China Doesn't Make Sense, Unless?

The tail risk of investing in China has never been higher.

China’s stock market has been in a major bear market for the last three years.

The Hang Seng Index, which hit an all-time-high of 33k in 2018 and a local max at 30k in 2021, has been on a beeline downwards ever since and is now at 16.8k, 50% below its all-time-high and 44% below its 2021 local peak.

At the same time, China continues to be the world’s foremost manufacturing powerhouse and export volumes remain high. Unlike the rest of the world, the Chinese economy hasn’t been plagued by post-pandemic inflation.

Yet sino-skepticism is seemingly at all-time-highs.

What gives?

In this issue we’ll dive into the Chinese economy, try to explain all the sino-skepticism, and show why a lot of what’s happening doesn’t make sense… unless something very significant is about to happen.

The Bad

The crux of China’s economic problems right now is weak consumer demand.

As Bloomberg aptly summarized after new Chinese economic data came out in January: “consumer prices continue to fall, import growth is stagnant, and the pace of lending is slowing down”.

Put simply, ever since the pandemic, the Chinese people have lost their appetite to spend and China is struggling with persistent deflation.

Weak aggregate demand is often a symptom of something wrong in an economy. People are spending less and there could be a spate of reasons why, all of which are not good.

For example, one reason could be the Chinese people are saddled with debt and can’t spend, another could be that there aren’t enough jobs to go around and people have less disposable income, and a third is that people are just less confident about their future and are thus holding on to more financial ballast.

We’ll dive into the actual reasons behind China’s weak aggregate demand below.

The Ugly

A New Cult of Personality

China’s political landscape has changed significantly in the last decade or so under Xi Jinping’s rule. After securing the top party position in 2013, Xi has been consolidating power under him to create a Mao-like cult of personality around him.

For example, in 2017, Xi’s ideological ruling doctrine, popularly known as “Xi Jinping Thought” was incorporated into the Constitution of the Chinese Communist Party. In 2018, Xi abolished term limits for the presidency, removing a key obstacle for him to rule for life.

The most surprising part of the whole process, besides the speed at which Xi consolidated his power, is how easily the rest of the party let him.

The troubling Cult of Mao days are still fresh in the minds of most of the party leadership as they saw not only the country struggle from Mao’s sweeping and volatile autocratic decrees, but even their families as well. No one was safe under the patronage of Mao’s paranoia.

Xi himself, saw his parents suffer a great deal, and he as well, having been exiled to the countryside to perform harsh labor just because he was his father’s son.

With so much cult of personality angst built into the CCP psyche, why on earth did the party the allow another cult of personality to form around Xi?

We’ll answer this question at the end, when we tie the whole narrative together.

Socioeconomic Policy Volatility 1.0: Wealth Crackdown

Xi Jinping certainly didn’t sit on his laurels with his new found concentration of power. In the past few years, he has subjected the country to one sweeping socioeconomic policy decree after another.

The two most famous of which are the crackdown on Wealth Concentration (with Jack Ma as the face of this crackdown) and the crackdown on a Highly Leveraged Real Estate Industry (with Evergrande as its face).

In November 2020, at the height of Alibaba billionaire Jack Ma’s power, his other company Ant Group was set to explode onto public markets with a $37 billion valuation. It would’ve been, at the time, the world’s largest IPO.

Running high on prestige and wealth, Jack Ma became a very outspoken billionaire, frequenting the public airwaves to share Jack Ma Thought on world affairs, and most importantly, China affairs.

However, right as Ant Group was about to IPO, Xi Jinping brought along his entourage of CCP officials to kick down the doors of the party and end it. Ant Group could not IPO and Jack Ma had to quiet down for a while.

Since then, the whereabouts of the fallen multi-billionaire became the subject of much public discourse.

Of course, the crackdown on private wealth and power was not limited to Jack Ma and his businesses. Many other high-flying private companies, especially in tech, experienced a similar heavy-handed “tamping down” treatment.

Even today, more than 3 years after Ant Group’s IPO was blocked, China’s ultrawealthy elites are still reeling from the crackdown.

CNBC reporter Michelle Caruso-Cabrera recently spoke with an American CEO who met with Xi Jinping during the 2024 China Development Forum in Beijing last week.

She had this to say about their conversation:

“After spending nearly a week there speaking with the leadership and members of the business community, this CEO said there was no indication the country is is backing away from centralizing the economy”

“He said wealthy Chinese are fearful and selling items that are seen as ostentatious, such as private jets, "because its dangerous to be rich in China." He added that they are trying to get their money out of the country.”

Not good.

Socioeconomic Policy Volatility 2.0: Real Estate Crackdown

At the same time the Wealth Crackdown was happening, the government started a major Real Estate Crackdown. In August 2020, the government introduced the infamous Three Red Lines financial regulation that was especially aimed at China’s high-flying and highly indebted property development firms.

