Quick Predictions on the 2022 Stock Market

As 2021 draws to a close, I share predictions on the stock market in 2022.

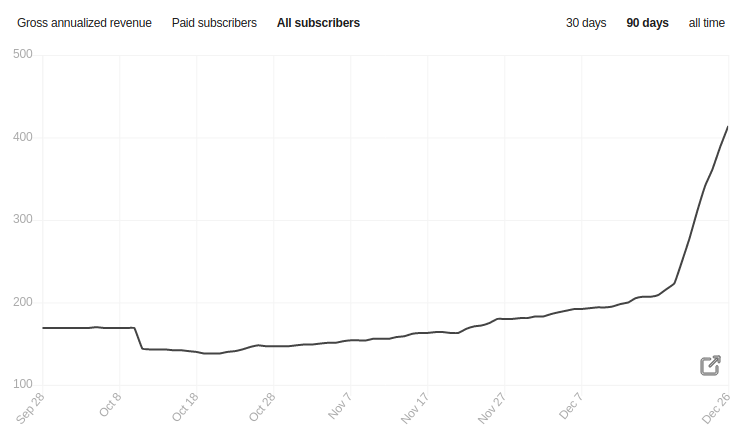

Before I begin, I'd like to share some fantastic growth numbers for the FinanceTLDR newsletter. I restarted the newsletter in earnest in October and since then, subscriptions have been on a tear. Thank you to new and old readers for following and reading the newsletter this year and I hope it has been informative and helpful.

In addition, if you haven't received some of the recent articles, such as Palantir (PLTR): Must-Own Growth Stock? and Curious About Investing in Rockets? Rocket Lab vs Astra, and you're using Gmail, check your Promotions tab as Gmail has a weird habit of burying Substack newsletters there for some users. Substack recommends to add financetldrblog@substack.com to your contact list or sending an email to said address to stop Gmail from sending newsletters to Promotions.

Happy Holidays! 🎄☃️

We're near the end of 2021. What a crazy year it's been. The coronavirus pandemic continues to plague the world one dangerous variant at a time, yet we've largely adapted to the new state of things. The Federal Reserve and Congress continued to issue massive monetary and fiscal stimulus to great effect for the US economy (maybe working a little too well), companies and workers have largely embraced remote work, masks have become an accepted and often expected piece of clothing, and most people are now fully vaccinated against COVID.

In the US stock market, the fears (and realities) of elevated inflation have put a massive damper on the high growth mid-cap stocks that performed so well in 2020. However, the overall market has marched on higher, buoyed by large-cap tech stocks like Apple and Alphabet that incessantly pushed new all-time-highs throughout 2021.

With only a week left in this crazy crazy year, I'd like to share my predictions on the US stock market in 2022, and end with a few personal stock picks.

Stocks Are Going Higher

Demography is an amazing predictor of markets. This chart shared by Tom Lee (regular CNN contributor and Managing Partner/Head of Research at Fundstrat Global Advisors) on an episode of The Compound & Friends podcast shows that market peaks and troughs follow generational peaks and troughs well. When the number of 30-50 year olds in the US peaks, the market peaks, and when this number falls, market growth stalls.

Prime skilled US adults aged 30-48 inflecting up and surging (source)

The above chart, but matched with US stock market growth (source)

North America is the only major developed economic zone that has a demographic tailwind. The populations of both Europe and Asia are declining. In addition, US millennials, an expanding generation (larger than the generation before), is just starting to reach the 30-50 age range, with the oldest millennial being 39.

People are the most productive, innovative, and spend the most in the 30-50 age range. They are at or near the peak of their careers and are starting or already have families. Interestingly, according to Tom Lee, the number of patents filed closely correlates with the number of people in their 30s, and most successful US companies were founded by people in their 30s.

We're still a few years away from the number of 30-50 year old millennials peaking and this creates a major positive demographic tailwind for stocks. As such, I think it's more likely in 2022 for the US stock market to continue rising with low volatility than to see a major pullback, barring any black swans.

Inflation Is Transitory

Earlier this year, I wrote two newsletter articles (Inflation Is Not Here To Stay and The Only Guide to COVID Inflation You'll Need) with the position that inflation is transitory. I'm sticking to this prediction, despite November recording the highest inflation rate since the 1980's at 6.8%.

I also want to be clear about what transitory means, since something that lasts for centuries is technically also transitory. For example, the Roman Empire was transitory. So to expand on this "inflation is transitory" position, I think the elevated inflation will cool down by Q3 2022 at the latest. Here are the two main reasons:

Fiscal stimulus is slowing down: fiscal stimulus (sending money directly to people) is the most effective government policy in jumpstarting demand. In response to COVID, the US government sent out $4.2 billion in stimulus cheques over the last 2 years (source) and passed a combined total of $5 trillion in stimulus (source). This aggressive fiscal stimulus policy is unlikely to continue in 2022. In fact, it's already stalling with the Senate expected to block the $1.7 trillion Build Back Better bill. Inflation was cited as a top concern.

