Parthian Shots

[4 minute read] Explaining why we believe the bull market fired its last Parthian Shots and a short-term bear market is about to set in.

The Parthians are an ancient Iranian people famous for their use of highly skilled horse archers in battle. A common tactic the nimble Parthian horse archers used to safely pelt arrows at enemy ranks is known as the “Parthian shot”. While feigning a retreat, the horse archer would turn around on the horse and fire arrows at the pursuing enemy. Inexperienced enemies easily fall prey to this tactic.

Readers might wonder, what does the Parthian shot have to do with the markets?

Good question.

I thought a Parthian shot is an interesting analogy for what the bulls in the market have done to the bears over the past month. Specifically, while many traders have shorted the market heading into the latter half of the year, expecting the lagged effects of interest rate hikes to finally result in a severe earnings recession, the market has instead orchestrated an almost parabolic move upwards (e.g. SPY went from $410 to over $440 in a month).

Overzealous bears with too much short exposure too early are getting crushed by the volleys of Parthian shots from the bulls, forcing many offside shorts to cover and adding to the incessant buying of the past month.

As painful as this upwards move has been for the bear thesis, I think the final few Parthian volleys have been fired. In the short term, the bear market is back.

The Bear Market is Back

Here’s why.

The biggest reason is the upcoming end-of-month and end-of-quarter rebalancing that the equity and bond markets are facing in the next two weeks.

Don’t take this from me, it’s coming straight from JP Morgan’s Quant Desk, which estimates that $150 billion need to flow out of equities and into bonds in the next two weeks given the massive performance gap between equities and bonds in the past quarter.

“The last time we had such a gap with equities and bonds in opposite directions was in the 4th quarter of 2021.”

What does rebalancing mean and why does it need to happen? Here’s a quick crash course.

End-Of-Quarter Rebalancing

Most major passive funds are composed of equities and bonds, with a target composition for each asset class. A famous target composition is 60% and 40%, equities and bonds. If equities significantly outperform bonds such that a fund is out of balance (e.g. 75% equities and 25% bonds), then the fund needs to sell equities and buy bonds to bring it back into the target composition.

When do funds tend to rebalance? We don’t know for sure as many of these massive funds are expectedly secretive about this to avoid getting front-run by enterprising traders. Fortunately, we do have a reasonable approximation based on the literature published by funds with an affinity for transparency.

For example, State Street’s popular S&P Market Sector ETFs rebalance on the third Friday of the quarter-ending month.

These are quotes from their prospectuses:

“If necessary, a final adjustment is made to ensure that no stock in the index has a weight greater that 4.5%. This step of the iterative weighting process may force the weight of those stocks limited to their maximum basket liquidity weight to exceed that weight.”

“The market capitalization threshold and the liquidity threshold are each reviewed from time to time based on market conditions. Rebalancing occurs on the third Friday of the quarter ending month.”

We are approaching the end of the year’s second quarter, a quarter in which stocks have significantly outperformed bonds. This is why JP Morgan predicts that a massive bout of rebalancing will occur.

I’ve written about fund rebalancing at great length before. Here are the articles for more reading:

More Bearish Bullet Points

The foremost reason why I expect an impending short-term bear market is the upcoming end-of-quarter rebalancing period but the overall market backdrop is also quite bearish. Here are some reasons why:

SPY is at the same level as it was in March 2022 when the Fed first hiked the Fed Funds Rate from 0.25% to 0.50%. Today, the Fed Funds Rate is at 5.25%. It’s astonishing that SPY is at the same level as when the Fed Funds Rate was at near 0%.

