Market Forecast - What Now?

Reviewing recent market news and forecasting where the market is headed. Can the ongoing market rally last or is it just another bear market rally?

Last week, the market shrugged off a large but expected 75-basis-point interest rate hike from the Federal Reserve and rallied hard after five tech giants, Alphabet, Amazon, Apple, Meta, and Microsoft, all reported Q2 earnings results in the same week. Although the results didn’t quite meet expectations, they were “not that bad”. In this market environment, bad news that’s “not that bad” is great news and thus an excellent excuse to rally off of.

This week, in the Market Forecast section below, we’ll dive into what’s driving the current market rally and whether it has more room to run.

At a Glance

A Strong Dollar vs US Companies

The US Dollar has been steadily appreciating relative to other currencies since the start of the year. The DXY (US Dollar Index) climbed from 96 in January to over 108.5 in mid-July. Although a strong dollar lowers the cost of imports, it often negatively impacts the financial results of US companies with international businesses. These companies report all international sales and profits in dollars and thus need to convert foreign currency cashflow into dollars. A strong dollar means weak dollar-denominated financial results.

Thanks to globalization, many US companies have large international businesses (as seen in the chart below) and are thus exposed to significant currency risk. Generally, these companies mitigate currency risk by hedging through “currency swap forward contracts” (i.e. shorting a foreign currency to reduce losses if the currency falls in value).

We’re Eating Out Again

2020’s massive spike in food delivery demand growth has fully retraced. With the economy reopening, people are eating out again. Food delivery companies that greatly benefited from this fleeting growth spike are now forced into painful austerity as the market revalues them at a much more modest growth rate. For example, DoorDash’s stock price has fallen more than 70% from its 2021 peak.

Recovering Supply Chains

Shanghai to Los Angeles container rates are down 58% from their peak last year. This is yet another sign of cooling inflation as strained global supply chains gradually recover.

Market Forecast

The S&P 500 roared upwards last week, jumping more than 8% from $381 to $412. There were worries that Q2 earnings results will push the market lower and continue the past two quarters’s market sell-off. However, with the market shrugging off missed expectations from the Q2 earnings reports of the five largest US tech companies last week, it’s clear that bad earnings results are not a risk factor.

Many investors were blindsided by the strength of the recent rally. With things calming down after an eventful past week, the question on everyone’s minds is:

“What now?”

The prevailing driver of this massive rally is the expectation that inflation has peaked and the Fed will soon have the green light to ease interest rate hikes. Last week’s 75-basis-point rate hike was large, but expected. Many are now expecting future rate hikes to be smaller, at 50 basis points or less, and the bond market is even pricing in interest rate cuts next year!

Inflation

There are very good reasons to be bullish. For one, falling commodity prices (especially oil) has really helped cool inflation. While June’s inflation print might have been the largest this year, many are expecting July’s inflation print to be a lot milder due to falling commodity prices. In fact, the Cleveland Fed is forecasting July CPI to increase by only 0.27% month-over-month (when annualized, this is just 3.24%). If this forecast is correct, it’d be the lowest month-over-month CPI increase since January 2021.

But are we really out of the woods yet with inflation? Inflation has a tendency to be sticky and can easily roar back, especially if geopolitical tensions worsen. Nancy Pelosi is currently doing a tour of Asia and likely to visit Taiwan, much to the chagrin of China. The Eastern European war could also escalate at any moment and further restrict the supply of global commodities.

In addition, even if inflation holds steady month-over-month for the rest of the year, the annual inflation rate will still come out to 6.3% since inflation was so hot in the first half of the year. 6.3% is much higher than the Fed’s 2% target for inflation.

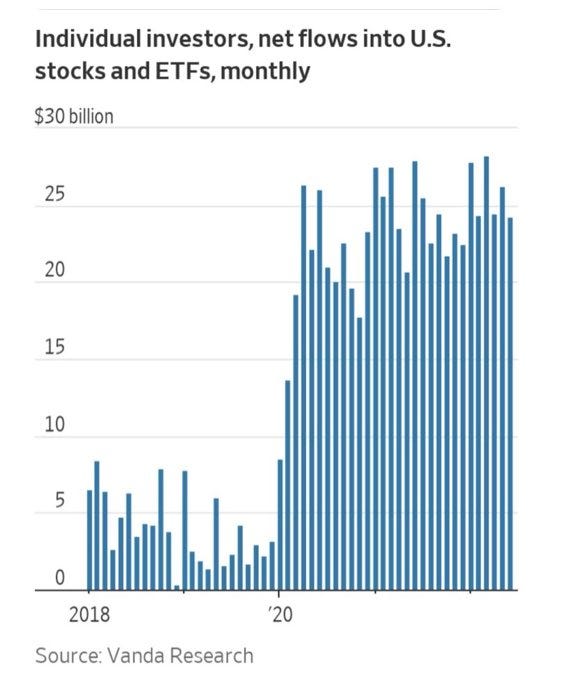

Individual Investors Keep Buying

Another contributing factor to the recent rally is the relentless buying of individual investors. Individual investors remain unfazed by the current bear market and continue to pile money into stocks. This is yet another sign that recent recession warnings are overblown. American consumers are clearly not feeling the effects of a recession and have significant capacity to keep consuming and investing.

Historically, in major market downturns, institutions are the first to sell while individual investors take a lot longer to capitulate. Similar to historical bear markets, this current market sell-off was led by institutional selling; the main difference this time is the steadfast confidence of individual investors. For now, there isn’t a strong reason for this confidence to crumble (a doubling of milk prices is not enough). A real recession will do the job, but we’re nowhere near a real recession.

The Bottomline

We are not out of the woods yet.

There is cause for celebration but it’s not yet time to celebrate. If you got on this market rally early, congratulations! It’s a good idea to keep riding the rally as long as you have a reasonable stop loss. If you’re still on the sidelines, consider layering into a long position (e.g. 10% or 20% to start). There is always the chance that this is the start of the next major bull market.

Despite the recent euphoria, we need to keep the poor macro environment in perspective. The Fed is still raising rates, a war is still raging in Eastern Europe, and US-China tensions continue to worsen. We might be far from a recession at this moment but we could very well start experiencing real economic pain by year-end, especially when American consumers burn down their excess pandemic savings.