Japan Gives Up

The Bank of Japan finally gives up on a pivotal but highly unconventional banking policy. What does this mean for the rest of the world?

The Bank of Japan is unique among central banks in that they have practically committed to printing infinite Yen to pin, with an iron fist, the interest rates of Japanese government debt for the better part of a decade.

A couple days ago, the BoJ surprised the market by signaling that they are starting to abandon this policy. This is a huge policy u-turn for the BoJ with major ramifications for Japan and international markets.

Before we discuss the “so what?”, let's go over what “printing infinite Yen” to keep interest rates pinned actually means.

Infinite Yen, What?

Bond yields (i.e. interest rates) are dependent on a bond’s price. The higher a bond’s price, the lower its yield, and vice versa.

To keep Japanese Government Bond (JGB) yields close to 0%, the BoJ is willing to print as much Yen as possible to buy JGBs until yields fall to where they want them to be.

Sounds Irrational, Why Are They Doing This?

Japan has been subject to severe deflationary pressures for the past couple decades as its once-booming manufacturing sector stagnates and its population shrinks.

To keep deflation at bay and to stimulate a tepid economy, the BoJ decided in 2016 to enact this unconventional banking policy of printing money to fix interest rates.

What Are the Effects So Far?

Investors have occasionally tried to call the BoJ’s bluff and short JGBs. The BoJ has always responded to these short attacks by summoning the full power of their currency printers to buy JGBs, crushing the speculators in the process. As a result, shorting JGBs is now known as the widow-maker’s trade.

In addition, this policy has effectively caused the BoJ to own the entire JGB market. The BoJ currently owns more than 50% of all JGBs in existence and the bank is typically the largest, and sometimes only, buyer in the JGB market.

The BoJ has so far gotten away with this radical banking policy due to Japan's strong export industry, significant deflation, and the largest foreign government holdings of US Treasuries in the world at over $1 trillion.

Inflation Changes Everything

Post-pandemic, inflation started popping up everywhere in the world as geopolitical tensions rise, the global workforce shrinks, and global supply chains come under strain.

