Market Forecast - Hurricane Dimon

Let's review market happenings this past week as well as what's to come. This week, we discuss JPMorgan Chase CEO Jamie Dimon's comments on the market and market indecision.

At a Glance

Jamie Dimon Takes the Market for a Spin

JPMorgan Chase CEO Jamie Dimon took the market for a spin in the past two weeks by first, on May 23rd, saying that the economy is strong and that the ongoing storm clouds might dissipate. Then, less than two weeks later on June 2nd, he backtracked by saying:

“You know, I said there’s storm clouds but I’m going to change it … it’s a hurricane… That hurricane is right out there down the road coming our way. We just don't know if it's a minor one or Superstorm Sandy. You better brace yourself.”

This abrupt change in tone is certainly curious and appears to be timed around the official start of quantitative tightening by the Fed (balance sheet sell-off) on June 1st. As the CEO of the US’s largest bank, the market pays close attention to his words and it’s uncharacteristic of him to flipflop on his messaging in such a short period of time. His May 23rd comments buoyed the market while his June 2nd comments wobbled it.

What could Hurricane Dimon be up to?

The Labor Market Is Still Strong

The Short: The labor market is still extremely strong, to the chagrin of the Fed. May’s labor market numbers were reported on Friday and the economy added more jobs than expected (390,000 vs 325,000 expected) and unemployment held steady at 3.6%. The most recently reported April Quits Rate also held steady (relative to March and February’s numbers) at a high of 2.9%.

The Long: As mentioned in previous issues, the Fed is worried about inflation as a result of a Wage Price Spiral. We’re at high risk of this with a strong labor market and the Fed’s monetary tightening policies is primarily aimed at cooling down the labor market. Strong labor market numbers suggest that the Fed needs to, at the very least, hold steady on its tightening policies and at worst, increase its aggressiveness.

Is China Reopening?

The Short: Beijing and Shanghai are starting to loosen intense lock down restrictions after case counts drop. This will reduce pressures on the strained global supply chain as Chinese factories and ports resume normal capacity.

The Long: Beijing and Shanghai have been in intense lockdown over the past couple months as China tried to contain outbreaks in its major cities. This has significantly affected global supply chains as factories and ports shut down. When they return to normal operating capacity, the global supply chain can breathe a sigh of relief. On the flip side, it’ll also mean a spike in global oil demand that will put upwards pressure on already highly elevated energy prices.

Fed Balance Sheet Run-Off, What’s Next?

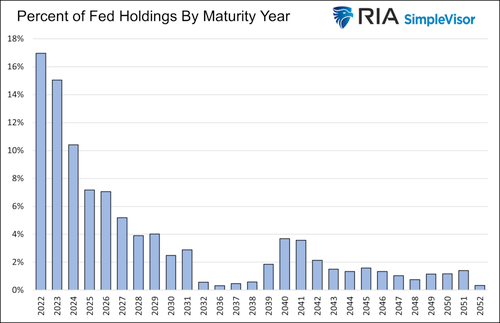

The Short: The Fed’s balance sheet run-off officially began on June 1st but in practice, actually begins on June 15th as $15 billion worth of Treasuries mature and will not be reinvested into more Treasuries.

The Long: As part of quantitative easing, the Fed bought trillions of Treasuries, Mortgage-Backed Securities, and other debt assets. With quantitative tightening, the Fed will no longer be buying debt assets and expanding its balance sheet, and will instead allow these debt assets to mature without reinvesting the proceeds into more debt assets. Without this tightening policy, the Fed would’ve reinvested the $15 billion of maturing Treasuries on June 15th. As such, this is in effect taking out $15 billion worth of buying pressure from the Treasury market. Over time, this reduction in Treasury buying pressure from the Fed should reduce prices and increase long term interest rates. It can take quite a while for the market to respond to quantitative tightening. The Fed began quantitative tightening in November 2017 and it was not until Q4 2018 when the market keeled over.

We’re So Much Closer to Driverless Taxis, Thanks to Cruise

The Short: In a unanimous vote last week, the California Public Utilities Commission (CPUC) has given Cruise the green light to operate a commercial driverless ride-hail service in parts of San Francisco. This makes Cruise (and parent company GM), the first companies to obtain such a permit in a major US city.

The Long: With this vote, driverless taxis will very soon become reality. You will soon be able to hail and pay for a Cruise self-driving vehicle to get ferried around San Francisco without a driver in the seat. I’ve been incredibly optimistic about Cruise’s prospects but am still pleasantly surprised at how fast it received this permit. The driverless taxi business will be a major money-printer and should propel GM to the nation’s top AV/EV (Autonomous Vehicle/Electric Vehicle) company. This permit is a major foot-in-the-door for Cruise where regulation is concerned and the company will look to aggressively expand the geographical areas and time-of-days it can operate in. As for GM’s stock price, the market can stay detached from reality for a long time, as we’ve seen in Netflix’s case and many others. Ultimately, GM’s current stable stock price is just more time to accumulate GM before a news catalyst changes the market’s opinion of GM.

Market Forecast

The market’s on edge. The jury is still out on whether we’re in a bear market rally or not. The odds are not in the market’s favor though, with quantitative tightening proceeding on schedule, Dimon warning about an impending hurricane (likely from quantitative tightening), and the labor market still going strong.

However, there’re also positive signs that inflationary pressures are letting up. There are rumblings of a possible negotiated peace in Eastern Europe as well as the ongoing easing of lock down restrictions in China.

This week, we’ll see May’s CPI numbers released. The entire market is watching these numbers for an indication of where inflation is trending. A falling core CPI number (excluding energy and food) will be well received by the market.

Changing market conditions will change expectations on Fed policy. However, it’s still unclear how deeply the Fed wants to cut into its balance sheet and it’s quite possible they will keep reducing the balance sheet even as inflation eases.

The bottomline is the market is in wait-and-see mode. A lot hinges on May’s CPI print that will be released on Friday.

In Case You Missed It

Here’s last week’s newsletter issue on the importance of trading volume in the stock market. We discuss how volume can provide a wealth of information for traders and also answer a very fundamental question for the stock market: how do stock prices change if trading doesn’t change the total cash in the stock market and only moves cash around?