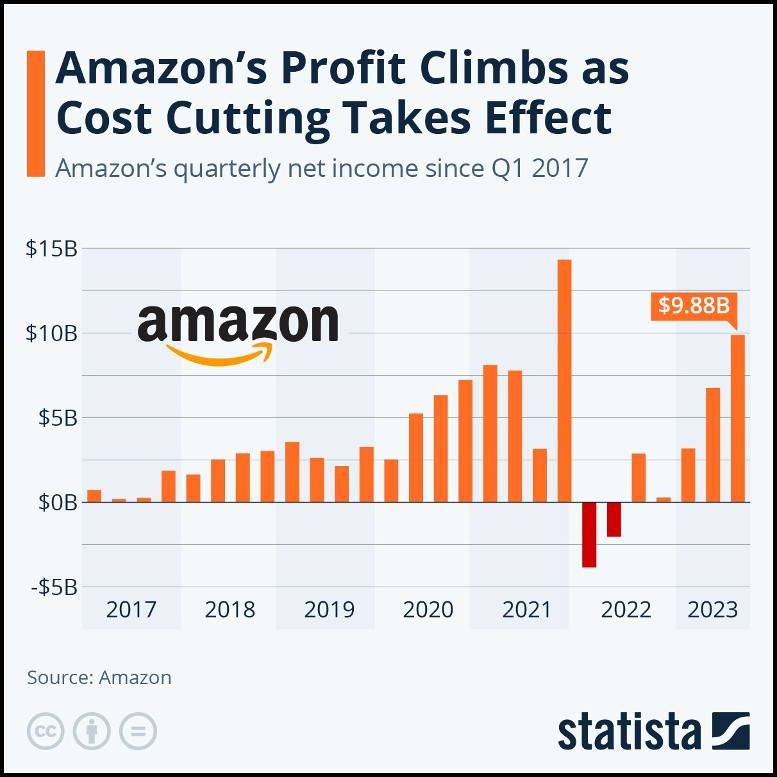

Amazon’s retail and Prime have arguably saturated their respective markets (or are close to) and the focus here after heavy capex during the pandemic is cost-cutting. On this front, the company has “turned the ship around” with remarkable speed. In Q3, Amazon’s North American segment (ex-AWS) saw operating margins improve from -0.5% last year to 4.9%. The International segment (ex-AWS) saw an even bigger year-over-year improvement, from -8.9% to -0.3%.

That’s a lot of cost-cutting.

Together with some cost-cutting in AWS as well, Amazon’s profits have rocketed upwards after a red 2022. See chart below.

Other Innovations

Credits to Amazon for not taking market leader status across multiple major markets for granted. It continues to push for innovation despite a long list of failures.

A special mention must go towards the Alexa/Echo gamble. Although the initiative originally supercharged the home voice assistant market, it was middling out and even declining by 2022. With the AI boom, Alexa/Echo again looks like a stroke of genius as their widespread distribution immediately puts Amazon on the cusp of bringing conversational generative AI to hundreds of millions of households worldwide.

Amazon’s other ongoing innovations that are particularly exciting include:

Project Kuiper: With all due respect, I’m going to call this a Starlink clone but this isn’t meant to understate the impressive engineering that’s gone into the project and the progress the company has made. For example, the recent successful test of a novel capability to optically link two satellites to send 100 gigabits/s across 600 miles is particularly impressive.

Healthcare: American healthcare is a substantial market that’s long overdue for disruption. Few other companies are in a better position than Amazon to take on the regulatory hurdles to disrupt this market and healthcare services fit integrate perfectly into Amazon’s Prime membership business. For example, the company’s successful acquisition of One Medical last year, which is a membership-based brick and mortar clinic network, fits perfectly into Amazon’s Prime + healthcare ambitions.

Lab126: One of the best ways to build a high moat business is to have physical touch-points with consumers that are ubiquitous and well-loved (this is why Warren Buffett loves Apple). Amazon’s Lab126 is the physical devices division of the company and it’s been cranking out innovation after innovation. It’s most recent creation is a cute little home assistant robot called Astro that’s a perfect physical host to serve up gen AI mischief.

