Do This Now to Trade Like DeepFuckingValue (GameStop Deca-Millionaire)

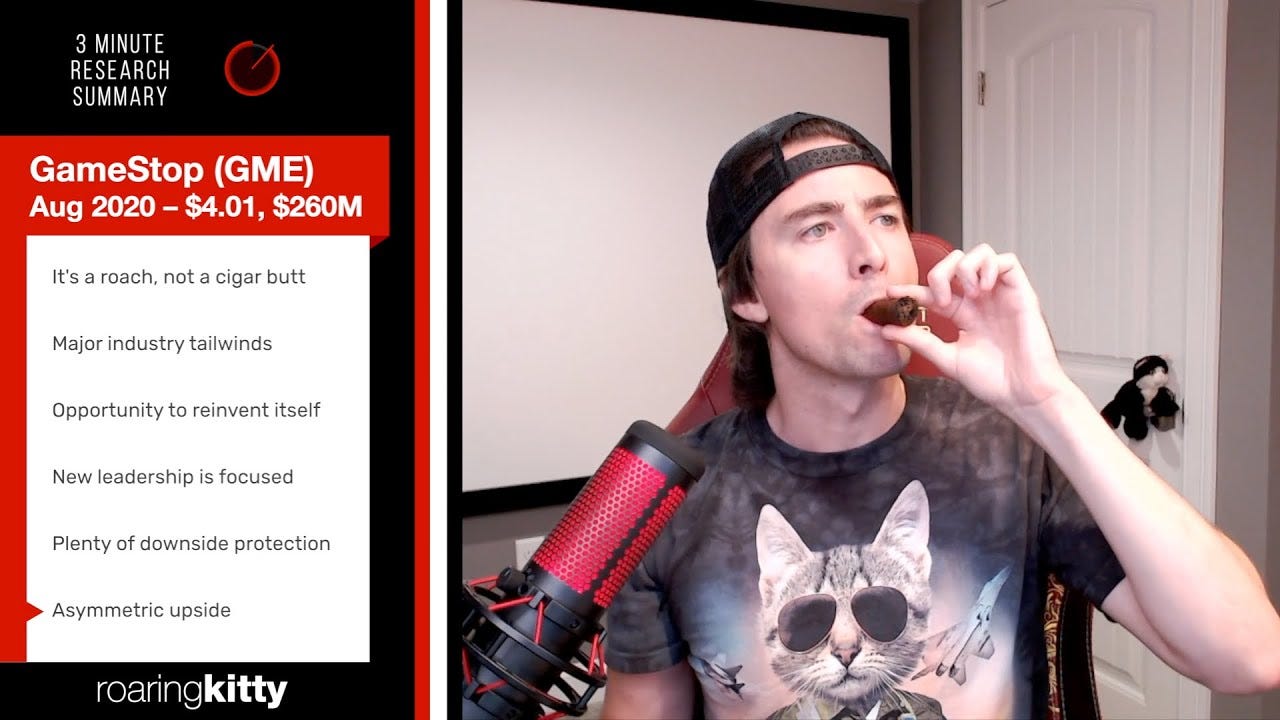

An indepth guide to how you can trade like GameStop deca-millionaire DeepFuckingValue, who's analysis led him to invest in GME more than a year ago when it was under $5.

At the peak of GME's price last week, DeepFuckingValue's portfolio was worth more than $50 million... and this all started from $50,000 invested in just over a year ago. So how exactly did DeepFuckingValue (DFV) find GameStop and see massive potential? Was it a fluke or was it the result of an intelligent due diligence process? After watching several of his videos and breaking down exactly how he finds companies to invest in, I'd say it's the latter; but you can be the judge. Here's how DeepFuckingValue does it, and how you can copy him.

This article is an in-depth continuation of last week's article exploring DFV's investment process.

Create an efficient research process

If you've ever researched a stock, you know that it's time consuming and messy. Information takes time to gather, organize, and understand. To solve this problem, DFV has an elaborate and efficient research process centered around a Google Sheets spreadsheet that fetches and organizes information from a wide range of online sources. Significant effort was spent making the spreadsheet efficient to use.

Although you don't have to create a spreadsheet as complicated as DFV's, the key takeaway is to be obsessed with streamlining your own process to save as much time as possible. After all, every stock that you haven't researched could be a missed opportunity.

A spreadsheet serves as an aggregator of the disparate information sources out there. Here're a list of websites DFV uses for his research:

StockCharts.com: used to view stock charts. It's a paid product and a free alternative is TradingView.com.

OpenInsider.com: used to view insider trading activity.

WhaleWisdom.com: used to view institutional ownership of stocks.

SeekingAlpha.com: used to find research from a large community of independent analysts.

Twitter: excellent for staying up-to-date on market news, gauge sentiment, and on the rare occasion, has insightful conversations.

FINRA bonds: used to find the yield of a company's bonds. Bond yields are an excellent gauge of a company's insolvency risk.

