Market Pulse: The Profound Impact of 0DTE Options

In 7 minutes, understand how 0DTE options work and how they have profoundly impacted the stock market.

In 7 minutes, understand how 0DTE options work and how they have profoundly impacted the stock market.

Over the past year, there has been a spectacular rise in the trading of 0DTE (zero-day-to-expiry) options.

The majority of the 0DTE options that are issued and traded have been for the US stock market’s quintessential index, the S&P 500.

Because these options are tied to the S&P 500, their tremendous trading volume has had a profound impact on the entire stock market.

This is why it’s important we talk about them.

Before we discuss this impact, let’s start with a brief primer on options in general and 0DTE options in particular.

💡 How do options work? (in 2 minutes)

An options contract has three fundamental properties: the Underlying Stock, the Strike Price, and the Expiration Date.

When you purchase an options contract, you are purchasing the option to buy (or sell) the Underlying Stock at the option’s Strike Price. As long as you own this contract, you can execute the trade at any time until its Expiration Date.

Here’s an example. Say you own a $160 call option for AMD that expires on June 21st, 2024. Between now and June 21st, 2024, if you don’t see the contract, you have the option to execute it and buy 100 shares of AMD at $160 (each options contract represents 100 shares).

This could be a very profitable deal if AMD goes above $160 during this time.

A CALL option let’s you buy shares at its strike price and a PUT option let’s you sell shares at its strike price.

📈 📉 Options are volatile

Option prices are volatile and can swing both ways much more violently than just holding the stock. Here’s why.

At the time of writing, AMD is at $146. If I own a $160 June 21st call option, there’s no point in executing the contract since I can just buy AMD at $146 on the market, rather than $160.

However, because there’s a chance AMD can go above $160 by June 21st, the call option still has value.

Let’s say the price of the contract is $2 per share right now with AMD at $146. If AMD went up to $170 in the next week, then the contract will have to be worth at least $10 per share.

Why at least $10?

Because I can execute the contract and buy AMD at $160, then immediately sell the shares at $170 for a guaranteed $10 profit.

As such, while the contract's price surged by 400% from $2 to $10, AMD’s price went up by only 16.5% from $146 to $160. That’s a lot of upside volatility!

On the flip side, if AMD’s price is still at $146 after June 21st, the $160 call option would be worthless since there’s no point in a paying a higher price than what the market is offering. However, if you’ve just held the stock, you wouldn’t have lost any money holding it past June 21st.

With significant upside volatility comes significant downside volatility.

💡 What are 0DTE options?

0DTE options, or zero-day-to-expiry options, are options contracts that expire on the same day they are traded.

This makes them exceptionally volatile, being sensitive to any slight price changes in the underlying stock.

In addition, the majority of 0DTE contracts will decay to $0 given their short lifespan (e.g. a $470 call quickly becomes worthless at the end of the day if SPY never gets to $470 or above).

While most stocks have options that expire at the end of each trading week or month, the SPX and SPY have options that expire every single day of the week.

💡 How do 0DTE options impact the stock market?

The recent prevalence of 0DTE options trading has resulted in a corresponding surge in attention and research interest.

Here’re our favorite high level insights from several major financial institutions (big credits to market data firm SpotGamma for their 0DTE impact video).

Who trades 0DTE options?

JP Morgan found that retail investors accounted for a small fraction of 0DTE options trading, making up just 5% of SPX 0DTE volume and 20% of SPY 0DTE volume.

Institutional traders are responsible for the majority of 0DTE options trading.

From Ambrus Capital: “However, when we surveyed ten different market makers that handle electronic and voice orders in the SPX complex, we found a much more diverse set of market participants including wealth managers/RIAs, market makers, speculators, event hedgers, volatility hedge funds, as well as retail. Our survey indicated that institutional flow was actually a much larger proportion of 0DTE volume than retail.”

How are 0DTE options traded?

Traders predominantly buy puts and calls in the AM and close out the positions in the PM.

