The US Government's Seismic Policy Shift

An unexpected solution to the US government's uncontrollably growing debt problem that will upend how we see a renegade asset class.

Let me be direct.

The US government is current implementing a series of significant policy changes with the end goal of legitimatizing cryptocurrencies as an alternate global financial system backed by the full might of Washington DC and Manhattan.

Why?

The reasons for doing so stem from a US Dollar that’s losing global influence and an uncontrollably growing US government debt burden (more on “The Why” later on in this issue).

First, let me present evidence of this very under-reported seismic policy shift within the US government.

Then, I’ll expand on what the end goal of all these changes are.

Finally, I’ll discuss The Why. Why did the US government suddenly fall so deeply in love with a burgeoning asset class that it once treated as renegade and contraband?

Let’s start.

The Under-Reported Evidence

The most overt evidence of the US government’s sudden about-face on cryptocurrencies comes from the approval of Bitcoin ETFs last year.

This was rapidly followed by the approval of Ethereum ETFs last week.

“The SEC’s approval [of the Ethereum ETF applications] on an accelerated basis caught many off guard as just the week prior almost everyone, including the Bloomberg ETF analysts, had predicted that… there was little chance of an approval by the Thursday, May 23 deadline” - Lexology

The US government moved so fast on the latter that it even surprised the typically-overly-optimistic cryptocurrency industry.

These ETF approvals come after years and years of feet-dragging by the SEC.

In fact, Grayscale, the asset manager behind the long-running Grayscale Bitcoin Trust, first tried to file for a Bitcoin ETF in 2017. The SEC soundly rejected this application.

Subsequent attempts kept failing, prompting the company to hire Obama’s top White House lawyer, David Verilli, to bolster its efforts to sue the SEC in 2023.

Then, suddenly, the SEC changed its mind.

It not only signaled a willingness to approve cryptocurrency ETFs, but it also started working with US federal prosecutors to bring the myriad of global swashbuckling crypto firms in line with US financial regulations.

Ripple, Consensys, Coinbase, Binance, Kraken, Robinhood, etc. all received lawsuits from the SEC in a span of about a year.

Besides policy changes in the SEC, cryptocurrency legislation has also been showing up a lot on Capitol Hill and on the Presidential desk in the past couple years.

In early 2022, Biden issued an executive order calling “on federal agencies to take a unified approach to the regulation and oversight of digital assets” and to, in particular, “explore a digital version of the dollar”. The US Treasury called this executive order “historic”.

In September 2022, the White House released the “First-Ever Comprehensive Framework for Responsible Development of Digital Assets”. Around the same time, the US Treasury published three reports on cryptocurrencies in accordance with Biden’s executive order earlier in the year.

In just the past couple weeks:

“The Senate, with bipartisan support, votes to repeal SAB 121 through H.J. Res. 109, marking the first

standalone crypto bill to pass both chambers of Congress”

“House approves landmark FIT21 Bill with wave of Democratic support”. Even Nancy Pelosi voted for the bill, commenting that this is a “first step” and that “digital currency is already integrated into our economy and will only grow in significance in the years to come”.

“SEC approves Spot Ethereum ETFs”

In sum, it’s very clear that Washington DC has significantly warmed up to cryptocurrencies and is moving at a rapid pace to not only embrace the burgeoning new asset class but at the same time also bring it closer under US laws and regulations.

The End Goal

I think the end goal of all this is to legitimize cryptocurrencies as an alternate global financial system that’s fully regulated by the US government.

This might sound questionable at face value, but there’s significant impetus for the US government to do so. More on this in The Why section below.

First, let’s answer some house keeping questions on cryptocurrencies.

What about all the illegal money flows that happens with cryptocurrencies?

Well, it turns out, because of the public and immutable nature of blockchains, it’s actually very easy to monitor who is doing what with cryptocurrencies.

