How Did Sam Do It? The Grand FTX Heist

Recounting the fascinating way Sam Bankman-Fried pulled off his multi-billion dollar FTX heist and how it all collapsed.

For this newsletter issue, let’s do something different.

I wanted to write about how Sam Bankman-Fried (SBF) pulled off one of the biggest scams in the last decade. As most of us are aware, SBF and his motley crew of FTX/Alameda execs stole billions of FTX customer deposits to fund lavish lifestyles and spend wantonly on frivolous things like Bahamian real estate, political donations and sports team sponsorships.

Both FTX and Alameda have since folded and the key wrongdoers of the scheme have been arrested and are going through US federal criminal trials.

Here’s the fascinating way SBF pulled off this multi-billion-dollar scheme, and how it all collapsed.

The three main ingredients necessary to pull this scheme off are:

An ability to create fake but outwardly credible wealth.

An ability to convert this fake wealth into real dollars in your bank account, with plausible deniability.

A veil of secrecy.

SBF achieved all three, in practice, through conducting business in a nascent and poorly monitored financial system (cryptocurrencies), starting a real, highly credible, and popular company called FTX, and pairing this company with Alameda, a shady offshore hedge fund exempt from the SEC's strict reporting requirements.

Let’s discuss the details.

🧩 An ability to create fake but outwardly credible wealth

One powerful and easy wealth-creation scheme with cryptocurrencies is the ability to create “tokens” and immediately make markets for them.

These tokens would essentially act as a defacto currency and all the accounting and transactions of them would be guaranteed by the blockchain (e.g. Ethereum).

This is a powerful feature of cryptocurrencies that’s easily abused.

SBF created the Ethereum-hosted FTT token and used his FTX exchange to do just that. Given FTX’s massive popularity as a crypto exchange, SBF could quickly and easily create a market for these FTT tokens.

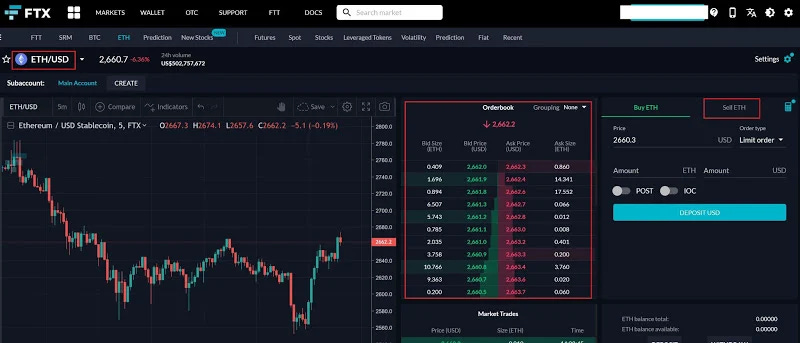

Creating a market for the FTT token means creating bid and ask orderbooks with the ability to match orders in both books to create transactions. A transaction is a transfer of FTT token from one trader to another, at an agreed upon $ price. This ultimate results in a constantly updating price for the FTT token, through a constant stream of transactions, as well as the ability for anyone with an account at FTX to invest or divest in the token.

One flawed but common way of calculating the value of an investment is by multiplying the quantity of the asset owned by the last traded price of the asset.

In the case of the FTT token, if the last token traded for $100 per token and there were 100 million outstanding FTT tokens, it was not unusual to imply that the FTT token had an aggregate market cap of $10 billion.

This is a dangerously false conclusion, because no one with $10 billion would want to buy every single FTT token at $100, yet the last purchase of even a fraction of an FTT token at $100 per token implied this $10 billion market cap.

As the reader can probably surmise, this flawed way of extrapolating the worth of an asset based on its last traded price can be easily abused to inflate balance sheets.

It’s a form of fake wealth creation that SBF had easy access to via the FTT token and the FTX exchange.

Unfortunately, he chose to wantonly abuse this privilege.

🧩 An ability to convert this fake wealth into real dollars in your bank account, with plausible deniability

The existence of the FTT token with FTX as a major market maker for the token gave SBF an easy way to print wealth.

Consider this: if FTX pushed the price of the FTT token up by $1 using $10 million in buying volume, and someone owned 100 million FTT tokens, then their balance sheet would’ve arguably inflated by $1 billion!

Imagine that, turning $10 million into $1 billion instantly.

