Market Pulse: 2024 According to 5 Major Financial Institutions

In 7 minutes, we summarize the 2024 market outlooks of 5 major financial institutions including JP Morgan and BlackRock.

In 7 minutes, we summarize the 2024 market outlooks of 5 major financial institutions including JP Morgan and BlackRock.

We reviewed the 2024 market outlooks of JP Morgan, BlackRock, Citi, Mastercard, and Charles Schwab. This is a summary of their overarching themes.

Themes

💡Inflation and interest rates will fall

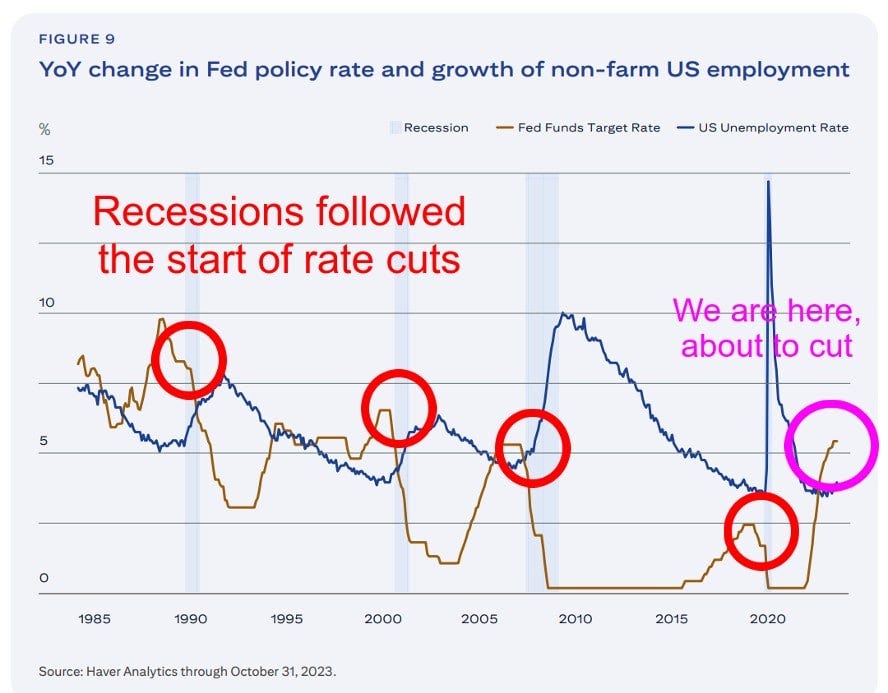

The five firms agree that inflation will continue to fall throughout 2024, giving central banks room to cut interest rates. Even JP Morgan, the only firm that published a bearish outlook, predicts US inflation will drop to 2.1% with the Fed starting to cut interest rates in the third quarter.

Falling interest rates is generally good for stocks but it’s important to keep in mind that the past three recessions started right after the Fed started cutting interest rates. As such, expect the market to be more antsy as we near the first rate cut later this year.

Consensus: ⚠️ caution

💡CapEx returns

CapEx, short for capital expenses, are the costs companies incur when they invest for the future. An example of CapEx would be the money Microsoft spends to bring up a new AI data center.

Last year, companies (and pretty much everyone else in the economy) were nervous about an impending economic slowdown and companies cut back on spending. Much of these fears were assuaged as economy remained strong throughout the latter half of the year. With economic angst subsiding this year, CapEx is expected to bounce back.

More CapEx means higher revenues and faster growth. This is ultimately good for stock prices.

Consensus: 📈 bullish

💡US election year

2024 is a US election year. As much as the Fed would deny it, we believe that politics has a meaningful sway on the Fed’s actions and they will try their best to avoid drastic changes to monetary policy this year to keep the waters calm for the election.

Less policy volatility is good for markets.

In terms of election outcomes, all five firms don’t expect large changes to the current market regime no matter which party wins. If the Democrats win, it’s business-as-usual with little to no changes to the overall policy direction of the last four years. If the Republicans win, the markets will probably react favorably given the party’s generally market-friendly stance (less regulations, more open to mergers and acquisitions). However, a Republican victory is bad news for war stocks since Republicans are more skeptical of the Ukraine war than Democrats and are less likely to fund it.

As a side note, in 2016, many were expecting a large market sell-off following a Trump election but the market roared upwards instead.