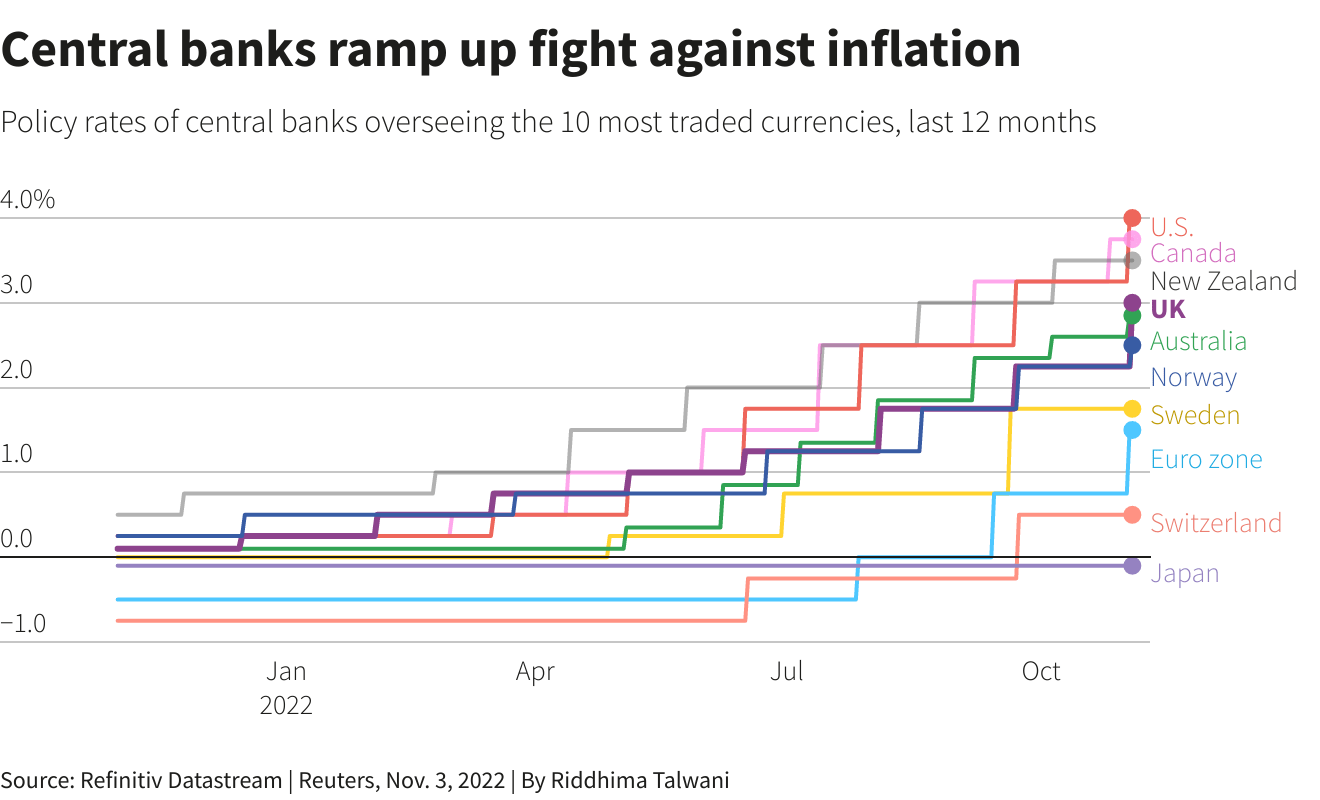

In response, central banks started to raise interest rates aggressively, except Japan.

While other countries have already raised their interest rates by several full percentage points, the BoJ has stubbornly kept theirs constant at 0%.

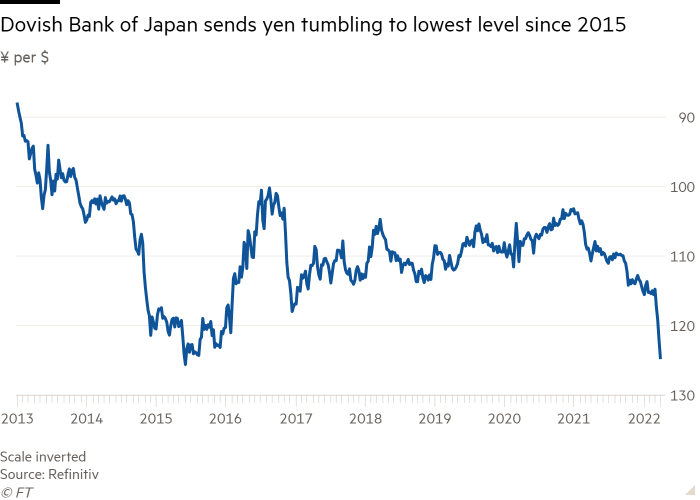

This has crushed the Yen as investors sell Yen and JGBs to invest in significantly higher yielding bonds from other governments.

Many international hedge funds have also added on to the pressure by placing massive shorts on JGBs, fearlessly partaking in the widow-maker trade.

To keep JGB yields suppressed, the BoJ has had to print a tremendous amount of Yen to buy JGBs (over 100 trillion Yen this year!). This has crushed the Yen even more.

Although a weak Yen makes Japan's export industry more competitive, it also makes imports more expensive. At close to 4%, Japanese inflation is soaring right now relative to where it’s been in the past and a central bank policy that sacrifices the Yen to keep interest rates low makes less and less sense every day.

Defending the Yen

To defend the Yen's price, the Japanese government reopened the country for tourism in October, thus increasing international demand for the Yen, and the BoJ has also been selling its vast amount of US Treasuries to buy the Yen.

This has not been enough and the BoJ finally blinked a couple days ago and raised their 10-year JGB yield ceiling from 0.25% to 0.50%. Although small in magnitude, many interpret this move as the beginnings of the unpinning of JGB yields.

This came as a surprise to the market as JGBs immediately got sold off, the Yen soared, the US dollar fell, and government bond yields elsewhere rose. Investors are clearly pre-trading expectations that more money will move to Japan as Japanese yields rise in the future.

So What?

The BoJ's task is now to slowly lift its iron fist on JGB yields without causing pandemonium in Japanese debt markets.

Most Japanese debt issuers, including major Japanese corporations, are operating under the assumption that JGB yields don’t change. If they rise too fast, it could cause disastrous cascading defaults throughout the Japanese economy.

As for international markets, as Japanese yields rise, the Yen and JGBs become much more attractive investment options than before and will cause some selling as international investors divert capital to Japanese markets.

All in all, the post-pandemic world has ushered in a global economy that's much more sensitive to inflation and even the obstinate BoJ cannot ignore the tide of inflation sweeping over Japan.

Higher interest rates are here to stay.

I’m going to mention this post in my next post on Jan 1. I want to reference JPN and your article is perfect.

Excellent work!