Inverted Yield Curve

[4 minute read] A simple but deep explanation of inverted yield curves and why the US's seriously inverted yield curve might * not * portend an upcoming recession.

Economists consider an inverted yield curve as one of the best indicators of an upcoming recession. The US economy has been steeped in an inverted yield curve for about a year now.

Here’s what an inverted yield curve means and why this time, it might just be different (aka no upcoming recession).

Primer: US Treasuries

The US government raises money by issuing debt in the form of US government bonds (informally referred to as “treasuries”).

Treasuries are sold for $100 per contract and pay interest over time. At maturity, the US government guarantees that the treasury can be turned back to $100. An investor of maturing treasuries will thus get their initial principle back plus interest.

Primer: Yield Curve

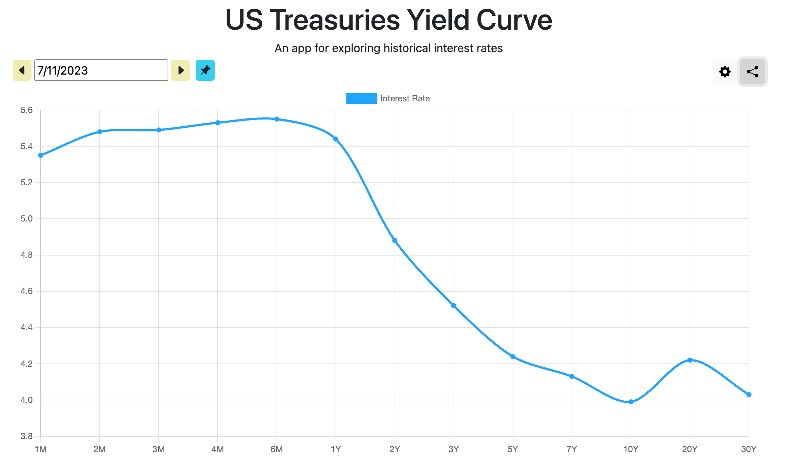

The yield curve is a plot of the different interest rates offered by treasuries of different maturities. The Y axis is the interest rate and the X axis is the maturity length (short to long).

In the most basic sense, a yield curve should be going up and to the right 📈. This is simply because longer term loans are more risky and thus they should pay a higher interest rate.

An inverted yield curve is a yield curve where long term interest rates for treasuries are actually lower than near term interest rates.

One interpretation of this inversion is that the market thinks there is higher risk in the near term (e.g. upcoming recession) thus near term interest rates should be higher.

The Yield Curve Is Super Inverted!

The US treasury yield curve has been inverted for about a year. In fact, just a few days ago, it reached its most inverted level since 1981.

This is what it looks right now.

Down and to the right 📉.

An Upcoming Recession?

The primary reason why an inverted yield curve forecasts a recession is that it puts a ton of stress on banks, causing them to lend less which reduces liquidity in the economy.

The adage for how banks make money is that they “borrow short and lend long”.

This business model works in normal economic conditions when the yield curve is up and to the right, i.e. long term interest rates are higher than short term interest rates. In such an environment, the interest earned from lending in the long term is more than the interest paid to borrow in the short term and that’s how a traditional bank makes money.

A concrete example of the “borrow short and lend long” business model is when a bank takes money from checking account deposits (borrow short) and invests those deposits in 30-year treasuries or mortgages (lend long).

When the yield curve is inverted, long term interest rates are lower than short term interest rates and a traditional bank’s business model just. doesn’t. work.

Does a regional banking crisis ring any bells?

The Case for No Recession

The yield curve has been inverted for about a year and recently, the inversion has gotten to levels not seen since 1981 (which, by the way, was followed by a severe global recession).

Theoretically, this sounds like a setup for an impending economic disaster.

Here’s the case for the oft discussed “soft landing” economic unicorn scenario.

US banking is thriving

First of all, even though regional banks might have suffered the brunt of the damage from collapsing treasury prices and a deeply inverted yield curve, the largest US banks have actually benefited greatly from the regional banking crisis while successfully absorbing most of the costs of an inverted yield curve through widely diversified business models and surprisingly, unwavering levels of checking account deposits that are still offering near 0% interest rates. In other words, borrow short and lend long is still working for the big banks!

Despite the severely inverted yield curve, the top-heavy US banking system is actually thriving!

This optimism for US banking was recently further buoyed by a successful Federal Reserve annual banking stress test in which all 23 banks in the test weathered a severe recession scenario while continuing to lend.

China, China, China

While an inverted yield curve might be the canary in the coal mine for a recession, it doesn’t preclude the US government from trying to avoid said recession. This is exactly what the Biden administration has been doing recently as it tries to rekindle economic relations with China. It’s likely that the administration sees the Eastern economic giant as the key to saving a US economy steeped in high inflation and an inverted yield curve.

In just the past month, US Secretary of State Anthony Blinken and US Treasury Janet Yellen both made separate visits to China. While Biden stumbles and mumbles his way through teleprompted speeches, Blinken and Yellen are the heavy-weight policy makers of the US government and the significance of these two back-to-back high profile visits to China cannot be understated. Xi Jinping even agreed to meet with Blinken, a type of meeting that the Chinese government usually reserves for heads of states.

A quote from Janet Yellen after her China trip:

“China has an enormous market. It's a significant share of the global economy, and we want to make sure that American businesses and workers can profit from that, and contribute also to China's success as well as our own.”

At the same time, China is about to launch a new wave of fiscal stimulus to boost a softer-than-expected economy and the tightly interlocked economies of the US and China means that fiscal stimulus in China is fiscal stimulus in the US.

In addition, US inflation could also cool down with recovering US-China economic relations given China’s staunch role as the world’s factory. More supply = lower prices.

Just like in 2008, it’s looking like China will save the US economy and the Biden administration is trying to make sure this happens.

Fin

With all that said, this is perhaps why US stocks have been on a tear in 2023 and especially lately, even as economists sound the alarm bells for an impending recession. The yield curve may be inverted, commercial real estate might be on the precipice of collapse, and company earnings might fall, but holistically in this wonderfully complex world economy, things may just be looking up and up.