Market Review - What You Must Know (Dec 19th)

This week, let's discuss why the market is selling off despite cooling inflation and why we think a recession is practically guaranteed.

It was a busy week last week. November CPI numbers were released and the Fed raised rates for the last time this year. Markets haven’t been happy with the past week and have sold off aggressively.

This is what happened and why.

Inflation Is Cooling, but the Market Doesn’t Care

The market’s weak reaction to a great November CPI report last week (7.1% year-over-year instead of the estimated 7.3%) was surprising given how much inflation has driven market narratives this year.

Here’s why:

First, the majority of the market is expecting inflation to ease and few are shorting in anticipation of a hot CPI report. As a result, the short squeeze from a better-than-expected CPI report was weak, resulting in muted buying after the report’s release.

Second, as we’ve mentioned in the Market Review issue last week, the market no longer cares about inflation and is more worried about a recession next year.

Third, as we’ve predicted, the Fed signaled last week that it isn’t going to loosen financial conditions any time soon despite cooling inflation. More on this below.

A Recession is Guaranteed

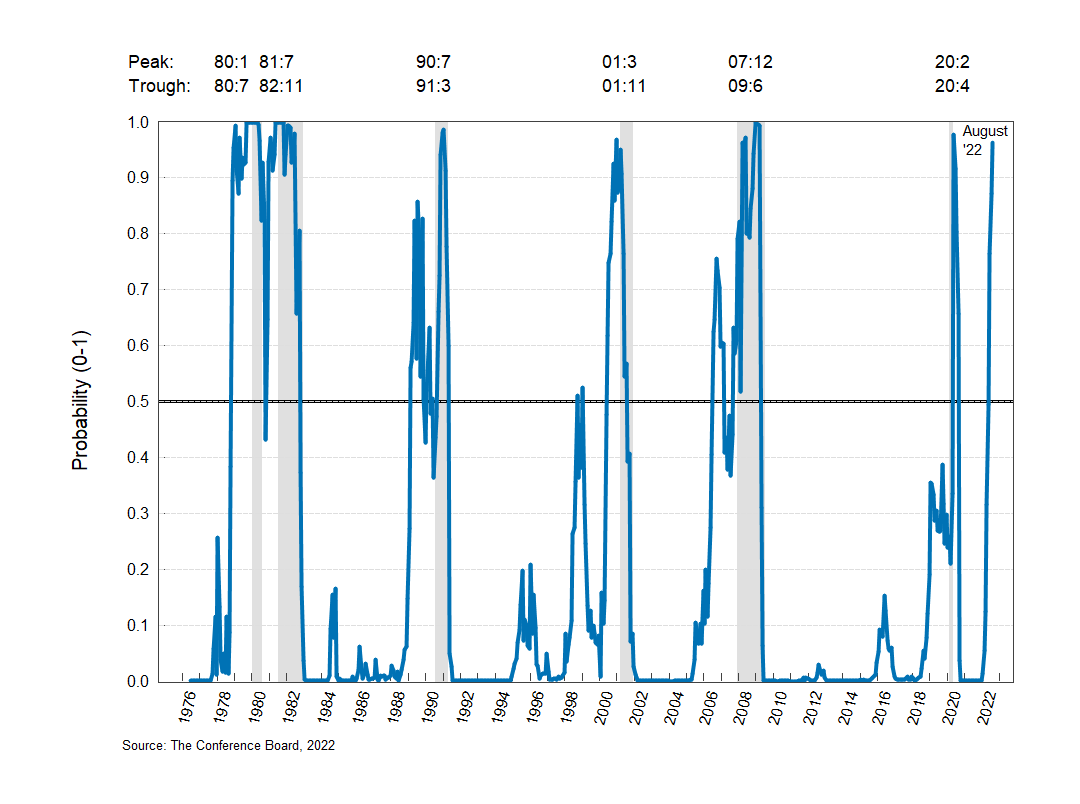

The economic woes of the 1970s and 80s showed that inflation is incredibly sticky. Fed Chair Volcker tamed this inflation by raising interest rates aggressively and keeping them high for long enough to plunge the economy into a recession.

