Market Forecast - Watch Out for June 1st

Reviewing market happenings this week, and reviewing what's to come. There is one important date coming up that every acute trader should watch out for.

At a Glance

June 1st. This is the date when the Fed will start selling assets from their $7 trillion balance sheet. So far the only things the Fed has done to tighten monetary policy is stopping balance sheet growth and raising the Fed Funds Rate by 1%. On June 1st, they start selling up to $30 billion in treasuries and $20 billion in mortgage-backed securities per month. We don’t know what will happen when they do, but it’s very likely we’ll see elevated volatility leading up to this date.

Signs of economic slowdown everywhere. But the job market is still hot. April’s Empire state manufacturing index (-11.6 vs expected 16.5) and Philadelphia Fed manufacturing index (2.6 vs expected 15.0) both drastically underperformed expectations. The performance of Walmart and Target are bellwethers for the health of US consumers and both were crushed after their earnings report. However, the job market remains strong with continuing jobless claims decreasing by 200,000 since the last report (1.32 million vs the last period’s 1.34 million) while initial jobless claims came a hair above expectation (218,000 vs expected 200,000).

BlackRock’s $10B Momentum ETF is rebalancing out of tech and into energy stocks next week. This ETF rebalances twice a year and it’s expected that next week will be a rebalancing event. With the recent underperformance of tech and strong performance of energy, the ETF will rebalance by selling tech stocks and buying energy stocks. This adds to the volatility leading up to June 1st.

This chart shows what inflation is doing to the US consumer. Inflation is shifting spending from non-essentials to essentials, with gas leading the pack.

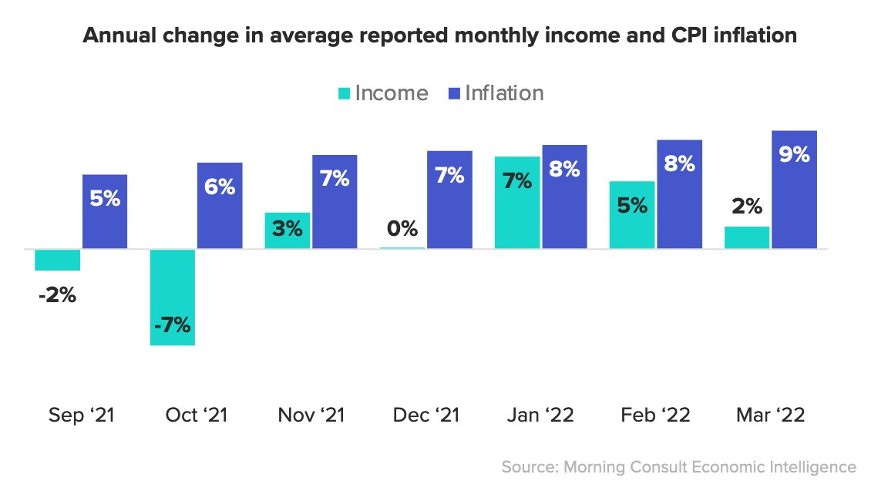

In the meantime, incomes are not keeping pace with inflation. This is the wage-price spiral that the Fed is really worried about. As inflation rises, income rises, which starts a destructive fly wheel of more inflation, more income, more inflation, more income. Ultimately, income will greatly lag inflation.

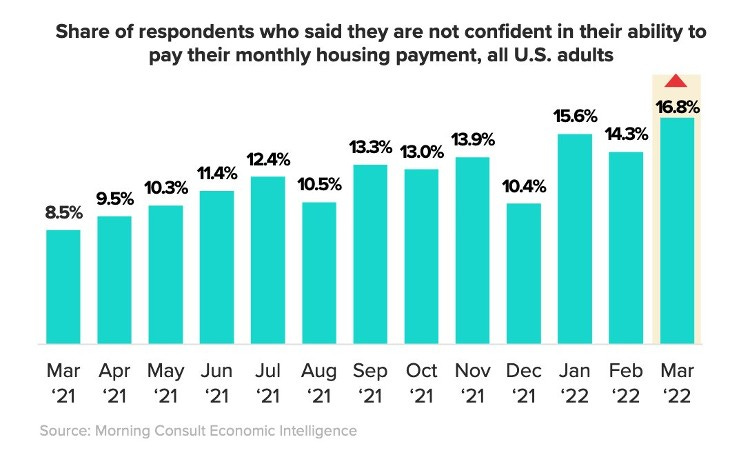

Finally, Americans are feeling less confident about meeting their monthly housing costs. This makes sense with inflation pushing up commodity prices, mortgage rates soaring, and incomes not keeping pace. Although not alarming just yet, it’s still a worrying trend.

Fed Chair Jerome Powell has never been more hawkish. In a Wall Street Journal interview on Tuesday, Powell was incredibly hawkish. A few select quotes: “a softish landing is still a good landing”, “there could be some pain involved”, “if we have to go past neutral, we won’t hesitate”. Powell is talking the market down to tame inflation, and if the market won’t cooperate, then the actual policy actions later this year will do the job. It’s bearish out there, but we still think it’s best to hold on and dollar-cost average into high quality stocks.

Market Outlook

Let’s review what the Fed has done so far in terms of tightening monetary policy. They have increased the Fed Funds Rate by 1%, and stopped expanding their balance sheet. That’s it. What has the market done in response? SPY dropped 20% year-to-date while TLT (long-term US treasuries fund) dropped 13.5%. The market is pricing in significantly tighter monetary conditions, in line with the Fed’s super hawkish tone of late.

In a couple of weeks, anticipatory price moves become reactionary price moves as the Fed starts to implement a significant tightening policy they were warning about. On June 1st, as I mentioned above, they will start selling off their balance sheet.

People say that trading macroeconomic theory is hard, because you need to be right about two things. One, you need to be right about future macroeconomic conditions. Second, you need to be right about how the market reacts to these conditions.

Thankfully, with the Fed starting to sell off their balance sheet, you only need to be right about one thing, and that’s market reaction. Though it’s bearish for the Fed to be selling off their balance sheet, there is a good chance of a relief rally as uncertainty passes. After all, the Fed is only nibbling at the bit by selling off such a small portion of the balance sheet each month.

One thing is for certain though, there will be elevated volatility leading up to June 1st (i.e. likely red markets). This is also because, next week, several important inflation-related economic numbers will be reported on Friday (April PCE and Core PCE inflation, real and nominal consumer spending, real and nominal disposable income). Finally, BlackRock is also expected to rebalance their $10B Momentum ETF out of tech into energy.

Bottom line: expect elevated volatility leading up to June 1st. If you’re trading, reduce your risk, then prep for a relief rally. If you’re holding, try to ignore the volatility, add to your best positions, and hold on.

Did You Know…

At the end of 2020, an interesting trend started to emerge. The past four bear markets since the end of 2020 all ended with a V-shaped bottom in the last week of the quarter. Three of those bottoms took place on the exact same day of the month, the 23rd.

In a future newsletter issue, we’ll dive into why this might be the case, why this trend has weakened in the past year, and whether it will hold water moving forward.