This Is the Next Tesla. Here's Why

Tesla is priced for perfection, yet this undervalued company is making all the right moves to outcompete Tesla.

I'll start this piece with a bold prediction: within the next 5 years, General Motors will not only seriously challenge Tesla's EV market dominance, but will also beat Tesla in launching a self-driving taxi service.

The underlying principle behind this investment thesis is that stock market sentiment moves significantly slower than internal company decision making and execution. This is fundamentally true because company executives can quickly make high-impact decisions and employees generally act cohesively and in alignment with high-level decision making. The public, on the other hand, is a decentralized mass of external observers with low information about internal company happenings.

This is why patience matters. When you identify a company that is well capitalized, has pivoted to a new high-growth mission, is executing as planned, and the public is still stuck on a prior image of the company, you have an opportunity. I think GM fits this mould.

Tesla's Promises

The majority of Tesla's business involves building mid-to-high-end electric vehicles. However, its current market cap is $1.1T with a 360+ P/E ratio on $47 billion in Trailing 12 Months (TTM) revenue. Traditional car-makers, which sell a lot more cars than Tesla, have relatively very modest P/E ratios (e.g. GM has a 7+ P/E ratio with $131 billion in TTM revenue and Toyota has a 9+ P/E ratio with $285 billion in TTM revenue).

Why?

Tesla's charismatic CEO Elon Musk is very good at selling narratives that people want to invest in. Consequentially, the market sees Tesla as more than just a car-maker. To the market, Tesla is also a self-driving car company and renewable energy (solar and batteries) company. These are stories people want to invest in, and Musk has a good track record of achieving seemingly impossible business feats.

Tesla discusses robotaxis in its 2019 Autonomy Day

Tesla is priced for perfection, but there's no sense or value in arguing whether the market is overvaluing Tesla's potential. It's much better to identify, in the wake of the success of Tesla's stock, lesser known opportunities that potentially has a better chance at achieving the narratives sold by Tesla.

I stipulate that there's a huge opportunity in GM.

Enter GM

What company comes to mind when you see "car-maker dinosaur"? Sadly, it's likely GM. The company has a name that couldn't be more bland or uninspiring, is more than a century old, and is today a conglomerate of car-makers that many people would consider "boring". Even worse, the company took a huge beating during the 2008 financial crisis and had to be bailed out. All this adds up to a less than stellar public image.

However, behind this tarnished and boring brand is a highly capitalized company that has made many strategic but low profile moves over the past decade to reinvent itself, taking serious inspiration from Tesla.

In many respects, it's on par or even ahead of Tesla. The market just doesn't realize it yet.

Self-Driving Cars

Tesla recently passed $1 trillion in market cap on the news that Hertz is planning to order 100,000 cars, 50,000 of which are earmarked for Uber. Along with this news is the rollout of 10.3 of the "Full Self-Driving" beta software for Tesla Autopilot to a select group of closed beta testers.

These two pieces of news renewed excitement for Tesla's self-driving car technology. Could Tesla be the first company to commercialize self-driving taxis? If Uber and Lyft's valuations are any indicators, this business is worth at least hundreds of billions of dollars.

However, to achieve this vision, Tesla's technology needs to safely and reliably work without a driver in high-density urban and suburban environments. Unfortunately, it's not even close. Autopilot is strictly a "driver assistance tool" that requires supervision at all times. In addition, the driver assumes liability (and not Tesla) if anything goes wrong. In fact, a May 2021 study by Guidehouse Insights ranked Tesla last for both strategy and execution in autonomous driving.

There is no indication that Tesla is close to a driverless version of Autopilot. If it were, you can bet that Musk will at least be hinting about it on Twitter.