Economists remember Volcker positively for taming inflation and overlook the recession he caused. It’s generally accepted that a recession is a reasonable price to pay to slay the inflation dragon.

Unsurprisingly, this is also the Fed’s current mindset and we think they are determined to plunge the US economy into a recession to unequivocally beat inflation, even if it could be overkill.

Why?

Even as the tech industry lays off tens of thousands of employees this year, the rest of the US economy has been incredibly hesitant to conduct layoffs. This is a massive problem for the Fed. Fed Chair Powell spent a significant portion of last week’s FOMC press conference reiterating and stressing that the labor market is way too strong.

High wages fuel inflation and risk subjecting the economy to a dangerous Wage-Price Spiral, as we’ve written about in the past (Market Forecast - The Only Thing That Matters).

In fact, November’s jobless claims came in at 10% lower than expected (211k vs 230k), partially confirming the Fed’s fears of a stubbornly strong labor market.

A guaranteed way to cool a strong labor market is to plunge the economy into a recession and the Fed is willing to pay this price if it means quelling inflation. It’s no wonder the market sold off so aggressively after last week’s FOMC press conference.

Are You Sure a Recession Is Guaranteed?

Some people think that if everyone is expecting a recession, then a recession is unlikely to happen.

We disagree. We think that a recession is practically guaranteed for two very simple reasons.

Money is significantly more expensive now with interest rates dramatically higher and the Fed selling off its balance sheet. Money is a fundamental fuel that drives an economy and when you make it substantially harder to access money, the economy slows down. This is a simple and inarguable economic axiom.

The Fed has traditionally acted as the backstop to a slowing economy, fending off recessions and driving growth by injecting markets with easy money whenever things looked wobbly. This time, however, the Fed is not only unwilling to stop the economy from going into a recession, it’s actively pushing for one!

This is why a recession is practically guaranteed.

More Reasons for the Market Sell-Off

A few internal market mechanics are also driving this sell-off:

Year-end tax loss harvesting: investors are incentivized to sell underperforming stocks before year-end to shrink next year’s tax bill.

Hedge funds “window dressing”: hedge funds need to report their portfolio holdings at the end of each quarter and are incentivized to get rid of their worst-performing investments before reporting holdings to make their portfolios appear better than they actually are. This is known as “window dressing”.

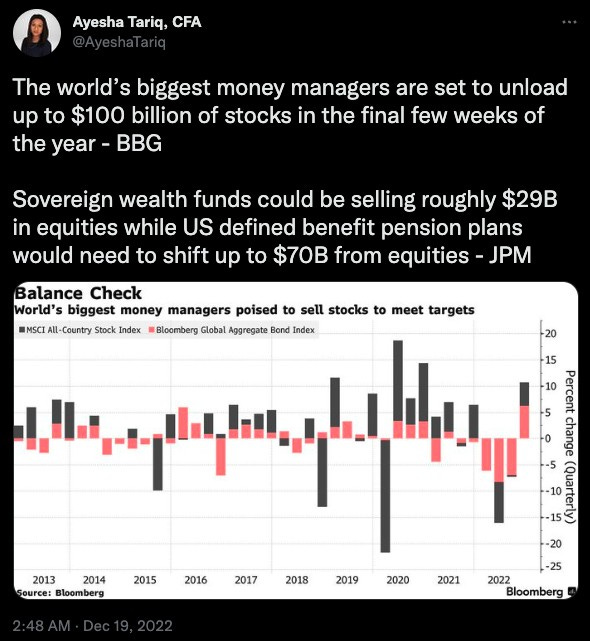

Institutions rebalancing from stocks to bonds: with stocks outperforming bonds this quarter, JP Morgan is predicting that institutional money managers need to sell up to $100 billion in stocks to rebalance into bonds by the end of this year.