Palantir. What's Next?

[8 minute read] A CIA-backed meme stock in 2021 and a stock market darling for its AI business analytics solutions, Palantir's stock price has cooled off recently. We think there's a lot of upside.

Palantir is a two-decades-old business intelligence company that’s heavily involved with Western militaries and intelligence services. It also has a commercial arm that serves corporations.

The company went public at the onset of the pandemic bull market and quickly became a meme stock darling. In just a few months, the stock went from $10 on its opening day to over $35 at its peak, before sharply selling off throughout 2021 and 2022 as high inflation and rising interest rates put a damper on growth stock valuations.

The recent generative AI boom has thrust Palantir back into the limelight with its stock price more than doubling since May. Famed tech analyst Dan Ives even called the company the “Messi of AI”.

Is this a prescient description or a messy prediction? Here’s our take.

Palantir’s suite of products is complex and poorly understood. Most analyses of the company don’t go beyond the simplistic semantics offered by buzzwords such as Big Data, Machine Learning, Cloud, and AI to describe Gotham, Foundry, AIP, etc.

You can’t fault these analysts. Even with my computer science background, I had trouble digging into the details of Palantir’s highly technical products. I’ll spare the reader a long and dry essay on “what Palantir does”. A TLDR should suffice for the purposes of this article.

What does Palantir do? A “TLDR”

Palantir is a business intelligence company with three flagship products: Gotham, Foundry, and AIP. Gotham is mainly used by the intelligence services and military of Western governments. Foundry is meant for corporations.

Both Gotham and Foundry extract valuable insights from vast amounts of data through deep understanding of the data. In other words, for organizations to fully leverage Palantir’s capabilities, they need to map their data into a “language” (AKA ontology) that’s understood by Gotham and Foundry. This data transformation is not easy but once complete, enables Gotham and Foundry to do very powerful things. It’s the not-so-secret sauce behind the effectiveness of Palantir’s software and a key differentiator from its competitors.

In contrast, companies like Snowflake, Databricks, and AWS focus on giving organizations simple but reliable building blocks to manage data. Organizations can then build their own custom business intelligence workflows with these building blocks. Although this is a straightforward approach to business intelligence, these bespoke workflows are often inefficient, produce lower quality insights, and are difficult to maintain.

Palantir offers organizations a highly scalable and effective business intelligence solution… if they’re willing to do the heavy leg work of transforming their data into Gotham and Foundry’s ontology.

Finally, it’d be remiss not to mention AIP. AIP is basically a ChatGPT-like interface for Gotham and Foundry that’s being heavily pushed and advertised by Palantir since generative AI is the investment thesis du jour.

With how much I’ve written in this section, I’ve heavily stretched the definition of “TLDR”. For a company as complex and enigmatic as Palantir, it’s necessary.

The Lay of the Land

Here are several key data points that will provide readers with a nuanced understanding of where Palantir’s business stands today, with a focus on industry trends, company performance, and stock valuation.

Expensive Because of AI Hype

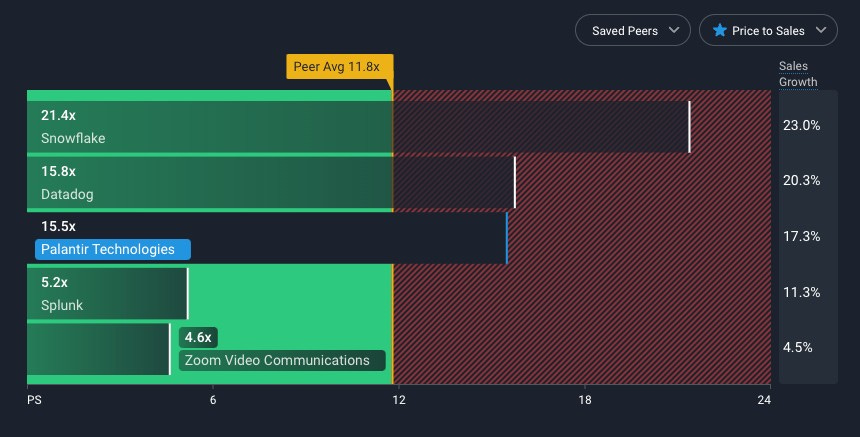

Palantir is a growth tech company and the two most important financial metrics to measure this class of companies is Revenue Growth and the Price-to-Sales Ratio (PS ratio).

In general, a company’s PS ratio should be positively correlated with its revenue growth. As revenue accelerates, the company's PS ratio should also increase, resulting in a higher stock price.

Palantir’s revenue growth has been steadily falling but its PS ratio experienced a significant uptick recently because… you guessed it… AI enthusiasm.

This recent bump in its PS ratio has catapulted Palantir to the expensive half of its peer group.