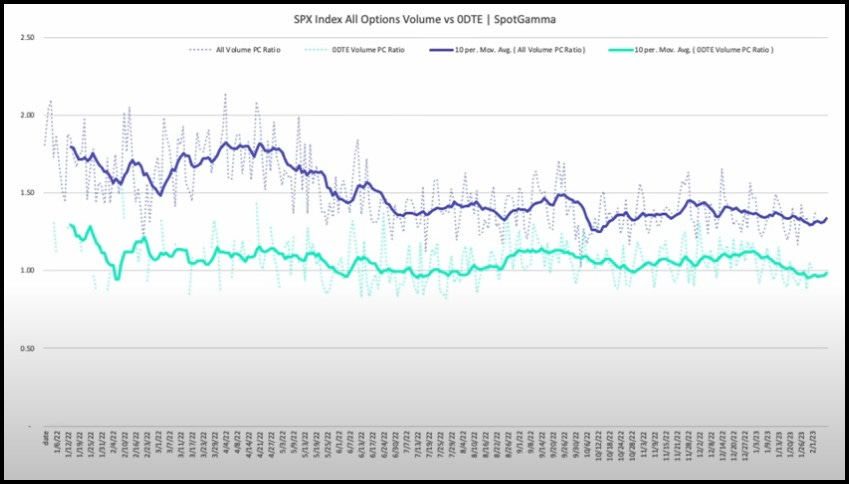

This is in contrast to long-dated index options where investors largely use them for portfolio protection (i.e. sell calls and buy puts). As such, there is a large skew towards put contracts for long-dated index options.

The ratio of puts and calls is more balanced for 0DTE options, suggesting that they’re more often used for speculation rather than portfolio protection.

This makes sense given their significant volatility.

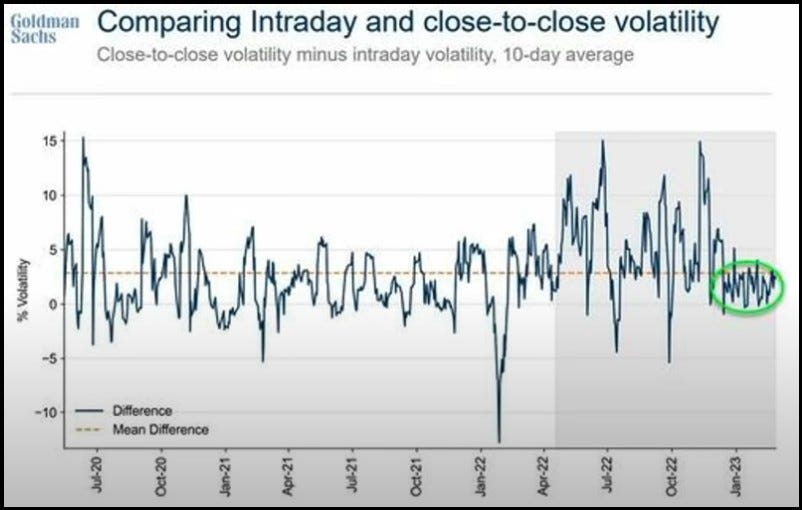

Most importantly, the prevalence of 0DTE options trading reduces volatility BUT increases the likelihood of flash crashes

0DTE options trading exhibits a curious mean reversion behavior. In other words, 0DTE traders like to bet on market reversals after large intra-day market moves.

We don’t see the same “dip-buying” phenomenon for long-dated options.

0DTE’s mean reversion flows dampen market volatility but many suspect the market is also more vulnerable to flash crashes.

For example, if an unexpected event causes a surge in selling that overwhelms mean reverting 0DTE trades, these trades will shift from a stabilizing force to one that increases volatility as a large number of 0DTE positions go in the red and have to be aggressively hedged against or closed out.

This cascade will push the market much farther in one direction than if the 0DTE positions didn’t exist.

In a February 2023 research note, a J.P. Morgan analyst stated that they believe 0DTE options could drop the market more than 20% in one day, citing it as “Volmageddon 2.0”.

From Ambrus Capital: “0DTE options create a new form of risk because of their ability to accelerate negative situations. This is not different from other better known reflexive effects in markets. However, it’s notable that in an already highly reflexive market, we’re taking the heat on the pressure cooker and turning it up to HIGH.”

📣 Shout out to my friend Antonio’s newsletter where he does excellent deep dives into stocks like Robinhood, Duolingo, Palantir, Amazon, and Meta. You can find it here:

💡 In Conclusion

The rapid rise of 0DTE options trading is a fascinating phenomenon that underscores a greater-than-expected appetite for high-risk-high-reward trading in the market.

It’s surprising that the vast majority of 0DTE volume comes from institutions given the contracts’s highly speculative return profile. In addition, the overall trading behavior around 0DTEs seems to encourage mean reversion in the underlying asset which reduces volatility.

Put together, 0DTE options appear to be a valuable asset class for financial markets.

However, the risks of prevalent 0DTE options trading are not fully explored. Many suspect that their volatility-suppressing effects during “normal” times could aggravate volatility during times of market stress, causing sudden and deep flash crashes.

Until something really breaks, expect regulation to be light and slow.

💎 Portfolio Update (paid subscribers section)

We’ll share updates on our Macro Market Insights and Active Trade Ideas below.

These next two weeks will be very interesting for markets.