Market Pulse: Unpacking Amazon's Earnings

In 4 minutes, understand exactly why the market liked Amazon’s Q3 earnings report.

In 4 minutes, understand exactly why the market liked Amazon’s Q3 earnings report.

Amazon reported Q3 earnings last Thursday.

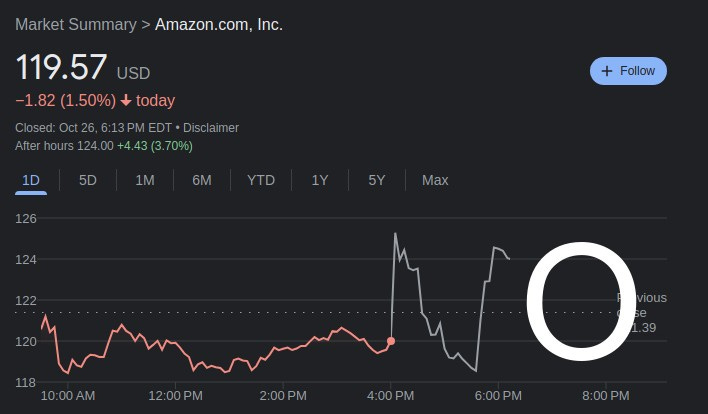

Did the market hate it? AMZN’s chart painted a big “N” for “No” during the earnings call. The report was well-received, but the market’s reaction was certainly volatile.

At a high level, this was a phenomenal Q3 earnings report. The company beat analyst expectations for both revenue (+0.89%) and earnings (+60%). However, both Alphabet and Meta also double-beat analyst expectations but the market reacted negatively to their earnings reports.

What set Amazon apart from its Big Tech peers in this earnings cycle? What did the market like about its report?

The two top reasons for the market’s positive reaction to Amazon’s Q3 earnings report are (1) their rapidly growing ads business and (2) their deep investments in AI for both AWS and Alexa.

Amazon Ads has been consistently growing at a breakneck pace despite a volatile economic environment and this quarter is no different. Ads revenue grew 26% year-over-year and beat analyst expectations by $0.5 billion. Enterprise demand for AWS’s burgeoning AI segment is high and growing fast while steady progress is being made to enhance Alexa with ChatGPT-like capabilities.

Amazon’s other businesses like e-commerce and Prime also posted positive quarterly results but we believe the market primarily cares about advertising and AI.

The Details

Amazon Advertising is an emerging industry juggernaut that’s threatening to take market share from Alphabet and Meta

Amazon’s advertising business has been growing at breakneck pace for the past few years. The business’s finances were originally lumped into the “Other” segment in Amazon’s earnings reports but it had grown big enough by 2021 ($31 billion in revenue!) that the company decided to break it out into its own segment.

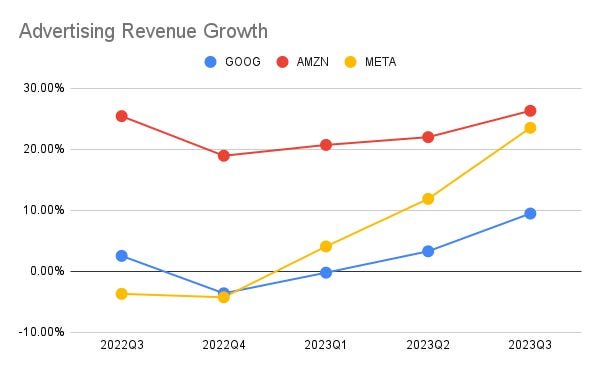

What’s particularly impressive about the advertising business’s pace of growth is its anti-fragility. Revenue continued to grow at +20% year-over-year in the past two years during a period of rapidly rising interest rates when both Alphabet and Meta saw significant slowdowns in their own advertising businesses.

Although Amazon’s advertising revenue is still a small fraction of Alphabet’s and Meta’s, the market is excited at the possibility of Amazon capturing more market share from Alphabet and Meta and this quarter’s positive results adds fuel to the fire (+26% year-over-year revenue growth, beating expectations by $0.5 billion).

In the recent Q3 earnings call, Andy Jassy referred to Amazon’s advertising business as having “barely scraped the surface” of its potential.

Wall Street loves AI, and Amazon is exceeding expectations

Amazon uses a three-layered framework to guide its AI initiatives:

Compute for LLMs (Large Language Models): this is the base layer consisting of the hardware required to power AI models. For this layer, Amazon is developing its own AI chips called Trainium and Inferentia. Amazon’s chips are a few steps below Nvidia’s but the foundations are there to keep pace and potentially bridge the gap.

LLMs as a Service: companies want access to powerful and secure LLMs without having to develop the models themselves. This is currently the biggest enterprise use case for AI and AWS Bedrock is designed to meet this need. Bedrock gives companies access to a wide variety of different LLMs and many large companies like Adidas, United Airlines, and even Ray Dalio’s Bridgewater hedge fund are already using it with more deals coming down the pipeline.

Applications of LLMs: this layer consists of applications that are built on top of LLMs such as ChatGPT. For this layer, Amazon is working on integrating ChatGPT-like conversational skills into Alexa and a new AWS service called CodeWhisperer that allows companies to customize an AI-powered coding companion for their own proprietary codebases. Given Alexa’s widespread household adoption, the market is particularly excited about Alexa’s potential as an everyday AI interface.

The market is excited about Amazon’s AI initiatives, with AWS Bedrock and Alexa standing out as key highlights.

AWS Bedrock is the best “LLMs as a Service” available to corporations right now, coupling high flexibility with enterprise-grade data security. Microsoft Azure’s OpenAI integration comes in at a close second but AWS’s offering appears to be the most mature. Alexa’s widespread household adoption and existing conversational interface makes it a leading candidate for the first successful consumer-facing AI application.

The rest of the business is doing well

The market’s positive reaction to this recent earnings report was primarily driven by excitement for Amazon Advertising and AI. However, I’d be remiss if I didn’t mention how the rest of the business is doing.

In short, the rest of the business is doing well 😅, which adds to the overall positive sentiment.

Amazon’s core e-commerce business grew 7% year-over-year, up from 4% year-over-year growth in Q2, and is showing signs of recovery after a tepid 2022. The cost-cutting efforts over the past year are also bearing fruit, as evidenced by an earnings per share (EPS) print that significantly beat analyst expectations ($0.94 vs $0.58 expected).