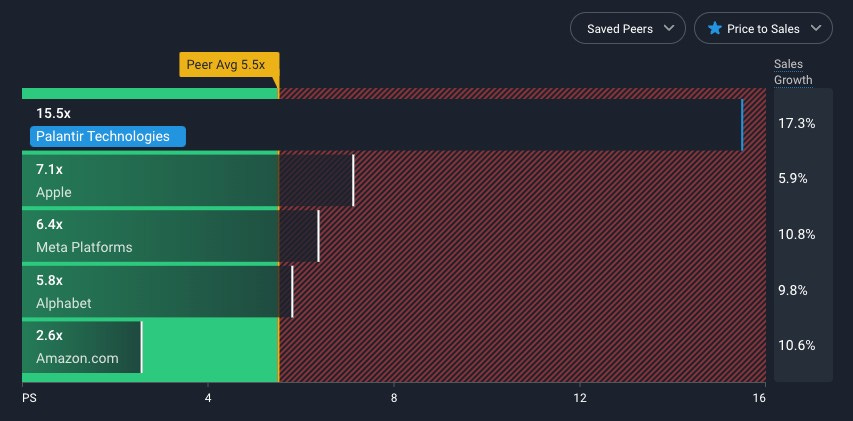

As a sanity check, let’s compare Palantir to Big Tech.

This may not be a fair comparison given that Palantir is a high-growth burgeoning company while Big Tech comprises of mature tech companies, it still sufficiently demonstrates Palantir’s pricey-ness when juxtaposed against the grounded valuations of mature tech companies.

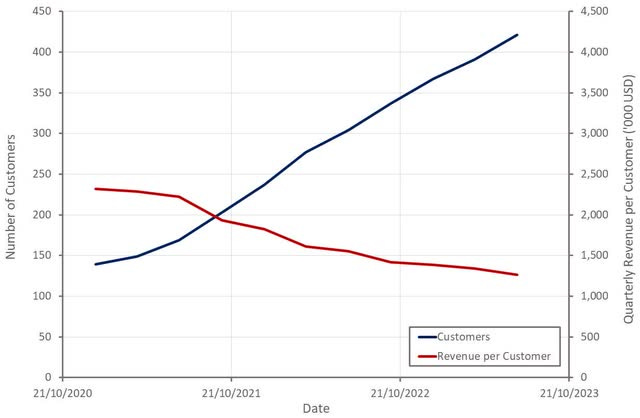

Customer Base Is Growing but Revenue Is Still Concentrated

In the commercial side of the business, Palantir’s revenue sources are concentrated among a small group of customers but the company is rapidly expanding its customer base. This is dragging down its revenue per customer in the short-term as new customers “dip their toes” with the software before expanding usage.

In general, a fast-growing customer base is great news for Palantir given how hard it is for a company to onboard their data to Foundry. High onboarding costs is Palantir’s greatest hurdle for growth and accelerating customer acquisition suggests that significant progress was made in streamlining the onboarding process.

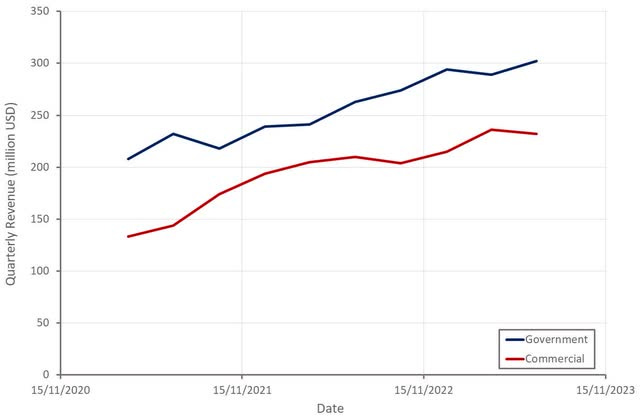

Public vs Private Sector

As mentioned above, Palantir is a two-part business that serves both the public and private sector. Despite significant investment in growing its commercial arm, the government business continues to form the majority of revenue for Palantir and has recently grown faster than the commercial business given a weakening economy and the ongoing war in Eastern Europe.

What’s Next?

To come up with a point-of-view for the trajectory of Palantir’s stock price, it’s helpful to understand the company’s high level strengths and weaknesses.

This is our perspective.

Excellent Financial Management (Bullish)

I haven’t seen this point mentioned in the litany of Palantir analysis pieces out there: Palantir is a master-class in corporate financial management.

The best example of this is how the company navigated the volatile economic landscape in the years since the onset of the pandemic which has resulted in a profitable, high cash flow company even as most other growth companies struggled financially. Specifically, the company built a massive cash position before the Federal Reserve started aggressively raising rates. This cash position kept the company well-funded even as corporate liquidity dried up. As interest rates rose, the company poured this war chest into high-yielding US treasuries and the interest income from these treasuries has propelled the historically cash-burning company into profitability in the last three quarters!

