Market Forecast - Real Estate, Real Inflation

Reviewing market happenings this past week as well as what's to come. Let's discuss falling oil prices and the Fed's real estate inflation problem.

I wanted to preface this newsletter issue by reiterating the message from last week’s issue. What Josh Brown said really resonated with me. Although the market is a mess right now, this is the type of market that the best traders are made from. Hang in there, and when the dust settles, you’ll have a trove of experiences and lessons that will serve as excellent guides to navigate future markets.

At a Glance

The Fed’s Real Estate Inflation Problem

It’s clear from the market’s reaction to May’s CPI report that CPI is the main metric driving the inflation narrative right now. The problem for the Fed is, shelter represents a whopping 42.4% of the CPI, and there are legitimate concerns that this component is about to shoot up higher as a lagging effect of the past year’s extremely hot housing market. We expand on the Fed’s Real Estate Inflation Problem in the Market Forecast section below.

Oil Prices Are Falling

The Short: Oil prices fell steeply last week (WTI crude tumbled from over $120 to under $110). If sustained, this should significantly cool inflation. However, it’s unclear whether this dip is temporary or the start of a longer term trend.

The Long: We wrote last week that for the stock market to recover, we need to cool inflation, and for inflation to cool, energy prices need to fall. It’s thus good news that oil prices fell drastically last week after the Fed raised interest rates by 75 basis points. This fall is generally attributed to worries of an impending recession from accelerating rate hikes. We’re unsure whether this is a short term dip or the start of a longer term trend. There are so many geopolitical factors that affect oil prices. We are watching out for:

Biden’s upcoming trip to Saudi Arabia on July 13th. He’ll try to get OPEC to increase oil production.

Libya’s oil production is under stress as tribal groups shut down much of the country’s oil facilities in southern and central Libya in protest of the current government.

Sanctions on Iran continue to block Iranian oil from entering Western markets. Unfortunately, the prospects for reducing sanctions on oil are dwindling.

China’s reopening will significantly increase demand for oil.

Europe is set to ban most Russian oil imports by the end of 2022. This is still several months away but when it does happen, it’ll significantly increase Western oil prices.

Crypto Is Bailing Itself Out

The Short: Major crypto companies Binance and FTX have taken it on themselves to bail out the crypto industry after a string of massive liquidations from less well-run companies. These liquidations have put significant pressure on crypto prices and other leveraged market participants.

The Long: The top two international crypto exchanges Binance and FTX have taken it on themselves to bail out the ailing crypto industry that’s currently suffering from a string of massive liquidations. Binance confirmed that it has recently bought over $2 billion worth of Bitcoin as a way to “buy the dip” as well as to stabilize Bitcoin’s falling price. Sam Bankman-Fried, founder and CEO of FTX, has all but confirmed rumors that FTX is bailing out struggling crypto companies. This likely includes struggling crypto lender Celsius that recently froze more than $10 billion in customer deposits. These bailouts show that crypto has matured enough that there are now highly capitalized and well-run companies with the ability and willingness to self-modulate the industry.

Federal Reserve Appearances This Week

One thing is clear from this year’s turbulent markets: the Fed plays an outsized role in driving market movements. Having pitted itself in an urgent fight against inflation, it’s more important than ever for traders to know when the Fed will talk. The market hangs on to the Fed’s each and every word, making Fed speaking events risky bubbles of uncertainty to watch out for.

This week, we’ll have:

Jerome Powell testifying on monetary policy to the Senate on Wednesday and the House on Thursday

Richmond Fed President Tom Barkin speaking on Tuesday

Chicago Fed President Charles Evans speaking on Wednesday

San Francisco Fed President Mary Daly speaking on Friday

St Louis Fed President James Bullard also speaking on Friday

Samurai Banking

The Japanese 10-year bond is at risking of breaching the Bank of Japan’s 0.25% interest rate ceiling. Major market participants are shorting the 10-year bond betting that the BoJ can’t maintain this ceiling in the face of rising interest rates worldwide. To defend this ceiling, the BoJ is printing money at unprecedented levels to buy 10-year bonds. It’s unclear how long the BoJ can keep this up before something breaks.

