Binance Finishes Off FTX

The only summary of the Binance and FTX drama that you'll need. A story about an epic clash of titans and the humiliating fall of a high-flying crypto billionaire with too much hubris and ambition.

We’re currently witnessing the unraveling of the largest crypto insolvency in real time and it certainly has been a show of epic proportions filled with intrigue, subterfuge, and maybe a little bit of schadenfreude. Two crypto titans clashed and only one emerged solvent.

Here’s the quick and dirty, but comprehensive, summary of what happened. Strap in for a wild ride.

If you’ve enjoyed FinanceTLDR’s content, please consider upgrading to premium for only $6/month to support the publication.

In addition, we are working on premium-only content containing our best research and investment ideas. Fret not, FinanceTLDR’s regular content will remain free.

Setting the Stage

Binance is a cryptocurrency exchange founded in 2017 by Changpeng Zhao (CZ). Originally based in China, the company moved its servers and offices out of the country when the Chinese government cracked down on cryptocurrencies in September 2017. The exchange quickly grew to dominate crypto trading and became the largest crypto exchange in the world by volume in just a few years.

FTX is a cryptocurrency exchange founded in 2019 by Sam Bankman-Fried (SBF) and Gary Wang. Similar to the story of CZ and Binance, SBF grew FTX incredibly quickly and in just three years, FTX’s valuation ballooned to $32 billion. SBF was lauded as a crypto visionary as well as a highly savvy CEO for growing FTX to such an impressive valuation with a skeleton crew of only a few hundred employees.

FTX’s rapid success quickly made it Binance’s most threatening competitor.

Play-By-Play

SBF launches crypto hedge fund Alameda Research.

Alameda makes a ton of money arbitraging the “kimchi premium” (Bitcoin prices in Korea were significantly high than US prices).

The kimchi premium slowly fades away and Alameda needs a new profit source.

SBF launches crypto exchange FTX and Alameda provides the initial liquidity to jump start trading on the exchange.

Alameda starts acting as the top market maker for FTX. Market making on FTX becomes the hedge fund’s new major profit source.

In interviews, SBF makes it clear that he’s only in crypto to make money. Reading between the lines, it appears SBF’s mindset has always been to use FTX as just another profit source for his hedge fund, Alameda.

CZ (Binance founder and CEO) purchases a 20% stake in FTX just six months after its launch.

In July 2021, FTX raises $900 million at an $18 billion valuation from over 60 investors, including Softbank, Sequoia Capital, and other firms.

In March 2021, FTX secures naming rights to the Miami Heat basketball team’s stadium in a $135 million, 19-year deal.

Several celebrities invest in FTX and become its brand ambassadors, including Tom Brady and Gisele Bündchen, Stephen Curry, and Shaquille O’Neal.

In January 2022, FTX announces a $2 billion venture fund. The company also raises $400 million in Series C funding at a $32 billion valuation.

In May 2022, SBF buys a 7.6% stake in Robinhood after a significant fall in the company’s valuation.

In June 2022, with crypto prices collapsing, several crypto asset lenders become seriously at risk of insolvency. FTX and Alameda step in to bail out BlockFi and Voyager through several multi-hundred-million dollar deals.

On November 2nd, someone leaks Alameda’s balance sheet and the leak is widely reported. The leaked balance sheet showed that the hedge fund had $14.6 billion of assets and $8 billion of liabilities. Most importantly, the leak exposed Alameda’s ownership of $6 billion worth of FTX’s own cryptocurrency, $FTT. This is an absolutely massive and unusual amount of $FTT for Alameda to own.

On November 6th, Alameda’s CEO, Caroline Ellison, indirectly confirms the accuracy of the balance sheet by tweeting that the leaked balance sheet was incomplete.

With the balance sheet confirmed, CZ spots significant weakness in FTX’s financial position and tweets that Binance and him will be liquidating the entirety of their $FTT holdings. This amounted to about $600 million worth of the cryptocurrency.

At the time, $FTT’s market cap was only around $4 billion with an average daily volume of about $100 million. The selling of $600 million worth of $FTT will undoubtedly collapse the price of the token and CZ’s tweet spooked the market. Everyone else started selling $FTT as well.