The Global Supply Chain is recovering: consumer goods prices spiked in 2021 in large part due to a clogged supply chain that overenthusiastically scaled down during COVID lockdowns, underestimating how quickly fiscal stimulus could revive consumer demand. Now that we're about a year into the supply chain crisis, there are signs of recovery as retail companies adapt with bespoke solutions (e.g. stockpiling inventory early and some even chartering their own container ships) and supply chain companies fix their bottlenecks. As a result, shipping freight rates and major port backlogs have started falling from the highs of the year, ahead of the holiday season (source).

For more on my thoughts on inflation, check out this article: The Only Guide to COVID Inflation You'll Need.

The Return of the Growth Stocks

2021 has not been kind to COVID's high performing mid-cap growth stocks, especially in Q4. This was caused by a large number of factors, including inflation fears, a decline in retail trading, and for some, the end of a period of abnormally high growth from COVID lockdowns.

I predict that 2022 will be kinder to growth stocks, with Q1 being especially green as professional traders re-establish the positions abandoned around Thanksgiving when the highly mutated Omicron variant first hit headlines. Next year's tax season should also be a boon as many retail traders should get refunds instead of capital gains tax bills like this year's tax season (from windfalls in 2020).

I'm unsure about how the rest of the year plays out for growth stocks. I would advise extra caution in the middle of the year, as student loan payments restart in May, adding strong headwinds for retail trading participation.

Stock Picks

General Motors (GM)

Some readers know that I'm a GM bull and I continue to be. I think GM is the best positioned car company to challenge Tesla's growth narrative with a strong lineup of mid-to-high-end EVs launching in the next few years (the first of which, the Hummer EV, started production this month), in-house battery technology that rivals Tesla's, as well as self-driving car technology under its Cruise subsidiary that's a hair's breadth away from launching a fully autonomous taxi service. In October, San Francisco gave the company a permit to receive compensation for driverless deliveries in a limited capacity in the city, while Google's Waymo received a similar permit that required safety drivers.

By principle, the market is always slow to react when a company makes large fundamental changes. Old funds need to divest and new funds need to invest. Public sentiment shifts at a glacial pace. This is a long and choppy process which creates opportunity. Think about how long AMD treaded water under $30 before rocketing to over $140 in just a couple years. The seeds of this change were germinating within the company long before the stock price responded.

GM should open the year strong with CEO Mary Barra delivering an opening keynote at CES 2022 on January 5th. Barra will share GM's vision for mass adoption of electric vehicles and give an update on the company's progress, including unveiling the new Chevy Silverado EV and sharing more details on the Cadillac Personal Autonomous Vehicle.

Barra also delivered an opening keynote at CES 2021 earlier this year and this event propelled the stock from $43 to over $50.

Nikola (NKLA)

Nikola is another company that, in my opinion, is about to surprise the market. Long written off as a scam due to a big-talking bombastic CEO that was swiftly ousted, Nikola quickly rewired the company and trimmed its vision to be fully focused on manufacturing and delivering battery electric trucks (BEV) and fuel cell trucks (FCEV) next year.

The company completed the first phases of its manufacturing facilities in Coolidge, Arizona and Ulm, Germany this year and has begun assembling trucks. It made its first US BEV delivery to Total Transportation Services this month and also scored a letter of intent from Heniff Transportation to purchase up to 100 BEVs. This news propelled the stock up 22% in just a couple days.

Tre BEV production line at Nikola's Coolidge manufacturing facility (source)

The entire company is dead set on proving its critics wrong and is well-capitalized, well-equipped, and well-staffed to do so. Expect NKLA's sentiment to begrudgingly shift from overly bearish to optimistic in 2022 as manufacturing and deliveries ramp up.

Palantir (PLTR)

If you've read my recent piece on Palantir, you'll know that its another company I'm optimistic about.

My biggest worry with the company is difficulties scaling the customer base for its flagship commercial product, Foundry, which is key to its growth. My concerns were largely abated by its Q3 2021 earnings call. Foundry's adoption is skyrocketing while customer acquisition costs are falling.

Interestingly, someone recently gathered a list of public subdomains of top-level domains owned by Palantir (e.g. palantircloud.com, cloud.palantir.com, etc.) and found a list of companies likely working with Palantir. This includes major companies like Pepsico, Wendy's, Lockheed Martin, General Motors, and more. Check it out here.

Finally, Palantir is a company that thinks differently, with a commercial data-focused SaaS product that's wildly differentiated from the competition, and, unlike most tech companies, is not afraid to serve the US military and intelligence services. This "Think Different" mentality is paying off in spades as it has found significant moats around its unique products.

I expect Palantir's stock to perform well in 2022 after a tough Q4 2021 as Foundry's growth accelerates.

Disclaimer: this isn't financial advice, and the content is intended for informational purposes only. You should always do your own research and/or consult with a financial professional before making any financial decisions.