Interest Rates Will Determine Your Life

In 7 minutes, understand how interest rates work and why they play a massive role in our quality of life.

Let's talk about interest rates – you know, that topic that keeps cropping up in financial news, almost like a celebrity that won't leave the headlines. But why are we constantly hearing about them? Well, it's because interest rates are not just some financial jargon tossed around by economists; they're the foundation upon which our entire economy stands.

In this issue, we're diving into how interest rates work and why understanding interest rates is crucial, not just for Wall Street, but for everyone else. Believe it or not, interest rates are pulling more strings in your life than you might think – they're like the silent puppet masters of your personal finances.

Fundamentally, interest rates are the cost of using someone else’s money for a period of time. In this way, they are often referred to as the price of money.

Who sets interest rates?

One of the most obscure and yet important aspects of interest rates is how they are determined.

For example, why is it that in 2021 the interest rate for mortgages was around 3% and today it’s closer to 8%? Salaries haven’t fallen and houses aren’t significantly harder to build, so what caused mortgage rates to go so high?

In the US, the central bank (aka The Fed) and the market determine the country’s interest rates. During periods of economic normalcy, the Fed has the most control. Here’s how it works.

Let me introduce you to the Fed Funds Rate and US Treasuries. In broad strokes, these two financial instruments form the bedrock with which interest rates across the country, and even the world, are determined.

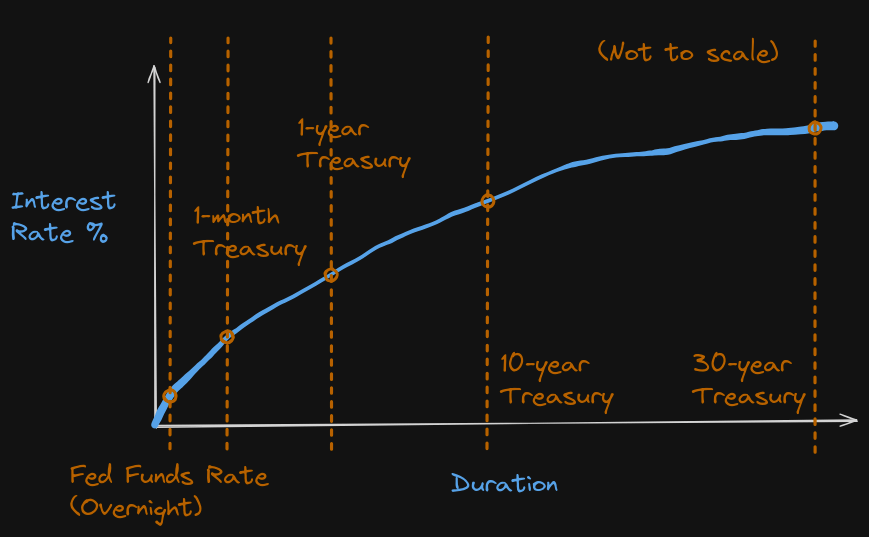

One important thing to know about interest rates is that they are also a measure of risk. Generally, the longer a loan is, the more risky it is. As such, we can categorize interest rates by loan duration. The Fed Funds Rate and US Treasuries span a wide range of loan durations, from overnight (Fed Funds Rate) to 30 years (30-year Treasury Bond).

If you’ve found our work helpful or informative, consider treating us to a coffee and/or pastry by upgrading to a paid subscription. Thank you!

☝️ But wait, who controls the Fed Funds Rate and US Treasury rates?

The Fed fully controls the Fed Funds Rate. This is the interest rate that is being changed whenever you see headlines like “Fed increases rates a quarter point and signals a potential end to hikes” and “Fed signals it will raise rates one more time this year before it ends hiking campaign”.

US Treasury rates are controlled by the market through the constant buying and selling of US Treasuries, similar to how stock prices are determined. However, the Fed could also intervene by literally printing money out of thin air to buy Treasuries. This is known as Quantitative Easing (QE) and it’s an extreme way to keep interest rates low, with the end goal of stimulating the economy. During the pandemic, the Fed printed trillions of QE dollars to keep the economy afloat.

