Market Pulse Premium: Seize The Moment

Discussing the Federal Reserve's decision to support markets, its second order effects, and strategic ideas.

In this issue I write about where I think markets are headed given recent news, and share strategic ideas based on this news.

Before I start, James Gorman, 14-year CEO of Morgan Stanley, recently announced his retirement.

Here are some fun and informative excerpts on M&A deal-making from his parting public interview:

“I flew to Japan overnight to meet with my counterpart, Nobu Hirano (Chairman of Mitsubishi UFJ Financial Group).

We met at the Westin Hotel in Tokyo and it started with me pulling out a napkin, literally on the table, a paper napkin drawing a line down the middle of it and putting on the left hand side of it ‘Nobu wants’ and on the right hand side ‘James wants’.

And I said, What would you want? What do you want out of this?

And he told me his things, and I told him my things and I crossed off the ones that sort of matched and put circles around the ones that didn't.

I said, ‘This is where we need to focus.’

We got a deal done which resulted in what has been phenomenal for Morgan Stanley and phenomenal for MUFG.

You've got to seize the moment to get deals done.”

To get deals done…

“To get deals done, there are four things that matter.

One is the strategic fit. If it’s off strategy, just don’t do it.

Number two is the culture can’t be damaging. It can be neutral, doesn’t have to be additive.

…

The third is the timing of it.

When the door opens, you walk through it. You don’t wait for when it’s convenient for you. You have to act.

…

And finally, obviously, price, and I would say price is the least important.”

Okay, back to the issue at hand.

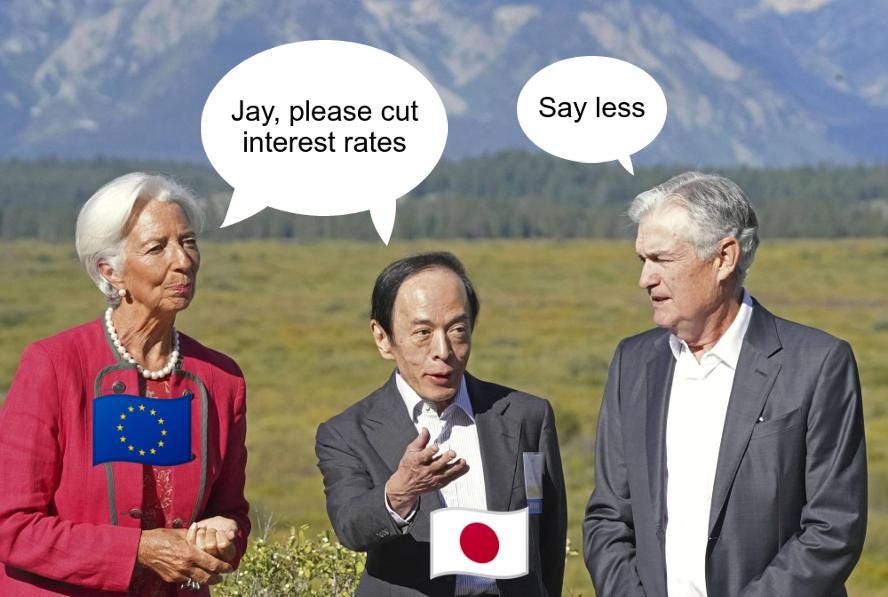

The Federal Reserve is facing significant domestic and foreign pressures to ease monetary policy (cut interest rates, print more money etc.).

At the same time, the inflation battle is far from over yet.

Energy prices are high and geopolitical risks are the highest they’ve been for years.

The Federal Reserve has recently caved to pressures to ease monetary policy rather than stay tough on inflation.

The Headline: the Federal Reserve has signaled that it’s going to support financial markets for the foreseeable future. The reason is unclear, though it has many good reasons to do so.

This issue dives into the second order effects of this and also discusses an ongoing significant shift in US government policy that must not be ignored.

The Macro Details

Imagine the US financial system as a classroom.

The players in the system are students milling about the room.

In this scenario, the US Treasury is the biggest student in said room, waddling around, clumsy under his own weight, and pushing everyone else around.

The US Treasury was not always like this. Only since a major sickness 4 years ago did he really start overindulging in culinary delights and sized up.

Now, everyone else has to make space for him.

This includes the Federal Reserve, who’s the coolest kid in class. The Federal Reserve sets the mood and the energy of the whole class.

These days, the Federal Reserve constantly has to accommodate the US Treasury.

As awkward as this off-the-cuff analogy I came up with is, it’s quite an accurate representation of the US financial system today.

The US Treasury is indeed the largest player in the financial system. It has to not only refinance $34 trillion in existing debt this year (by reissuing the same treasuries), it also has to issue $2 trillion of new debt.

$2 trillion is a LOT of new debt to push onto the rest of the system.

The schedule for the new debt issuance this year looks like this:

Q1: $850 billion

Q2: $260 billion

Q3: $850 billion

Q4: $100 billion ← Presidential Election in November

It’s no wonder the Federal Reserve decided to add ~$50 billion of extra US treasury buying demand each month starting in June.

Inflation is still far from the Federal Reserve’s 2% goal, but the Federal Reserve has signaled that supporting the market is a higher priority than fighting inflation.

Not only does this benefit the US financial system, foreign economies benefit as well.

When the Federal Reserve lowers interest rates / prints money, it weakens the US Dollar. This gives foreign central banks the ability to loosen their own monetary policy without their currencies depreciating too much against the Dollar.

And foreign central banks, especially Japan, are currently chomping at the bit to loosen their own monetary policies.

They’re just waiting on the green light from the US Federal Reserve and the US central bank has given them the green light.

Alright, so what I just wrote about is a super high level view of what’s happening with the global financial system.

Now let’s discuss its second order effects on the US stock market.