Thoughts - The Rare Balloon Bear 🎈🐻

Markets are in an environment we've not seen since the 70s. It's an extraordinary time. If you're having a tough time, know that this is the type of environment the best investors are made from.

Regular CNBC contributor Josh Brown couldn’t have put it better:

Nobody ever learns anything from smooth sailing, and from a low VIX… These are the market environments that you really learn and grow from. You are benefiting right now from this experience from ways that you will not realize until 10 years go by… You might not realize it, but I’m telling you, you’re getting better and this is really helping you in the long run.

We’re going through an extraordinary time right now. It’s something we’ve not seen for decades, and markets are behaving in crazy and often inexplicable ways. Here are some examples:

The Federal Reserve hiked interest rates by a whopping 75 basis points on Wednesday, the first time they did so since 1994. What’s even weirder is how the markets reacted to it. Right as Jerome Powell started to speak, SPY plummeted. Then it shot up hitting new local highs and chopped around before ending the day nicely green. The next day, SPY gapped down to new lows and kept falling. The market is erratic.

Internationally, we’re seeing equally extreme behavior from central banks and markets alike. Right after the Fed rate hike, the Swiss National Bank raised its own rate by 50 basis points. This is the Swiss National Bank we’re talking about… they don’t do that. This was the bank’s first rate hike since 2007.

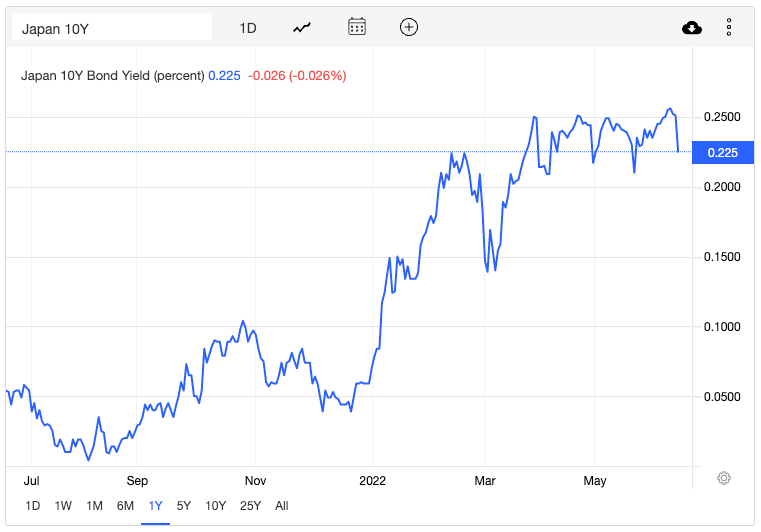

Meanwhile in Asia, the Bank of Japan is fighting its hardest to keep its interest rates steady, even as more and more market participants put on bets that the bank can’t keep maintaining easy money and low interest rates in this environment. The bank aims to hold the 10-year Japanese Government Bond (JGB) yield at a maximum of 0.25%, yet the yield has recently been rocketing higher and even breached 0.25%. The market participants behind this offensive trade against the JGB (infamously known as the “widow-maker” trade) include major hedge fund BlueBay, which manages $127 billion in assets. In response, the BoJ hugely ramped up their purchases of JGBs to defend the 0.25% ceiling, which has caused the yen to plummet. The bank thinks a falling yen is a worthy price to pay to keep its credibility. Time will tell whether they have the stomach to keep defending such attacks when every other central bank is raising interest rates.

What’s the Balloon Bear?

The current environment is so different, and so scary, because central banks are forced to be in a mode they haven’t been in in a long time. In prior bear markets, inflation falls along with markets and the easy decision is to loosen monetary policy and stimulate the economy. Now, central banks are the ones inducing a bear market to fight runaway inflation from soaring energy costs. I like to call this environment the Balloon Bear.

This is a huge sea change, and not something we’ve seen since the 70’s. Many companies, institutions, and traders have never experienced an environment like this. Old habits are sticky and even the Fed was dragged screaming and squirming into the inflation fight. The Fed of the late nineties wouldn’t hesitate to raise rates dramatically to cool inflation. The raises we’ve seen so far pale in comparison to its historical inflation-fighting rate hikes.

The general hesitance of market participants to prepare for and fight the Balloon Bear means we might just be in the first innings of the fight, and there’s likely more pain to come.

You Got This

Don’t beat yourself up because of this macroenvironment. The rarity of this situation made it incredibly hard to predict, even if you were an astute student of history. Seasoned traders and institutions managing significantly more money are getting caught seriously offside. The poster child for this is Tiger Global. The hedge fund, with almost $100 billion in assets under management in October 2021, saw its portfolio fall by 61.7% so far this year by the end of May. Even Berkshire Hathaway is taking huge hits to its portfolio, having suffered a $65 billion fall in value so far this quarter.

You got this. This is the type of market that the best traders are made from. The pandemic and its aftermath put markets on fast-forward mode and plunged traders into so many different environments. These priceless experiences will serve as valuable guides to navigate future environments. If you’re just starting out dabbling with markets, and have found it to be a hostile and treacherous environment, just know that it’s better to live through an environment like this at the start of your trading career than face it ignorantly 20 years in.

Looking Forward

The overarching requirement for a rescue from the Balloon Bear is a fall in energy prices. This hinges on several geopolitical factors, the most important being the course of the war in Europe as well as Biden’s meeting with Saudi crown prince Mohammed bin Salman next month. As far as international geopolitical events are concerned, anything could happen but it does pay to keep up-to-date. This isn’t easy, we’re all busy people, so FinanceTLDR will try to help with that.

In the short-term, we’re approaching the end of Q2 and that means rebalancing season. This should be a wild one given the volatility we experienced over the quarter. It’s likely that there will be significant inflows to stocks but it’s hard to say given that bonds also fell quite a bit this quarter. One beacon of light is that Goldman Sachs is estimating that there will be sizable buying demand for stocks from pension plans in this upcoming month/quarter-end (about $30 billion worth. Not a lot, but still significant).

In the long-term, investors want to dollar-cost average into cheap stocks right now. This is a generational buying opportunity and it’s very hard to predict a bottom. The current prices are as good as any to start scaling in for long-term positions. For signs that the worst is behind us, as I’ve mentioned before, look for a sustained rally in high risk assets (e.g. growth stocks) as the canary in the coal mine for the popping 🎯 of the Balloon Bear 🎈🐻 and a revival of the bull market.