Market Pulse: Big Week, Big Changes

In 7 minutes, understand this past week's major market events and their implications for stock prices in the coming months.

This past week was a big week for the market with many significant events happening:

Treasury Quarterly Refunding Announcement (QRA)

January Federal Open Market Committee (FOMC) meeting

Non-Farm Payroll data

Big Tech earnings

Another regional bank is in trouble

In this issue, we aim to simply and intuitively explain each event and its implications.

For paid subscribers we’ll go over how we plan to navigate markets given these events, discuss AMD’s earnings, and share new trade ideas.

Let’s start.

💡 Treasury Quarterly Refunding Announcement (QRA)

Why does US government debt matter?

The US Treasury is expected to nearly DOUBLE treasury issuance this year to $2 trillion and so the market is especially worried about debt issuance.

Govt debt issuance puts upwards pressure on long-term interest rates while directly reducing systemic liquidity (AKA less money for stocks).

Good news from the Treasury QRA:

The Treasury expects to issue slightly less debt than expected and believes its unlikely to increase planned debt issuance for the rest of the year.

Will significantly cut back on issuing short-term debt (-$317 billion in overall short-term treasuries supply in Q2).

This reduces pressure on a key pillar of the financial system, the short-term dollar funding markets.

First, what’s the QRA?

The US Treasury announces the amount of debt it expects to issue and the distribution of the debt across different maturities for the next two quarters through QRAs.

QRAs were typically a non-event for the market until last year when it became apparent the US government’s spending (already elevated since the pandemic) was about to surge.

Specifically, the US Treasury is expected to nearly DOUBLE treasury issuance this year to $2 trillion!

The market is worried about this year’s massive increase in government debt, fearing higher long-term interest rates (already at historical highs) and falling bank reserves.

The ultimate effect of both are cuts to spending and valuations across all parts of the economy.

Not good.

As such, how the Treasury expects to issue new debt has become increasingly important and the previously mundane QRAs have recently become market-moving events.

So what happened with the QRA last week?

There was some good news and the market took it in stride.

First, the Treasury expects to borrow $760 billion in Q1, which is $55 billion below estimate (small win) and for Q2, it expects to borrow a reasonable $202 billion.

More importantly the Treasury will reduce borrowing in short-term and long-term treasuries and increase borrowing in the “belly” of the debt maturity curve (AKA 2-year to 7-year treasuries).

This is strategic.

Short-term treasury issuance puts pressure on short-term dollar funding markets, a crucial pillar of financial markets while long-term interest rates hold disproportionately more influence over the economy due to their relationship with significant industries like real estate.

We think it’s a good move by the Treasury to reduce debt issuance in the tail ends of the debt maturity curve. It’s an even-handed approach that reduces turbulence for financial markets.

💡 January Federal Open Market Committee (FOMC) meeting

Why does the FOMC matter?

The Fed makes regular updates to its monetary policy at 8 FOMC meetings spread throughout the year.

The market expects the Fed to start easing monetary policy in March after two years of rapid tightening.

Easing monetary policy → more systemic liquidity.

Bad news from the January FOMC:

Jerome Powell crushed the market’s hopes of the Fed cutting interest rates in the March FOMC meeting.

The Fed wants to see more evidence of inflation cooling before easing monetary policy.

Counter-intuitively, delaying rate cuts is good news for the economy.

Over the past few months, the market has picked up hope of the Fed starting to cut interest rates in the March FOMC meeting.

As such, the market is looking for affirmation of this expectation in last week’s January FOMC meeting.

That didn’t happen.

Leading up to the meeting, the market was pricing in chances of a March rate cut to as high as 65%. After the press release, the odds plummeted to just 36%.

The key issue at hand is inflation. Powell wants to see further evidence of inflation falling without specifying what exact threshold is.

At face value, cutting interest rates is a good thing as it makes money cheaper, and thus more available, in the economy. However, rate cuts could also be a negative signal of an impending recession.

In fact, did you know that almost all recessions in the past few decades have started shortly after the Fed started cutting interest rates.

By keeping interest rates high, the Fed is indirectly signaling that it thinks the economy is still strong and doesn’t need support from rate cuts.

As such, counter-intuitively, it’s arguably good news for the economy when the Fed chooses to delay rate cuts.

💡 Non-Farm Payroll Data

Why does Non-Farm Payroll (NFP) data matter?

Payroll data is a direct measure of employment in the economy, and thus an indirect measure of economic growth and inflation.

Fed policy changes are significantly influenced by economic growth and inflation.

Bad (?) news from NFP data:

Non-farm payrolls rose by 353,000 in January, which is significantly above expectations of 180,000.

This shows the economy is running hot, which is generally a good thing, but…

The Fed really wants inflation to cool and a hot economy increases the risk of inflation rising.

As such, hot NFP data further hammers home the Fed’s point that it shouldn’t cut interest rates soon.

In this lop-sided economy, is good news good news, good news bad news, bad news good news, or bad news bad news?

The good thing is the market tends to go up by default so when there’s ambiguity on how to interpret the news, up it is!

💎 Lifting The Veil - All Our Research Made Available

We just updated FinanceTLDR premium to include more our:

Research

Trade ideas

Day-to-day market insights

Markets move incredibly fast and we use a combination of up-to-date macro market insights and market structure monitoring (e.g. net MM gamma exposure) to formulate asymmetrical trade ideas with positive convexity and capped downside.

Paid subscribers get full access to the process, ideas, insights, past trades, and active trades.

