Market Pulse: Shipping Woes, But Still Bullish

In 5 minutes, understand the shipping turmoil going on in the Red Sea and Fedex’s warning for the economy.

In 5 minutes, understand the ongoing Red Sea shipping turmoil and Fedex’s warning for the economy.

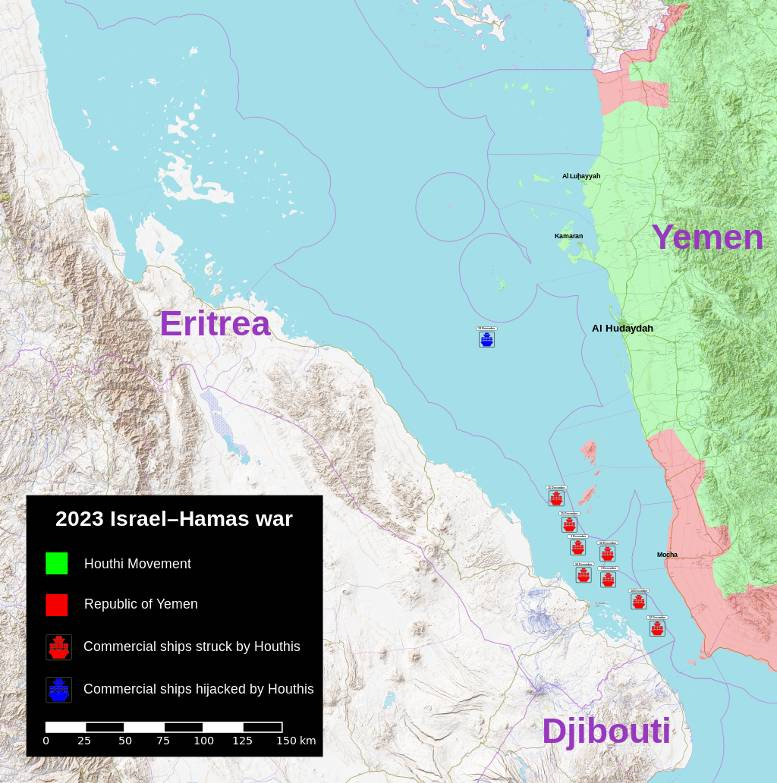

For the past two months, Yemen’s Houthi rebels have been escalating aggression on cargo ships passing through the Red Sea. One ship has been hijacked while several others have been hit by drones and missiles. The Red Sea is a large sea to the south of the Suez Canal that ships traversing the canal must go through.

These attacks are increasing worries of a new supply chain crisis that could give rise to higher inflation. More inflation means higher interest rates which means a weaker economy and falling stock prices.

Falling inflation has been the linchpin for the Fed’s plan to cut interest rates next year so a reversal in this trend may prevent the Fed from cutting. That’s not good for stocks. However, it’s important to note that this is not a major issue right now (the stock market doesn’t seem to care) but it’s certainly worth keeping close tabs on this highly dynamic situation.

Already, oil prices have gone up 8.5% since mid-December. Ikea and Abercrombie & Fitch are the first two major global companies that have warned about supply chain problems because of this crisis.

Why is shipping through the Suez Canal / Red Sea so important to global trade? Here are some quick numbers for this critical shipping route:

12% of global trade

30% of global container shipments

$1 trillion worth of goods every single year

10% of global oil shipments

For ships traveling between Europe and Asia, this route is 25% faster than the alternate route around Africa

For ships traveling between North America and Asia, this route is 8% faster

Already, 7 of the 10 biggest commercial shipping companies have routed their ships away from the Suez Canal, opting for the 25% longer (+5,000 km) but much safer route around the southern tip of Africa.

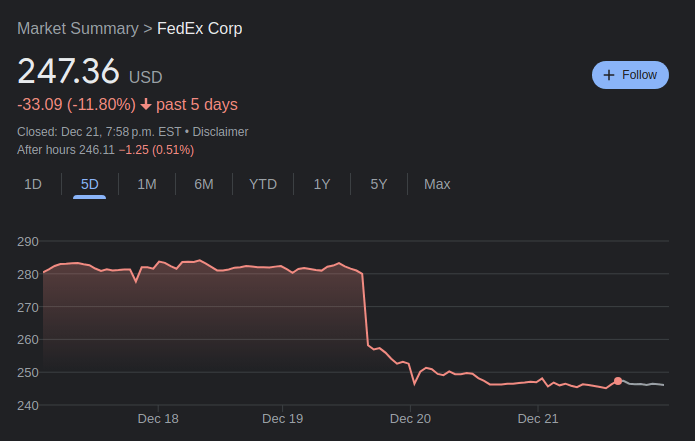

Meanwhile, on another shipping-related topic, Fedex reported earnings on Tuesday and the results weren’t received well by the market, causing the stock to crash over 10% post-earnings. One could say that Fedex failed to deliver. Okay, I apologize for that.

