Research - Marginal Buyers Gone

The Fed's ongoing fight with inflation has caused the withdrawal of several major Marginal Buyers that have fueled the past decade's bull market. Here's why.

We’re starting October off by donating to Sanctuary SF, a homeless shelter in San Francisco that provides a bed, showers, laundry, and two meals a day for up to 200 residents. This weekend, I met Sarah, who is currently living in Sanctuary SF. She told me that we’re all citizens of the universe and that we should love ourselves and each other 🌱

As before, don’t feel pressured to join us, we simply ask that we all do a little extra good this month, whether for a cause you believe in, a friend, a loved one, or even for yourself.

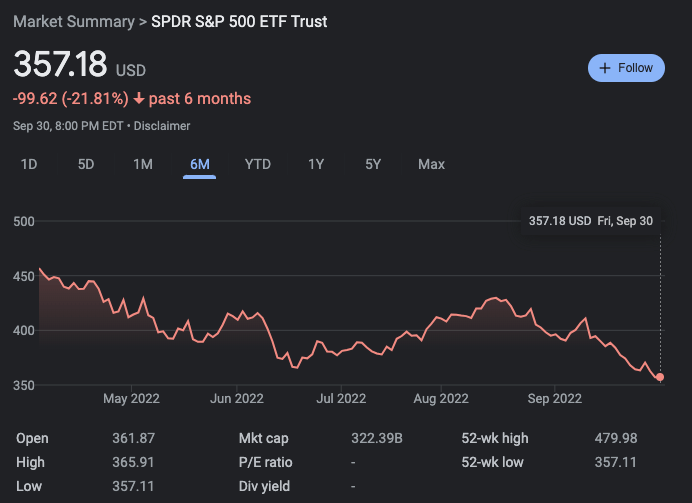

The S&P 500 dropped more than 1.5% on Friday to close out a brutal September. The index fell a massive 10% for the month, making this its worst September since 2008 and also the first time it fell for three straight quarters since 2009.

Talk about a painful market correction.

September completely negated hopes that the summer’s massive market bounce marked the end of the market correction. Instead, September confirmed that there’s more pain ahead.

A major contributing factor to this market correction is the departure of major Marginal Buyers as a result of the Federal Reserve’s monetary tightening policies to fight inflation. These Marginal Buyers fueled the past decade’s bull market (the US’s longest bull market in history) by ensuring steady and consistent gains year in and year out.

Now, they’re gone.

Before diving deeper, let’s go over what it means to be a Marginal Buyer.

What’s a Marginal Buyer?

Put simply, a Marginal Buyer is someone that’s actively buying in the market at any moment in time. This is in contrast to buyers that came before or after the Marginal Buyer.

For example, Hedge Fund A added $1 billion to their SPY position last week since they thought it was the optimal time to enter the market. Hedge Fund B thinks today is the optimal time to enter, so they are actively buying to establish their own $1 billion SPY position.

While both Hedge Fund A and B are buyers in the market, Hedge Fund B is the current Marginal Buyer.

This might seem like a trivial definition but Marginal Buyers are extremely important to the market. They play a major role in defining not only where prices are headed, but also their volatility. The behavior of the Marginal Buyer sets the current tone of the market.

For example, if the Marginal Buyer doesn’t show up to the market one day, but the Marginal Seller does, then it’ll be a pretty red day for the market since no one’s there to support prices as the Marginal Seller sells. If the Marginal Buyer isn’t there for a whole week or a whole month, it’ll be a pretty bloody week/month.

There are four main perennial Marginal Buyers in the US stock market:

The Federal Reserve

Corporations

Institutional Investors

Retail Investors

They are consistent, omnipresent, and most of all, filled with cash. The long bull market of the past decade was primarily fueled by the relentless buying of these four groups.

Marginal Buyers Gone

As many of us know, the Federal Reserve has adopted a very aggressive monetary tightening policy to combat US inflation. This primarily involves rapidly raising interest rates and cutting back Quantitative Easing (QE).

This has knocked out/is starting to knock the four main Marginal Buyers from the US stock market.