Consensus: 🤷 no big deal

💡First half angst, second half gains

Citi predicts that economic growth will be slow in the first half of 2024 before accelerating in the second half. They don’t see a recession happening. BlackRock also sees the economy slowly recovering this year in a “U-shaped” fashion. JP Morgan is the only firm of the five that forecasts an economic slowdown.

Citi’s outlook aligns with Fundstrat Managing Partner and frequent CNBC contributor Tom Lee’s outlook. He predicts that the S&P 500 will be flat or down 5% in the first half of the year before rallying to 5,200 by year-end.

Consensus: 📈 bullish

☕ If you’ve found our work helpful or informative, buy us a coffee by upgrading to a paid subscription. Also get access to the FinanceTLDR portfolio and our trade ideas. Thank you!

💡Everyone is bullish on AI

Everyone is unsurprisingly bullish on AI.

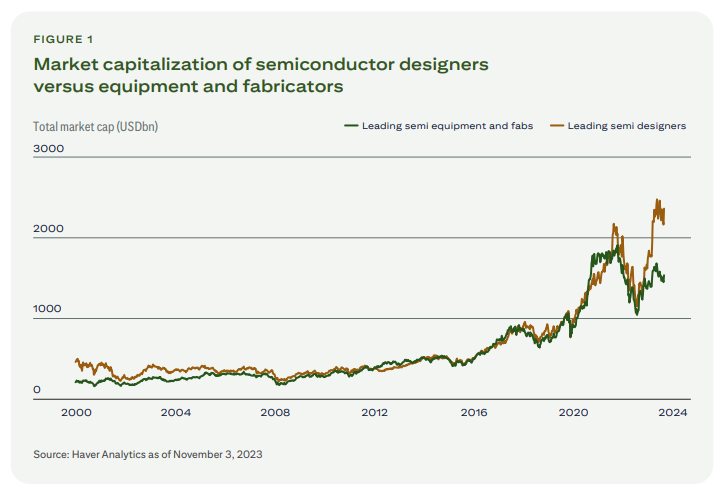

The Mag 7 is a good way to get AI exposure, as are chip designers like Nvidia and AMD. Citi is particularly bullish on chip manufacturers given their relative under-performance last year (e.g. TSMC).

In addition, Citi believes that AI has the most potential to uplift these industry segments:

Mag 7 (mega cap tech)

Infrastructure (chipmakers, semiconductor equipment, data centers)

Robotics

Drug discovery

Cybersecurity

Consensus: 📈 bullish

💡International: Japan, China, and India

For international markets, the five firms are generally bullish on Japan, China, and India while being lukewarm on Europe.

Charles Schwab made a particularly astute point on the under-discussed disproportionate power Japan has over the global financial system:

Moves by the Bank Of Japan (BOJ) could overshadow those by the Federal Reserve and other central banks if Japanese investors begin to sell foreign bonds, stocks, and currencies. Decades of current account surpluses have accumulated, giving Japan the world's largest net international investment position (even more than China) with $3.3 trillion of investments held abroad according to the International Monetary Fund (IMF). Although the U.S. has the largest economic influence in the world, Japan may have the largest influence in the asset markets due to these account surpluses. Should the BOJ begin to substantially tighten monetary policy next year, as signaled by the end of yield curve control at the BOJ's meeting in October, the potential for a reversal of decades of outward flow of capital may be felt by investors worldwide. With rates rising in Japan contrasting with rate cuts elsewhere, the yen could surge along with Japanese bond yields, prompting Japanese investors to bring their money home and invest in Japanese assets.

The high level bull case for Japan is that the BOJ will finally have to seriously raise interest rates this year. This will lead to a stronger yen, attract more foreign investment into the Japanese economy, and ultimately drive up the dollar value of Japanese tech and finance stocks.

Consensus: 📈 bullish

Risks

💡Economic risks

Interest rates and inflation are top of mind.

The general worry is that we haven’t felt the full negative effects of 2021-2022’s large interest rate hikes (perhaps they surface this year?) AND there’s a high chance we’re entering into a high interest rate and high inflation economic environment.

This is largely why JP Morgan is so bearish, predicting that the S&P 500 will fall almost 11% from current levels to 4,200 by year-end. The other firms acknowledge the economic risks but are cautiously bullish.

💡Geopolitical Risks

Every firm warned about geopolitical risks in 2024, from the ongoing wars in Eastern Europe and the Middle East to tensions in the South China Sea. A couple firms recommended defense and energy stocks as a hedge against these risks.

