Research - The Evergrande Case Study

Discussing the dire financial woes of Evergrande, China's second largest real estate developer. Is China's economy actually in serious trouble?

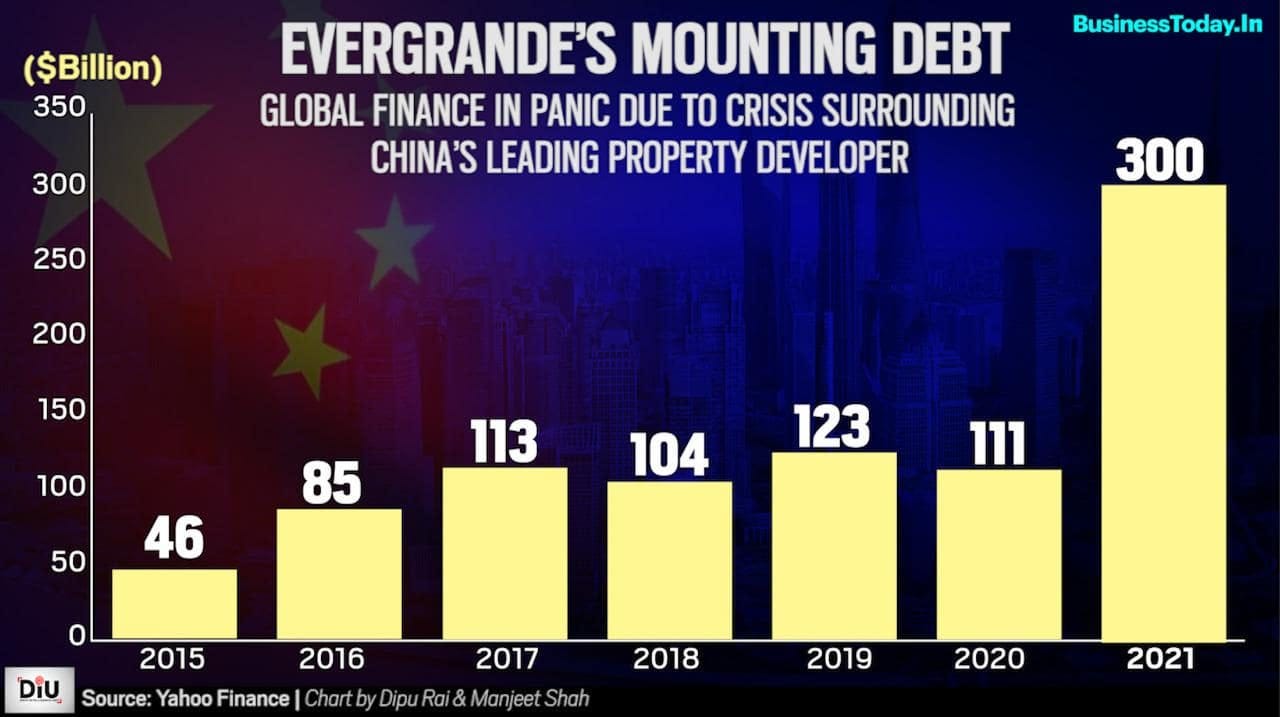

In September of last year, news broke that China’s second largest real estate developer by revenue, Evergrande, was facing serious default risk. This was incredibly alarming given the size of the company. Evergrande’s land bank had 214 million square meters of gross floor area (almost 4x Manhattan’s land area) and it managed an additional 400 million square meters of real estate.

How did this happen, and could Evergrande’s financial woes spell doom for not just China’s real estate sector, but China’s economy at large?

We think that this is not as scary as the media makes it out to be. It’s simply another case of the Chinese government exerting power over the private sector via a controlled demolition, similar to what they did with tech.

Here’s why.

Background: Chinese Real Estate

As China’s economy rapidly grew over the last few decades, so has the wealth of its population. The country’s middle and upper classes are filled with families that were, less than a generation ago, subject to extreme poverty.

The angst of poverty has resulted in a population with a strong bias for investing in hard assets. This is especially true for real estate, arguably the best hard asset to own if one were scared of poverty; you could lose everything but at least you have a house to sleep in!

