Market Forecast - What the Fed Is Really Scared About

Discussing market outlook for this week and what aspect of the economy the Fed is really scared about.

Quick View

The Fed is most worried about sticky inflation as a result of something called the Wage-Price Spiral. Find out what this means for your trading below in this issue’s Long Form section below.

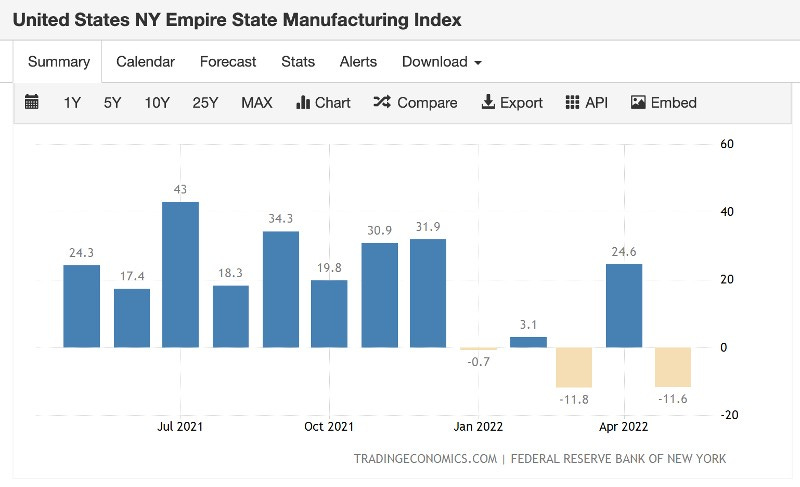

NY Fed's Empire State Manufacturing Survey slumped to -11.60 in May from 24.60 in April. That was much larger than the expected drop to 17.00 and marked the largest miss on expectations since April 2020, when the pandemic first struck the US. This report is adding on to fears of an impending recession.

Buy Now Pay Later (BNPL) is booming. According to Experian, 4 in 5 U.S. consumers use BNPL and most shoppers said BNPL could replace their traditional payment method. BNPL could be fueling strong aggregate demand in the US.

Peloton is down 90% ($162.72 → $15.46) from its pandemic peak during Christmas 2020. To better illustrate what a 90% drop means, it’s when a stock falls 80% and then gets cut in half again!

Pandemic-era Zoom once had the same market cap as Exxon. Now not so much. Zoom at one point during the pandemic was worth as much as Exxon. Now it’s worth just 8% of Exxon ($384.61B vs $27.19B).

Market Outlook

The end of last week saw SPY staging a respectable +4.6% come back from a Thursday low of $385.36 to a peak of $403.17 on Friday. Flanking the broad market’s recovery are even more spectacular recoveries in crypto and high growth stocks.

There’s a saying to not buy lower highs and lower lows. This might apply at this moment as last week’s market recovery might just be shorts covering and not actually the discovery of a market bottom. This morning’s tepid price action suggests just as much.

Following the NY Fed’s Empire State Manufacturing Index release this morning, this week will see April’s Retail Index and Industrial Production Index reported on Tuesday, as well as the super important jobless claims numbers on Thursday (you’ll see why below). The market is likely expecting the other economic numbers to disappoint similar to the NY Fed’s manufacturing number today. If so, these economic number reports build a stronger and stronger case that the economy is heading for a recession.

Jerome Powell in his previous FOMC press conference stated that he’s willing to bring the economy into a recession if that’s what it takes to avoid sticky inflation. US employment numbers are critical to his assessment of the likelihood of sticky inflation. Let’s found out why.

Long Form: What the Fed Is Really Scared About

I spent the last few days reviewing Fed commentary and here’s what I gleaned about what the Fed is really scared about.

Most of us know the Fed is targeting inflation at 2%. Actual inflation is way higher than that.

The Fed used to think inflation is transitory, but have greatly changed their tune and thus their policy change projections in the last few months.

Here’s why.

There is an economic concept known as the Wage-Price Spiral where rising wages (e.g. from a tight labor market) increases business expenses and thus businesses raise prices. This increases inflation and cause workers to demand more wages. The increased wages then increase inflation. The cycle goes on and on causing sustained inflation and unstable prices.

The Fed right now is very worried that inflation isn’t transitory because of a wage-price spiral.

The most dangerous thing about the wage-price spiral is that it’s based off of people’s expectations on wages and inflation. This makes it very sticky and hard to stop when it starts. There is historical precedent of this in the 70s and 80s.

Here’s a direct quote from Jerome Powell about it in the last FOMC press conference:

“It's a risk that we simply can't -- we can't run that risk. We can't allow a wage price spiral to happen. And we can't allow inflation expectations to become unanchored. It's just something that we can't allow to happen. And so we'll look at it that way.”

Powell also mentioned several times that wages are rising too quickly, and the labor market is super tight (too many jobs for too few job seekers). Another quote:

“Wages are running high, the highest they've run in quite some time. And they are one good example of or good illustration really of how tight the labor market really is. The fact that wages are running at the highest level in many decades. And that's because of an imbalance between supply and demand in the labor market. So we think through our policies, through further healing in the labor market, higher rates, for example of vacancy filling and things like that, and more people coming back in we'd like to think that supply and demand will come back into balance. And that, therefore, wage inflation will moderate to still high levels of wage increases, but ones that are more consistent with two percent inflation. That's our expectation.”

Powell also blames the super strong labor market on strong consumer demand. Thus the Fed thinks it’s appropriate to use Fed’s tools to lower demand to weaken labor market, and thus weaken inflation.

As such, we can expect the Fed to start easing off from tightening if the labor market starts cooling off. One of the key metrics to watch for this is the Vacancy to Unemployment Ratio. According to the Peterson Institute for International Economics, this ratio is the best predictor of core Consumer Price Index (CPI) inflation. Right now this ratio is at 1.9, a historic high. Powell mentioned that he’d feel more comfortable with that number at 1.

And it may very well be the case that the labor market cooling is a leading indicator of Fed policy. As such, an astute investor would watch labor market numbers closely to get ahead of Fed policy announcements.

Finally, Powell also mentioned in the last FOMC press conference that he’s not afraid to bring the economy into a recession if that’s what it takes to avoid a wage-price spiral. It’s clear that this Fed prioritizes price stability over employment and will tank employment if that means fighting off entrenched inflation.

Hope this was helpful in shedding light on what the Fed is thinking, and worried, about.

You can read the FOMC press conference transcript here.

Parting Question

Do you think the Buy Now Pay Later boom is fueling strong consumer demand, and thus a tight labor market, right now? If so, do you think the Fed is watching the emergence of BNPL closely or is this a blind spot?