Market Forecast - Earnings Season

Let's discuss how Q3 earnings season is going so far and share our predictions on where the market is headed in the next few weeks.

We’re starting November off by donating to Sanctuary SF again. Sanctuary SF is a homeless shelter in San Francisco that provides a bed, showers, laundry, and two meals a day for up to 200 residents ❤️ 🌱

As before, don’t feel pressured to join us. We simply ask readers to do a little extra good this month, whether for a cause you believe in, a friend, a loved one, or even for yourself.

In this week’s Market Forecast issue, we’ll discuss how Q3 earnings season is going so far and share our predictions on where the market is headed in the next few weeks.

At a Glance

Big Tech Earnings (Meta, Alphabet, Amazon, Microsoft, Apple)

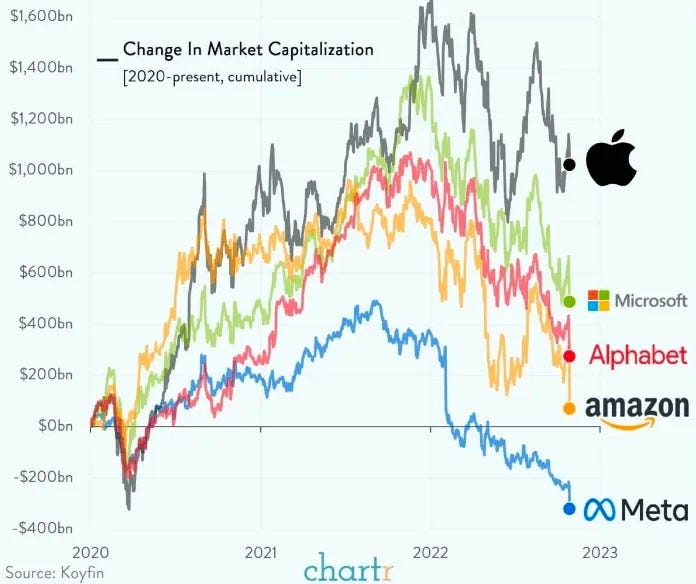

The Short: Meta investors capitulate as Zuckerberg continues to pump billions into the metaverse. Alphabet, Amazon, and Microsoft start feeling the pain of inflation, rising interest rates, and quantitative tightening. Only Apple escaped a post-earnings sell-off after the company beat Wall Street expectations.

The Long: Here are our three main takeaways from this earnings season for Big Tech:

It finally hit home to Meta investors just how much of the company’s cash flows Zuckerberg is willing to sacrifice to invest in the metaverse. Reality Labs lost $3.7 billion in Q3, $1.1 billion more than Q2’s loss of $2.6 billion. To add insult to injury, it appears the Reality Labs cash flow black hole is just getting started with outgoing CFO Dave Whener stating that “Reality Labs’s operating losses in 2023 will grow significantly year-over-year”. Zuckerberg maintains full control of the company and outside investors have no way of changing its course.

Alphabet and Microsoft have major revenue streams (advertising and B2B respectively) that are highly sensitive to interest rates. With the Fed aggressively raising interest rates and shrinking its balance sheet in the past two quarters, we’re starting to see the negative impact of this policy on Alphabet and Microsoft’s revenue streams in Q3. As we’ve mentioned before, the effects of rate hikes and quantitative tightening are delayed and we should expect more pain in the upcoming quarters.

Apple caters to higher end consumers than Amazon and we can see the split impact of inflation on both types of consumers. A higher income comes with a disproportionately lower sensitivity to inflation. Apple’s high-earning customer base continues to buy Apple’s devices and pay for Apple’s services, while Amazon’s customer base is starting to falter. Although overall consumer spending remains high, Amazon’s customers are being more selective on purchases and focusing on value pricing. This, coupled with higher input costs, is hurting Amazon’s bottomline. The lifting of most pandemic restrictions worldwide has also contributed to weakness in Amazon’s retail business as consumers not only spend less online and more at brick-and-mortar stores, but also spend less on physical goods and more on travel and experiences.

If you’ve enjoyed FinanceTLDR’s content, please consider upgrading to premium for only $6/month to support the publication.

In addition, we are working on premium-only content containing our best research and investment ideas. Fret not, FinanceTLDR’s regular content will remain free.

Payments Earnings (Visa, Mastercard, American Express)

The Short: All three payments giants had a great quarter as consumer spending remains strong despite high inflation (retailer margins are getting crushed but payment processors aren’t exposed to low margin purchases or higher input costs). Soaring travel spending is a top contributor to the upbeat earnings reports.

The Long: The impact of high inflation on payments companies has so far been muted as consumer spending remains high while low margin purchases and higher input costs don’t affect them as much as they affect retailers like Amazon. In addition, this is the first summer where most pandemic restrictions worldwide have been lifted and travel spending is soaring. Cross-border volume increased 38% YoY, 44% YoY, and 57% YoY for Visa, Mastercard, and American Express respectively. Strong consumer spending has prompted Visa’s CFO to go so far as to say that the company is “assuming no recession”!

