Nvidia. What's Next?

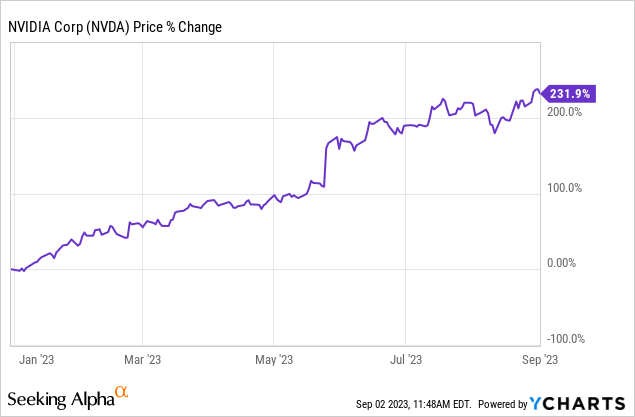

[8 minute read] Nvidia's stock has more than tripled since the start of the year. This newsletter issue is concise yet thorough explanation of how the company is doing and what's next.

Nvidia reported Q2 earnings two weeks ago on August 23rd and the company crushed them. It beat top line (revenue) expectations by 21% and bottom line (earnings per share) expectations by 29%. For a brief moment, the stock touched $500 before selling off in the next few days. Nvidia is the undisputed primary beneficiary of the ongoing AI boom but the market’s lukewarm reception to a spectacular Q2 earnings report has put a damper on the stock’s exceptional story.

With the dust from the earnings report settled, a question on most investors’s minds is: what’s next for NVDA?

Here’s our take.

As most of us know, the fundamental story driving NVDA’s price upwards is the recent AI boom brought on by the consumer release of OpenAI’s Dall-E and ChatGPT products. This has created a frenzy in tech start ups and giants alike to invest in their own AI technologies. As it turns out, AI infrastructure investment is synonymous with buying Nvidia products given that the company has the best-in-class chips for all sorts of AI workloads.

At the same time, stock market investors are driven into a frenzy to bring AI into their portfolios. The best stock that provides that exposure right now is Nvidia, the company selling picks and shovels to the metaphorical AI gold miners.

The result?

This chart of NVDA’s stock price since the start of the year speaks for itself.

The Lay of the Land

Here are several key data points that will provide readers with a nuanced understanding of where Nvidia’s business stands today, with a focus on industry trends, company performance, and stock valuation.

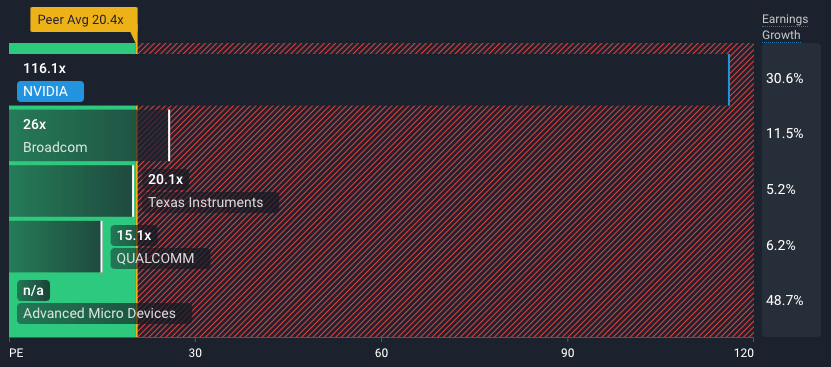

The Stock Is Expensive

Nvidia’s stock is, unsurprisingly, very expensive compared to its peers. Here’s a chart comparing its price-to-earnings ratio (PE ratio) to peer companies like Broadcom and Qualcomm.

Granted, sometimes the PE ratio is not the best yardstick to measure companies with, since AMD reported negative earnings last quarter and thus has a negative PE ratio.

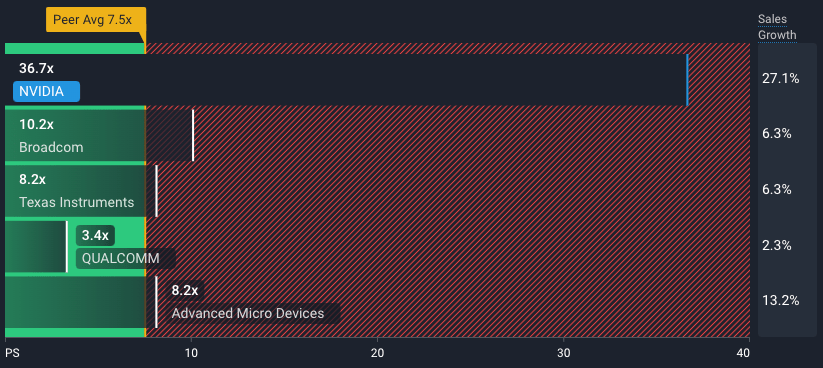

A better yardstick to measure fast-growing companies is the price-to-sales ratio (PS ratio), which is closely related to the PE ratio but focuses only on revenue and ignores the cost of running the business.