The Federal Reserve, unsurprisingly, has bowed out of buying. Corporations are starting to feel cold feet with stock buybacks. Institutional investors are pulling back as well. Retail investors remain the last stalwart pillar of buying.

Marginal Buyer #1: Federal Reserve

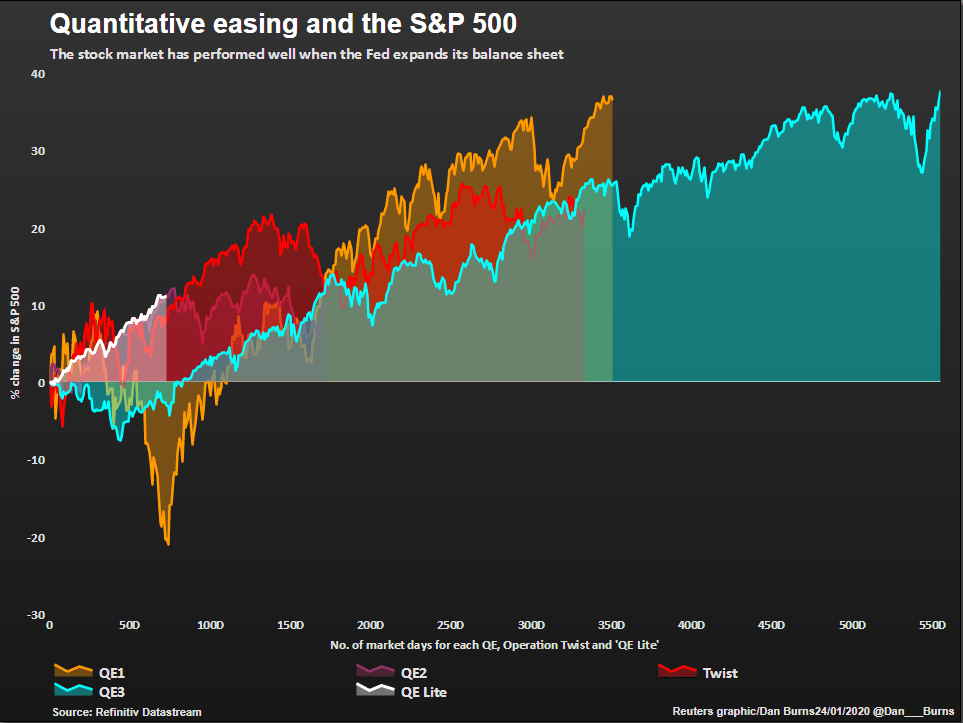

The Fed’s Quantitative Easing (QE) program is the main mechanism through which they exert buying pressure on the stock market (more on this in just a bit).

QE involves the Fed conjuring money from thin air to buy US government bonds and mortgages from the open market and keeping these assets on their balance sheet. The Fed first engaged in an aggressive QE policy as a response to the 2008 Financial Crisis. Seven years later, the Fed’s balance sheet had ballooned from $900 billion to over $4.5 trillion in 2015.

However, this QE pales in comparison to the Fed’s response to the pandemic in which its balance sheet rocketed from $4.2 trillion to almost $9 trillion… in just two years!

But wait, one might be wondering why the Fed would be a Marginal Buyer of the stock market if they are only buying US government bonds and mortgages. I can explain.

The reason for this is found in how stock and bond markets interact through massive investment funds (e.g. ETFs and mutual funds) that have exposure to both stocks and bonds. These funds hold trillions of dollars in aggregate and have target allocations for each asset class. If their actual allocations veer too far from their targets, the funds need to rebalance by selling the overweight assets in the portfolio and buying the underweight ones (e.g. selling bonds and buying stocks). As such, every time stock prices fall, the Fed’s massive and unyielding buying presence in the bond market keeps bond prices stable even in the face of heavy selling from stock-bond funds that need to rebalance into stocks.

To summarize, QE from the Fed stabilizes bond prices, which then indirectly buoys stock prices.

