Thoughts - Let's Talk Inflation

In this article we discuss what a recession means exactly, and how we should think about inflation and where it's headed.

I’d like to preface this article by reminding myself of how wrong I was about inflation last year. Like the Fed, I thought inflation was transitory. It’s clearly not, and I’ve learned a lot in the process. Here are some updated thoughts and learnings.

Okay, let’s talk inflation.

The Federal Reserve is scared of runaway inflation and is raising interest rates in response. They hope higher interest rates can quell demand, thus pulling prices back. However, some fear that they are going too far and will trigger a recession.

In this article, let’s go over two topics.

First, we hear the “recession” word thrown around a lot, often in a doom and gloom context, but what does it mean exactly and how does it relate to the Fed’s dual mandate of employment and price stability?

Second, we know that inflation’s trend is key to stock prices right now, so let’s discuss where it’s headed. Some argue that the Fed is way too behind the curve to quell inflation, while others think the worst might be behind us.

How do we pull signal from the noise? Hopefully this article can help.

Hold On. What Does a Recession Mean?

Everyone seems to be throwing around the word “recession” right now. Having gone through the 2008 financial crisis, recessions are certainly an overtly negative concept in the North American psyche. But what does a recession mean exactly?

Simply put, a recession is a slowdown in business activity.

Recessions can be specific, down to a company or even an individual. It can also be broad-based, affecting an economic sector, a national economy, or the global economy. A slowdown in business activity means less money invested, which means less money paid, less money earned, and less money spent. The decline in money velocity makes everyone poorer.

Many people are wondering whether we’re in a recession right now. The official definition for one is two straight quarters of negative GDP growth. We already had one quarter of that in Q1 2022 and if Q2 is negative, I guess we’re officially in a recession. However, I posit that the official definition doesn’t matter. Parts of the economy are already in a recession.

Take, for example, the tech sector. It’s in a recession. VCs are pulling back funding, the public markets are selling off tech stocks, and companies, big or small, are cutting spending and some are even laying off people. These are clear-as-day symptoms of a recession. The same thing is happening in the real estate sector.

So are we in a recession? Yes we are, but not everywhere.

What’s More Important, Low Inflation or Avoiding a Recession?

The Fed has a dual mandate. They want to keep prices stable and also keep employment high. In the past decade, the Fed had it easy. Inflation was stubbornly low and all the Fed had to worry about was employment. Quantitative easing and a low Fed Funds Rate kept people employed with minimal effort.

Now, things have changed. The Fed is forced to make a choice. Do they crush inflation and risk a recession, or let inflation run while keeping today’s hot job market going?

The answer for the Fed is clear. Inflation must be crushed at all costs. There are two reasons for this. For one, while a recession might be extremely painful for a small subset of people (the unemployment rate reached almost 10% during the 2008 financial crisis), inflation hurts everyone at once and poor people the most. Secondly, the inevitable conclusion of runaway inflation is stagflation where prices get high enough that economic growth slows down. When this happens, we’re plunged into a recession anyways. Prices and wages are sticky while economic growth is not.

Is the Fed Too Far Behind?