Where’s The Stock Headed?

Everything I wrote above, with all the numbers, charts, bullet points, diagrams, is just to say that the stock might go up, down, or stay flat from here.

Just kidding.

Here’s what I really think.

As a successful conglomerate with market-leading presences in both retail and cloud, Amazon serves as a stable foundation to any equity-heavy portfolio. However, the flip-side of being a conglomerate is that it’s unlikely to create spectacular returns.

Wall Street rewards focus and discounts conglomerates. A quintessential example of this is Standard Oil’s breakup that turned John Rockefeller’s $100,000,000 stake into 10 $100,000,000 stakes in 10 companies. In addition, the US government doesn’t like conglomerates and will fire off antitrust lawsuits any opportunity it gets, especially if the company gets too profitable. This is partly why Amazon has historically suppressed its profits by immediately reinvesting excess profits back into the company. A 2022 Reuters article called Amazon “the poster child of technology giants bucking the trend of major conglomerates breaking up”.

With that said, we present a simple framework containing two questions to determine whether Amazon is a BUY, HOLD, or SELL. We can keep it simple because Amazon is such a complex and exhaustively analyzed company that any heavy number crunching is extra unnecessary work. The two questions to answer are:

What are the threats to the company and its stock price?

What are the wild cards in the company’s portfolio that can deliver exceptional growth?

For 1, we think the threats are three fold:

Geopolitical and macroeconomic risk

For example, the ongoing attacks by the Houthis on Red Sea shipping could cause another supply chain crisis which results in higher inflation. Higher inflation means higher interest rates.

Another example, energy prices could suddenly tick up again if the ongoing wars in Europe and the Middle East intensify. Higher energy prices 👉 higher inflation 👉 higher interest rates.

Disruption risk

Disruption from AI. Amazon was caught flat-footed by ChatGPT’s release. It doesn’t have an LLM that comes even close to the power and accuracy of the leading LLMs from OpenAI and Google but Amazon’s auxiliary AI efforts like AWS Bedrock, the Anthropic investment, and the Trainium and Inferentia chips have made it a top AI company.

Regulatory risk

Amazon’s soaring profits this year after a costly 2022 will probably bring increased regulatory scrutiny given its conglomerate status. However, regulatory risks are unpredictable and although bad for a company’s stock price in the short-term, they are rarely catastrophic (see Meta and its incessant legal scuffles with US and EU regulators).

As far as risks are concerned, we think that Amazon is in a good spot for 2024. For one, geopolitical and macro risks are unpredictable and often apply to the economy at-large. In addition, with the Fed signaling a dovish pivot, we think that macro has actually become a tailwind for Big Tech going into next year. In terms of disruption, AI is the biggest disruptive risk for many companies right now, Amazon included. The good news is that the company responded excellently to the threat this year and has set itself up to capitalize on AI moving forward rather than be disrupted. The omnipresence and unpredictability of regulatory risks make it a difficult and unproductive variable to quantify. We think it’s a largely a non-issue.

What about wild cards for exceptional growth? We really like:

Amazon ads

A fast-growing, high-margin business segment that’s primed to take significant market share from Google and Meta. What’s not to love?

AI and Alexa

Alexa’s ubiquitous presence in households worldwide makes it a prime candidate as the consumer’s easiest interface with conversational generative AI. In our opinion, Amazon, with its prescient early investments in Alexa and Echo, is one of only three companies (Google and Apple) that are perfectly positioned to immediately bring the powers of gen AI to hundreds of millions of consumers worldwide.

In sum, we are bullish on Amazon and think that it’s a BUY for 2024. It won’t create spectacular returns, but it’ll serve as an excellent bedrock for any growth-focused equity portfolio.

We have to stress that this isn’t financial advice and it’s for informational purposes only. We hope you’ve found our Amazon deep dive helpful.