Market Pulse: Nvidia Saves the Market

In 6 minutes, understand how Nvidia's earnings call saved the market and where we think the market is likely headed from here.

In 6 minutes, understand how Nvidia's earnings call saved the market and where we think the market is likely headed from here.

🔥📈 Nvidia saves the market

Nvidia had another blockbuster earnings call.

Here are the top-level numbers.

Earnings Per Share (EPS): $5.16 adjusted vs. $4.64 expected

Revenue: $22.10 billion vs. $20.62 billion expected

Q1 guidance: $24 billion vs $22.01 billion expected

As we anticipated, Nvidia handily beat their own revenue and EPS guidance for the quarter.

What’s most important to the market for this earnings call is Nvidia’s much higher-than-expected Q1 guidance.

Adding more color to these top-level numbers:

Data center revenue (aka AI chips revenue) came in at $18.404 billion, growing 408% year-over year!

In the previous quarter, data center revenue grew by just 278% year-over-year.

Gaming is Nvidia’s second largest business and growth here is much slower. Revenue came in at $2.865 billion this quarter, growing 56.47% year-over-year. This is much lower than last quarter’s 81.45% year-over-year growth.

Gaming growth is slowing down. Nvidia’s AI business is running the whole show.

As the AI business skyrockets, Nvidia’s profit margins are skyrocketing as well. Earnings per share rose to $5.16, growing 486% year-over-year. Profit margins rose to an all-time-high of 55.58%.

As the company with the best AI chips on the market by far, Nvidia enjoys significant pricing power and can grow its profit margins even as revenues surge. This is a very rare and potent cash-making combination that has Wall Street enamored.

Although competition is rising, Nvidia’s market leader status in AI chips isn’t showing any cracks yet.

These are big numbers. So what?

This was a pivotal earnings report for the market. The market was very worried about a significant sell-off in the next few weeks for various reasons: bad February seasonality, an overheated market, $700 billion in new treasury issuances, etc.

A disappointing Nvidia earnings report would serve as a great catalyst for a reflexive S&P 500 sell-off.

This sell-off catalyst disintegrated into dust just like Spider Man after Thanos snapped his fingers in Infinity War. The market’s near-term worries are largely gone and we’re cleared for lift off. Yesterday’s very green market (+2.11% for the S&P 500, +2.96% for the Nasdaq) was a good start.

💡 How did the Nvidia options chain change after earnings?