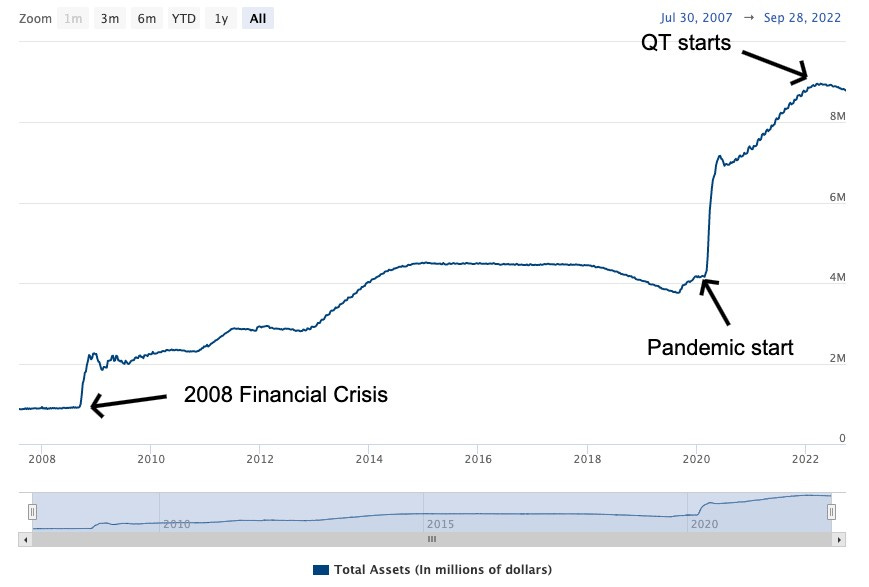

With the Fed’s current inflation fighting drive, the Fed is bowing out of QE and is slowing letting the assets on their balance sheet mature and run off. This is also known as Quantitative Tightening (QT). QT started on June 1st of this year where the Fed allowed up to $30 billion of government bonds and $17.5 billion of mortgages to mature and run off its balance sheet. The pace of QT increased on September 1st when these run-off caps were doubled.

With the Fed no longer supporting the bond market, bonds are hurting. If 2022 were to end today, this would be by far the worst year for bonds in nearly a century! By exiting the bond-buying business, the Fed has also stopped being a Marginal Buyer of stocks.

Marginal Buyer #2: Corporate Buybacks

Corporations are Marginal Buyers through stock buyback programs. Compared to dividends, buybacks are a much more tax efficient way to return money to investors.

