Inflation Is Not Here to Stay

There is a lot of buzz and fear about inflation right now. But here's why inflation is definitely not here to stay.

COVID lockdowns shutdown the face-to-face operations of most businesses, which resulted in sudden and severe unemployment worldwide. In response, central banks around the world, and especially the US, implemented their most drastic economic policies yet. Many countries, like the US, combined monetary and fiscal policies to print money and replace the lost income of the populous (global stimulus tops $15 trillion in response to COVID) This drastic policy worked, and worked much better than any policymaker expected. Aggregate demand skyrocketed even as lockdown policies were still in effect and continued to increase as the world started opening up again from the quick availability of vaccines.

This massive increase in aggregate demand was not met with an equivalent or greater increase in supply. Governments can print and distribute money faster than factories can be built and ports can be expanded. As such, bottlenecks started appearing in the global supply chain that manifested as increased prices and delayed goods.

This has prompted wide speculation and fears that inflation is here to stay, or at least will become a severe short term problem.

Inflation headline from the Wall Street Journal (source)

"CONSUMERS' INFLATION FEARS PICK UP" - CNBC

I don't think inflation is here to stay and we're a far cry away from inflation being a major global economic fear. Here's why.

Hold on, what's inflation?

Inflation is simply an increase in the price of goods or assets. This can be caused by a variety of factors, some good and some bad. Inflation is not inherently bad. For example, central banks like to target a steady but low annual inflation rate. If incomes keep up with inflation, then inflation is indicative of economic growth (price of goods is going up because people are making more and there's more demand for goods). Generally, central banks prefer steady inflation to discourage the hoarding of cash and thus increase demand. The more demand there is, the more supply grows to match, and the more the economy grows.

Put simply, inflation is good when it's driven by growing demand and supply can easily catch up.

Inflation is bad when it's caused by bottlenecks in supply. People naturally pay higher prices when goods are scarce and the lack of goods could not only indicate a failing economy but also the inability of people to meet their basic daily needs (e.g. lack of food, face masks, or toilet paper). Incidents of hyperinflation, such as during the German Weimar Republic between 1921 and 1923 and what's going on in Venezuela right now are caused by supply shocks. Weak domestic production coupled with incessant money printing making imports super expensive creates a domestic economy that can't feed itself.

It's also important to keep in mind that inflation can be specific to a class of assets or goods. The stock market can experience inflation while other asset classes don't experience inflation (😂👉 gold 👈😂). The toilet paper market can experience inflation while the cabbage market doesn't. Inflation can also be viewed favorably depending on the asset class. For example, people are generally happy when the stock market experiences inflation.

Why isn't inflation a problem?

Since the 2008 financial crisis, central banks across the world have engaged in aggressive quantitative easing (QE), which is economist jargon for printing money to buy short to medium-term government bonds. The buying has been so aggressive that, for example, the Japanese central bank owns 48% of Japanese government bonds while the US Federal Reserve's balance sheet went from just under $1 trillion in 2008 to almost $8.5 trillion today. During COVID, QE policies were not only expanded but money was also printed and directly given to people, resulting in $15 trillion in global stimulus to revive a locked down global economy.

US Federal Reserve balance sheet from 2007 to October 2021 (FederalReserve.gov)

It's easy to conclude that this incessant money printing is an indication that our debt-driven economy is failing and central banks are simply kicking the can down the road, putting nations at serious risk of uncontrollable inflation.

However, this is only true if we look at money printing by itself. Afterall, the more money there is, the less each unit of money is worth, right? However, like I mentioned before, inflation can be caused by a variety of factors and money supply is just one of a group of global factors heavily affecting inflation right now. The others are demographics, globalization, and technological innovation.

I argue that these three factors have caused and are still causing massive deflationary pressures (i.e. falling demand for goods, which is bad) on the global economy and any inflation caused by one-off stimulus injections is temporary. Central banks will soon be back to fighting deflation.

A good indicator of how bad the deflationary pressures are is the fact that US long term treasury yields have been in a strong downtrend for the past few decades (QE only buys short and medium term government bonds) and this is despite the massive money printing. Other indicators of deflation include relatively stable commodity prices and CPI (consumer price index) over the last few decades. Again, this is happening despite the massive money printing.

So how are demographics, globalization, and technological innovation causing a massive global deflationary cycle?

Demographics

Demographics play a major role in inflation. The more people there are, the more demand for goods and the higher their prices. Unfortunately, the population growth of developed nations, which account for the majority of global consumption, have been in gradual decline for a while now. The reduced living space from living in cities and the increased cost of living have reduced birth rates to below the replacement birth rate of 2.1 for most developed nations. Many have resorted to immigration to plug the gap but population pyramids are still inverted.

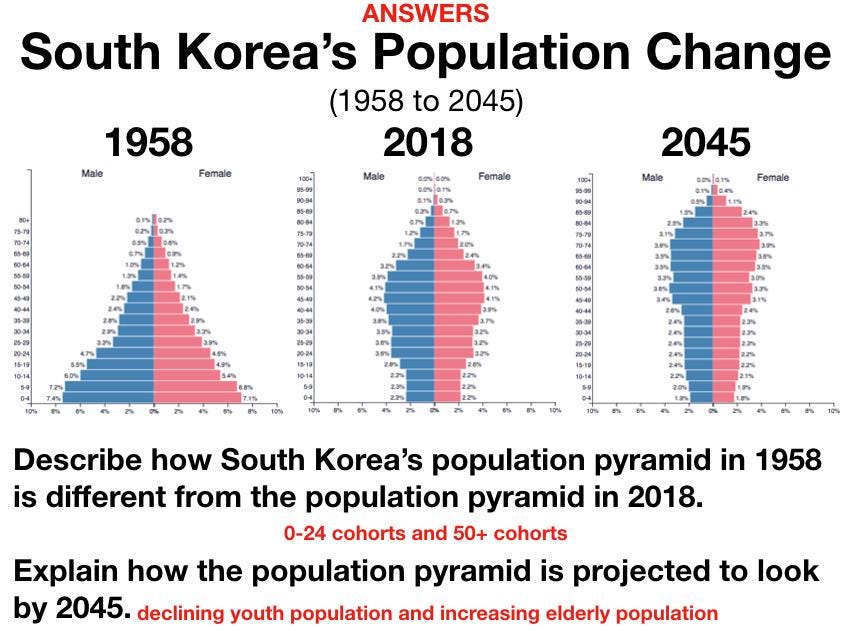

Change in South Korea's population pyramid from 1958 to 2045 (University of Tennessee Chattanooga)