Rapid Growth

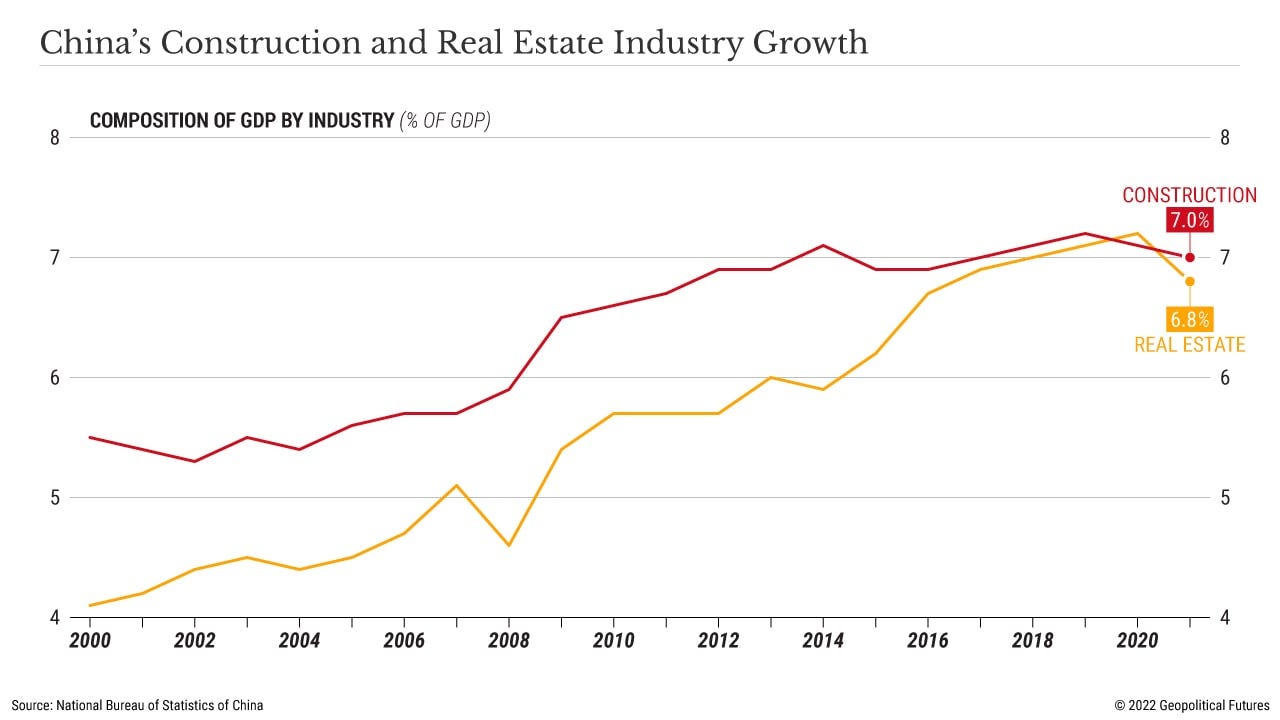

As such, it’s no wonder that China’s real estate sector grew at a breakneck pace over the last two decades. It was an exceptionally fast growing economic sector in an exceptionally fast growing national economy.

One of the biggest beneficiaries of this rapid growth is a slew of real estate development companies that were able to accrue significant wealth and power in Chinese society.

As these companies grew, they increasingly sought ways to outcompete their peers. The easiest way to do so was through leverage. After all, houses are slow to build but loans are fast to issue and houses (even if incomplete) are fast to sell.

Developer-Led Mortgages

As such, developers started pre-selling units of incomplete buildings to quickly raise cash. Many hopeful homeowners would take on mortgages guaranteed by developers to pay for and reserve incomplete units. In other words, if a homeowner defaults on their mortgage, the developer must cover the full cost of the remaining loan.

This is known as a developer-led mortgage.

The money received for these incomplete houses was then used to start more housing development projects, enabling developers to pre-sell even more houses.

Real estate developers grew rapidly through pre-selling since they didn’t need to wait for construction to complete to cash-in on developments. This is such an effective growth engine that pre-selling houses and developer-led mortgages now dominate Chinese real estate. In 2005, only 50% of new Chinese houses were pre-sold. Today, 85% of new houses are pre-sold.

Not as Bad as It Looks

Although the ongoing financial woes of such a massive Chinese real estate developer is, to put it lightly, concerning, the on-the-ground reality is not as bad as it looks.

The angst of poverty not only causes the Chinese people to favor real estate investments, but it also instills a deep aversion to debt. Mortgages are relatively rare in China; most people tend to borrow from family than from the bank. 65% of US homeowners have a mortgage while only 18% of Chinese homeowners have one.

