Research - The Fraying World Order, Part 2

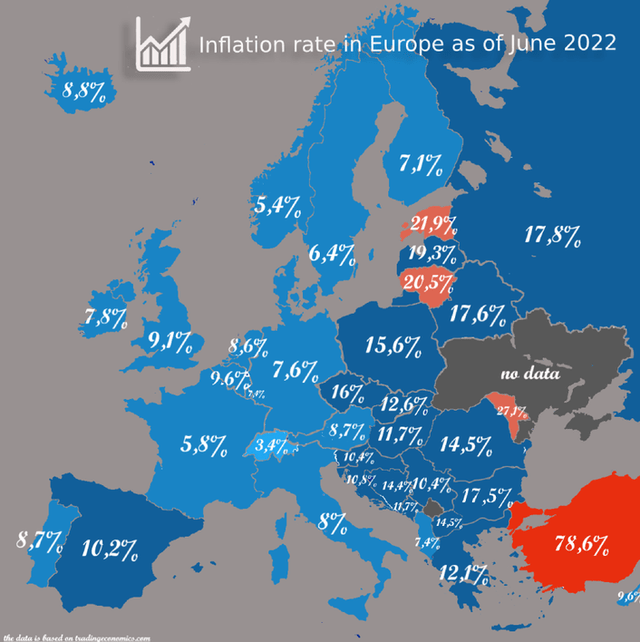

The EU's ongoing economic woes have potentially disastrous consequences for the fragile union. The European Central Bank is paralyzed despite soaring inflation and a crashing Euro. Let's discuss.

This is the second issue in The Fraying World Order newsletter series. Two weeks ago, I wrote about Saudi Arabia starting to break ranks with the West. In this issue, we’ll discuss a Europe that’s tearing at the seams.

Europe is in a really tough economic spot right now. From a war on its eastern border to soaring domestic inflation and a crashing Euro, the EU desperately needs its last economic line of defense, the European Central Bank (ECB), to moderate economic conditions. However, the ECB is paralyzed with little options to cure the fragile union’s ailments. If the situation festers, it has the possibility of crumbling the foundations underpinning the EU’s existence.

Here’s why.

The story starts across the Atlantic Ocean in a country we’re all familiar with, the United States. In response to the global pandemic, the US government worked with its central bank, the Federal Reserve, to print trillions of dollars for economic stimulus. This stoked enough domestic inflation that the Fed was forced to aggressively raise interest rates lest the country be sent into a disastrous inflationary Wage Price Spiral. In a matter of three months, the Fed raised the Fed Funds Rate from 0.25% to 1.75%. The market is expecting another 75-basis-point hike later this month.

At the same time, the ECB has been waffling on raising interest rates. Its main policy interest rate was stuck at -0.50% until just yesterday when the bank surprised the market with a 50-basis-point hike.

Design deficiencies of the EU’s monetary system have tied the ECB’s hands. More on this later in the article.

The large and growing spread between interest rates in the US and interest rates in the EU is a major driving force behind the Euro’s rapid decline against the US dollar. From a EUR/USD high of over 1.20 last year, the Euro fell to be at par with the dollar last week (it even dipped below parity for brief periods).

This hasn’t happened in 20 years!

Aside: Higher interest rates in a country causes its currency to appreciate because investors earn more holding its currency and bonds. As such, when a country’s interest rates rise faster than its peers, more international investors flock to its currency and bonds.

Before we dive further into how the crashing Euro and uncontrolled inflation is tearing apart the EU, and why the ECB is largely paralyzed from doing anything meaningful, let’s provide some context on how the EU’s monetary union works and the internal strifes and differences making the ECB’s job incredibly hard.

Europe’s (Fraying) Bonds

Here’s a quick and dirty overview of the European Union’s monetary policy. It certainly won’t be comprehensive, but it’s sufficient for the article’s purposes.

Just like the Fed, the ECB is able to print money to buy bonds. However, while the Fed doesn’t need to choose what bonds to buy (they simply buy US government bonds), the ECB, when buying bonds, has to choose between bonds issued by different EU member states.

This makes the ECB’s job significantly more complicated. Although the countries in the EU are joined together in an economic union, national differences and national pride runs deep, solidified by centuries of conflict and coexistence.

As such, if the ECB favors one country in its bond-buying program, other countries will protest. Unfortunately, and needless to say, EU countries vary dramatically in their economic situations and it’s impractical for the ECB to proportionally buy the same amount of bonds across all member states.

Some countries need the extra help more than others, but biased help often conflicts with the national ambitions of countries left out.

For example, Germany (perhaps the union’s strongest economy) has been famously known to butt heads with the ECB.