We have a slightly contrarian opinion. We think that 2024 is a year of geopolitical normalization with the major geopolitical hot spots of yesteryear cooling down. The Eastern European conflict will likely wind down as Western support for the war wanes and the Middle East conflict should also subside given the significant power imbalance between the two sides. The Taiwan conflict will continue to ineffectually simmer, creating catchy headlines that continue to end up as nothing burgers.

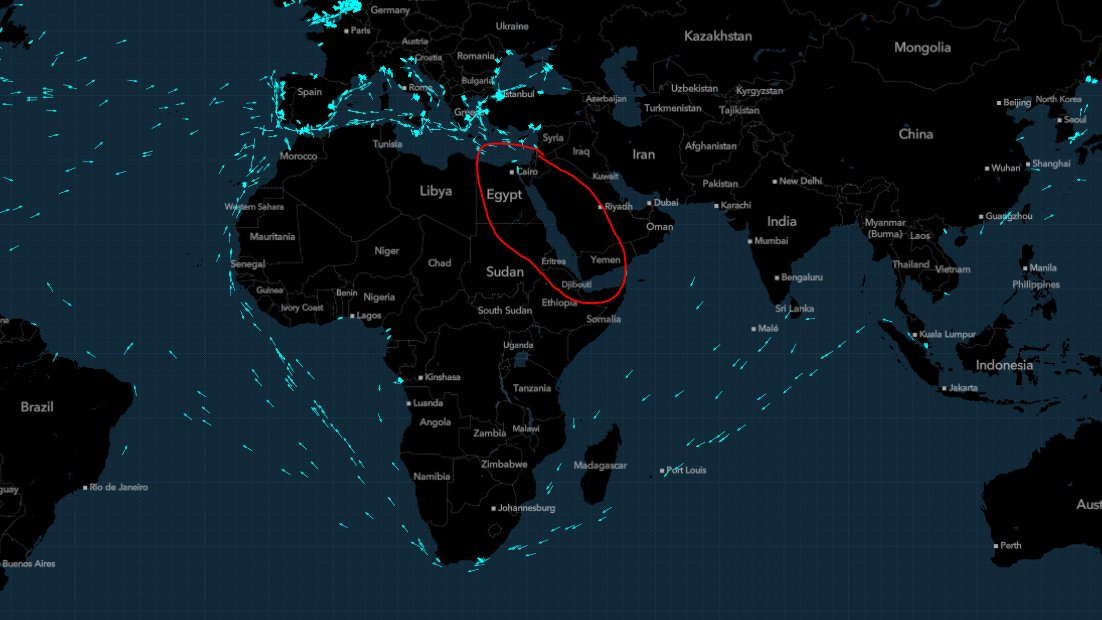

The Red Sea shipping crisis is an annoying thorn on the side of the global supply chain. Maersk, the world’s largest shipping company, recently had to walk back its decision to resume sending ships through the Red Sea when another one of its ships was hit by a missile on December 30th.

The extent of the damage to global trade and inflation due the crisis remains unclear but we know that it’s non-trivial. The Red Sea trade route is incredibly important to the global economy. Here are some stats:

12% of global trade

30% of global container shipments

$1 trillion worth of goods every single year

10% of global oil shipments

For ships traveling between Europe and Asia, this route is 25% faster than the alternate route around Africa

For ships traveling between North America and Asia, this route is 8% faster

Summary

With the exception of JP Morgan, everyone else seems to align on a general theme of “economic normalization to growth” for 2024. Citi sees the US economy going through three major phases from the start of the pandemic:

2020-2021: emergency low rates and quantitative easing to stimulate the economy

2022-2023: bear market caution as a result of rapid interest rate hikes and quantitative tightening

2024-2025: normalization to growth

We agree with this prediction and see more upside for US stocks in 2024. Last year, the S&P 500 almost returned to all-time-highs despite having to climb a wall of worry from a myriad of economic and geopolitical risks. This year, many of those risks are subsiding, opening the way for stocks to go higher.

Barring black swan events, this stock market has time and time again demonstrated that it pays to be default bullish and tactically bearish. Currently, we don’t see a reason to be tactically bearish in the near future.

To read our full summaries of each firm’s market outlook, including links to the full outlooks, click here.

Portfolio Update and New Trade Ideas

An update on the FinanceTLDR portfolio and our thoughts on the market’s movements in the first two trading days of the year.