These new rules instantly put many of these firms underwater. The most internationally visible of which is Evergrande, the country’s second largest property development firm at the time.

Despite largely being a controlled, albeit hasty, deleveraging (according to top China analyst Jason Hsu, the government had extensively simulated the Three Red Lines policy before implementing it), it was an incredibly painful process for the affected companies and their millions of customers.

Given the real estate sector’s massive size and importance in Chinese society, its sudden rapid contraction had far-reaching implications for the country beyond asset prices.

What one must know about the Chinese people and real estate is that real estate is considered to be the most reliable store of wealth in the country.

Unlike in the US, where the S&P 500 only goes up, stocks are viewed with great suspicion in China. As such, the average Chinese doesn’t know of an alternate store of wealth besides real estate and the sudden fall of the industry has created widespread “Wealth Angst” in the country.

This is one of the top reasons for the country’s anemic aggregate demand.

Massive Capital Outflows

Xi Jinping’s socioeconomic policy volatility and aggressive crackdowns have worried Chinese and international investors alike.

This is manifesting as significant capital outflows from the country in the past 5 years.

The tidal waves of capital divestment from China have been incessant and this is the Biggest Issue plaguing the country’s economy right now.

By the way, we think that capital flight from China is the top reason for the ongoing cryptocurrency bull market, given that cryptocurrencies is the best way to move money out of a country with tight capital controls.

The Good

The thing is, things may be bad, but it’s Not That Bad.

China is actually in a very strong economic position right now. This is why, at face value, the large capital outflows don’t make sense.

First of all, China’s export industry is booming and has yet to see its best days. There are two parts to this story:

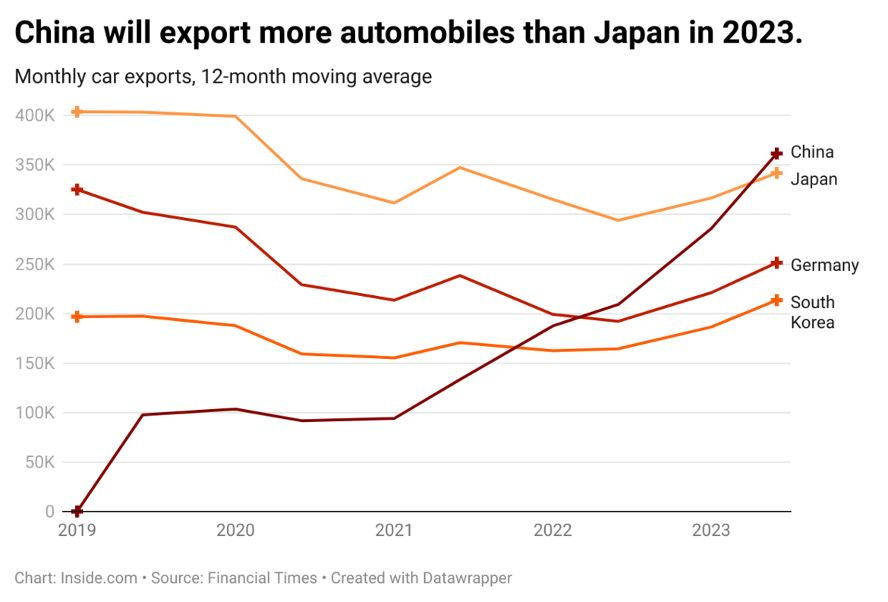

Moving up the value chain: China is rapidly moving up the value chain in manufacturing. The best example of this is its booming car industry. In just two years, from 2021 to 2023, the country rose from the world’s fourth largest car exporter to become the largest, outpacing incumbent juggernauts like Germany and Japan in a heartbeat.

Friend-shoring low value products: at the same time, the country is holding on to its once-dominant low value manufacturing industry and moving its factories to Low Cost Of Labor and Western-friendly countries like Mexico and the Philippines.

This has resulted in persistent year-on-year positive Current Account flows despite the large capital outflows. The world is still pouring money into China even as investment capital flees.

Secondly, remember how I wrote about Japan’s low domestic consumption rate because of the prevalence of Danshari (断捨離) in the Japanese psyche?

Well the Chinese psyche takes embodying Danshari up a couple notches. China has one of the lowest, if not the lowest, domestic consumption rate among developed countries.

This, coupled with an incredibly high savings rate and tremendous workforce productivity, makes China the most financially sustainable developed country in the world.

It Doesn’t Make Sense… Unless?

Now that I’ve set the stage with all this preamble, it’s time to ask the Big Questions. The answer to these questions will tie the whole narrative together.