As such, even if China’s real estate sector experiences a disastrous forced deleveraging, the ensuing economic damage will be limited and not as widespread as the damage caused by the 2008 Financial Crisis.

Controlled Demolition

The Chinese government kept a close eye on the rampant and dangerous use of leverage in the real estate sector and stepped in during the height of the pandemic to rein in the sector and introduce more financial discipline.

On August 2020, the government passed the “three red lines” policy, limiting how much leverage real estate developers can take on:

Liability-to-asset ratio excluding advance receipts of less than 70 per cent

Net debt-to-equity ratio of less than 100 per cent

Cash to short-term debt ratio of 1

This immediately pulled the rug out from under Evergrande and many other developers. The company had a massive amount of debt and relied on raising more debt to pay off the existing debt. The government effectively banned them from taking on new debt and this subjected the company to serious default risk.

The three red lines policy was partly a move by the government to shield China’s economy from excess leverage and partly a move to contain the power of China’s private sector, similar to what the government did with Jack Ma and the rest of China’s tech industry.

Where is Evergrande now?

Evergrande has $7.4 billion of maturing bonds and $2 billion of interest payments to pay back this year. The cash flow from its operations is far from enough to cover the payments. Without being able to take on more debt, the fastest way it can raise money is to sell assets. This is exactly what Evergrande has been doing for the past year, though sometimes not on its own accord.

Some examples include…

The company sold a 20% stake in Shengjing Bank last year in September for $1.5 billion. Earlier this month, it was forced to sell its remaining 15% stake in Shengjing Bank for another $1.05 billion

Evergrande has also been aggressively selling off its development properties. Earlier this year, it sold four properties to state-owned firms for $337 million

Several development properties have also been seized by creditors, such as an apartment complex near Shanghai and a plot of land in Hong Kong (both seized by LA-based Oaktree Capital Management)

Evergrande is trying to sell its Hong Kong headquarters but has so far been unsuccessful. Earlier this month, the headquarters was seized by creditors

Finally, showing just how dire the situation is, the chairman of Evergrande, Xu Jiayin, has sold a significant chunk of his personal assets to prop up the company ($1.1 billion sold by November of last year)

The Chinese government, in one fell swoop, pulled the rug out from under Evergrande and now it’s being torn asunder trying to repay its debts.

In a statement in October of last year, the government blamed the company for its problems and said that contagion to the financial system was controllable. Through this statement, it was clear that Evergrande was on its own.

Moving forward, we should expect lots of debt restructuring to give the company more room and time to repay its debts, as well as more fire sales and seizures of the company’s assets by creditors. It’s unclear whether the Chinese government will bail out Evergrande but if it does, the terms will be harsh and it’ll only occur if the overall Chinese economy was seriously threatened.

So What? Is This Actually Serious?

As mentioned above, although a contraction of the Chinese real estate sector will be painful for the global economy, it’s not as serious as many make it out to be.

The three main reasons are that (1) the Chinese government intentionally put its real estate sector in such a difficult bind through passing the three red lines policy, indicating that this is a controlled and reversible demolition, (2) mortgages are a lot less common in China than the US and thus the average Chinese household is relatively insulated from real estate leverage risk, and (3) inflation is surprisingly mild in China right now, giving its central bank room to lower interest rates while almost every other major economy has to raise theirs.

However, this is not to minimize the negative economic impact of a real estate sector decline. Let’s discuss the three main risk factors of such a decline.

GDP Impact

China’s real estate sector and its dependencies contribute a massive 20-30% to the country’s GDP. The leverage woes of its real estate developers have significantly slowed down the construction and selling of new homes. A report released by the China Real Estate Information Corp indicated that August was the 14th consecutive month of falling new home sales by the country’s top 100 developers.

A dramatic slow down in economic activity in such a vital sector of the world’s second largest economy will be painful, but not disastrous, for the global economy.

Banks At Risk

There is an ongoing strike across China to not pay developer-led mortgages given that many financially-strained developers have slowed down or completely stopped construction on unfinished housing developments. After all, why pay the mortgage for a house that might never exist?

The problem is, these mortgages were issued by banks and guaranteed by real estate developers. If borrowers refuse to pay and developers default, then banks are the last ones to hold the hot potato. Talk about financial contagion.

