Market Pulse: Apple Earnings, What You Must Know

In 4 minutes, understand exactly why Apple’s stock fell after its earnings call today.

In 4 minutes, understand exactly why Apple’s stock fell after its earnings call today.

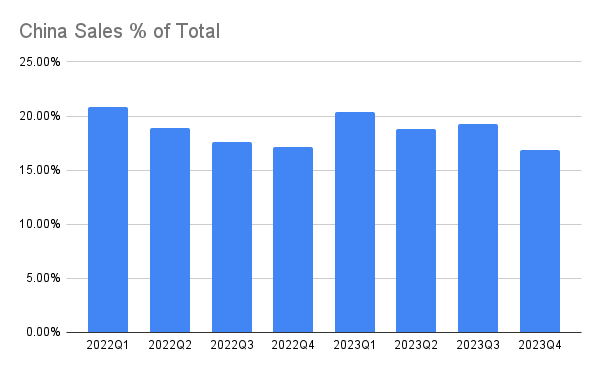

Apple reported earnings today. It was a mixed bag of lukewarm results, except for China, which is showing serious signs of weakness. Apple’s China market represents a significant chunk of its business (~17%) but rising geopolitical tensions and competition from Chinese firms (e.g. Huawei) are putting pressure on a key regional market for the company. A rapidly softening China market is the market’s biggest concern for Apple. This, in tandem with economic headwinds in Western markets, are the major contributors to disappointing guidance for the upcoming holiday quarter (“similar to last year” but Wall Street expects +5% growth).

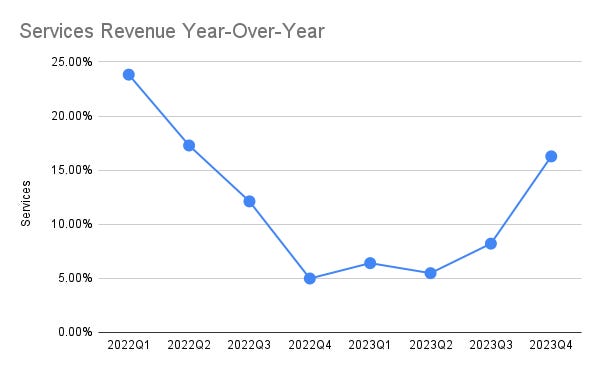

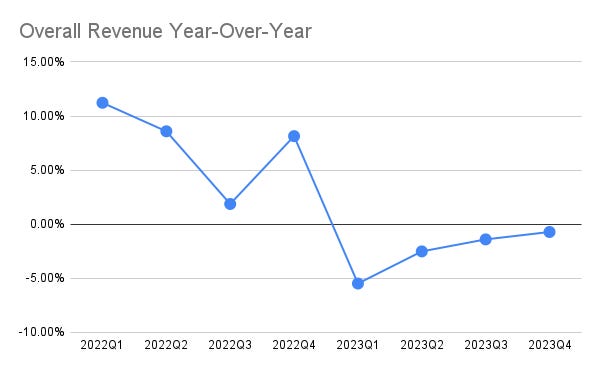

Elsewhere in the business, the results are lukewarm. iPhone sales are slightly up year-over-year and the market is excited about the massive progress Apple has made in chip development with the recently announced M3 chips. The company’s second largest business segment, Services, saw revenue increase year-over-year by an impressive 16%, greatly surpassing Wall Street expectations. However, while Services revenue soars, overall revenue isn’t faring well as device sales falter. This is the fourth consecutive quarter of negative year-over-year overall revenue growth.

The Bad:

Holiday quarter guidance is bad. Wall Street expects +5% growth but Cook says “similar to last year”. Weak guidance is likely the result of a weak China market and economic headwinds in Western markets.

Overall revenue is down again year-over-year (-0.72%). This is the fourth consecutive quarter of negative year-over-year overall revenue growth.

China revenue is down year-over-year as well (-2.52%) and greatly missed expectations ($15B vs $17B expected). Investors are increasingly worried about Apple’s China market given geopolitical tensions and increased competition from Chinese companies like Huawei. China represents a massive chunk of Apple’s revenue (~17%).

All other device segments besides the iPhone saw year-over-year revenue declines.

While existing products are under-pressure, the market is disappointed with weak news on AI and new product lines. There’s little news of an AI integration for Siri, the Vision Pro isn’t expected to go mass market until 2027, and there has been little news on the much anticipated Apple Car.

The Good:

Apple’s second largest revenue contributor, Services, saw revenue increase by 16.27% year-over-year. This is a significant uptick from +8.21% and +5.48% year-over-year in the prior two quarters and beat Wall Street expectations by 4.5%. Services is an important revenue stream for Apple given its stability relative to device sales.

Apple’s largest revenue contributor, iPhones, saw revenue increase by 2.78% year-over-year. iPhone revenue growth has been tepid over the past year given a tumultuous economic and geopolitical environment so a small year-over-year revenue increase is welcome but the market is still nervous.

There’s tentative excitement for the new M3 chips. Although they come at a hefty price (the fully decked out Macbook Pro costs $7k!), they are the most advanced personal computer chips ever released. The M3 is 11 times more powerful than the highest end Intel Macbook chip and no one expected Apple to make such incredible progress in chip development since the launch of the M1 in 2020.

The Details

Apple’s large China market is in decline

Apple’s China market represents a large chunk of its business (~17%) but it’s coming under increasing pressure with rising geopolitical tensions and domestic competition.

In early September, the Chinese government banned the use of iPhones for all central government agencies. The government would later dispute this news but the uncertainty suggests rising tensions between the Chinese government and the US firm.

A few days later, Huawei announced a new phone equipped with a powerful new domestically-manufactured chip. This chip was originally deemed impossible for China to manufacture given the US’s aggressive export sanctions on semiconductor technology.

All this news suggests that pressure is ramping up on Apple’s China market and the results are starting to show in this earnings call. Apple’s China revenue is down 2.52% year-over-year and missed Wall Street expectations by over 11%!

Services is an important revenue segment and it’s looking good

Services revenue is significantly less volatile than device sales and is thus a critical revenue segment for Apple. It’s also the second-largest contributor to Apple's overall revenue. The best news from this earnings call is the significant uptick in Services revenue (+16% year-over-year) that greatly surpassed expectations (+4.5%).

Here’s a chart of Services revenue growth for the past 2 years.

Supplemental charts (Overall Revenue and iPhone Revenue)

Overall revenue fell year-over-year for the 4th quarter in a row.

iPhone revenue grew slightly year-over-year. This is the company’s largest business segment and tepid growth is concerning.