Research - The Unstoppable TikTok

Viral app TikTok has proven that it isn't just a fad, and is quickly threatening the businesses of the world's largest tech companies. Here's why it's unstoppable.

Before I jump into TikTok, I have to acknowledge that I was wrong again in Monday’s Market Forecast issue. The forecast was for the stock market to fall in the short-term due to poor Q2 earnings results. Unfortunately, rising expectations for both cooling inflation and the Federal Reserve cutting interest rates next year has lifted consensus P/E (Price-to-Earnings) ratios. Despite many large companies underperforming Q2 earnings expectations, the results weren’t bad enough to offset rising consensus P/E ratios.

Such is the business of publicizing market predictions; sometimes you are publicly and dramatically wrong.

As a consolation prize, I’m happy to have recommended reducing risk instead of shorting. In volatile markets, it’s better to be conservative than aggressive. A conservative trader can always jump onto an emergent trend once things settle down while an aggressive trader is shoe-horned into an early risky decision. With trading, it’s better to be late than wrong.

Here’s one stat that shows exactly why TikTok is so alarming to the world’s largest ad publishers, Alphabet and Meta. TikTok made $4.6 billion in revenue last year and expects to triple that this year to $12 billion!

This tremendous growth rate from a multi-billion-dollar base is unheard of. A mature startup making hundreds of millions of dollars in revenue and growing 50% year-over-year is already considered the cream of the crop. TikTok is growing faster than the best startups out there, at the scale of billions of dollars.

In this article, let’s go over what makes TikTok so effective and the implications of its seemingly unstoppable success.

Numbers Don’t Lie (Unless You’re Enron)

Before we dive into TikTok’s effectiveness, here are a couple more stats to emphasize the app’s rapid growth and dominance.

Although TikTok’s active user base (1.4 billion, Q1 2022) is smaller than both YouTube’s (2.4 billion, Q1 2022) and Instagram’s (2.0 billion, Q1 2022), TikTok is growing significantly faster than both. The app’s quarterly user base grew by more than 72% year-over-year in Q1 2022 while YouTube and Instagram only grew by 5.8% and 4.4% respectively.

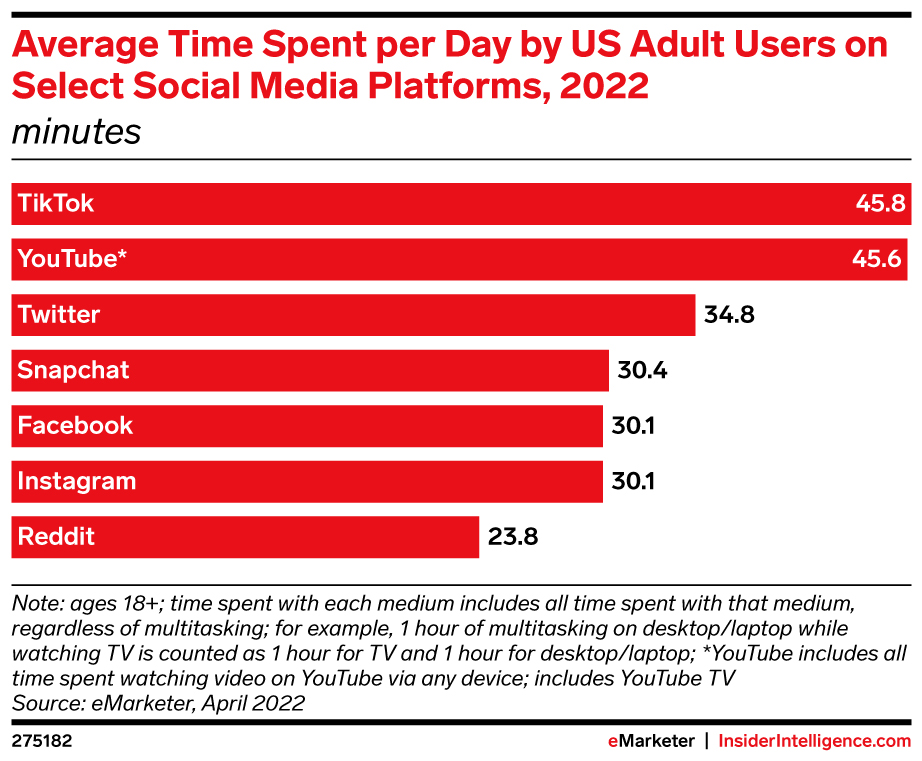

TikTok might have a smaller user base than YouTube and Instagram but US users are already spending more time on the app on average than the apps of both social media giants. While TikTok surpassed Instagram on this long time ago, it only recently usurped YouTube to take the top spot among social media platforms.

A person’s total free time is generally inelastic and definitely finite. The more time someone spends on TikTok, the less time they spend on other platforms. TikTok’s incredible ability to seamlessly and continuously engage its users, along with its fast growth, is tearing into the market shares of YouTube and Instagram and putting both businesses on edge. The execs of both businesses are probably spending most of their time figuring out how to fend off this relentless invader. They are trying to dig deeper moats and shore up their walls, but has TikTok already breached their paltry defenses?

History is littered with the ruins of once-dominant social media platforms suddenly kicked to the wayside by upstarts that seemingly came out of nowhere.

The Unstoppable TikTok

Alright, we’ve established that TikTok is growing at light speed and threatening the once impenetrable businesses of the incumbents. It's grabbing large swathes of market share one 30-second video at a tim- Hey look! A cute cat video! I’ll be right back.

(6 hours later…)

Where were we? Oh right, we were talking about TikTok. Let’s discuss why the app is so engaging.

