SOFI: Overpriced Or 10x Potential?

A deep dive into the exciting personal finance company SoFi to determine whether it's overpriced or has 10x potential.

SoFi (Social Finance, Inc.) is a personal finance company that went public via a SPAC late last year that many people are excited for. Does this company live up to the hype? Let's see.

SoFi is what you'd expect from a Silicon Valley fintech company. It's well funded, technically competent, growing quickly, but also constantly losing money. They want to be a "super app" for all of a user's financial needs, from loans to investing to insurance. The app currently allows users to obtain loans (student, personal, car, and home), trade stocks and cryptocurrencies, invest in automated wealth management accounts, open a checking account, get a credit card, and more. Besides a consumer-focused "super app" product, SoFi also has an enterprise product called Galileo (acquired last year). Galileo enables others companies to provide digital banking services and issue debit cards via an enterprise API. According to its CEO, Galileo powers 95% of digital banking in North America.

Like most fintech startups seeking market disruption, SoFi is targeting a young audience. Their first and most popular product is student loan origination though they have been aggressively diversifying their product offering in line with the "super app" vision. Despite good progress in diversification, student loans remain a major part of their business.

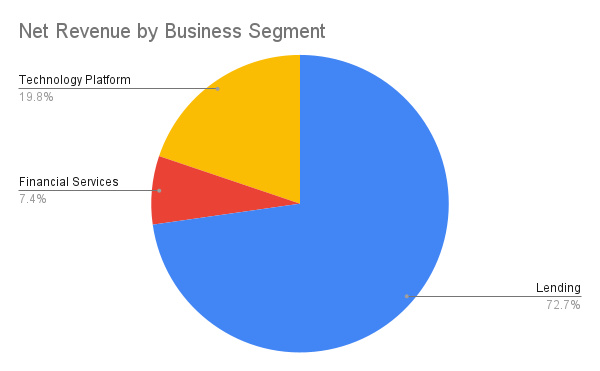

Source: SoFi Q2 earnings press release

Business strategy, strengths, and challenges

SoFi's business strategy is to attract new users using any one of its products from its large product offering. Once users are onboarded with the "super app", SoFi can then increase per user revenue by upselling users to its other products via in-app marketing and cross-product synergies (e.g. earn 2% cashback from a SoFi credit card if the cash is redeemed to a SoFi chequing account). Historically, student loan origination has been SoFi's primary top-of-funnel product and still remains a large contributor to the business despite diversification efforts. It's important to note that even with the COVID student loan moratorium, SoFi continues to produce strong revenue growth, demonstrating success in diversification.

With its competency of launching and managing a wide variety of products, SoFi's greatest challenges include growing its userbase and perfecting each product to ensure they're strong competitors in each of their niches. The last thing SoFi wants to be is a jack of all trades and a master of none. Fast user growth is key to growing SoFi's business because of its high revenue per user but low market share. The company reported 2.7 million users in its most recent quarter and expects $980 million in revenue this year. That's about $330 per user (roughly). This is high compared to Cash App's $200 per user, Affirm's $84 per user, Robinhood's $120 per user, and Lemonade's $246 per user (rough numbers, using q2 members if available and 2021 guidance if available).

SOFI revenue per user compared with Cash App, Affirm, Robinhood, Lemonade, and Upstart

With that said, SoFi raised a huge amount of money from going public ($2.4 billion) and this war chest is funding a significant marketing push. For example, the company recently announced a 20-year partnership with Hollywood Park that gives SoFi exclusive naming rights to the new SoFi stadium, the future home of the Los Angeles Chargers and the Los Angeles Rams. In addition, SoFi will be an official partner of both teams and also a partner of the performance venue and surrounding entertainment district. This is great for getting SoFi's brand out there. Moving forward, SoFi needs to continue its marketing efforts while also lowering its user acquisition costs. For example, it could follow Cash App's lead and market directly with social media influencers, such as those on Twitch, at low cost.

Photo by Kirby Lee, USA Today Sports

Another important challenge for SoFi is achieving profitability. Although SoFi is well capitalized, no business besides the US government can lose money forever and a top priority for SoFi, especially as a public company, is to become profitable. SoFi's current profitability plan involves inhousing many of its operations. Most of SoFi's products rely on third party service providers which adds extra operating cost and a worse product. To this end, SoFi acquired Galileo last year and is on track to obtain a bank charter, allowing it to "lower cost on loans (by utilizing use SoFi Money members' deposits to fund loans), offer lower interest rates on loans to members and offer higher interest rates on SoFi Money accounts, all while continuing not to charge non-interest based fees". (https://www.marketwatch.com/investing/stock/sofi/SecArticle?guid=15013870)

How to value SoFi?

In its last earnings report (Q2), SoFi maintained it's 2021 year-end guidance of $980 million in revenue. SoFi is a growth company and growth companies are often valued at a revenue multiple. For example, Tesla trades with about a 20 P/S ratio (price to sales ratio). As of writing, SoFi's market cap is roughly $13 billion (though the stock is quite volatile) which implies a 13 P/S ratio at year-end if they meet guidance. A good way to understand whether this valuation is fair is to compare SoFi with other high growth and recently IPO'd fintech companies.

SoFi compared with Affirm, Robinhood, Lemonade, and Upstart

As you can see, SoFi's valuation is actually at the low end compared to its peers. However, there's nuance and context with these numbers such that a simple magnitude comparison is not enough to compare valuations. For example, among its peer group, SoFi is probably the closest competitor to Cash App, a youth-focused fintech juggernaut that dwarfs SoFi in market share and has already obtained a bank charter earlier this year. In addition, SoFi is the least specialized company among its peers, offering many products across multiple fintech niches. The stock market tends to reward hyperfocused companies over generalistic ones.

Conclusion

I think SoFi has 10x potential, with the assumption that it can grow aggressively in the next few years. Despite significant revenue per user, it has a relatively small market share and a steep hill to climb to match incumbents. However, its historical growth, future plans, and ample funding suggest that the odds are in SoFi's favor. The key to this growth is marketing and continuous product improvements. The extra funding it received from going public is key to driving marketing efforts and obtaining a bank charter allows it to improve and expand its product offerings. What SoFi needs to watch out for is growing product overlap (hence competition) with Cash App and, separately, the risk of being a jack of all trades and master of none.