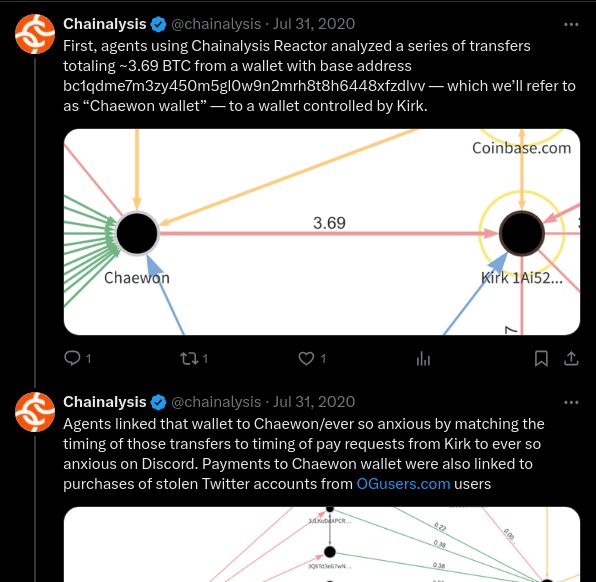

There are many blockchain analysis companies that have been deeply cooperating with US intelligence and law enforcement agencies for many years now to identify illicit blockchain activity. The most famous of which is Chainalysis.

Cryptocurrencies have a bad rep but if you really think about it, they’re one of the worst ways to send illegal money around because every single one of your transactions will be visible to everyone else for the rest of time.

If you wanted to hide dirty money, you’re much better off carrying bags of cash around and laundering them through casinos and fake businesses.

What about all the volatility?

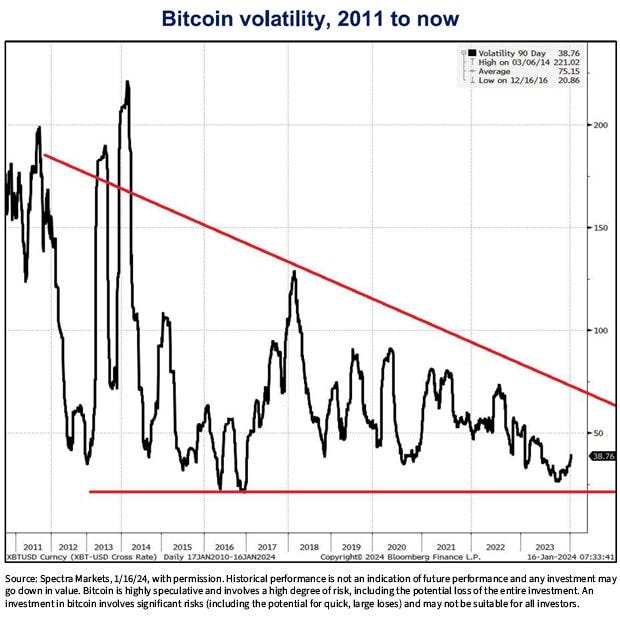

Another misconception about the dangers of cryptocurrencies is their high volatility.

A highly volatile asset means more risk and greater danger for investors and the overall financial system, right?

Well, the financial system is filled with much, much more volatile assets. Options, for one, have insane volatility, yet the market loves trading them and the options market’s volume has grown tremendously over the past few years.

In addition, Bitcoin’s volatility has been falling a lot over time and this trend is expected to continue as the asset matures.

“[B]itcoin’s price volatility has been declining for a significant period, and this has had nothing to do with ETFs. The market itself has been maturing, prices and market cap have been rising, and more participants trading and investing, which have all brought down the volatility.” - WisdomTree

Don’t cryptocurrencies challenge the dominance of the US Dollar?

Cryptocurrencies don’t challenge the status of the US Dollar.

First of all, cryptocurrencies make for poor currencies and thus shouldn’t be thought of as currencies. Their value is too volatile and, in the case of Bitcoin, transact way too slowly for day-to-day payments.

Cryptocurrencies are more like commodities or investment assets.

Bitcoin, for one, very much acts like a digital form of gold and no one today thinks gold has any chance of supplanting the US Dollar in its preeminent role in global trade.

This is a good segue into the next section where I share why cryptocurrencies not only don’t challenge the US Dollar, they’re actually accretive to the Dollar’s global dominance.

