Spotify (SPOT) Deep Dive: Worth a SPOT in Your Portfolio?

Spotify is the leading music streaming service worldwide that many of us are familiar with and use. However, it trades at a lower multiple than many of its growth stock peers. Let's explore why.

Spotify is a business many of us are well aware of. A company founded in Sweden decades ago (2006 is 16 years ago!) by two entrepreneurially inclined Swedes that saw music as not an authoritarian dystopian for record labels nor an anarchic playground fronted by Torrent and Limewire but somewhere in the middle, where user freedoms and corporate greed can meet and agree on shared principles of user happiness and market cap appreciation. The result is a service where hundreds of millions of people worldwide listen, store, and organise their music all through a digital copyright restricted framework that ensures that users feel like they have control of their music, while record labels get their cut.

Let’s review whether this company has what it takes to hold a SPOT in your portfolio.

TLDR:

Top music streaming service worldwide with great product execution and fast growth, but faces tough challenges, hence priced at a significantly lower revenue multiple than peers

One top challenge is the vice grip of major record labels on the company since the majority of the music in Spotify’s music catalogue is supplied by these labels. Labels take a significant cut of revenue through royalties, and siphon shareholder value

Making matters worse, strong competition from Apple, Amazon, and Alphabet reduce room for maneuverability for Spotify in dealing with record labels and also reduces the company’s pricing power on the consumer side

For these reasons, Spotify needs to seek growth in its non-music audio streaming businesses, such as podcasting, for diversification and better margins

Good news is Spotify is doing really well with its podcasting business, surpassing Apple Podcasts in listeners for the first time in 2021 since Spotify launched podcasts on its platform in 2015

Spotify trades at a low revenue multiple of 2.3 relative to peers for good reason, but this also means lots of room for upside growth, especially if the company can meaningful address its top challenges

Reasonable stock to own in a growth-oriented portfolio

How Does Spotify Work?

Spotify’s core business is simple. They make deals with record labels (mostly 4 big ones, Universal Music Group, Sony Music Entertainment, Warner Music Group and Music and Entertainment Rights Licensing Independent Network) that allows Spotify users to stream their music anytime, anywhere on Spotify’s platform and Spotify gives the record labels a cut of the revenues as well as ownership of the company.

From a user’s perspective, users feel like they own their music, are able to search and discover songs, favourite them, organise them in their own playlists, and listen to songs in Spotify’s vast catalogue practically anytime and anywhere. The only caveat is that they have to do it on Spotify’s platform. For an ad-free and mobile-centric experience, users can subscribe to a premium service.

More concisely, Spotify’s core business is comprised of an ads-powered freemium music streaming service and a subscription-based premium music streaming service.

Beyond the core business are a couple smaller satellite businesses of podcasting and audiobooks. The former has seen significant growth, outpacing competitor services, but has also been controversial with their multi-year contract with Joe Rogan. Spotify’s audiobooks business is still very new, with the company just entering the market last year partnering with Storytel in May and acquiring Findaway in November.

Is Spotify Investable?

Like many other growth companies over the past few months, Spotify’s stock has been battered and bruised by a nervous market. The stock went as high as almost $390 in February last year but has since seen four straight months of selling starting in November, pushing the stock down to its pre-pandemic levels of about $140 ($29B market cap).

Compared to its growth / consumer digital entertainment peers, Spotify trades at a significantly lower valuation. Check out the chart below. The price to sales ratio (PS ratio) is a good metric to value growth companies with.

Spotify’s depressed valuation is because of two main issues:

Spotify loses a big chunk of revenue from its core music streaming business to record labels via royalties, significantly contracting margins

The core business is also facing strong competition from FAANG companies including Apple (Apple Music), Amazon (Amazon Music), and Alphabet (YouTube music)

Spotify pays a loooot of money to record labels. In 2020, the company pulled in an impressive $7.8B in revenue, yet cost of revenue was more than $5.8B (75% of total revenue). In 2021, the company pulled in almost $10B in revenue, yet cost of revenue was $7B (73%). To offer its music streaming service to users, Spotify has to continuously transfer significant value away from the business to the record labels that supply the bulk of its music catalogue.

In addition, even though Spotify remains the top music streaming service worldwide, competition from major tech companies is fierce. It’s far from ideal for a business to compete with not just one FAANG company, but three: Apple, Amazon, and Alphabet. All three offer competing music streaming services that are constantly nipping at the heels of Spotify. For the company to remain on top and still experience strong growth is a testament to the quality of the company's product and execution competency.

However, Spotify is far from a bad business, it’s growing incredibly quickly. Over the past 3 years, Spotify has grown monthly active users by 31% (2019), 27% (2020), and 18% (2021) to 406 million, and annual revenue by 22% (2019), 18% (2020), and 27% (2021) to $9.6B. I suspect if Spotify can significantly reduce royalties paid to record labels as a percentage of revenue, the market will be willing to pay a significantly higher sales multiple (i.e. PS ratio) for the stock.

Escaping the Vice Grip of Record Labels

Spotify is currently slowly reducing royalties paid to record labels through two main ways: promoting and growing its catalogue of independent music and diversifying audio streaming content away from music. I was thinking Spotify may be able to create its own record label, similar to how Netflix and Prime Video funds original content, but this might be something explicitly prohibited by record labels and would trigger their departure from the platform. In the long run, if Spotify can continue to grow and dominate the music / audio streaming space, they could start to negotiate more favourable terms with record labels but I don’t see this happening for at least the next five years.

Fortunately, Spotify is making significant inroads in its efforts to diversify audio streaming content. For one, the percentage of music streams not from a major record label is slowly trending up, from 15% in 2018 to just over 22% in 2021. In addition, Spotify’s podcast business is doing incredibly well.