Pay attention to Insider Trading

Insiders are people with extra information about a company that isn't public (material nonpublic information, or MNPI). A great example are C-suite executives that have real-time information on how the business is performing and where it's headed. Given their access to MNPI, the buying and selling of company stock by insiders is an amazing signal for where a stock is headed. Thankfully, this information is publicly available and it's no wonder that insider trading is DFV's favorite trading signal.

An excellent website that aggregates insider information is OpenInsider.com. It's simple, easy-to-use, and most importantly, free.

Investors looking for undervalued stocks should watch out for frequent and sizable insider purchases (e.g. more than $100,000). It's even better if multiple insiders buy at the same time. This works best for small to mid-sized companies and is a less effective signal for large companies that are well understood publicly with a stable stock price.

Follow hedge funds that invest like you do

You should understand what type of investor you are and follow hedge funds that invest like you do. DFV, being a value investor, follows several value-oriented hedge funds. A key inspiration for his GameStop trade is hedge fund Scion Asset Management. Scion held a large GameStop position before DFV and had sent a series of publicly-available letters to GameStop's management expressing their confidence in the company's potential and encouraging management to turn the company around. Scion's involvement served as a strong impetus for DFV to buy his own stake in GME.

There are several websites that keep track of hedge fund holdings by aggregating information from quarterly 13F filings. DFV recommends WhaleWisdom.com. These websites help you find funds that have a similar investment strategy as you. Once you've found them, dive into their portfolios, understand their research, and keep close tabs on them. The ideas, commentary, and investments of hedge funds serve as excellent inspiration for the construction of your own portfolio.

Follow great independent analysts

Even though hedge funds often produce high quality research, they can be bureacratically slow and secretive. That's why DFV also follows research from independent analysts. He keeps a list of analysts and closely tracks their commentary and research. The problem with independent research is that there's just so much of it out there and you really need to isolate the signal from the noise. It's well worth the effort to do so; high quality independent research can even be better than institutional research since their authors are not bound by bureacracy or institutional orthodoxy.

An excellent website to find independent research is SeekingAlpha.com. There's a vast collection of research on it and you can sift through the articles for analysts that are worth following. DFV also notes that you shouldn't limit your search to articles, comments can also help you find people to follow.

Being a contrarian pays. Don't be afraid to "dabble in sh*t"

DFV aggressively targets for a 50% to 100% annual portfolio growth rate. That's why he specializes in investing in small to mid-cap companies and is particularly interested in seemingly hopeless stories that makes a surprising comeback. This type of stocks have high risks, but can also generate outsized returns. He reduces his risk through diversification (typically more than 30 stocks in his portfolio) and immaculate research. You can see this in practice through a screenshot of a portion of his portfolio in August 2020. Notice that most of the stocks in the portfolio represent less than 3% of the overall portfolio, and their market caps are rarely above $5 billion.

If you also want to invest in high risk stocks, here's a quick tip by DFV on checking for a company's bankruptcy risk. Use the FINRA bonds website mentioned above to see the yields of bonds issued by the company. The higher the yield, the more likely the bond market believes the company will go bankrupt. Bonds might be boring but the bond market does its homework. Afterall, if all you want is to make sure the company doesn't declare bankruptcy before your bond matures, you'd spend extra effort pricing in the risk.

Understanding financial metrics

Finally, the best way to find undervalued companies is to understand their fundamentals. This means understanding their financial situations. If you've ever dived into a company's 10-K, you know that financial statements are complex and hard to understand. Learning how to read them seems like a daunting process. Fortunately, there are shortcuts. Financial statements are a comprehensive view of a company's performance and thus have a wide array of different business metrics. It turns out, only a few of them are sufficient for a good-enough-understanding of how the company's doing.

Here are some examples:

P/S ratio (Price to Sales ratio): this metric measures a company's market cap relative to its annual revenue. The lower this ratio is, the more likely the company is undervalued. It's one of the best gauges of a company's valuation and a DFV favorite. A great example of GME's extreme undervaluation was their 0.05 P/S ratio in the second half of 2019 while the S&P500's average P/S ratio was around 2.

P/FCF (Price to Free Cash Flow ratio): free cash flow measures the company's ability to pay debt, pay dividends, buy back shares, or grow the business. The lower this ratio, the more likely the company is undervalued. Free cash flow is often used to measure a company's health and is also a way to double check what the P/S ratio is telling you.

P/B ratio (Price to Book ratio): this metric measures a company's market cap relative to its book value. Book value is the total value of the company's assets that shareholders would receive if a company is liquidated. The lower this ratio, the stronger its balance sheet and the more likely the company is undervalued. For a company experiencing structural decline, a strong balance sheet, especially one with a lot of cash, gives the company room to potentially turn the business around before bankruptcy. This metric is important for DFV's investment style since he invests in high risk companies.

Disregard the P/E ratio (Price to Earnings ratio): this metric is commonly cited as a measure of a company's valuation but using earnings as a way to value a company has fallen out of favor in recent years (besides for mature, highly profitable companies). There are many companies with an insanely high or even negative P/E ratio and yet trade at very generous market caps. The irrelevance of earnings is especially true for small market cap companies that DFV likes to invest in, where growth is more important than making money.