Robinhood (HOOD) Deep Dive: Can The Stock Be Saved?

Why did Robinhood's stock crater after its latest earnings report? Can the stock be saved?

In 2014, Robinhood became the first broker in the US (and perhaps the world) to offer commission-free trading of stocks and ETFs with an unparalleled mobile-first user interface. This quickly made it the most popular broker among younger generations (i.e. millenials and gen Z). It was also the beneficiary of a huge increase in retail trading during the COVID lockdowns as people that were locked in their homes, flush with COVID stimulus cheques, turned to the stock market for entertainment and supplemental income. With this major tailwind in its back, the company IPO'd at the perfect time in mid-2021 right after a red-hot meme stock market.

The stock IPO'd at $38 and went as high as $85 before slowly crashing down in the months after the IPO. It ended 2021 at a measly $17.82, less than half its IPO price. An absolute disaster.

Here's why it happened, and how I think the company will react in 2022 and beyond.

Understanding Robinhood

Before we dive into why the price of HOOD cratered, we need to understand the company's background and current state.

As mentioned above, Robinhood is the first broker to offer commission-free stock and ETF trading with an unmatched user interface. The company entered and disrupted a stagnant industry where trading costs were high (typially $5 per trade!) and user interfaces were atrocious. The Robinhood app was launched in 2014 and it took the incumbent brokers 5 years to drop their own trading commissions to zero in 2019.

User Demographics

The reluctance of the incumbent brokers to eliminate trading commissions allowed Robinhood to quickly become the young investor's favorite stock broker. The platform's number of funded user accounts grew rapidly from 500,000 in 2014 to 22.4 million in Q3 2021. The median age of a user is 31 with about 50% of them being first-time investors.

The youthfulness of its userbase is evident in its average account size. Robinhood has $95 billion in assets under management (AUM) as of Q3 2021, which means that its average account size is about $4,200. This is tiny compared to the other major brokers. As examples, E*TRADE and Schwab's average account sizes are $100,000 and $240,000 respectively.

How Does Robinhood Make Money?

Now let's examine how Robinhood makes money. It's quite simple. They primarily earn two types of revenue: transaction-based and net interest. The former represents the majority of the company's revenue and comes from payment for order flow (PFOF, more on this below) from stock, ETF, and options trading. They also earn significant revenue from crypto trading commissions (yup, the crypto industry still isn't ready to accept commission-free trading). The more trading that occurs on Robinhood, the higher its transaction-based revenue. The other type of revenue Robinhood earns is net interest and it's essentially interest earned from lending out a small portion of their customer base's assets as well as interest earned from margin trading. The more AUM Robinhood has, the higher its net interest revenue.

(Source: Robinhood)

PFOF is a controversial stock broker practice where brokers direct their order flows to market makers for trade execution. This gives market makers deep market information and opportunities to frontrun the broker's traders. Orders executed via PFOF can easily be at less than optimal prices and greatly benefit market makers. This is how Robinhood is able to make money without trading commissions. Robinhood's use of PFOF generated a lot of bad press for the firm, but it's important to keep in mind that most other major brokers with commission-free trading like E*TRADE, Schwab, and TD Ameritrade use it as well.

What Went Wrong With Robinhood?

The main catalyst for HOOD's precipitous fall is its Q3 2021 earnings report, its second earnings report since going public in July. Although year-over-year numbers were impressive, quarter-over-quarter numbers were abysmal. This threw off Wall Street's growth projections for the company and forced many firms to aggressively lower those projections.

Here's a quick overview of Robinhood's Q3 underperformance:

Net cumulative funded accounts fell from 22.5 million in Q2 to 22.4 million (-0.5%)

Monthly active users fell from 21.3 million in Q2 to 18.9 million (-11.2%)

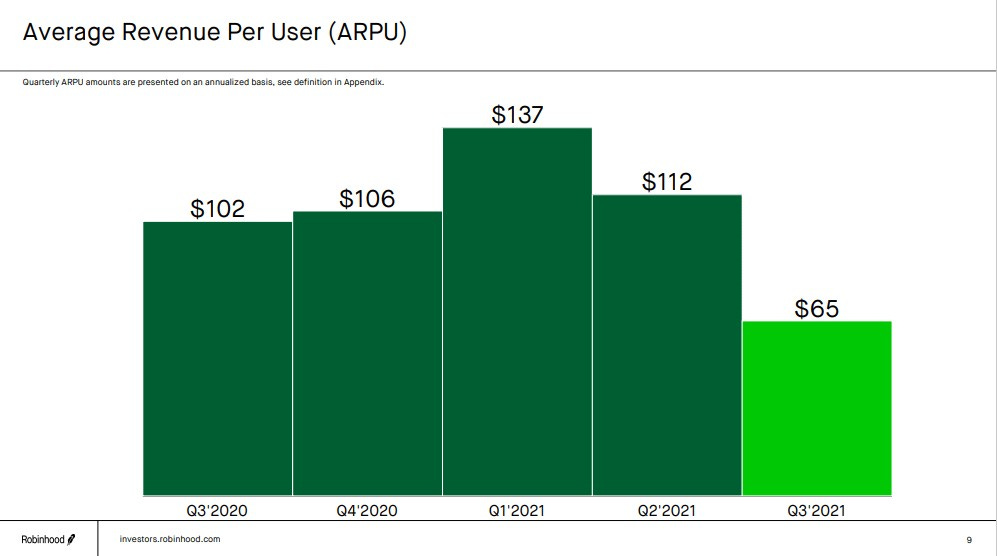

Average revenue per user fell from $112 to $65 (-42%)