“As we've said before, we are not economic forecasters. Clearly, there's a high risk of a global recession, but we do not have a specific point of view on if, when or the kind of recession we might have. For internal planning purposes, we are assuming no recession.”

Energy Earnings (Exxon and Chevron)

The Short: Exxon smashed Wall Street expectations and reported a quarterly profit of $18.7B ($16.2B expected). This makes Q3 its most profitable quarter in the company’s 152-year history. Chevron had a similar performance, reporting its second highest quarterly profit ever of $11.2B ($9.41B expected).

The Long: A major global energy supply disruption from the ongoing Eastern European conflict and strong global energy demand are greatly benefiting US energy companies. Energy is the only sector holding up broad stock market indices while many other sectors are feeling the pain of high inflation and rising interest rates.

Market Forecast

Here’s the rundown for what’s going on in the market right now.

The market has been rallying over the past few weeks for three reasons:

A rumor that the Fed will pivot away from tightening financial conditions and slow down its rate hikes. This was largely started by The Wall Street Journal’s chief economics correspondent Nick Timiraos in an article published on October 21st.

The upcoming Nov 8th midterm elections might bode well for the stock market. On average, stocks tend to rally after midterm elections. In the 15 midterm elections since 1962, the S&P500 climbed an average of 14.4% over a six-month period starting Nov 1st.

Hopes of a mild earnings season like the previous Q2 earnings season where the market overreacted to the damage rate hikes would do to earnings prior to their release. In Q2, many were expecting earnings to materially decline but since there is a lag between the economic impact of rate hikes and when they are actually implemented, earnings were still quite strong. This surprised the market and was a major contributing factor to the summer’s massive rally.

The fact of the matter is, the market is way too optimistic. This is yet another round of rumors of a Fed pivot and each time these rumors spring up, they become less and less trustworthy.

However, we can’t fault the market for unfounded optimism. We did just emerge from a decade-long bull market after all. This bull market wiped out pessimists and most investors, retail and institutional, are long-only. At this point, pretty much everyone is hoping for the market to return to its bull market form.

Yesterday, former Federal Reserve vice chairman and a member of Alphabet’s Board of Directors, Roger Ferguson, gave a pertinent interview on CNBC on the market’s unfounded optimism.

Here are some great quotes from the interview:

Becky Quick: “Part of the reason that the market has done so well this month… has been this idea that the Fed was going to slow down, and that’s there largely because of the article Nick Timiraos wrote… just talking about how maybe the pivot was near. But maybe people got a little carried away with that.”

Roger Ferguson: “Look I think the challenge has been that the market, which is meant to be forward-looking also has built-in a kind of optimism and I think it’s disconnected from the Fed’s deep commitment to getting inflation much closer to the 2% target. I think the market also has been hanging on to ideas, first peak inflation then pivot, and losing track of the big picture, which is that inflation is dramatically higher than the Fed likes, labor markets are still very tight, survey data suggests that CEOs plan to increase wages going forth for some period of time, and then the article that Nick just wrote suggesting that households are actually in pretty good shape when it comes to cash. All of these things will be driving the Fed to keep rates higher than maybe the market expects, and for longer. And so that’s been the disconnect and frankly it’s, to me, a bit of a head-scratcher.”

This interview is spot-on in describing the state of the market and we encourage our readers to give it a listen.

As for our predictions on where the market is headed, we think it’s going down. Here are the top reasons:

As we’ve mentioned in prior newsletter issues, the Fed has hiked rates dramatically in the past few months and there is a long lag time between the economic impact of rate hikes and when they are actually implemented. This long lag time is causing the market to seriously underestimate the impending economic damage.

The Fed is nowhere close to pivoting from rate hikes. Inflation is still extremely elevated, households are still flush with cash, and the labor market continues to be overheated. In fact, recently released job market data showed that the ratio of vacancies to unemployed workers ticked up in September to 1.86 from 1.68. This is one of the Fed’s favorite measures of the labor market and it wants this number to go down. History shows that inflation is very sticky and the Fed was punished multiple times for loosening financial conditions too early. Jerome Powell is a student of history and has quoted renowned Fed Chair Volcker multiple times. Volcker is widely credited for having ended the high levels of inflation in the 70s and early 80s by being relentless with rate hikes and keeping rates high to the point of bringing the economy into a major recession. It’s clear from Powell’s public statements that he’s willing to do the same.

Finally, the US recently introduced some of its most sweeping export controls yet aimed at cutting China off from advanced semiconductors and severely throttling its hegemonic ambitions. So far, the Chinese response to US economic aggression has been tit-for-tat but this latest round of export controls was met with deafening silence. This is likely because the government was busy running the 20th Party Congress where Xi Jinping formally cemented his unilateral power over the Chinese government. In the next couple months, we should expect an equally severe Chinese economic response to this new set of US export controls. This should be incredibly bad for stocks given that most major US companies bring in significant revenue from China (almost 20% of Apple’s revenue in Q3 came from “Greater China”!).