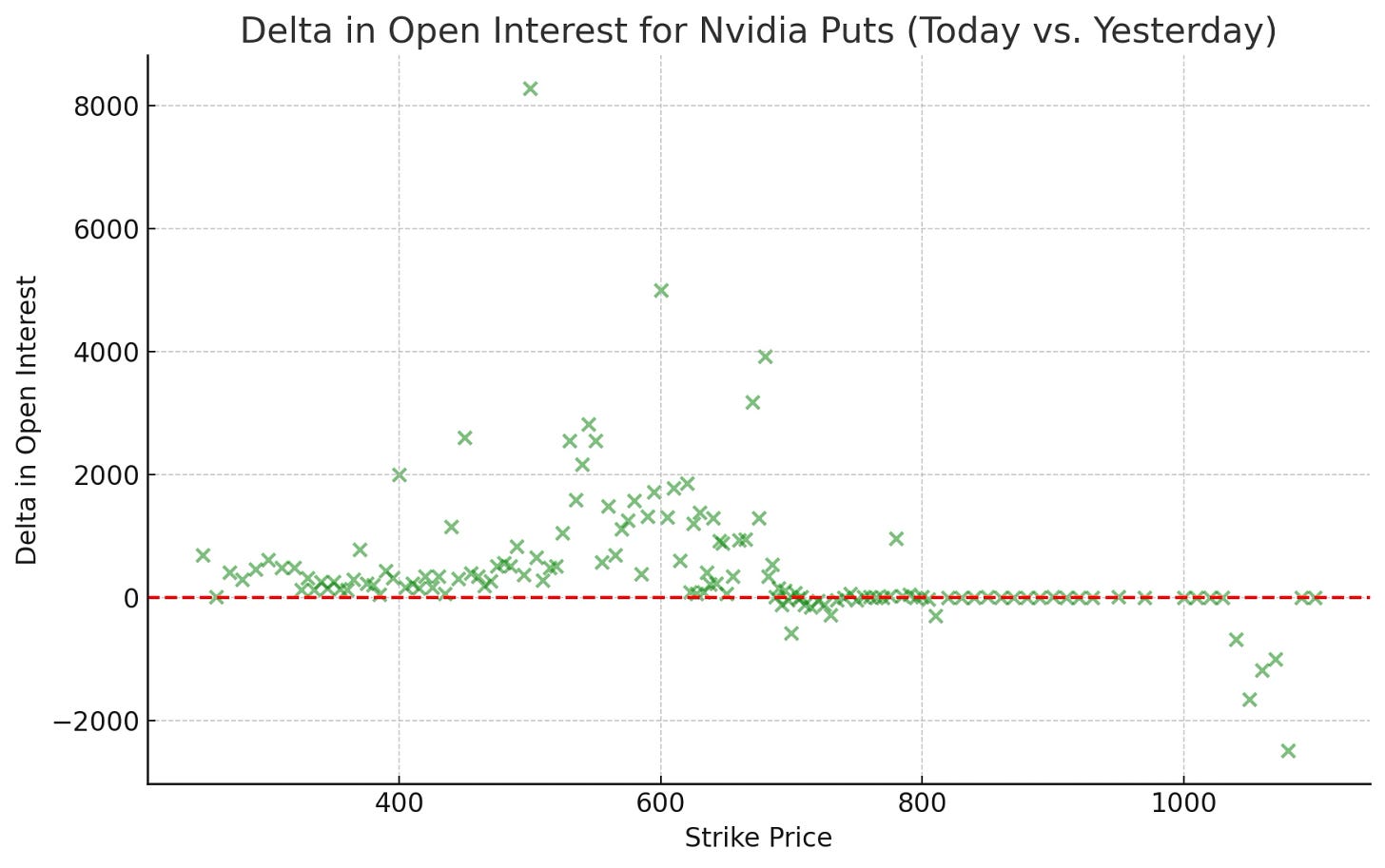

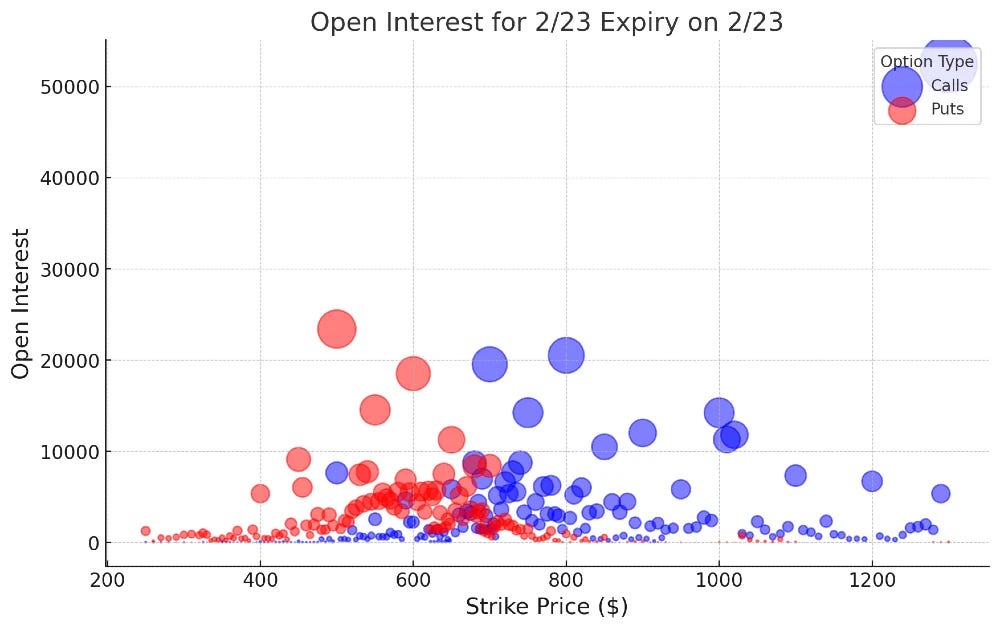

Generally, we saw open interest in 2/23 options contracts significantly increase the day after Nvidia’s earnings call. I found this surprising.

On the call side, open interest increased across almost all strikes above $600, with an absolutely massive amount of new calls (+36,092 contracts) opened at the $1,300 strike!

These new $1,300 calls are likely opened from call selling rather than call buying. The call seller(s) is looking to profit off of the very unlikely probability of NVDA getting to $1,300 by the end of the week (it’s at $800 right now).

The increased call open interest after the earnings call shows that market is very bullish on the results and more investors piled on to the long call trade as the positive earnings result came in.

On the put side, open interest also increased across almost all strikes below $700. It’s unclear if the rising put open interest after the positive earnings report is mostly from put selling (bullish) or put buying (bearish). Speculators that bought puts the day after earnings yesterday lost money as NVDA rallied throughout the day.

Notably, there was decreasing open interest in puts for higher strikes, with the biggest decreases in strikes above $1000.

However, we don’t know if these $1000+ strike puts were sold puts or bought puts. If it’s the former, the put sellers made a lot of money as those puts fell in value and they cashed in by buying those puts back, thus reducing the open interest. If it’s the latter, the put buyers lost a lot of money closing the positions.

We do know that this clump of $1000+ puts appear to be from one entity given that few other open puts exist in the neighboring strikes and the open interest significantly declined after earnings, indicating a unified closure of these isolated put positions.

This is the first time I’m monitoring how options chain data changes after an earnings report and the preliminary results are fascinating.

I’m surprised by the rising open interest in 2/23 options contracts given that they expire in 2 days. One would think that after such a momentous earnings report, investors would take profits or cut losses but no, more money piled into the soon-to-expire options chain.

I’m working on expanding these options chain analyses to include more stocks, more expiry dates, and deeper options metrics like Implied Volatility, Delta, and Gamma.

Here are supplementary visualizations of Nvidia’s 2/23 options chains before and after the earnings call.