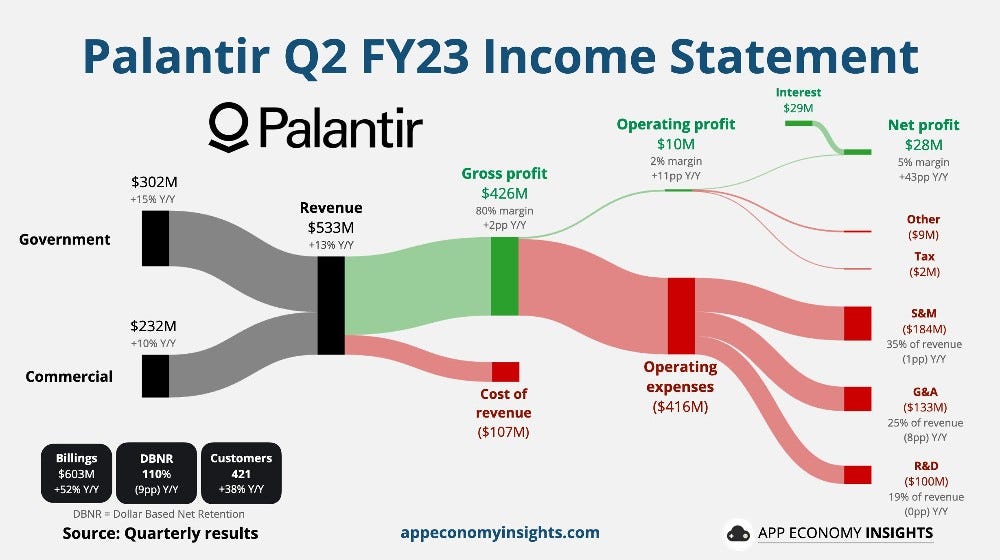

Check out these two income statement infographics from Palantir’s last two earnings calls. Interest income tipped the company to profitability both times.

Part and parcel with the company’s drive to profitability is a consistent improvement in operating profit margins over time, as seen in the chart below.

What Palantir’s operating team has managed to achieve in the past few years in the public spotlight has been nothing short of excellent and this bodes very well for the company’s future.

Minimal Competition (Bullish)

What Palantir is doing is hard.

Most companies have lots of poorly organized data that take significant time and money to unravel. This is why data companies tend to focus on selling data building blocks that any company can easily use. Palantir is asking companies to do the hard thing to get ten times more value from their data. This requires a very powerful system that actually generates significant value from organized data, an efficient company onboarding process, and an efficient sales team. All three things are very hard to build in tandem, which thins out Palantir’s competitive landscape.

Finally, no other growth company at Palantir’s scale are as tightly coupled with governments as Palantir is. This gives Palantir a highly reliable revenue source to fall back on if its commercial business experiences headwinds.

S&P 500 inclusion (Bullish)

A company is eligible for inclusion in the coveted S&P 500 if they report four consecutive quarters of GAAP profitability. Palantir has reported three so far and is on track to report another profitable quarter in its next earnings call. Excitement for S&P500 eligibility should be a short-term tailwind for the stock running up to the next earnings call and right after.

The S&P 500 is the most popular index for the US stock market and there are trillions of dollars in funds that track the S&P 500. As such, a stock’s inclusion in the group is especially bullish.

Slowing Revenue Growth and AI headwinds (Bearish)

As mentioned above, Palantir’s year-over-year revenue growth rate has been consistently slowing every quarter since it went public. The recent price bump is the result of an increase in its PS ratio as a result of AI excitement. As such, Palantir’s current valuation is at risk if AI excitement falters. And worries are growing for exactly this.

For one, search interest in ChatGPT peaked earlier this year in April and steadily declined before seeing another uptick recently (still below the peak). Second, there are rumors that Microsoft is scaling back orders for Nvidia H100 chips. Third, Nvidia’s stock price has fallen almost 16% since its $500 peak a month ago.

AI enthusiasm is faltering and the cracks are starting to show.

For Palantir, it has to prove to the market that it can capture significant value with its burgeoning AIP product. The company claimed that they are in talks with over 300 companies to deploy AIP but talk is cheap. The hardest part is turning talks into substantial revenue streams and it’s clear that even though companies see great potential in AI, many are still very hesitant to deploy AI-powered tools for widespread internal usage. This is what Palantir had to say on the subject:

“There are many challenges customers will encounter as they attempt to leverage this technology operationally at any scale. From managing the mismatch between the ever-growing big data scale of the enterprise and the bottlenecks and choke points of smaller context windows of LLM's, to product design challenges of constructively embedding these models and workflows, and safety and trust challenges in governing the AI in an operational and decision-making context..”

Verdict

Palantir’s stock should experience some upside as we approach its Q3 earnings call in November as a result of excitement for a potential inclusion in the S&P 500 when the company inevitably books its fourth consecutive profitable quarter. However, there is significant risk of faltering AI enthusiasm and we don’t think the stock is a short-term buy until we’re closer to its Q3 earnings call in November.

Overall, the stock is a strong long-term investment. Palantir’s customer-base is diverse, the product is powerful, and the management team is excellent.