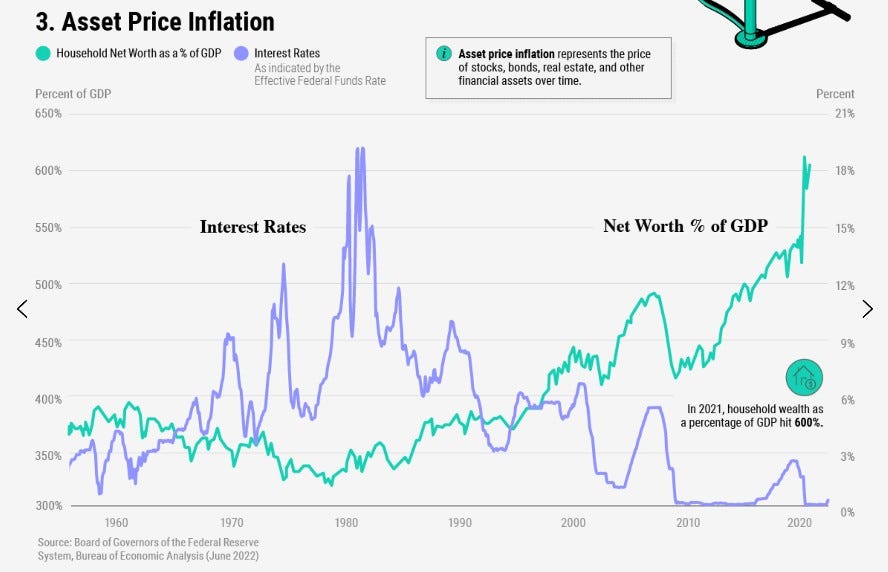

Many economists and major investors have started to sound alarm bells, claiming that the Fed is too far behind the curve to quell inflation. Take a look at this chart:

The red line is inflation, the black line is the Fed Funds Rate, and the blue line is roughly red minus black. Historically, when inflation is high (see the 1970s), the Fed had to raise the Fed Funds Rate to at or above inflation to cool it. Today, inflation is soaring and the Fed Funds Rate being at 2% is nowhere close to the current CPI of 8%.

The list of economists and major investors calling out this low Fed Funds Rate include Stanley Drunkenmiller, a legendary hedge fund manager who recently noted that inflation has never come down from above 5% without the Fed Funds Rate rising above CPI. Another major hedge fund manager, David Einhorn, has also presented a similar position. He looked at historical Fed inflation fights to show that today’s Fed Funds Rate seems way too low to cool inflation. A third famous (or infamous) hedge fund manager that’s sounding alarms is Bill Ackman, who recently tweeted that “[i]nflation is out of control and inflationary expectations have become unanchored”. There are many more people on this list but I shall spare readers of a dry iteration of people and quotes. The message is clear.

The Bottom Line

Despite these warnings, there are also many people that think inflation is trending down. They cite the recent falling commodity and energy prices as the main reason why.

While falling commodity and energy prices are certainly helpful in cooling inflation, they might not be enough. There are generally two types of inflation, demand-pull (people are buying too much, asking for too much wages) and cost-push inflation (commodity and energy prices rising). Inflation skyrocketed in the past year because we had both types of inflation pushing prices up.

With commodity and energy prices falling, cost-push inflation is down but there’s still demand-pull inflation. In addition, cost-push inflation is far from being gone, since not only is there a chance of commodity and energy prices going back up, but rising rents from a hot real estate market (as I’ve mentioned in a previous newsletter issue) is likely to significantly add to inflation later this year.

The bottom line is, it’s very tough to forecast inflation. I have to admit I don’t have a good answer for where it’s headed, but I know what to watch out for to get a sense of the trend. First, a lot rests on where commodity and energy prices are headed in the second half of the year. Second, we need to see how strong the American consumer remains after a few months of aggressive monetary tightening from the Fed.

Here are three scenarios we can find ourselves in by year end:

Commodity and energy prices resume their uptrend and inflation continues to remain high throughout the rest of the year. The Fed aggressively tightens but the effects of high interest rates are too slow to drop consumer demand, forcing the Fed to be even more aggressive. The economy is plunged into stagflation. Only falling commodity and energy prices can get us out of this rout.

Commodity and energy prices fall. The Fed’s aggressive actions plunge the economy into a broad-based recession. Inflation falls and the Fed thinks it’s in the clear to loosen monetary policy. The American consumer is stronger than the Fed expected and cost-push inflation resumes the moment the Fed starts loosening monetary policy, forcing tightening again. It’s clear at this point that the Fed Funds Rate was way too low to fight inflation and the Fed should have raised the rate to at least where CPI was.

Commodity and energy prices fall. The Fed’s aggressive actions plunge the economy into a broad-based recession. Cost-push and demand-pull inflation are successfully quelled together and the Fed is free to loosen monetary policy again. We resume the relatively easy and smooth economy of 2010-2020.

I apologize for not having a great answer for where inflation is headed, but I think it helps to clear the picture if we lay out the possible scenarios for inflation by year end. At least for me, this makes it easier to make informed judgement calls as new information comes in.

For now, let’s cheer on the falling commodity and energy prices, which are necessary, though not sufficient, to bring inflation down.