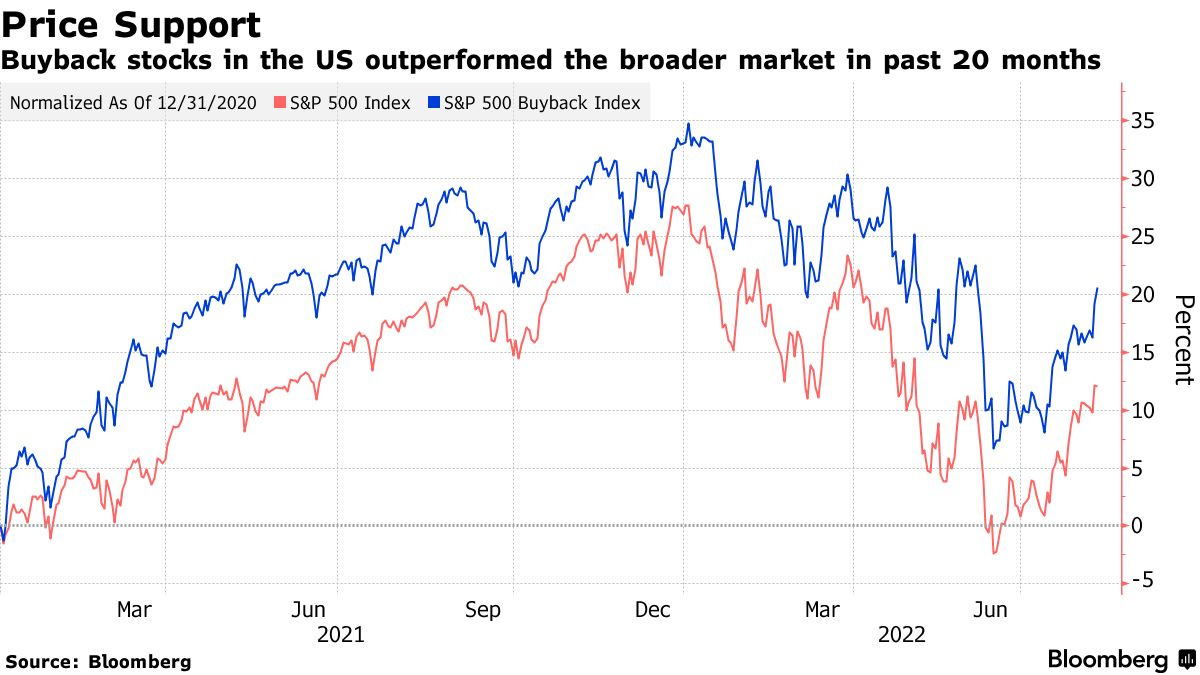

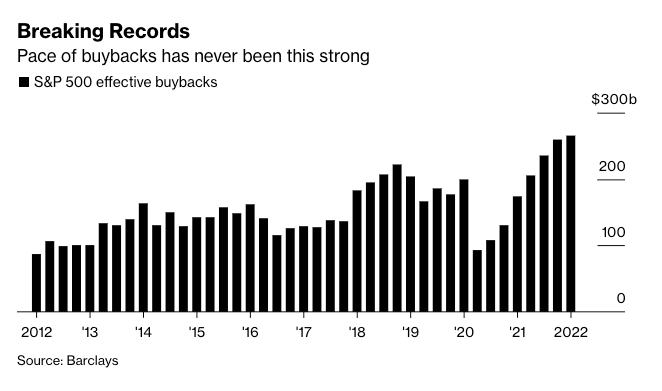

Buybacks have become tremendously popular over the last two decades. In fact, in 2018, total US stock buybacks exceeded $1 trillion for the first time ever. Although the rate of buybacks dipped (as expected) at the onset of the pandemic, they have roared back stronger in 2021.

However, moving forward, we’re likely to see the rate of buybacks drop off significantly for two reasons.

First, with interest rates rapidly rising, it’s a lot more expensive for corporations to raise cash by taking on debt. Less cash available through debt means less cash available for buybacks. In addition, as the economy stalls from higher costs of capital, corporations will naturally make less money, further reducing the cash available for buybacks.

Second, the passing of the Inflation Reduction Act in early August adds another hindrance to the popularity of buybacks. Buybacks have so far been tax-free but the law sets a precedence by imposing a 1% tax on them starting in 2023. Although 1% is small, it’s a foot-in-the-door for taxing buybacks and we can expect this tax rate to increase over time, thus further deterring companies from buybacks.

In fact, buybacks are already faltering. The US financial sector is leading the retreat with many major US banks suspending buybacks earlier this year. They include JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon and State Street.

Marginal Buyer #3: Institutional Investors

Institutional Investors (e.g. pension funds, high net worth individuals, family offices, sovereign wealth funds) are pulling back from buying as well. These investors pay close attention to the economy and tend to be agile; when economic conditions deteriorate, they are quick to reduce risk.

However, the departure of institutional investors as buyers will be muted given that we’re riding the coattails of the longest bull market in US history and old ideas, assumptions, and habits die hard.

Marginal Buyer #4: Retail Investors

Finally, retail investors will remain a stalwart Marginal Buyer of stocks.

Most of them, if they are working, are automatically investing in stocks by diverting a portion of every pay cheque into employer-sponsored 401k plans. In addition, retail investors are the least attuned to macroeconomic conditions and are staunch believers in the adage “time in the market is better than timing the market”. The mentality to put money to work in the stock market as soon as possible, no matter what happens and at what price, is preached by 99% of the personal finance literature out there and supported by the long bull market that we’re just emerging from.

Fin

To summarize, the presence or absence of Marginal Buyers (and Sellers) sets the direction of the market. Four main Marginal Buyers have propelled the US stock market upwards in recent years. The Fed’s ongoing fight with inflation is causing the withdrawal of several of these Marginal Buyers. We think that this partially explains, and forecasts, the ongoing stock market crash.