Research - Volatility As the Best Hedge

Let's discuss why Volatility is an amazing hedge, and how we can use the VIX to do so.

This is a chart of the VIX, or the CBOE Volatility Index, over the last four years or so. The VIX is the most popular way to measure volatility in the stock market. Volatility is defined as the amount of variance in an asset’s price over a given time period. If the asset’s price swings wildly, then it has high volatility. If it holds steady, then it has low volatility.

What do you notice with VIX’s chart? First, VIX tends to go up and down in a range. It never stays too high nor does it fall too low. Second, VIX seems to spike when the stock market is under stress, such as during the 2018 mini-crash and the 2020 pandemic crash.

This makes the VIX a great hedge for any portfolio that is heavily invested in stocks. Unfortunately, it’s not as simple as that since the VIX isn’t an asset you can just buy, it’s an index (i.e. a calculation). There are funds that approximate the VIX, but only in the short-term and tend to lose a huge amount of money over the long-term.

This is the first in a pair of articles where we introduce a VIX-tracking strategy that is a better approximation of the VIX and thus act as a better hedge for stocks.

Why Is the VIX a Good Hedge Again?

As we touched on in the intro, the VIX is often seen as the Holy Grail of portfolio hedges. Like the Holy Grail, it’s highly desirable, at least for the folks on Wall Street. Unfortunately, also like the Holy Grail, it’s impossible to attain.

Well, sort of, we shall see later on that we can approximate it.

But first, let’s elaborate on what makes the VIX such a great hedge.

For one, the VIX is often inversely correlated to stocks. This is because its value is derived from SPX option prices. The VIX basically represents the average implied volatility of all available options on the market, and when the markets go down, implied volatility will go up. To understand this we must realize that during times of market stress there will be a greater demand for put options as investors look to insure against further downturns. This will in turn raise the prices of both put and call options due to put / call parity.. This drives up option prices broadly and by extension also raises the implied volatility.

So market stress means options prices go up, which means the VIX goes up.

Don’t believe me? Check out this rolling SPY/VIX correlation chart below showing the inverse correlation effect.

The second thing that makes VIX a great hedge is its mean reverting nature. “Volatility cannot move higher in perpetuity. It also cannot move to zero.” Even though other negatively correlated strategies exist (i.e. shorting), these strategies have a theoretical maximum loss of infinity. Not exactly what you look for in your ideal portfolio hedge. In combination this gives a long VIX strategy the potential to not only increase portfolio Sharpe ratios, but also total returns.

Below I’ve provided a backtest of how a hypothetical 90:10 SPY/VIX portfolio would have performed over the past decade.

This hypothetical portfolio would have:

Had a Sharpe ratio almost double that of the SPY-only portfolio

Almost doubled the SPY portfolio in terms of total return

A worst trading day of 17% vs 34%

Alas, this is where reality sets in. While this strategy can be backtested it is not readily replicable. This is because, as was mentioned above, the VIX is not an asset one can buy but merely a calculation. However, this doesn’t end the case for long VIX as a portfolio hedge. There are imperfect long volatility products that we can use in a sophisticated way to increase a portfolio’s Sharpe ratio and outperform more traditional hedges such as bonds.

Lousy Long VIX Products

The first thing to know about long VIX products is:

Yep that's right! You may have heard of various products such as VIXY or VXX that at face value appear to track the VIX, but in fact actually aim to reproduce completely different indices.

Generally speaking all “long VIX” products will aim to track one of the following indices:

As is implied by the names of these indices, even though the VIX isn’t an asset you can buy, it does have a futures market. For the layperson, a futures contract is an agreement to buy or sell a particular commodity, asset, or security at a predetermined price at a specified time in the future. A VIX futures contract thus has an expiry date and its settlement price is the level of the VIX at the time of expiry. However, since the VIX isn’t a tangible asset, VIX futures contracts don’t involve the delivery of anything at expiry and are instead cash-settled. This means that if a VIX futures contract holder bought at a price lower than the actual level of the VIX at expiry, they receive the difference, while holders that bought at a higher price have to pay the difference.

VIX futures are incredibly popular. In fact, they are the most traded futures contract on the CBOE Futures Exchange.

Back to the two VIX futures indices in question. Both of these indices track the daily returns of rolling various futures contracts into a more distant month (selling near-expiry futures contracts for further out futures contracts) such that an average duration until expiry is maintained.

The “Short-Term” index aims to maintain an average duration of one month by rolling “this month” futures into “two months from now” futures. The “Mid-Term” follows a similar process but seeks to maintain an average duration of five months.

Because these two indices are based on the VIX futures market, and thus on actual assets that one can buy and sell, they are easily reproducible and ETPs (exchange traded products, e.g. ETFs and ETNs) exist to track them, such as the VIXY.

Now a natural follow-up question would be, is it possible to use these ETPs to get long volatility exposure and thus achieve the Holy Grail volatility hedge I was talking about? Unsurprisingly, the answer is a resounding no. These ETPs gradually lose money over time since the VIX futures market is typically in contango (the further out a futures contract expires, the more expensive it is). This means that selling near-term futures contracts and buying further out future contracts is typically a money-losing operation. To track the aforementioned indices, these ETPs need to repeat this operation over and over again. That’s the only way they can keep the average time-to-expiry of the contracts they’re holding the same length as what the index defines.

To see how contango destroys the value of ETPs trying to track VIX futures indices, we only need to see the price of VIXY in the past ten years.