Ageing of Europe (source)

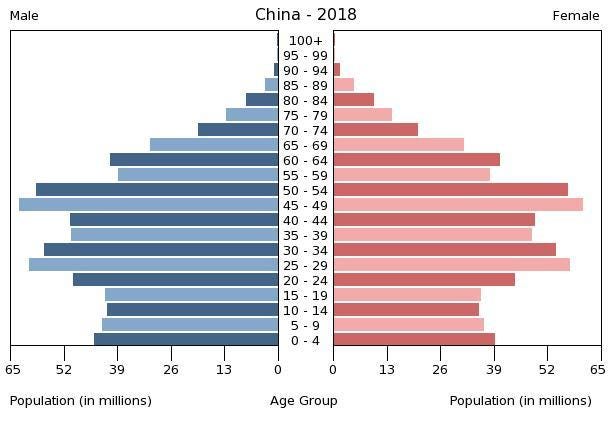

China is starting to age (source)

This is especially true for heavily urbanized Asian nations such as China, South Korea, and Japan. While South Korea and Japan have been experiencing the effects of an aging population for a while now, China, which has driven much of global growth in the past few decades, is just entering into its own population aging phase. This is heavily exacerbated by the infamous and ill-conceived one-child policy that was only recently withdrawn.

Not only does less people mean less demand, the age distribution of a population affects demand as well. Young people tend to consume more while old people don't.

Aging populations create very powerful deflationary pressures.

Globalization

Globalization is also a major contributor to global price suppression. Open international trade laws and unbelievably cheap ocean transport allowed multinational companies to tap into super cheap labor in developing nations to manufacture goods, thus significantly reducing manufacturing costs. The lower manufacturing costs are then passed on to the consumer as cheaper goods.

In addition, globalization shifts high-paying manufacturing jobs from developed nations where labor is expensive to developing nations where labor is cheap. This adds another deflationary force on developed nations in the form of lower wages. Lower wages means less discretionary income which means less consumption demand.

Technological innovation

Finally, technological innovation is also driving down global prices. We're living in the most innovative period in known human history and rapid technological improvements across the entire supply chain from raw materials to production to shipping increases efficiency and lowers cost (e.g. factory automation, improved mining/drilling technology, and GMO crops). This is passed on to the consumer as cheaper goods.

Innovation tends to also eliminate more jobs than it creates. For example, automation in factories and warehouses replaces several human laborers with a few machine operators and maintenance staff. The pinnacle example of innovation eliminating jobs is AI, which has the potential to completely replace human labor in many professions. Similarly, less jobs means less discretionary income which means less consumption demand.

But what about $15 trillion in global stimulus?

Okay, so the world is experiencing major deflation... but we still can't ignore the $15 trillion in global stimulus, right? Surely this much money has a profound impact on inflation?

The exact mechanical impact of this stimulus is a sudden increase in demand without a corresponding increase in supply. The number of factories, shipping lanes, and port capacity remained the same (or fell) during COVID while everyone suddenly had more money, courtesy of central banks.

This creates three primary effects: 1. Inflation in assets that one can own infinitely, such as equities and real estate 2. Supply shock in discretionary goods such as furniture, automobiles, and electronics 3. Minor change on the price of essential goods such as food, toiletries, and cleaning supplies

(1) and (2) are the direct result of stimulus cheques creating a step function rise in discretionary income. When people have extra discretionary income, they invest. This is evident with the red-hot crypto, equity, and real estate markets of the last two years. Extra discretionary income also compels people to indulge in discretionary goods, starting home improvement projects and buying new electronics and/or cars. This is evident with the clogged supply chain that we read so much about in the news. Many international shipping ports are at full capacity with container ships stuck at sea waiting their turn.

(3) happens because the demand for essential goods is limited by population size and stimulus cheques don't change population size. When you suddenly have more money you're unlikely to eat a lot more or buy more laundry detergent.

Of the three effects, (2) is what people worry the most about. Some claim that this supply shock for discretionary goods can have long term effects or at least severe short term effects. However, I think that if we're about to develop COVID vaccines and vaccinate billions of people within a year of COVID lockdowns, then the global supply chain is definitely dynamic and resourceful enough to adjust to this temporary burst in demand. These stimulus payments are one-off events and most of the world has reopened, indicating that this demand spike is contained and thus relatively easy to solve.

Conclusion

US 10-year treasury yield in the 5 years (macrotrends.net)

If this article didn't convince you that inflation fears are overblown, then there is one number that should decisively close the argument. The US 10-year treasury yield, which is a good approximation of the market's collective view of inflation rate in the next 10 years, is struggling to even go above its level prior to the start of COVID lockdowns (1.59%), and is significantly lower than the average 2.405% of the last 10 years. The bond market is massive (much larger than the stock market) and if highly capitalized bond traders don't believe inflation is a problem, is it really a problem? Could the media just be oversensationalizing yet another issue?