Source: Seeking Alpha “Spotify Stock: Widening Gap Between Price And Fundamentals” by Logos Capital Management

Launched in 2015, the podcast business has experienced rapid growth and even overtook Apple Podcasts in listeners for the first time last year. Revenue from the podcast platform has grown just as rapidly as its users. In Q3 2021, podcasts brought in a record $375 million in ad revenue, which is a 75% year-over-year increase from Q3 2020.

According to the “Global Podcasting Market 2021-2028” report released by market research firm Research and Markets, the global podcasting market size is estimated to reach almost $95 billion by 2028, which amounts to a 31.1% annual growth rate from 2021 to 2028. Spotify appears to be well positioned to capitalise on this massive and fast growing market.

FAANG Competition

In a perfect world, Spotify rapidly grows music streaming market share, and becomes a major source of revenue for the record labels. With this dominant position, the company strong arms the record labels into more favorable deals. In addition, the company continuously increases its premium subscription price to expand margins on the consumer side.

Alas, the world is far from perfect for Spotify. With Apple, Amazon, and Alphabet nipping at its heels, they not only draw customers away but also reduce Spotify’s pricing power. To make matters worse, the competing services also severely curtail Spotify’s leverage on the record labels. The record labels have similar deals with competitors and if they’re unhappy with Spotify, they can easily pull out and still have their music streaming on another platform.

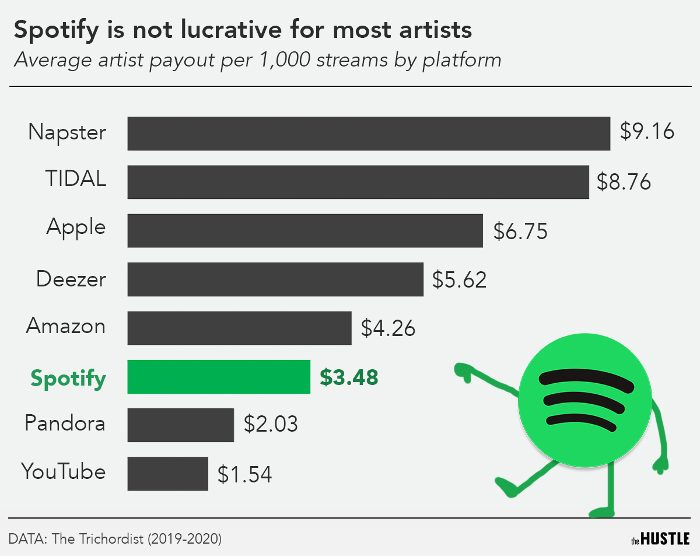

Spotify’s FAANG competitors are fantastically well funded and happy to run their music streaming service at breakeven or even as loss centers. As such, they can not only charge less for subscriptions but also pay more to artists in royalties. Spotify, on the other hand, is a public company scrutinised by public investors for its revenue, costs, and margins and has less capabilities to aggressively compete by taking hits to its bottomline.

In fact, even as other subscription services like Netflix or Amazon Prime has gradually increased subscription prices over the years, Spotify has not raised the $9.99/month price of its flagship premium plan since its launch in 2011.

In Spotify’s quest to break free from the vice grip of record labels and grow its margins, the strong competition from major tech giants significantly inconveniences the company’s efforts.

Moat?

Even though Spotify faces tough competition, it remains the top global music streaming service partly through its excellent product offerings that create a semblance of a moat. According to Comparably, Spotify ranks 10th in Global Best Brands, 13th in Top Brands for Millennials, and 9th in Top Brands for Gen Z.

Spotify has one of the best, if not the best, music recommendation engines out there. Its flagship recommendations product Discover Weekly is consistently lauded for its almost magical music recommendations. The Spotify Wrapped product, where, at the end of each year, the company compiles and shares a user’s listening trends throughout the past year, is also a massive hit and called the company’s “secret growth hack” by The Hustle. According to CEO Daniel Ek, 2020’s Spotify Wrapped roll out led to a 21% bump in app downloads in the first week of December of that year and “has helped establish Q4 as the company’s biggest quarter”. It’s evident that Spotify knows music and is exceptionally competent at productizing it.

In addition, in general, it’s harder to switch music streaming services given that one’s entire music collection, organised into familiar playlists, is already on one’s current in-use streaming service. Moving all these songs and playlists over to another service is tedious, time consuming and nigh impossible to do without using a third party music migration tool.

Fin

At the end of the day, Spotify is the largest music streaming service worldwide and continues to see rapid growth. Sure, it faces tough challenges with a less than symbiotic relationship with major record labels as well as intense competition from very well-funded competitors, but the market has also priced the stock accordingly. For a growth stock, its PS ratio is significantly lower than its peers which gives the stock lots of room to move up if Spotify manages to significantly alleviate even just one of its top challenges.

I expect Spotify to continue to maintain a comfortable lead in its core music streaming business, consistently releasing high quality and delightful products that change how users discover and listen to music. However, its core business will not, at any time soon, be able to convince the market to pay a significantly higher sales multiple for the stock. Record label demands and intense competition will hold this business down for the foreseeable future.

I see Spotify’s valuation story changing only from its non-music businesses, especially in podcasting. Metrics show that Spotify has executed well on its podcast business and is well positioned to capitalise on this fast growing and massive market. Keep an eye out on how Spotify continues to grow its podcast business.

Finally, at a low PS ratio of about 2.3, I think Spotify is a reasonable stock and it certainly deserves a SPOT in any growth oriented portfolio. The stock also provides pure play exposure to the music industry that is hard to find elsewhere in the market.