Market Forecast - This Is It!

Reviewing market happenings this past week as well as what's to come. This is a crucial week that will probably set the tone for Q3.

This is it! This is the week that will probably set the market’s tone for Q3.

Several important events are happening this week: Wednesday’s release of June’s CPI report, Biden’s trip to Saudi Arabia (beginning on Wednesday), and S&P500 companies starting to report Q2 earnings this week.

For predictions on where the market’s headed, check out the Market Forecast section below.

At a Glance

First Full-Color Photo From the Most Advanced Space Telescope

NASA is set to release the first full-color, high-resolution photo taken by the James Webb Space Telescope (JWST) today. The $10 billion telescope was launched to space on December 25th 2021 and recently became fully operational.

The image being released today, called “Webb's First Deep Field”, is the deepest and highest resolution infrared view of the universe we’ve captured so far, showing galaxies as they appeared up to 13 billion years in the past. The reveal will be held at the White House at 5pm ET, with President Biden and NASA officials in attendance.

Exciting!

“What I have seen moved me, as a scientist, as an engineer, and as a human being”

NASA's deputy administrator, Pam Melroy

Germany Is Going Back to the Stone Age

Germany’s electricity costs are soaring as Russia continues to wage an energy war on continental Europe. Germany currently relies on Russia for 35% of its natural gas imports, and Russia has been gradually cutting natural gas flows to the country as well as to the rest of Europe.

The situation is dire enough that several cities like Hamburg are restricting hot water to certain times of the day and turning off traffic lights at night. Germany’s largest landlord is also restricting heating at night in its buildings.

To make matters worse, Nord Stream 1, the biggest pipeline carrying natural gas to Germany (and the rest of Western Europe) begins its annual maintenance today. The maintenance period is expected to last for 10 days and gas flows are stopped entirely during this time. Many are worried flows won’t resume.

The US Job Market Remains Hot

Nonfarm payrolls increased to 372,000 in June, 48% higher than the Dow Jones estimate of 250,000!

Unemployment rate was unchanged from May, at 3.6%.

Average hourly earnings increased by 0.3% from May, up 5.1% from a year ago. This is slightly higher than the Dow Jones estimate of 5%.

The sectors that created the most jobs in June were education and health services (96,000), professional and business services (74,000), and leisure and hospitality (67,000).

A hot job market signals to the Fed that they need to keep up their aggressive tightening policies. This is likely why the market’s expectations for another 75-basis-point rate hike increased after this jobs report. Higher rates means further contraction in the most rate sensitive parts of the economy, including real estate and high growth tech. Both are already plunged into a deep recession.

A stubbornly hot job market shows how slowly the Fed’s blunt instrument of raising interest rates is able to cool the economy at large.

Quantitative Tightening? How Does That Work?

There’s a lot of talk about the Fed’s ongoing quantitative tightening (QT) policy without much explanation about what JPow and his motley crew of Fed officials are actually doing. At a high level, QT means shrinking the Fed’s balance sheet.

There are two ways to do so. One is more gradual, where the Fed stops replacing maturing bonds in its balance sheet. Another is to actively sell bonds. The Fed’s current QT policy does the former. It’s allowing a capped dollar amount of bonds to run off its balance sheet each month. The monthly run-off for Treasuries is capped at $30 billion while the monthly run-off for Mortgage-Backed Securities is capped at $17.5 billion. On September 1st, these caps increase to $60 billion and $35 billion respectively. Practically, this means less bond-buying from the Fed. Less buying means lower bond prices, and lower bond prices directly translate to higher interest rates.

In the meantime, the balance sheet can fluctuate in value as the bonds in it appreciate or depreciate. This means that the balance sheet can grow in size even as QT is happening. You can track the Fed’s balance sheet here.

Market Forecast

A Broad-Based Recession Isn’t Happening, Just Yet

Just as there’s a lot of talk about QT, there’s also a lot of talk about a recession. I think the recession buzz is just noise.

