Market Pulse: Sugar High

In 7 minutes, we’ll break down last week’s March CPI report and discuss the report’s problematic implications for the market.

In 7 minutes, we’ll break down last week’s March CPI report and discuss the report’s problematic implications for the market.

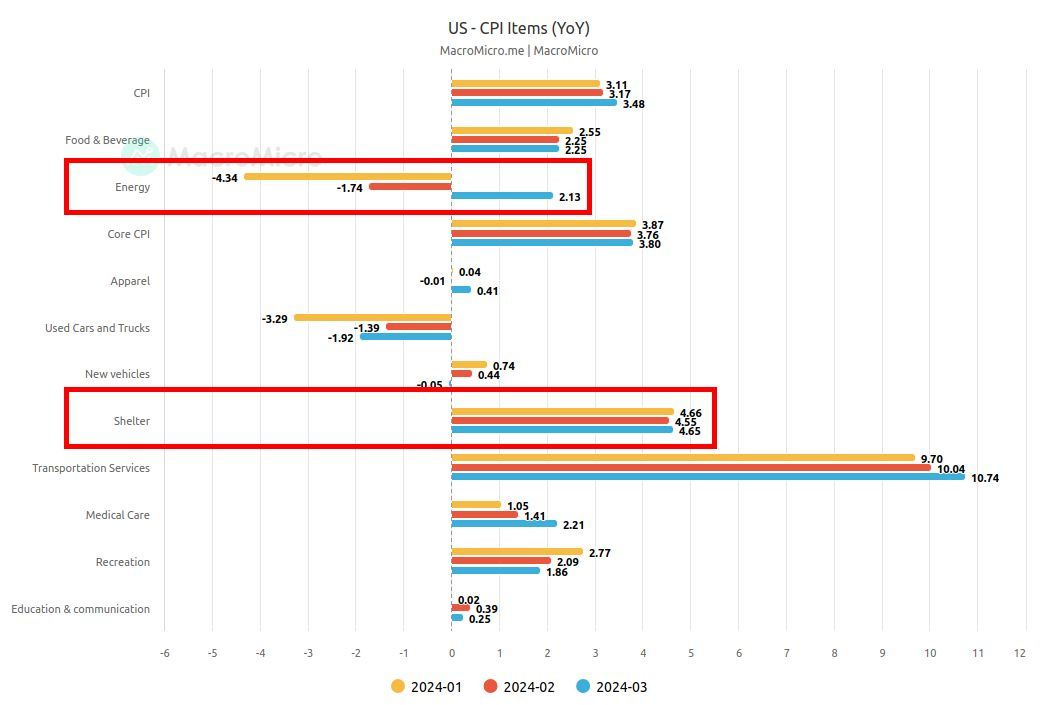

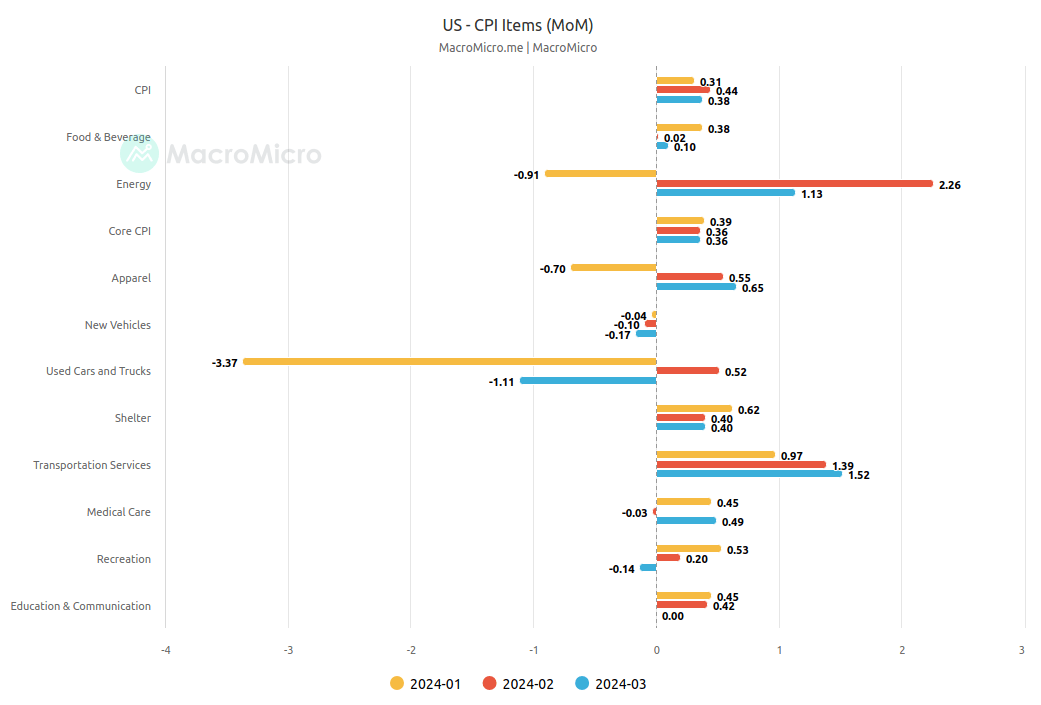

As many of us know, March CPI came in hotter than expected.

3.5% higher year-over-year and 0.4% higher than February, beating expectations of 3.4% and 0.3% respectively.

This hot CPI report was driven primarily by stubbornly high shelter prices in tandem with rising energy prices.

Many hoped that shelter costs will fall significantly this year, bringing overall inflation down with it, but March’s hot shelter CPI print significantly dampened those hopes.

The hot energy CPI is not a surprise given the rapid climb of global oil prices in the last two months as a result of worsening global geopolitical conflict (e.g. Russia banned gasoline exports for 6 months starting in March).

So What?

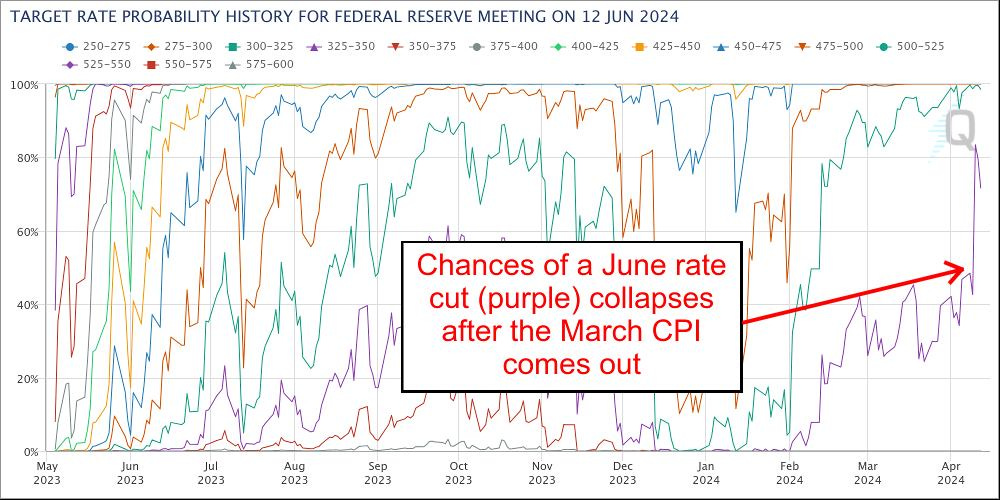

At the start of the year, the Fed Funds Futures market was pricing in 7 rate cuts with the first starting in March. These expectations have gradually been pushed back as the first couple monthly inflation reports came in.

Before the March CPI report, the market had shrunk rate cut expectations to 3 rate cuts by the end of the year, with the first in June.

👋 Hello dear reader, if you’ve enjoyed FinanceTLDR so far, consider sharing the newsletter with friends and family.

In the past few issues, I’ve written about:

Thinking in probabilities using probability density functions

How Yellen leveraged the trillions of dollars in the Fed’s ON RRP to fund the US government

The fascinating economies of Japan and China and how they are both boosting liquidity in the US

I have a lot more content planned and am grateful that you’re keeping up with the newsletter.

Also, if you’d be so inclined, you can financially support the work for a very small amount of $7 a month (or $70 a year for the annual deal). Thank you! 🙇♂️

Now, the market is predicting just 1-2 rate cuts by year-end and thinks there’s a much greater chance of the first rate cut happening after June (56% → 16%).

There’s a significant chance that rate cut expectations will continue to be pushed back. In fact, the inflation picture is bad enough that I wouldn’t be surprised if the Fed had to raise rates again later this year.

Why?

Energy is the biggest problem.

In the past couple months, oil prices have made a mad dash upwards as global geopolitical conflicts intensify. Eastern Europe is a growing mess, the Middle East is a growing mess.