Even using the PS ratio, NVDA is very expensive compared to its peers.

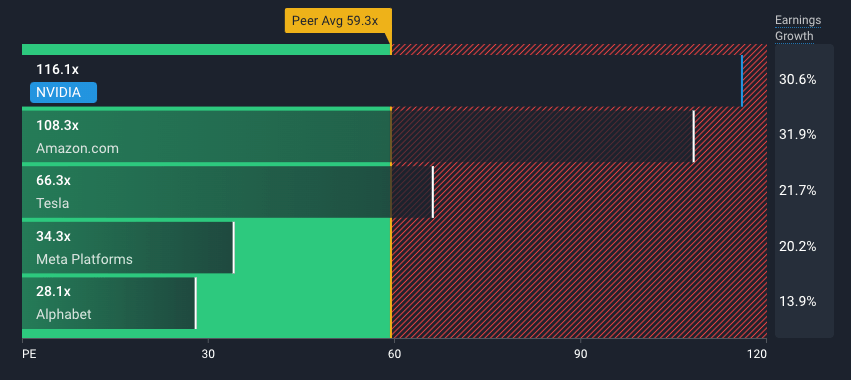

What if we compared NVDA to the stocks of other well known technology companies?

This looks a bit better but again, NVDA leads the pack in expensive-ness.

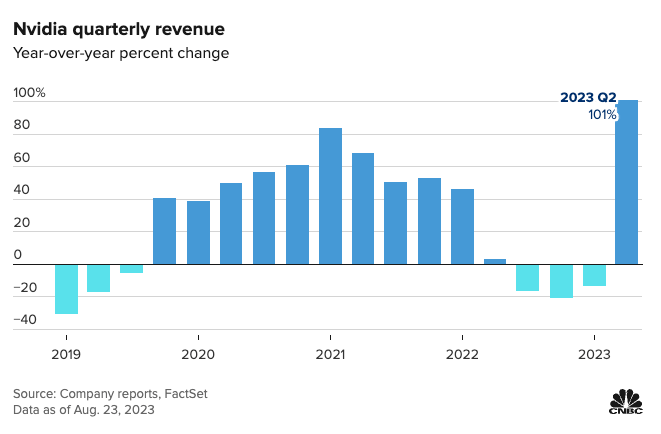

Business Is Growing Fast

What justifies NVDA’s high price tag is its extraordinary growth. No one with a business as large as Nvidia’s is growing this fast. Not even close.

Q2 2023 revenue growth, year-over-year:

NVDA: +101%

AMD: -18.2%

TSLA: +47.2%

GOOG: +7.1%

META: +11.0%

AMZN: +10.9%

Along with such a spectacular Q2, the company’s guidance for Q3 is even more scintillating. It forecasts $16 billion of revenue for the next quarter, which is 18% higher than Q2’s revenue and 170% higher year-over-year!

With these growth numbers in perspective, no wonder the stock is so expensive. The key question for investors moving forward is: how long before this growth stalls? We’ll discuss this in the “What’s Next?” section below.

Data Center Is Driving Growth, and China Is Unperturbed

Nvidia divides its revenue into 5 major categories: data center, gaming, professional visualization, automotive, and OEM/other. Data center represents its biggest source of revenue, even before the gush of new AI money pouring in. The ongoing AI boom has put rocket boosters on an already massive business.

In Q2, Nvidia pulled in $10.3B in data center revenue (up 171% year-over-year). Gaming revenue, which is its second largest business, came in at $2.49B (up 11% year-over-year).

The flagship products driving Nvidia’s data center business are the A100 and H100 AI GPU chips for Western markets and their equivalent purposely-throttled A800 and H800 AI GPU chips for the Chinese market. The engineered limitations of the latter two chips are meant to satisfy US semiconductor export controls to China. However, this hasn’t stopped Chinese appetite for Nvidia’s chips. On August 9th, a coalition of major Chinese tech companies, Baidu, ByteDance, Tencent, and Alibaba announced a $5 billion order for Nvidia’s 800 series chips!

Rarely do competing companies bulk buy things together. The fact that China’s Big Tech companies took this approach for Nvidia’s chips suggests extraordinary demand.

What’s Next?

The bull case for NVDA hinges on the company’s ability to sustain its current growth rate. This is essential to justify the stock’s extremely high multiples.