SBF loved this idea of printing fake wealth and thought he could use it to unlock the keys to the world. He loved it so much that he even went on a Bloomberg podcast in April 2022 to describe this scheme and laud its powers.

“In like five minutes with an internet connection, you could create such a box and a token… that's gonna appear on Twitter and it’ll have a $20 million market cap.

And of course, one thing that you could do is you could like make the float very low and whatever, you know, maybe there haven't been $20 million dollars that have flowed into it yet. Maybe that's sort of like, you know, mark to market fully diluted valuation or something, but I acknowledge that it's not totally clear that this thing should have market cap…

And obviously already we're sort of hiding some of the magic impact, right? Like some of the magic is in like, how do you get that market cap to start with, but, you know, whatever we're gonna move on from that for a second.”

With the ability to print fake wealth in place, SBF was almost ready to consummate the scam.

The next step is pivotal to the scam by allowing SBF to secretly turn this fake wealth into real spendable dollars in his bank account.

Specifically, SBF needed a way to opaquely swap customer deposits at FTX with FTT tokens, and do it with plausible deniability.

Remember, SBF might be able to print FTT tokens but he can’t actually spend them in the real world since the token is incredibly illiquid. The token just feels like it’s highly valuable because FTX, as its largest market maker, has tremendous influence over its price.

To turn FTT tokens into spendable cash in an opaque way with plausible deniability, SBF needed another corporate entity. This is where Alameda came in. As a shady offshore hedge fund that SBF also controlled, Alameda was the lynchpin that enabled shenanigans to ensue.

To start, Alameda was issued billions of dollars worth of FTT tokens for free. Next, Alameda took out massive loans from FTX by posting these tokens as collateral. FTX funded these loans with customer deposits.

No normal bank, or even shadow bank, will loan Alameda billions of dollars with FTT tokens as collateral but since SBF controlled both FTX and Alameda, these dubious loans went through without question.

This illicit arrangement between FTX and Alameda allowed SBF to quietly take out billions of dollars of customer deposits.

As long as FTX controlled the price of the FTT token, FTX’s books looked solid while Alameda got billions of dollars of customer deposits that SBF and his lieutenants could spend.

Few knew about this scheme early on and even if someone found out and questioned it, SBF could argue that these loans were fully collateralized and were thus safe and legitimate.

Since the collateral was FTT tokens, this was far from the truth.

🧩 A veil of secrecy

The last piece of the puzzle to complete the scam is a veil of secrecy around both FTX and Alameda.

US-based hedge funds are subject to strict reporting requirements by the SEC. For example, every quarter, a hedge fund needs to file a 13F form to the SEC that lists their equity holdings at the end of the quarter. The SEC makes these forms publicly available.

If Alameda was subject to these same reporting requirements, it’d quickly be clear that something fishy was going on.

It’s no wonder SBF chose to domicile FTX and Alameda in the Bahamas, a jurisdiction infamous for its financial secrecy.

🌐 Putting everything together

Here’s a rough diagram summarizing the whole scheme.

💥 How it all collapsed

The scam unraveled in a perfect storm.

First, the crypto market sold off sharply in 2022 as the Federal Reserve frantically raised interest rates to fight inflation. This created significant selling pressure across the entire cryptocurrency market and the FTT token was no exception. As a result, FTX needed more and more money to support the token’s price.

Second, for some reason, SBF started to feud with Changpeng Zhao (CZ), the founder and CEO of Binance, the largest international crypto exchange at the time.

Pissing off CZ was a very questionable move.

CZ had more than enough capital and influence over crypto markets to crash the FTT token’s price. To make matters worse, SBF made it even easier for CZ to do so a couple years earlier when he gave CZ hundreds of millions of dollars worth of FTT tokens as part of a $2 billion deal to buy back Binance’s stake in FTX.

Through this poorly-calculated move, SBF literally handed CZ the keys to collapse his empire.

When SBF started feuding with CZ, Binance already had hundreds of millions of dollars worth of FTT tokens just sitting there, ready to be dumped on the market to ultimately send SBF to prison.