A few headlines to demonstrate this point:

NBC News on 4/13: “Iran’s retaliatory attack on Israel has begun”

FT.com on 4/13: “Ukraine’s top commander says eastern frontline has ‘significantly worsened’”

Reuters on 4/13: “Iran seizes cargo ship in Strait of Hormuz, Israel goes on high alert”

BBC on 4/12: “Joe Biden expects Iran to attack Israel 'sooner than later'”

The two conflict zones in question just happen to be adjacent to two of the world’s largest oil-producing regions.

When oil prices go up, almost every other CPI component goes up as well. Goods are more expensive to manufacture and transport, food is more expensive to grow and transport, etc. etc.

To put it bluntly, I think oil prices continue to rise and we’ll experience a summer of hot inflation. By June or July, the talking heads on TV will be discussing the possibility of rate hikes later this year.

The Stock Market Doesn’t Seem To Care, Or Does It?

You may ask, so what if inflation goes up, what if rate cut expectations fall?

Inflation has been hot and rate cute expectations have been falling sharply since the start of the year and yet the S&P 500 is up 10% in the first quarter. 10% is how much the index rises on average in a full year!

I think the market’s fantastic Q1 performance is the result of tremendous liquidity pouring into the US stock market from global markets, and not because the market doesn’t care about falling rate cut expectations.

The US’s economic situation might be “shitty” but compared to the rest of the world, it’s the least “shitty”.

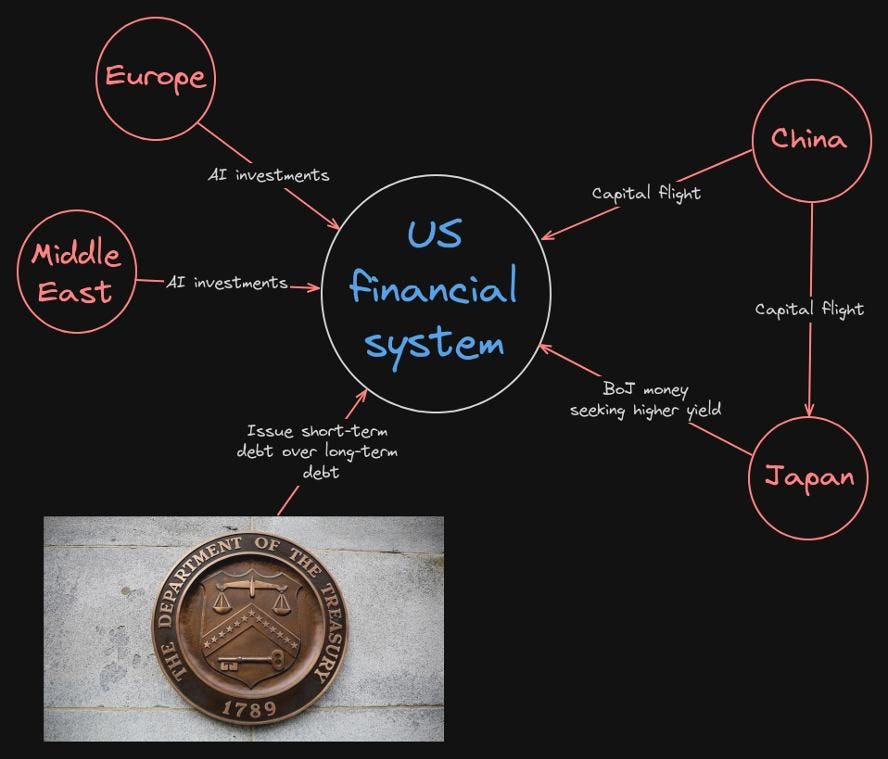

In particular, the two largest Asian economies, China and Japan, have been the largest suppliers of liquidity to the US financial system. For China, it’s capital flight to the West (i.e. Japan and the US) over fears of Taiwan troubles. For Japan, it’s excess capital from aggressive central bank money-printing searching for higher yields in the US.

The US’s AI boom has also brought significant international investment flows into the country (e.g. from Europe and the Middle East). No one wants to be left behind by AI and the US is decades ahead of the rest of the world in AI technology (with the one exception of China, but China is basically uninvestable right now).

On top of all these global capital inflows, the US Treasury’s heavy issuance of Treasury bills (which, in short, adds a lot of liquidity to the system) in the last two quarters is pouring buckets of additional fuel on the blazing fire.

No wonder the US stock market is booming.

The Biggest Problem

Large swathes of the US financial system are now built on the assumption of rate cuts throughout this year and the next. Certain sectors are not just optimistically positioned for rate cuts, they desperately need them to avoid very painful contractions.

This presents a big, delayed problem.