Time to Emotional Engagement

I recently came up with a framework to describe the process for social media content engagement. There are three stages. The first stage is Discovery. In this stage, a user is trying to find content to engage with. The next stage is Context, where the user has already decided on a piece of content and needs to understand what’s going on before they can enjoy it. Finally, once context is established, the user is ready to be Emotionally Engaged. Getting users to this third stage as fast as possible is how social media platforms keep users around and how they keep them coming back for more.

In every stage prior to being Emotionally Engaged, users have to spend time to progress to the next stage. This process is very risky as far as engagement is concerned. The more time it takes to progress to the next stage, the more likely that users will fall out of the funnel. They will then either reset and try to find another piece of content, or disengage from the platform altogether. Not good.

TikTok is hyper-optimized when measured with this framework. Every aspect of the app is designed to shepherd users through the stages as fast as possible until they are Emotionally Engaged. First, TikTok’s world class recommendations engine makes the Discovery process near instantaneous. The moment you open the app you’re presented with a piece of content you’re interested in. Once you’re engaged, it’s just as seamless to find the next piece of interesting content. An effortless and almost subconscious finger gesture upwards and the next perfectly recommended video is automatically playing. Second, the super-short lengths (under a minute) of most of the videos on TikTok make it very easy to establish Context. Super-short videos organically force creators to be concise. If their videos meander, they stand to lose a viewer’s frivolous attention to intense competition. Finally, the same factors (super-short videos and intense competition) that produce videos where Context is easily established also produce videos that quickly Emotionally Engage users. Creators know intuitively that if they don’t invest in emotionally engaging content, they will quickly become irrelevant. Intense competition creates tremendous pressure to be, for example, as funny or as awe-inspiring as possible.

If you measure YouTube and Instagram with the framework shared above, prior to their copycat TikTok products, they were nowhere close to being as optimized as TikTok is. No wonder TikTok became so dominant so quickly.

Advertising

TikTok’s design makes it incredibly engaging. However, this design doesn’t just lend itself to supercharging user engagement, it also generates a massive amount of information about its users. The is perfect for targeted advertising.

Each video that a user watches and reacts to is a new data point about the user. Since videos are short, many many videos are watched per watch session. This gives TikTok an inordinate amount of user information. I won’t be surprised if TikTok could build a sufficiently comprehensive emotional profile of a user within minutes.

TikTok’s rapid ability to understand its users makes it highly effective for targeted advertising. This rate of understanding was unparalleled among social media platforms before the emergence of copycat products.

TikTok is just starting to invest in its ads business. Once the business matures, it will eat up a significant portion of the ad market’s total ad spend and cut deeply into the top and bottom lines of incumbents. In fact, this year’s massive projected revenue growth (from $4.6 billion to $12 billion) suggests that the company is already aggressively dialing up monetization efforts. The app has a lot of room to run in terms of monetization, as one can see from the chart below.

Singular Vision

The last TikTok competitive advantage we’ll discuss is its singular vision.

This singular vision allows the company to execute aggressively on its bread-and-butter, hyper-engaging video feed with no qualms. YouTube and Instagram don’t have the luxury of a singular vision and their copycat products are hampered because of it. When you open TikTok, the first thing you see is the video feed. With YouTube and Instagram, an extra click is required to get to the same experience.

The conflicting visions of YouTube and Instagram also affect user sentiment. Earlier this week, Kylier Jenner and Kim Kardashian publicly complained that Instagram was trying too much to be like TikTok, which forced the Head of Instagram, Adam Mosseri, to post a poorly-received video defending the platform’s decisions. Instagram then rolled back the controversial TikTok-like experiments that drew the Kardashian sisters’s ire.

The lack of a singular vision also gives rise to bureaucratic inefficiencies. YouTube and Instagram have to contend with unavoidable internal conflicts that emerge when a new product cannibalizes a company’s existing cash cows. It’s incredibly painful for any well-established company to shift investment away from existing bread-and-butter revenue sources to a new product line. However, if companies aren’t willing to bite this bullet, it’s unlikely they’ll survive. Unfortunately, parts of the company managing the existing cash cows will fight against the new vision and thus slow down execution velocity.

Finally, even with the decent success of YouTube Shorts and Instagram Reels, most users still see TikTok as the best place for the “TikTok experience”. Its focused and fresh experience helps it stand out among imitators. TikTok is the first place where creators post their original content while Shorts and Reels are filled with stale or reposted content.

What’s Next?

Despite fierce competition from incumbents, TikTok has enough competitive advantages to maintain its rapid growth. The company’s investments into monetization is finally starting to pay off and it’ll likely grow revenue to the scale of YouTube and Instagram in a few years. The sudden emergence of an ad publishing giant the size of YouTube or Instagram will significantly cut into the businesses of existing publishers.

TikTok will also expand its influence through the development of tangential products like live streams (launched in 2020) and longer videos (max video length raised to 10 minutes in March). In addition, the widespread usage of TikTok inevitably results in novel emergent behavior from its users that the company can capitalize on. For example, a Senior Vice President at Google, Prabhakar Raghavan, suggested in a speech at an industry event that TikTok and Instagram are eating into the usage of two core Google products, Google Search and Google Maps.

If TikTok continues to grow rapidly, it could even negatively affect the stock market. TikTok is a private company and the windfalls from its meteoric rise are inaccessible to public investors. As TikTok grows and wrestles market share away from pivotal public companies like Alphabet and Meta, it’ll stunt their business results and suppress, by corollary, their stock prices. Not good, given that these are some of the largest companies in the S&P 500 and Nasdaq Composite.

The most serious threat to TikTok is government regulation. The app was banned in India (one of its largest and fastest growing user bases at the time) in mid-2020 over national security concerns and similar concerns are currently being raised in the US. The company is working to decouple with its Chinese parent company ByteDance but this is a long and arduous process. The faster this decoupling happens, the safer the company is from government regulations.