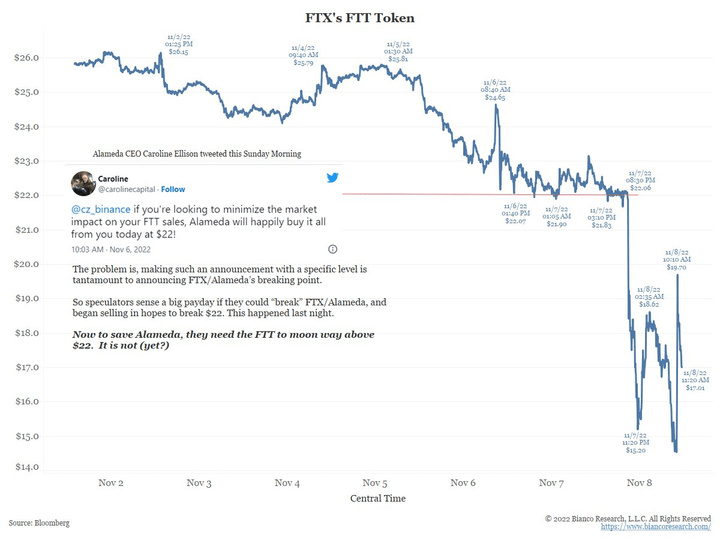

The price of $FTT is somehow integral to the solvency of FTX and Alameda (more on this below). Ellison tweets that Alameda is willing to privately buy all the $FTT CZ wants to sell at $22 in order to keep the token’s public price stable.

The market interprets this tweet as Ellison admitting that if the price of $FTT falls below $22, FTX and Alameda will be insolvent.

At the same time, a bank run is happening on FTX as its customers withdraw $6 billion from the exchange in just 72 hours! The bank run coupled with a falling $FTT price puts FTX and Alameda in serious financial trouble.

CZ publicly responds to Ellison saying that he would rather sell the $FTT tokens on the public market. This further spooks the market and the selling of $FTT intensifies. Alameda and FTX try to defend the $22 price level but this breaks on November 7th after just a little over a day of trading since Ellison’s tweet.

Earlier on November 7th, SBF tweets that “FTX is fine. Assets are fine.” This tweet was later deleted.

In the morning of November 8th, CZ tweets that FTX is experiencing a “significant liquidity crunch” and has asked for Binance’s help. In response, Binance signed a non-binding Letter of Intent to acquire FTX. The acquisition would only happen after Binance performed due diligence on the full state of FTX.

On November 9th, Binance announces that they are walking away from the acquisition deal after seeing FTX’s toxic books. Binance issues a statement saying that FTX's issues “are beyond our control or ability to help.”

On November 9th, Reuters reports that three US government regulators, CFTC, SEC, and DOJ, are investigating FTX.

On November 10th, SBF shuts down Alameda and tells FTX investors that the company needs $8 billion in emergency funding to cover customer withdrawal requests.

Don’t Speculate With Customer Deposits

It’s highly unethical for a trading brokerage to speculate with customer deposits, especially without informing customers of said speculation. For SBF, this ethical line was merely an annoying obstacle for him in his pursuit of unimaginable wealth.

Despite FTX’s overwhelming success, SBF always saw the company as just another source of profits for his hedge fund (this intention was clearly misunderstood by FTX’s large number of celebrity and institutional investors). One way to accelerate profits is to obtain leverage but few mainstream banks were willing to lend to a crypto hedge fund. Being a stubborn entrepreneur with dreams of grandeur, SBF wasn’t going to let the justified excessive caution of traditional financial institutions stop him and he engineered a clever way for Alameda to “borrow” from FTX’s customer deposits without anyone knowing.

SBF did so by first having FTX create and issue its own cryptocurrency, $FTT. Then, he let Alameda buy $FTT tokens from FTX at incredibly low prices. Next, FTX would “pump” the price of $FTT by generating demand through an unending series of paid publicity stunts like sponsoring and naming sports stadiums. This would all be funded by clueless venture capital money. With $FTT’s price inflated, it allowed Alameda to “safely” and cheaply borrow customer funds from FTX by posting the overpriced $FTT tokens as collateral.

The end result of this arrangement is the enabling and obscuring of Alameda speculating with FTX customer deposits as an illicit but cheap source of leverage.

This unethical arrangement worked as long as $FTT’s price remained high (ensuring that Alameda’s loans from FTX’s customer deposits were well collateralized) and FTX didn’t experience a bank run (so FTX could gradually sell $FTT to fund any withdrawal requests even if the token’s price got too low).

When Alameda’s balance sheet was leaked and confirmed, CZ recognized what was going on and saw the inherent weakness of this arrangement.

He immediately went in for the kill.

This is how Binance triggered the overnight collapse of its greatest competitor, and why Axios’s Brady Dale, in an interview on CNBC, called Binance and CZ the “apex predator of crypto”.

The crazy thing is, SBF could have avoided this humiliating collapse of both his ventures if he just pulled his ambitions back a tiny bit and not speculated with customer deposits. Both FTX and Alameda can operate lucratively without putting customer deposits at risk but SBF let his gargantuan hubris and ambitions get way ahead of him.

I’ll end this newsletter issue with this screenshot of partners from venture capital giant Sequoia falling head over heels for FTX after SBF pitched that he wants customers to be able to buy bananas on FTX.

Bananas!