Carrying on. Everyone should know what Fedex does and how important it is to the economy, so it shouldn’t be controversial to say that the company is a great bellwether for the overall economy.

Fedex’s earnings report failed to meet expectations for both revenue and earnings and the company also cut guidance for next year. They blamed a weak global demand for the under-performance. Executives mentioned weak demand 8 times (if I can count) during the earnings call!

So, if Fedex is experiencing demand woes, does this mean the economy is finally starting to weaken after being steeped in high interest rates for over a year now? Murmurs of this are growing in Wall Street. More on this in the The Details section below.

The stock market has so far brushed off these geopolitical and economic worries and marched on higher. We think that markets will continue to shake off these risks and climb upwards into the New Year. We’ll continue to monitor these highly dynamic global challenges and update readers if anything changes.

📣 Shout out to my friend Antonio’s newsletter where he does excellent deep dives into stocks like Robinhood, Duolingo, Palantir, Amazon, and Meta. You can find it here:

The Details

What’s the US government’s response in the Red Sea? Will the situation be resolved soon?

The US, leading a group of nations, have sent a task force to the Red Sea to protect global shipping. They’re aptly calling the initiative “Operation Prosperity Guardian”. The task force comprises of around 20 naval ships from various nations. In addition, there are five US destroyers, a US carrier strike group, and two US landing ships (1,600 Marines each) in the area.

That’s a lot of fire power.

However, the Red Sea is also very large, about the size of California, and former Supreme Allied Commander of NATO James Stavridis has described the job of the task force as “trying to patrol California with 20 police cars”. In addition, this is a thorny issue for nations in the region given the Houthis’s purported goal of fighting for the Palestinians. Curiously, Saudi Arabia has not joined the task force despite being adjacent to Houthi-controlled territory and owning the vast majority of the eastern Red Sea coast.

All this is to say that there isn’t going to be quick and easy solution for the time being. The final arbiter of success will be the willingness of the major shipping companies to resume sending ships through the Suez Canal.

US global shipping volumes have been unperturbed, a good sign

One good news is that US shipping has been largely unaffected by the Red Sea turmoil. That’s probably because most US shipping doesn’t go through the Suez Canal: US <-> Asia shipping goes through the Pacific and US <-> Europe goes through the Atlantic.

Murmurs of a weak first half of 2024, even from the staunchest Wall Street bulls

Evercore ISI, a major global investment research firm, recently published research predicting that the oft-mentioned recession will finally materialize in the first half of 2024, resulting in a stock market pullback.

Staunch market bull and frequent CNBC contributor, Tom Lee, also thinks that the first half of 2024 will be “flat or down 5%” without going so far as to calling for an impending recession (“we’re more likely going to have a growth scare in the first half”). Tom Lee was one of the rare market bulls earlier in the year who made a very prescient prediction of SPY hitting 475 by year-end (we hit this prediction on Wednesday before selling off). Tom thinks the second half of the year will be much better.

Major global banks also see weaker growth next year. Reuters recently reported: “Consensus forecasts from major banks, including Goldman Sachs, Morgan Stanley, UBS and Barclays, are for global growth to be constrained in 2024 by elevated interest rates, pricier oil and a weakened China, but with low odds for a recession.”

Fedex’s rough earnings report as a result of weaker than expected demand aligns with these outlooks.

Portfolio Update and New Trade Ideas

We published a new trade mid-week to paid subscribers and it’s going well. The stock has gone up 2.2% since the call despite the market turmoil on Wednesday afternoon. We’ll share updated thoughts on this trade below.

We’ll also go over what we think happened with Wednesday’s sudden market sell-off. It was a very unique market event that was triggered by very interesting market dynamics.

Finally, we’ll share a new trade idea.