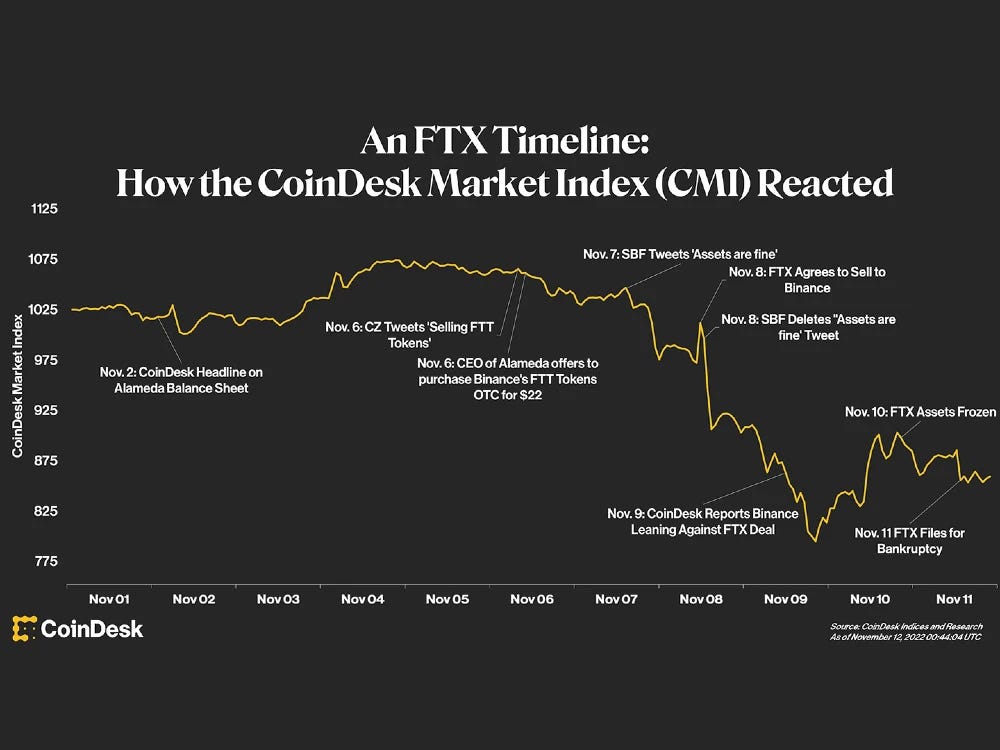

Finally, the killing blow was dealt when top crypto publication CoinDesk published a leaked Alameda balance sheet on November 2nd, 2022 revealing that the hedge fund’s books were suspiciously filled with FTT tokens.

In fact, 42% of Alameda’s $14.6 billion balance was comprised of FTT tokens, locked FTT tokens, and FTT collateral.

CZ was intent on finding out just how deeply SBF’s scam ran the moment he caught wind of Alameda’s highly questionable balance sheet.

Four days after the balance sheet leak, CZ tweeted that he was going to liquidate all $500 million worth of FTT tokens that he had held at the time:

“As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4”

“We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4”

“Binance always encourages collaboration between industry players. Regarding any speculation as to whether this is a move against a competitor, it is not. Our industry is in it’s nascency and every time a project publicly fails it hurts every user and every platform. 3/4”

“We typically hold tokens for the long term. And we have held on to this token for this long. We stay transparent with our actions. 4/4”

His first volley of tweets had a very innocuous tone that hid a sinister motive. He was gunning for the solvency of FTX and Alameda but claimed that this wasn’t “a move against a competitor”.

Amusingly, CZ couldn’t stop himself from running his mouth and publicly revealed his motives just a few hours later by tweeting:

“Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.”

These tweets caused a chain reaction starting with the collapse of the price of the FTT token, frantic bank runs on both FTX and Alameda, the insolvency of both firms, and eventually SBF being arrested and now at risk of a life sentence.

Oof.

Fin

So there you have it, a 10,000-foot view of how the greatest scam of the last decade was pulled off.

On November 2nd, 2023, exactly one year after CoinDesk published Alameda’s balance sheet, a jury found SBF guilty of all 7 charges laid on him by the SDNY. His tentative sentencing date is March 28th and by official sentencing guidelines, he’s deeply in the “life sentence” territory.

Thankfully, it’s entirely up to the judge to decide how long his sentence will be.

Another thing in SBF’s favor is that, because of recent favorable market conditions, FTX and Alameda will likely be able to pay back 100% of their customers’s funds.

The moral of the story? Don’t spend money that’s not yours.

💎 Important Market Update

Let’s come back to the present and discuss current market matters. We’ll touch on these topics below:

The end of the Fed’s Bank Term Funding Program (BTFP) last week

End-of-quarter rebalancing

VIX expiration and the March Fed FOMC

An update on oil

An update on Nikola

An update on Apple and Google