It’s just a straight downwards plunge as the selling of near-term contracts and the buying of long-term contracts take a toll on the ETF’s balance sheet. Of course, this is balanced out by the continuous inflow of funds from investors looking to use VIXY in their trading. In addition, one might’ve noticed that VIXY used to be worth tens of thousands of dollars ten years ago? Not quite. It’s just that as the value of the shares fell over time, the ETF would occasionally perform reverse splits (i.e. convert many shares into one share) so that the price of the shares are similar to the level of the VIX.

Barclays vs Proshares!

Before we start dabbling in any exchange traded VIX products, we need to understand some key differences between them.

The two largest VIX product families are offered by Barclays & Proshares respectively. Each has their own set of quirks.

Barclay’s Product Family

First let’s explore Barclay’s long VIX products:

VXX - Tracks the S&P 500 VIX Short-Term Futures Index

VXZ - Tracks the S&P 500 VIX Mid-Term Futures Index

The main thing that you need to understand about both of these “funds” is that they are in fact “Exchange Traded Notes” (ETNs). These ETNs are unsecured debt instruments and as such carry credit risk subject to the credit worthiness of Barclays itself. If Barclays were to default on their obligations you “may not receive the amounts owed to you under the terms of the ETNs.” See the prospectus for more information about the special “Risk Factors” that you should consider before purchasing.

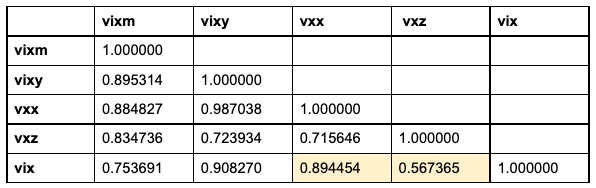

The other thing that is notable about the Barclays products is that they tend to exhibit a lower VIX correlation than the products offered by Proshares. Below you can see the correlation matrix for the daily log returns of each product. I’ve highlighted the two offered by Barclays in yellow.

The takeaway here is that the Barclay’s suite is a lot poorer at tracking the VIX than their corresponding Proshares offering. This is especially notable with Barclay’s mid-term VIX futures offering.

Proshares Product Family

Proshares has two long VIX products:

VIXY - Tracks the S&P 500 VIX Short-Term Futures Index

VIXM - Tracks the S&P 500 VIX Mid-Term Futures Index

Unlike Barclays, Proshares’s products are in the form of ETFs, which are generally less risky than ETNs. The risks still exist, however, and Proshares outlines them in the funds’s prospectuses (an example prospectus).

Additionally, there are special tax considerations for Proshares’s VIX ETFs that differ from your typical ETF. Being a partnership, Proshares will send you a special document at the end of the year called a Schedule K-1. If you’re doing your own taxes this will mean at minimum that you are filling out a few extra forms come tax time. This is probably just the start of the implications. Generally I would advise reviewing the Proshare’s FAQ on the matter and discussing with a tax professional before purchasing either of these funds.

Is All Lost?

Well yes and no. It depends on what you’re trying to do. If you’re trying to perfectly replicate the 90:10 SPY/VIX portfolio I showed at the beginning of this article, you’re going to have trouble. However, if you’re looking to approximate a VIX hedge to increase your portfolio’s performance while reducing risk, a VIX ETP can certainly help to do so, as long as we use it intelligently!

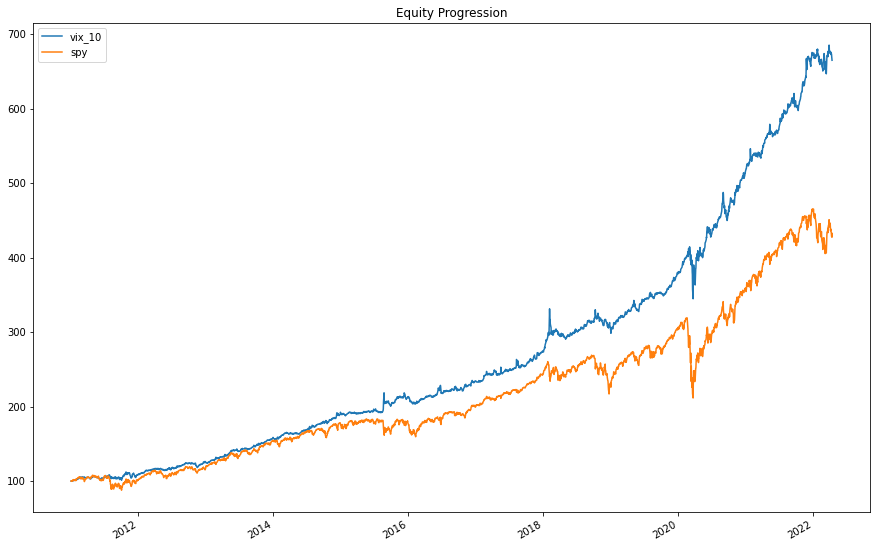

In the next article in this series I’ll cover a strategy which allows investors to avoid much of the negative roll yield associated with VIX ETPs while achieving a moderate correlation to the VIX itself. The returns from using this strategy are represented by the blue line below and the returns from the VIX and VIXM are given as a comparison as well. We see that VIXM severely underperforms the VIX over time while our strategy is much better at tracking the VIX. This VIX-tracking strategy can then be used as a hedge against stocks. We will also show that it’s a much better hedge than a bond-based hedging strategy over the past decade or so.

Interesting article, thanks for writing it. I just found your blog but I can't find the next article in the series that this one refers to, can you link to it? Thanks.