Research - Swimming With Rebalancing Whales!

Predict market correction reversals by understanding how this multi-trillion dollar asset class works.

Imagine this. You’re a scuba diver, surrounded by a pod of whales. The whales decide to change course and they shift their weights left. The entire pod starts to veer left. Microcurrents form in this new direction.

Do you fight against the whales’s new direction or do you swim with them?

What if you could predict their movements, change direction before they do, and avoid getting buffeted by shifting microcurrents?

At the end of 2020, a very interesting trend started forming. The past four market corrections leading up to this time all ended with V-shaped bottoms in the last week of the quarter (March 23rd, 2018, December 24th 2018, March 23rd, 2020, and September 23rd, 2020). Three of them ended on the same day of the month, the 23rd!

So what’s going on here, and how may it guide your future trading? Read on to find out.

The Whales in Question: Target Date Funds

Target date funds, typically mutual funds, are funds that have a lifelong investment strategy designed for retirement. They work in a simple fashion: the fund’s asset composition becomes more conservative as it nears its “target date”. In practice, this typically means starting out being overweight stocks and then gradually shifting to bonds as the fund matures.

Target date funds are incredibly popular and have trillions of dollars of assets in them.

When the typical American worker contributes to their 401k, they are likely investing in a target date fund by default. This is why, as Morningstar reports, target date funds consistently get tens of billions of net fund inflows each year, and the total assets in these funds topped $3.27 trillion at the end of 2021. Top target date fund providers include Vanguard and Fidelity.

Flows into target date funds are incredibly consistent. This is likely because they are automatically drawn from each and every pay check of most American workers.

As such, target date funds have become the perpetual buyer in the market. During the massive Q4 market correction in 2018, Vanguard’s top four target date funds (2030, 2040, 2050, and 2060) took in $23 billion. During the pandemic drawdown in February and March 2020, these four funds took in $43 billion!

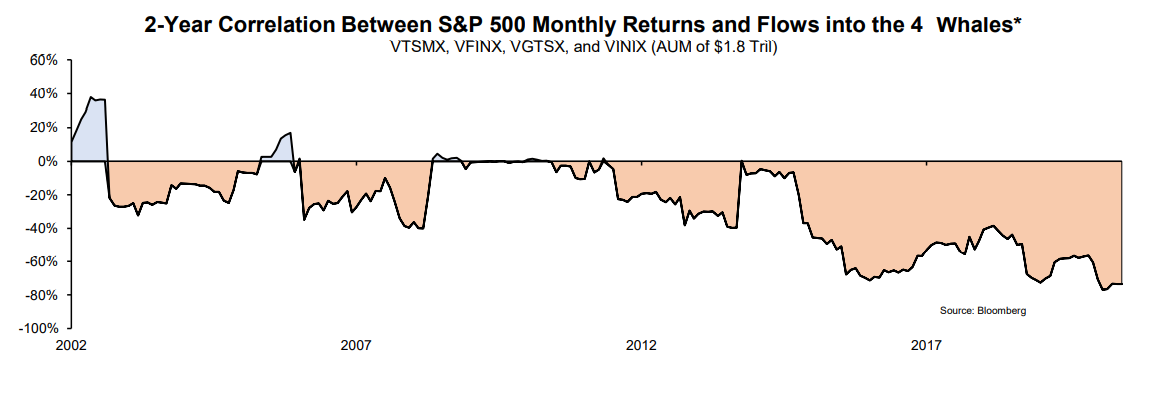

Flows into these funds are so consistent that they have become largely uncorrelated with stock market returns.

Rebalancing Whales

With so much assets under management, movements in these funds (such as from rebalancing) can really make waves in financial markets.

Funds rebalance when their actual asset composition diverges too far from the desired asset composition and new fund inflows are not able to shore up the difference. For example, Vanguard’s 2060 target date fund aims to be 90% invested in stocks, but if the stock market had a terrible quarter while bonds held steady and the fund drops to being 80% invested in stocks, this large drawdown will force fund managers to sell bonds and buy stocks such that the fund is back to being 90% invested in stocks. This rebalancing must happen or the fund fails its simple mandate of keeping to its advertised asset composition glide path.

Another factor that causes funds to rebalance is the time of the year. For example, the asset composition of a fund might deviate throughout a quarter but fund managers will ignore these deviations as long as they’re not egregious and only rebalance at the start or end of a quarter.

In practice, funds will primarily use a combination of these two factors, as well as other minor ones, to determine when to rebalance. The main impetus for rebalancing, of course, is a deviation of a fund's asset composition from its target. As an example, Vanguard's rebalancing policy states that:

"[M]ost of the time, the target retirement products are rebalanced within fairly tight guardrails by using the regular cash flows they receive, primarily from payroll deferrals. Occasionally, when payroll deferrals are not enough to accomplish this, the portfolio managers buy and sell two or more of the underlying funds to bring the target retirement products back into balance."

Each fund has its own rebalancing formula and they try to keep it under wraps as much as possible. This is because a rebalancing event involves the shifting of so much money that it can move markets, and adept market participants would definitely front-run this rebalancing if they had a good idea of when it'll happen.

Tying It All Together

Knowing this, we can posit that many aggressive stock market corrections are met at the end of the quarter with target date fund rebalancing, which is sufficient buying pressure to reverse the downtrend of the market. This is perhaps why, as I noted above, the past four market corrections since the end of 2020 all ended with V-shaped bottoms in the last week of the quarter.

Interestingly, the Fed might also be aware of this and used it to their benefit during the pandemic correction by timing the announcement of many of their dramatic monetary loosening policies in the last week of Q1 2020 to buoy the market. As most of us know, this triggered a massive market rebound through the rest of 2020 and into 2021. The market never looked back.

How Can This Help Your Trading?

Before I jump into how we can incorporate this information into our trading strategies, I have to note two things:

We never know exactly what's driving the market behind the scenes. Although it seems likely that target date fund rebalancing is the primary reason for why market corrections tended to reverse at the end of quarters, this still remains a conjecture without knowing exactly who is buying and selling around market reversals. As individual investors, we have the most opaque picture of this.

A single internal market mechanism doesn't define how the market will always behave. The market is swayed by so many other factors and there are certainly larger whales in the market whose behaviors can override target date funds. For example, BlackRock has almost $10 trillion of assets under management, three times as much as the $3.27 trillion under target date funds. In fact, we see that this end-of-quarter market reversal behavior didn't materialize in the current bear market.

With the cautionary notes out of the way, let's examine how you can use the knowledge of target date fund rebalancing to your advantage. I'll focus on the stock market, since that's where most individual investors are trading.

The best application of this idea is, you probably guessed it, being able to predict market correction reversals. If, in a quarter, stocks are down severely while bonds are holding up, target date funds will very likely rebalance from bonds to stocks at the end of the quarter. If both stocks and bonds are down, it's less likely that a rebalancing will occur.

This idea can also be used to predict the start of market corrections, but these scenarios are rarer, since the stock market tends to "take the stairs up and the elevator down", as they say. The market's general slow progression upwards usually gives inflows enough time to make up the difference in a fund's asset composition balance. Couple this with the general stability of the bond market and it's less likely for target date funds to rebalance the other way (from stocks into bonds).

Finally, an investor should always take the macroenvironment into account and the most important macro factor is the Federal Reserve. Trade ideas are most likely to play out when the Fed is on your side. For example, in this current bear market, it's harder for smaller market participants to reverse the market’s downward trend when the Fed wants it to go down.

This newsletter issue is inspired by this article from Evergreen Gavekal.