The Why

So why is the US government trying to legitimize cryptocurrencies in the first place?

Why don’t the Big Wigs in Washington DC just maintain the status quo, keeping the industry at arms length and subjecting its top companies to constant legal scrutiny?

It turns out, making cryptocurrencies a more legitimate alternate global financial system has significant benefits for the US Dollar.

And the Dollar needs all the help it can get right now.

My claim: by officially incorporating cryptocurrencies into the US financial system, the US government significantly increases global demand for both US Dollars and US government debt.

Why?

Cryptocurrencies have this feature where they can host blockchain-based US Dollars (US Dollar stablecoins) that allow users to convert between these dollars and other cryptocurrency assets like BTC or ETH directly on-chain (i.e. without the need for any centralized middlemen like banks or currency exchanges).

As a result, in theory, anyone with Internet access and the ability to buy cryptocurrencies will be able to buy US Dollars.

This, in effect, circumvents any capital controls that a nation has in place to protect its currency.

If a poor Argentina farmer or Venezuelan shopkeeper lost faith in how their governments are managing their national currencies, they can directly and quickly access US Dollars through the Internet (!).

You can bet there are billions of people in the world living in deeply fiscally-mismanaged nations that are chomping at the bit to own more US Dollars and use US Dollars in their day-to-day commerce.

This is why the deeply established, deeply mainstream politician, former Speaker of the House Paul Ryan is currently working hard to proselytize US Dollar stablecoin legislation on Capitol Hill.

Even without formal legislation, US Dollar stablecoins is already a major global asset class with $160 billion in market cap and $73 billion in daily trading volume.

Ranked among countries, US Dollar stablecoin providers are the 16th largest buyer of US treasuries today (they use these treasuries to back their issued blockchain dollars).

When US Dollar stablecoins are fully legitimized by the US government, the idea is that their global demand will skyrocket, which directly increases both demand for US Dollars and much-needed demand for US government debt.

Below are some quotes from Circle, the largest and most regulatory compliant US Dollar stablecoin provider, from its “State of the USDC Economy” published earlier this year:

“In the coming years, we expect millions of businesses and billions of people to begin using this new, open Web3 internet layer to transact trillions of dollars in value.”

“Last year marked a major turning point for the future of blockchain-based, internet native finance. Bad actors began to bear the full weight of their nefarious activity, frauds were uncovered, yet the underlying technology matured, and mainstream businesses deepened their involvement with technologies like USDC.”

“The dollar’s global role means the overwhelming majority of stablecoin activity today is denominated in dollars. USDC makes it possible for nearly anyone, anywhere, to access, hold, and transact digital dollars over the internet.”

“USDC is a payment stablecoin that combines the strength, trust, and network effects of the US dollar with the superpowers of the open internet.”

If I may speak in slight hyperbole, I think the marriage of the US government and cryptocurrencies will culminate in the merging of the US Dollar with the Global Internet. This will elevate the US Dollar to a higher level of prominence in global finance.

In the short term, it doesn’t hurt that it will help forestall the US government’s urgent debt problem (I’ve written at length on this problem in prior newsletter issues).

What are US Dollar stablecoins being used for today?

So US Dollar stablecoins are already a massive global asset class today, $160 billion in market cap and $73 billion in daily trading volume, but what exactly are they being used for right now?

From the Circle “State of the USDC Economy” report, stablecoins are mostly being used for:

On-chain trading (probably the biggest use case for stablecoins in the US)

Remittances

Cross-border payments

Great info as usual 👏

So I see this helping people in foreign countries be able to more readily have access to USD through stable coins and I see this benefiting the US Governments need to issue more debt to finance all the things the government wants to spend money on but I don’t see how this will help the average American or Westerner. Maybe I am missing something but it seems like just another way to keep the status quo going for a few more years.

What does this look like once integrated? Does it mean that all US companies need to accept crypto? Or is it more like legalizing it as an asset

Also are they just planning to integrate USD stable coins? Seems like an easy win if you trade the right crypto