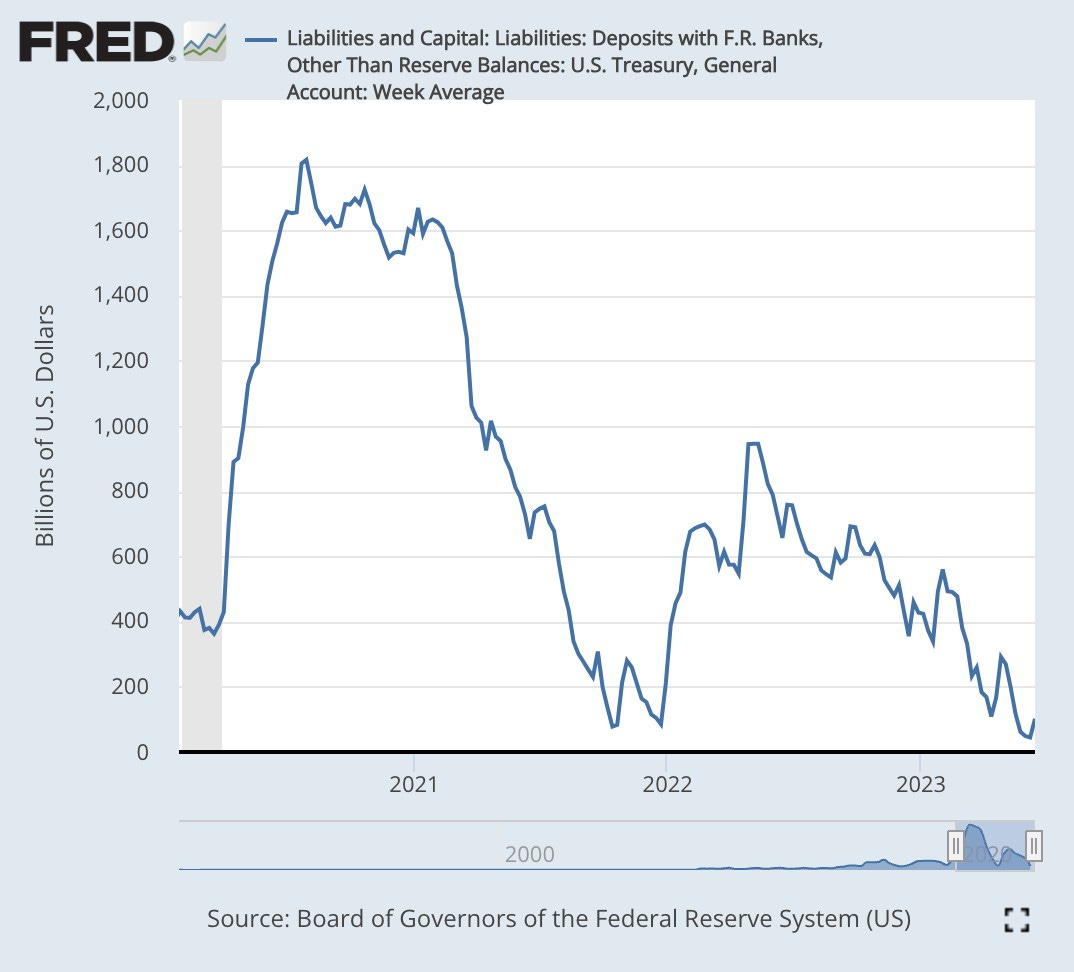

The US Treasury (aka the US government’s bank account) has been spending down the Treasury General Account’s balance over the past year to stave off the debt ceiling question. Now that the debt ceiling has been raised, the Treasury needs to issue and sell new treasuries on the open market to raise funds and bring the TGA’s balance back up to around $500 billion. This drains liquidity from markets whereas the Treasury was injecting vast amounts of liquidity when it was spending down the TGA over the last year.

With the new debt ceiling deal in place, student loan repayments are returning this October after a three-year pause. Higher education expert Mark Kantrowitz estimates that the three-year pause has saved 40 million Americans with student loan debt an average of $15,000 in student loan payments. That is a LOT of liquidity made available to the markets over the past three years and now this extra liquidity tap is closing.

Higher interest rates slow down money velocity in the economy, thus reducing company earnings and pulling liquidity out of markets at the same time. However, it takes a while for the negative effects of interest rate hikes to show up in the economy. This is known as the “lagged effect of interest rates”. This lag is estimated to be around 12 months, but given the wanton money-printing during the pandemic, this lag is a lot longer. In addition, the Fed Funds Rate only reached 5% a few months ago, so we’re still months away from experiencing the full effect of high interest rates on the economy. Nevertheless, it’s reasonable to expect earnings to continue to contract going into the latter half of the year as the lagged symptoms of last year’s rate hikes appear.