Thankfully this is unlikely to happen, given that the mortgage strike only affects 4% of outstanding mortgages and the Chinese government is prioritizing the completion of pre-sold housing developments and won’t hesitate to bail out banks if necessary.

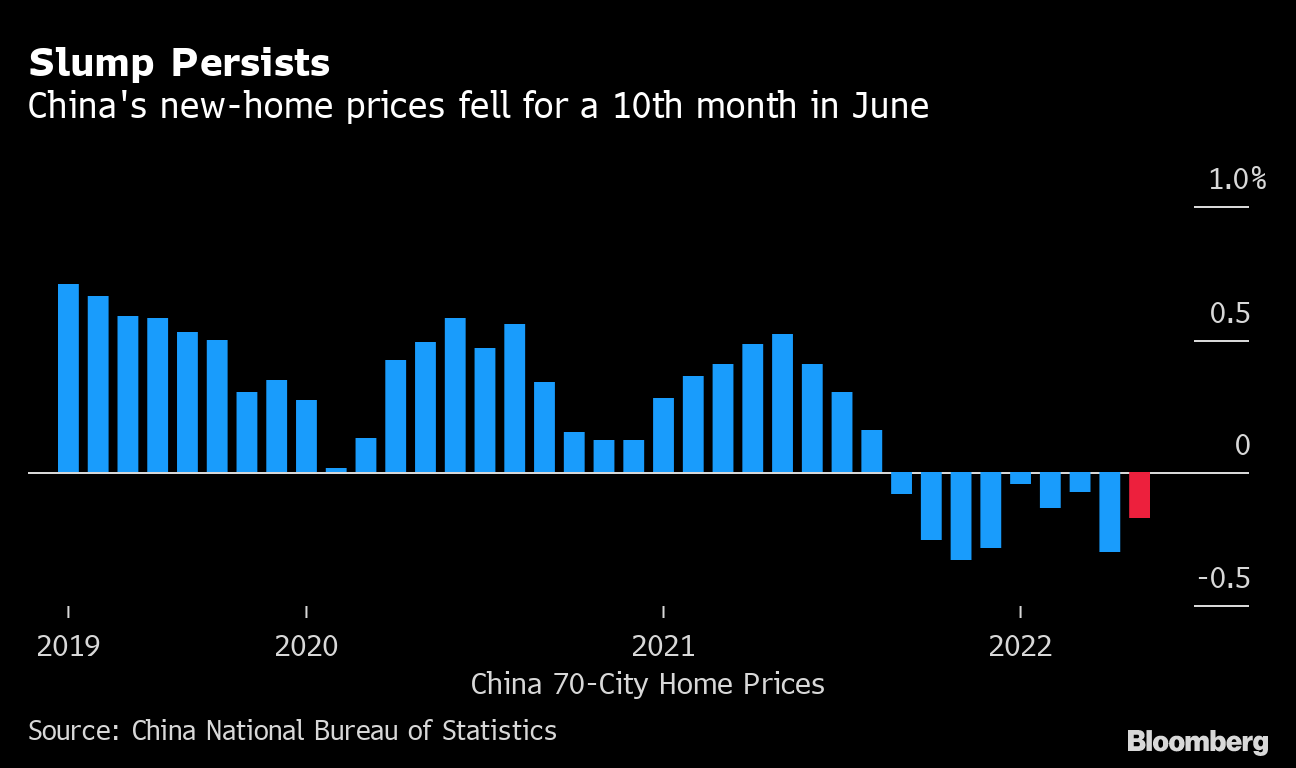

Wealth Effect

The last risk factor comes from the Wealth Effect (“when households become richer as a result of rising asset values, such as stock prices or home values, they spend more and stimulate the broader economy”). With 70% of the collective wealth of China’s middle class tied to real estate, a fall in real estate prices will subject the majority of its middle class to a negative wealth effect. This inevitably causes an economic slowdown/contraction as people spend less. Unfortunately but unsurprisingly, with the ongoing turmoil among real estate developers, real estate prices are falling precipitously.

The good news is that inflation in China is surprisingly mild and its central bank is able to lower interest rates to stimulate the economy while almost every other major economy is forced to raise rates.

Fin

To summarize, even though the financial situation for Evergrande and many other Chinese real estate developers is dire, we believe that the overall economic damage from a contracting Chinese real estate sector is limited and containable.

The Chinese government has a wide range of tools to mitigate economic damage if things get out of hand, including bail outs and central bank liquidity injections.