Two Europes

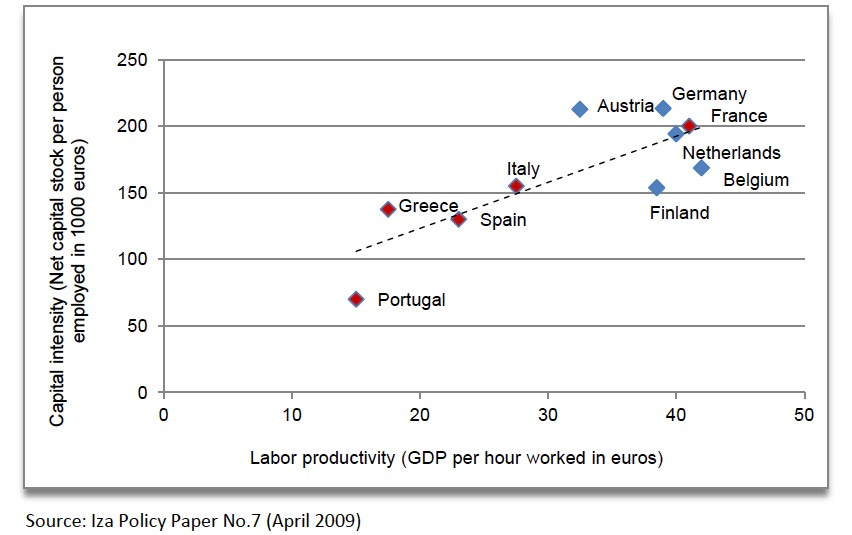

As fellow finance newsletter Rumelia Letters aptly describes, there are two Europes within the European Union. They are divided geographically and economically. Put simply, Southern Europe is significantly less productive than Northern Europe. As a result, Southern European countries (e.g. Italy and Greece) tend to sustain trade deficits, importing more than they export, while Northern European countries (e.g. Germany and the Netherlands) tend to experience trade surpluses as net exporters.

In times of economic stability, the productivity gap between the two Europes is easily ignored by investors. During times of economic stress, this difference often rears its menacing head.

The Crux of the Problem

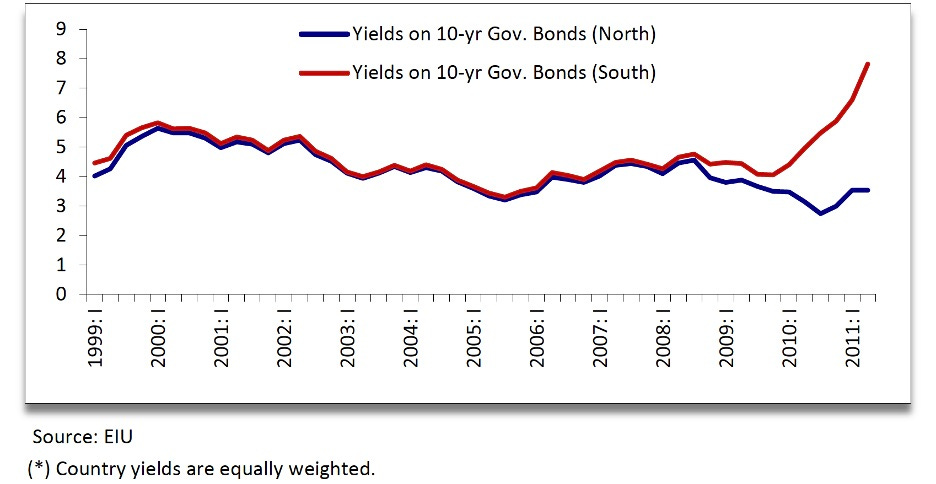

Herein lies the crux of the problem. As the Euro crashes, the net importing countries of Southern Europe struggle as import costs rise, while the net exporting countries of Northern Europe benefit. This causes investors to abandon the bonds of Southern European countries in favor of Northern bonds.

The result? Rising bond yields in the South and stable or falling bond yields in the North. Rising bond yields is bad for countries as their borrowing costs increase. If yields go too high, the country might be forced into insolvency as they can no longer afford to issue new bonds to fund the country’s government and infrastructure while paying interest on outstanding bonds.

The widening spread between North-South bond yields has prevented the ECB from raising interest rates. If they do, they could subject the financially weaker Southern European countries to a high risk of default.

The usual central bank solution to this is to print money and artificially suppress bond yields by buying bonds. Unfortunately, the ECB has to contend with the national interests of the Northern European countries. The Germans, despite being under the same EU roof as the Italians, don’t want to foot Italy’s bill.

As such, it’s very hard for the ECB to raise interest rates nor shift money around the EU to support Southern Europe, but they desperately need to do so in the face of uncontrolled inflation and a crashing Euro.

Talk about being stuck between a rock and a hard place!

Fin

The recent turmoil in the global economy and the war in Eastern Europe has put a spotlight on the weaknesses of the relatively nascent European Union. Unsurprisingly, an economic and monetary union that’s only decades-old can’t override the deep-rooted national and cultural divisions ingrained from centuries of conflict and coexistence.

The ECB has its work cut out for it to keep the union together. They’ll likely have to strike a compromise with the North to save the South. Without policy finesse from the ECB, if current economic conditions persist, the EU will likely tear itself apart.

Fortunately, we don’t think this will happen anytime soon. Although the EU and its member states are currently presented with a buffet of terrible options, the disintegration of the EU is certainly the worst of the lot. Multiple unpleasant but palatable alternatives exist (e.g. significant financial support of the South or the ending of the Eastern European war) before the continent is forced to contend with the possibility of disastrous disintegration.