To this end, there are bullish and bearish signs. We’ll share both sides and then present our own opinion.

A Capex Story (Bullish and Bearish)

Nvidia’s current business boom is a capital expense (capex) story. In other words, it’s a bunch of companies spending a large amount of initial capital to jumpstart their AI business. A personal analogy would be if you spend a lot of money at the start of the school year to buy school supplies like a laptop, bag, notebook, etc.

What I’m trying to get at is that a business fueled by a capex boom doesn’t scale well. Once companies are satisfied with their inventory of chips, they don’t buy more for a while.

However, this is only bad for Nvidia’s stock price if the AI capex boom is over. If the industry is just getting started, Nvidia’s stock price still has significant upside potential.

The good news is that many industry analysts believe that the AI capex boom is far from over. Analyst firm Dell’Oro Group believes that AI infrastructure spending will push data center capex to over $0.5T by 2027. The caveat is, the firm thinks that near-term capex growth is decelerating as the market “undergoes digestion”.

Regardless, the AI capex story is a tremendous story. Here’s an example to give the reader a sense of the enormous appetite for AI infrastructure right now. Just over two months ago, a little known start up called Inflection AI announced that it raised $1.3 billion in its second round of funding. This is a crazy amount of money to raise for such an early round of funding.

Why does the company (and its investors) believe this much money is appropriate? Because a billion dollars is the best way to efficiently buy Nvidia GPUs at scale.

Here’s what TheNextPlatform had to say about the matter:

“If you don’t have $1 billion, then you will be fighting to beg, borrow, and

stealrent capacity on older GPU systems that can run AI workloads reasonably well and waiting for your turn to get access to capacity for newer and more powerful GPUs on the clouds or for your order to be fulfilled from an ODM or OEM, which will probably take longer than you are used to.”

Since the supply of cutting edge Nvidia AI chips is incredibly limited, everyone wants to spend… and spend big. Buyers with the largest orders get priority allocation.

Human Capital (Bullish)

Nvidia has extraordinary human capital. It has a visionary CEO and the best semiconductor researchers on this side of the planet. As a result, the company has been well positioned to meet industry demand for cutting edge GPUs in all the semiconductor demand booms of the last two decades (e.g. gaming, crypto, and now AI).

Even if AI is the current focal point of Nvidia’s business, it’s clear that the company has the necessary human capital for long-term success in any new industry that needs high-end semiconductors.

Competition Is Ramping Up (Bearish)

Nvidia doesn’t have a strong moat.

Picks and shovels are easily copied. I admit that this is a crass analogy for something as complex and sophisticated as GPUs, but the principles are the same.

A GPU technology gap is much easier to catch up to than, say, building the next Instagram or iOS ecosystem. GPUs can be reverse engineered, the talent behind the technology poached, or innovation can be brute forced via an inundation of $$$ into research.

To this end, Nvidia’s recent success has lit a fire among other industry giants and even nation states (* cough * China * cough *) to catch up to Nvidia’s head start in GPU technology. Amazon, Meta, and Google already have their own in-house AI GPU chips and have undoubtedly stepped up investments into improving their in-house chips. Across the Pacific Ocean, the Chinese government is pouring a gargantuan amount of money into their own semiconductor industry in the wake of the Biden administration’s highly restrictive semiconductor export controls.

A relevant headline from 2 days ago: “Exclusive: China to launch $40 billion state fund to boost chip industry”.

Although the chips from Nvidia’s competitors are several steps behind the company’s A100 and H100 chips, Nvidia is just one company facing many highly motivated Goliaths.

The GPU technology gap will be swiftly filled.

Sour Macroeconomics and Geopolitics (Bearish)

Nvidia’s lofty valuation makes it more sensitive to macroeconomic tides than the average stock. This bodes poorly for NVDA’s near-term price given that we see strong macroeconomic headwinds ahead. We have written at length on this topic and you can read about it here (The Buy-den Calculus) and here (Black Swans on the Black Sea).

In addition, the geopolitical outlook for the semiconductor industry has been perpetually strained for the past decade. All of the world’s high-end semiconductor manufacturing occurs in Taiwan and, unfortunately, China has repeated expressed a strong desire to bring Taiwan under its fold. On the non-zero chance that China makes an aggressive move towards its neighbor, Nvidia’s stock price will collapse.

Verdict

We think that Nvidia’s stock price is approaching a local maximum soon (TM) but we don’t think it’s wise to try and call the top.

We’re not excited about the stock’s near-term upside potential but also must note that a stock with this much momentum could aggressively surprise to the upside.

As such, we wouldn’t start or add to a long position on NVDA at this point. If we had an existing long position, we would seek to cut exposure or sell calls.