Market Forecast

Real Estate, Real Inflation

At the end of last week’s FOMC press conference, Fed Chair Jerome Powell gave a stark warning to prospective home buyers. Don’t buy.

“I would say if you're a home buyer, somebody or a young person looking to buy a home, you need a bit of a reset. We need to get back to a place where supply and demand are back together and where inflation is down low again and mortgage rates are low again so this will be a process whereby we ideally do our work in a way that the housing market settles in a new place and housing availability and credit availability are at appropriate levels. So, thank you very much.”

This was a rare, direct call-to-action (or call-to-inaction) by Powell to the American people. From this statement, it’s clear that the Fed is worried about real estate’s impact on inflation.

But why are they so worried? Isn’t a spiking average mortgage rate (from 3% earlier in the year to over 6% recently) already slowing down the housing market?

The housing market may indeed be slowing but I recently stumbled upon a paper from Fannie Mae titled Housing Insights: Housing Poised to Become Strong Driver of Inflation. This paper was presciently published in June 2021. It warned that a hot housing market drives inflation, but this inflation won’t show up for about five quarters.

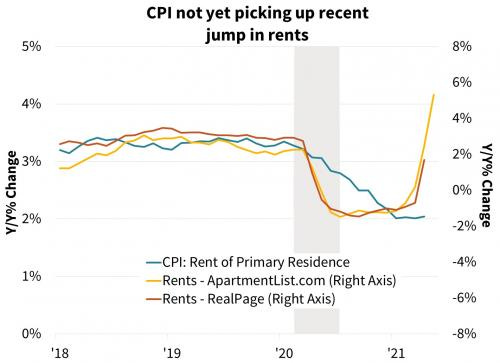

This lagging effect is the result of rent prices being sticky (note that the CPI’s shelter component only measures rent prices and not home prices, though rent prices are affected by home prices). Inflation indices typically measure current rents paid rather than the asking rents of vacant units. Current rents change slowly. Leases are typically set for a year and even when a lease is up for renewal, landlords are either legally unable or are hesitant to strongly raise rents on existing tenants.

As such, the Fannie Mae paper predicted that 2021’s extremely hot housing market would result in significant CPI inflation in 2022. Given that the housing market remained heated until earlier this year when mortgage rates started to spike, many economists are predicting that shelter inflation will start showing up in the CPI soon as a major driver of overall inflation.

In fact, shelter inflation is already picking up. This is probably why the Fed is so worried. In May’s CPI report, we saw shelter costs rise 0.6% month-over-month, the fastest one-month gain since March 2004. Shelter costs also rose 5.5% year-over-year, the fastest twelve-month gain since February 1991.

The Fed is correct to rapidly raise interest rates to cool down the real estate market in order to fight inflation, but could they be too late? Their first rate hike since the pandemic started happened in March with a measly 25-basis-point raise. In fact, they were still buying mortgage-backed securities in April! In addition, could there be short-term inflationary effects from cooling down the real estate market as money previously locked away for down payments and mortgage payments suddenly become spendable when people put off buying homes?

Many investors and economists definitely think the Fed is severely behind the curve. For now, we’ll have to wait and see how much rents will rise in the second half of 2022 and whether the Fed’s rate hikes were effective in dampening rent increases.

A Green Forecast

Here’s some good news, we’re forecasting a market rally as we near the end of the month. Oil prices fell hard last week, growth stocks appear to have bottomed (but haven’t started rising yet), and most importantly, we’re in the last two weeks of the month and quarter when funds will typically rebalance. For one, Goldman Sachs is estimating that there will be $30 billion worth of buying demand for stocks from pension plans, and secondly, stocks significantly underperformed bonds this quarter, which suggests that stock/bond funds need to rebalance by selling bonds and buying stocks.

Let’s hope this forecast is right, and we end the quarter with some green!