The Yield Curve

When you graph the interest rates of the Fed Funds Rate and US Treasuries against their loan durations, you get a graph that’s commonly referred to as the “Yield Curve”.

The Yield Curve should theoretically go up and to the right; after all, the longer the loan is, the more risky it is, and the more interest it should pay.

Practically, this is not always true since the market ultimately controls Treasury rates and it can change these rates however it wants. For example, if the market thinks rates will go down in the future, it could buy long-term Treasuries while selling short-term Treasuries until the Yield Curve slopes downwards.

Side note, a Yield Curve that’s sloping downwards is known as an inverted Yield Curve and this is a historically reliable predictor of recessions.

The Fed also has control over the Yield Curve. It can adjust the Fed Funds Rate to move the Yield Curve up or down or even reshape it. For example, if the Fed Funds Rate increases, the interest rates of every other loan duration should increase as well but if the former increases too fast, the Yield Curve could invert as the market is slow to respond to the Fed’s actions.

All this is to say that the whims of the Fed and the market can cause the Yield Curve to look all sorts of ways.

Today, the Yield Curve looks like this.

What about mortgage rates?

Now that we’ve explained the Yield Curve, let’s talk about how other interest rates in the economy are set.

The prevailing global wisdom is that loans to the US government are the safest loans in the world. That’s because if the US government can’t pay, then a resource-rich country could be forced to make up the difference through a visit from a couple US carrier battle groups. Just kidding 😅 Not really.

As such, rates on the US Yield Curve represent the absolute bottom of interest rates. They are also known as risk-free rates. Every other loan has added risk and so to determine their interest rates, you simply add to their corresponding rate on the Yield Curve to get interest rates that account for the added risk.

In other words, everything added on top of the Yield Curve rate depends on the loan’s perceived risk.

The most important corollary to this is that when the Yield Curve rises, interest rates across the economy rise.

This is why mortgages in 2021 cost ~3% while mortgages cost ~8% today. The Fed raised the Fed Funds Rate and rates across the Yield Curve also rose. Then, for mortgages, you add more interest on top to account for the extra risk. The 30-year Treasury is currently yielding 4.23% and the market has added 4% on top for mortgages because they are riskier than 30-year Treasuries.

How do interest rates determine our quality of life?

If interest rates are the price of money, then higher interest rates mean more expensive money. When money is more expensive, there is less money going around. When less money is going around, the economy slows down. Besides this direct causal chain, there are also many second-order effects that ripple through the economy to significantly reduce the total money in the system.

This goes both ways. When interest rates go up, money in the system decreases even more. When interest rates go down, money in the system increases even more.

I like to call this the Interest Rate Money Multiplier Effect.

You may be wondering, if the Fed raised the Fed Funds Rate from 0 to 5% over the past year and a half, why hasn’t the economy slowed down? If interest rates really do matter, why is the economy unfazed and continues to march onward?

This is because the Interest Rate Money Multiplier effect takes a long time to occur and in the mean time, weak economic growth can be staved off through:

Relying on excess money that’s already existing in the system

Borrowing money at high interest rates to keep the money flowing in. This comes at high cost to future generations

The US government has been heavily leaning into (2) to keep the stock market up and the people happy. However, this has also caused a significant rise in long-term US treasury interest rates as the global market rejects increased US debt issuance. FinanceTLDR has written at length about the ballooning US budget deficit.

All this is to say that interest rates have a profound impact on economic activity. The higher rates go, the less likely people will spend money and the less people spend, the less people make. The less people make, the lower the average quality of life.

I have to admit that this issue’s title, “Interest Rates Will Determine Your Life”, is hyperbolic but it has a profound morsel of truth that’s evident once you understand how interest rates work in the economy.

It’s no wonder rising interest rates have dominated financial headlines in the last two years.

Portfolio Update

The market is pulling back this week after a euphoric November. Palantir is down almost 15% since the start of the month. Even Coinbase is showing weakness even though it’s still significantly up for the month.

Here’s how we are positioning the portfolio for the rest of December…