Market Review - What You Must Know (Feb 9th)

[4 minute read] Discussing one key but rarely mentioned reason why markets in 2023 are in trouble, as well as an unspoken demographic undercurrent that's driving inflation up in the long run.

For February, the FinanceTLDR newsletter is donating to the American Heart Association, a charity that funds heart disease medical research.

As before, don’t feel pressured to join us. We simply ask readers to do a little extra good at the start of this year, whether for a cause you believe in, a friend, a loved one, or even for yourself ❤️

In this market review let’s discuss one key but rarely mentioned reason why markets in 2023 are in trouble, as well as an unspoken demographic undercurrent that's driving inflation up in the long run.

2023 Corporate Budgets 📉

The general consensus in the market is that stocks will perform poorly in 2023. We agree. There are a variety of reasons for this including soaring geopolitical conflicts and inflation that are well-discussed in mainstream financial media.

However, there is one very important reason for stock underperformance this year that isn’t discussed enough; the collapse of 2023 corporate budgets.

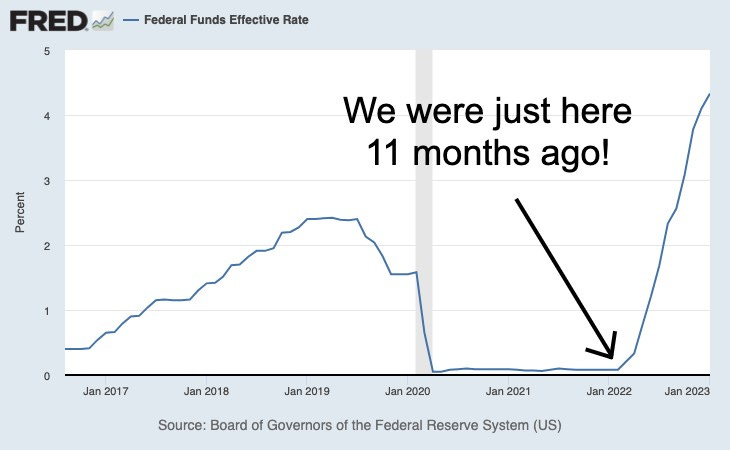

Although it may feel like we’ve lived in a rapidly rising interest rate environment for a long time now, it was only 11 months ago when the Fed Funds Rate was at essentially 0%. It hasn’t even been a year but it sure has been eventful for markets. Maybe that’s why it feels so long.

At the onset of 2022, most corporations were still setting annual budgets based on a 0% interest rate and had to taper off their budgets as the year went on. Even as budgets shrunk, reductions were made relative to the swollen budgets set when the Fed Funds Rate was at 0%.

In 2023, corporate budgets have to be set with the Fed Funds Rate at 5%. In other words, 2023 corporate budgets will be decimated relative to 2022 corporate budgets and we’ll see the initial effects of this in the Q1 2023 earnings season happening in 3 months.

The market doesn’t seem to be prepared for this and it doesn’t help that many companies have refused to provide guidance for 2023.

The first place this drastic fall in corporate budgets will impact is revenues from Software as a Service (SaaS) and ads publishing (e.g. Salesforce and Google). Many SaaS startups that offer corporate software products with superficial value will also feel the heat.

In other words, more layoffs are coming and watch out for a very ugly Q1 2023 earnings season.

A TikTok Retirement

Many of us have heard that boomers are retiring in droves this decade.

This is a big deal; baby boomers are a big generation and boomers retiring will open a large gaping hole in our labor market that the US government is doing too little to fill. To make matters worse, the pandemic has not only inspired boomers to retire early, it has also made early retirements a lot more financially feasible through overheated asset markets and the printing of trillions of stimulus dollars.

A large reduction in a country’s labor force is undoubtedly inflationary; companies have to raise wages to compete for fewer workers. Cue inflation from a Wage-Price Spiral.

Historically, this is as far as inflationary pressures go when a large number of people retire in a short period of time. This is because as people age, they consume less. However, we’re in the age of social media where people are inundated with TikToks and Instagram Reels of mouth-watering cuisines and drop-dead gorgeous travel locations and experiences. Boomers are no exception.

As such, as boomers retire, social media is egging them on to live their best lives and engage in what we’re calling a “TikTok retirement”. In other words, social media is turning this giant cohort of retirees into an experiences-consumption machine. This drives up demand for services as the services sector is usually what manages and runs the experiences behind the TikToks.

After all, why wouldn’t retirees indulge in a TikTok retirement when, to the best of humanity’s knowledge, we only live once.

In line with this thesis, services inflation currently remains heated even as goods inflation falls and the former has quickly become the Federal Reserve’s top inflation concern.

But Fed officials are closely watching what is happening with prices for other services, which include things like hotel rooms, sporting event tickets and health care. They worry that services inflation — which is unusually rapid — could keep prices increasing faster than the central bank’s target.

New York Times - December Inflation Report

The looming reality of baby boomers retiring in droves is driving countries everywhere to raise their retirement ages. France is proposing to raise their retirement age to 64 from 62, prompting hundreds of thousands of people to protest in the streets. US Republicans are proposing to raise the retirement age to 70 from 67.

Demographic problems can be an inconvenient topic that arbitrarily pits people in different age groups against each other. People are fundamentally very similar to each other, even if decades separate their birth years.

As such demographic problems are often left out of mainstream economic discussions but loom as a threatening subtext. Eventually, they cannot be ignored.