Sure, the recent aggressive rate hikes and expectations for more have plunged interest-rate-sensitive sectors of the economy into a recession, such as real estate and high growth tech, but it’s going to take a looong time before the rest of the economy is affected.

US consumers entered 2022 with $2.4 trillion in excess savings and this is still being burned down. In addition, this is the first real post-pandemic summer and 75 basis-point rate hikes won’t stop people from letting out their pent up travel and events energy. Corporations are also flush with cash, with many opportunistically taking out loans during the low interest rate environment of the last two years.

This thesis is supported by June’s jobs report coming in way above expectations despite pundits on CNBC, Twitter and other financial media constantly talking about an impending recession.

At this rate, higher oil prices are doing a better job at cooling the economy than Fed rate hikes, but crude oil at over $100 per barrel is only back to 2011-2014 levels and we need to go much higher before consumers and corporations feel squeezed enough to significantly cut back on spending.

We’re Bearish

As mentioned above, several important events for the market are happening this week.

On Wednesday, June’s CPI report will be released. Even though the Fed prefers PCE as an inflation measure, the market appears to be closely tuned to CPI instead given how strongly it reacted to May’s report. Right now, expectations are that June’s CPI will come in hotter than May’s 8.6% year-over-year increase.

Biden’s trip to Saudi Arabia starts on Wednesday. He’ll be meeting with Crown Prince Mohammed bin Salman (MBS) in an effort to repair US-Saudi relations and get OPEC to raise oil production. Given rumors that the Saudis and the UAE are pretty much at capacity, as well as the extremely poor relationship between the Biden administration and MBS, we think the Saudis are likely to deny Biden.

Finally, S&P500 companies start to report Q2 earnings this week. In total, $21 trillion worth of S&P500 companies will report Q2 earnings this month. This is huge. If earnings disappoint, consensus forward earnings estimates should fall. These estimates surprisingly haven’t come down yet but when they do, it’ll trigger significant selling of stocks from passive funds.

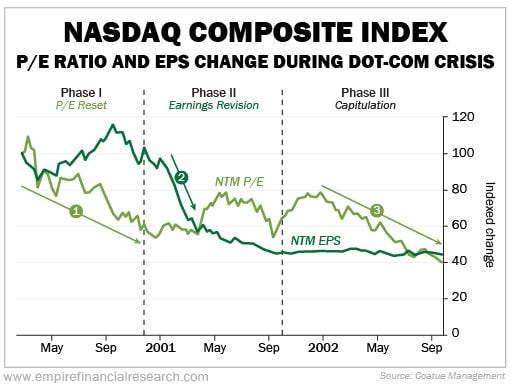

The chart below is from a leaked Coatue Management presentation outlining the steps the hedge fund is taking to protect its investors’s capital. Coatue has $70 billion in assets under management. The chart shows three phases of the DotCom crash’s market decline. During the first phase, earnings multiples contract. In the next phase, forward earnings estimates fall as current earnings disappoint. Finally, we have capitulation. The thesis here is that we’re about to enter the second phase of the market decline. In the past two quarters, falling earnings multiples pushed the market down. Now with high oil prices squeezing companies and consumers, company earnings should disappoint as margins drop.

Given all this, we think July will probably be a red month. The CPI report will likely be hot and continue to disappoint those hoping that we’ve hit peak-inflation. Real estate inflation is also just starting to affect the CPI (we discuss how home prices have a lagged effect on the CPI here).

Inflation will also be driven by an oil market that should continue to heat up. With the Eastern European conflict escalating, China reopening, and OPEC’s inability to raise oil production, it’s hard to see oil prices cooling down in the near future.

Finally, the kicker for the forecasted red market will be disappointing S&P500 earnings and a downward revision of forward earnings estimates.

As always, you can never be certain about where the market’s headed but we think the odds are it’ll be downwards. We recommend taking some risk off the table for the next few weeks. Thread carefully in these volatile markets!