(Source: Robinhood)

(Source: Robinhood)

Not only did Robinhood's userbase shrink, its revenue per user fell off a cliff. Related is an alarming fall in user engagement: in the preceding quarters, monthly active users stayed above 90% of cumulative funded accounts (94.67% in Q2 2021) but in Q3, this number fell to 84.38%.

These are drastic decreases in product and business metrics, and Wall Street is struggling to understand whether this is a blip on the radar or the start of a problematic trend.

There are several reasons for this drop in user count and user engagement. For one, Robinhood earns most of its revenue from trading volume (quantity of shares or contracts traded on the platform) and with growth and tech stocks (the young investor's favorite sectors) getting hammered in the latter half of 2021, so has trading interest as many Robinhood traders become "bagholders" or completely blow up their accounts with ill-timed bullish option positions.

In addition, Robinhood is still facing headwinds from bad press around its highly controversial decision to block the buying of GME during the stock's meme-fueled meteoric rise in early 2021. This left a bad taste in many of its existing users and certainly discouraged many prospective users from joining. With all the other major brokers having matched Robinhood's key features like commission-free trading and instant deposits, with the added impression of having mature and reliable services, it was an easy decision for disillusioned users to move off the platform or for prospective users to choose another broker over Robinhood.

However, the main problem that the Q3 earnings report highlighted is the fragility of Robinhood's revenue sources. The company earns a significant portion of its revenue from options and crypto trading volume.

The problem with options trading revenue is that most options buyers lose, and thus will likely disengage from the platform after sufficient losses, or at least convert to long term stock/ETF holders that don't generate trading volume. The problem with crypto trading revenue is that commissions will eventually fall to zero, just like stock-trading commissions. In addition, crypto trading volume falls drastically in a bear market and if history is a guide, a bear market could happen at any time, especially since crypto has been in a massive bull market for the majority of the past two years. In fact, Robinhood's crypto trading revenue is already cratering, falling 78% from Q2 to $51 million in Q3. This is a significant contributor to the huge 42% drop in overall average revenue per user in Q3 from Q2.

Robinhood's fragile revenue sources has always been a problem... it was just abruptly thrust into the limelight by the Q3 earnings report that subsequently snapped off the rose-colored glasses of any Wall Street funds that still happened to have them on. In addition, the stock was trading at a high revenue multiple (about 15x) and was primed to fall at any sign of weakness in its growth story.

What to Expect for HOOD in 2022?

Yes, Robinhood is in trouble, but they haven't crossed the Rubicon. A comeback is possible and they certainly have many positive factors working in their favor.

For one, they have a massive customer base with funded accounts (22.4 million). This dwarfs most of the customer bases of its consumer-facing fintech peers. The brand has also become a US household name, and even though it's tarnished with the GME fiasco, this wasn't a setback they can't shrug off. Finally, Robinhood is still a stock broker that's the most "in touch" with young investors, offering the best user experience. Even though young investors are relatively asset-light now, they will beome the future equivalent of today's wealthy boomers.

A rouch comparison of customer base sizes of top customer-facing fintech companies

To course correct, Robinhood needs to do two main things. The most important of which is the diversification of revenue sources away from trading volume and launch products that leverage their massive number of funded accounts. For example, they can launch a robo-investing or personal loan product and instantly become a fierce competitor to incumbents like Wealthfront and SoFi respectively. Second, they need to invest in a top tier customer service to match the services offered by incumbent brokers and shed the reputation that they're a nascent and unreliable broker. Robinhood shouldn't be seen as a gateway broker that people eventually "graduate" away from.

For the first action item, I suspect that the company already has new personal finance products in the works. I won't be surprised to see at least one of them announced before the second half of this year. This would be very bullish for the stock in the short term as the company's growth narrative changes. In the long term, they need to prove that they can successfully execute on these new products. For the second action item, they have already started heavily investing in customer service, having launched a 24/7 phone support service in October of last year. The significant increase in operational expense in Q3 is a reflection of this new investment.

Fin

Despite the precipitous fall of HOOD in the past couple months, I wouldn't write it off as an investment just yet. There's ample time and opportunity for the company to course correct and rebuild a growth narrative. However, I expect the stock to continue struggling in the short term as the recent turbulence in growth and tech stocks, as well as crypto, will likely further reduce trading volume and thus revenue. In the medium to long term, watch for the stock to regain its footing when it starts to diversify its revenue sources. For real and sustained price appreciation, they need to prove that they can successfully execute on revenue diversification.

For now... 😢