💡 Big Tech Earnings

Good news from Big Tech earnings:

Meta and Amazon blew away market expectations in their earnings calls on Thursday. Their stocks rose 20% and 8% respectively post-earnings.

This bullish outcome completely offset the market’s muted-to-negative reactions to Microsoft and Google’s earnings earlier in the week and major equity indices climbed higher.

Apple earnings was a big “meh” but the market is overall bearish from a saturated IPhone market and a shrinking Chinese market.

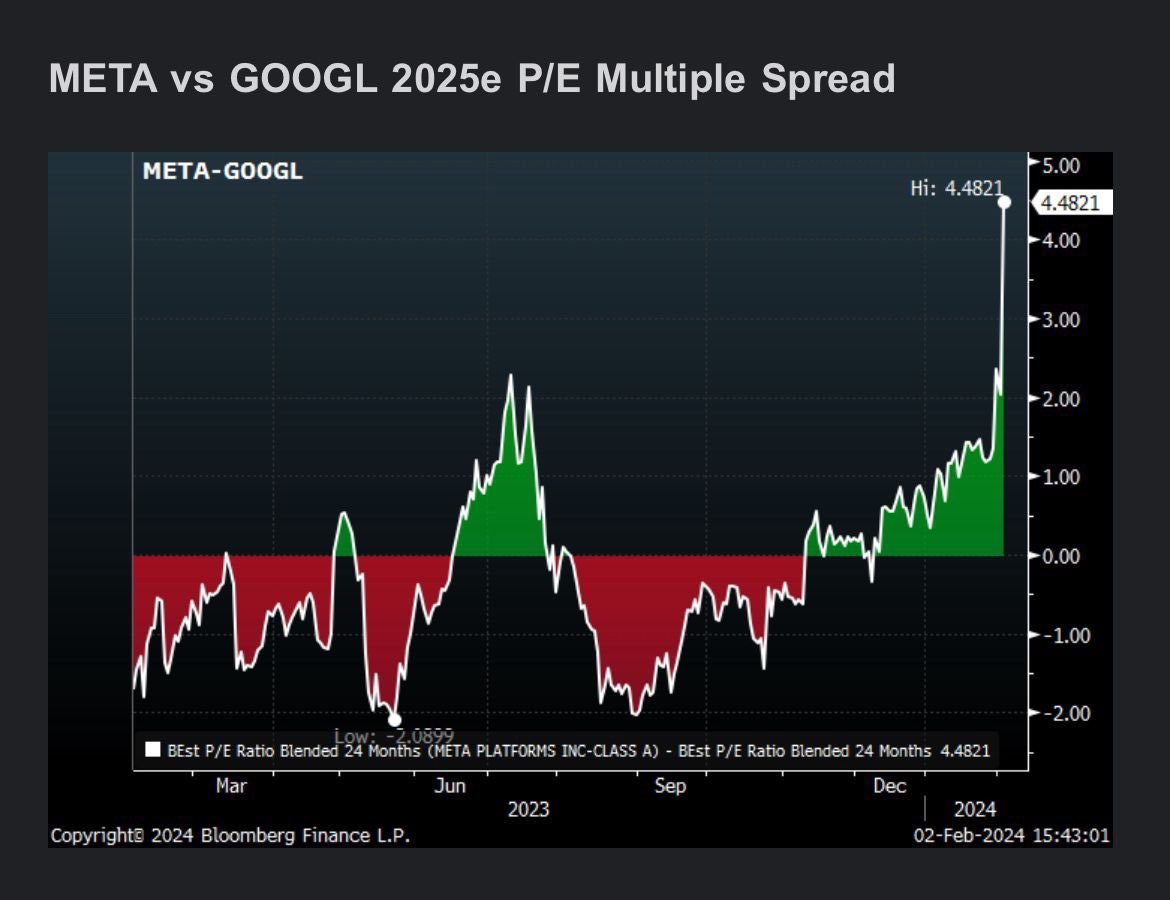

The market sees Google as having the most to lose from the emerging AI supercycle.

I wanted to specifically discuss Google after this round of Big Tech earnings.

Google’s stock fell by almost 8% post-earnings and it’s clear the market is pricing Google as having the most to lose among Big Tech from the emerging AI supercycle.

The crux of the issue is that Search is an incredibly profitable business for Google, running with a 75% profit margin.

However, there’s a growing view in the market that AI-powered Large Language Models like ChatGPT are superior products to Search and will likely take significant market share.

Even if Google launches an LLM that’s on-par or better than ChatGPT, Google’s complete dominance and high margins in Search means that if LLMs do replace Search, Google will lose market share in all cases.

In addition, the market is disappointed with Google’s operating efficiency.

While Meta almost tripled its earnings per employee in the past 15 months, Google’s earnings per employee only increased by 60%.

The market wants from Google a definitive answer for the AI revolution and higher operating margins but the company is dragging its foot on both fronts.

Not good.

💡 Another Regional Bank is in Trouble

The New York Community Bank’s (NYCB) stock price was cut by almost half from its earnings report this week.

After the regional banking crisis early last year, the market is understandably nervous when yet another regional bank comes under stress.

The bank’s commercial real estate portfolio experienced large draw-downs in the quarter and dividends were cut to increase capital on the balance sheet to protect against the losses.

Fortunately, market consensus is that NYCB’s bad earnings report is idiosyncratic to the bank and ultimately a “tempest in a tea cup” scenario.

💎 Important Market Update (for paid subscribers)

For the rest of this issue, we’ll discuss how we think this market will move based on the news this week.

We’ll also have a quick work on AMD’s earnings and update existing trade ideas while sharing new ones.