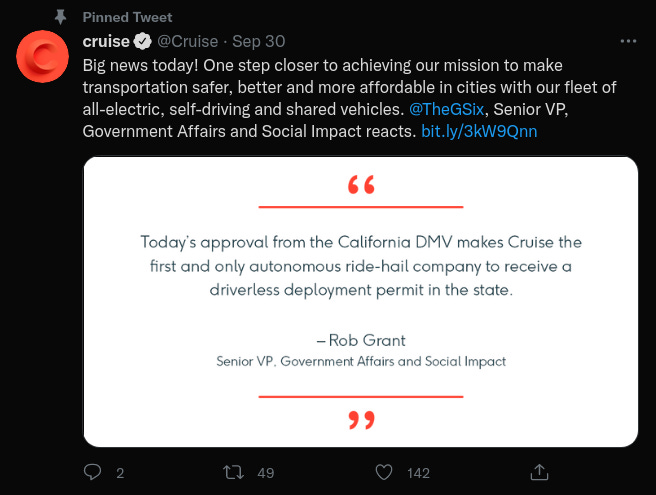

On the other hand, GM-owned Cruise has spent a little over the last 5 years intensely developing and testing its self-driving car technology in San Francisco, Scottsdale, and Detroit. The tech is advanced enough that Cruise recently received a greenlight from the California DMV to operate driverless self-driving taxis in certain parts of San Francisco at night. San Francisco is a relatively dense and hilly city filled with tight one-way streets, stop signs, and sometimes confusing intersections. This permit is not only a huge breakthrough in regulatory approval but also a testament to how far Cruise has come in its quest for driverless automation.

In addition, Cruise will leverage GM's vehicle design and manufacturing expertise to produce Origin, an all-electric vehicle specifically built as a driverless taxi. Production is slated to start next year and the first Origins should hit public roads shortly after.

Cruise Origin concept rendering

Finally, GM is actively deploying a limited subset of Cruise's self-driving technology into its own vehicles. The service, branded as Super Cruise, enables hands-free driving on highways and is already available in many of GM's latest car models. Super Cruise is already an improvement on Tesla's Autopilot, which requires drivers to keep their hands on the steering wheel. Autopilot's "Full Self-Driving" (FSD) upgrade, currently in closed beta, removes the "hands-on-wheel" requirement.

GM has also announced Ultra Cruise, which it expects to enable hands-free driving "across nearly every road including city streets, subdivision streets and paved rural roads, in addition to highways" (GM Corporate Newsroom). Ultra Cruise will start being available in select 2023 models.

Battery Technology

Another market narrative justifying Tesla's astronomical valuation is that it's a battery company. Tesla is expected to revolutionize batteries, not just for cars, but also for the entire energy economy. One of the biggest disadvantages of renewable energy is energy storage and transportation. Advanced battery technology fixes these shortfalls.

However, GM is also quietly but intensely competing with Tesla on this front. For the past few years, GM has been running a well-funded battery research and production division that is just starting to publicize its achievements.

The company's flagship battery platform is called Ultium. The recently productionized 3rd generation battery platform is called Ultium 1.0, and will be deployed in all of GM's upcoming all-electric vehicles including the Hummer EV and Cadillac Lyriq. The Hummer EV, which saw preorders sell out in 10 minutes, will start being delivered to consumers by the end of this year, while the Lyriq will be delivered next year.

Ultium is heavily lauded by GM and the media not only because its flexible architecture significantly speeds up vehicle development (26 months for the Hummer EV as opposed to the standard 50 months (CarAndDriver.com) but it's also energy efficient and cheap enough to compete with Tesla's best batteries.

Ultium battery diagram rendering (source)

Tesla's flagship sedan, the Model S, comes with a 100 kWh battery and has a range of more than 400 miles. That's about 4 miles per kWh. Although this metric is an imperfect measurement of a battery's efficiency, since a car's range is also dependent on its weight, aerodynamic efficiency, and motor efficiency, it's the best approximation I can find. GM's upcoming EV, the Cadillac Lyriq, will sport a 100 kWh battery with more than 300 miles in range (GM claim). Although this appears to be 25% less in energy efficiency, the Lyriq is an SUV and is a larger vehicle than the Model S, which is a sedan. Tesla appears to have an edge given its headstart but GM is rapidly closing the gap.

Besides energy efficiency, GM is also catching up on cost. According to a report by Cairn ERA, Tesla pays an average of $142 per kWh for battery cells while GM pays an average of $169/kWh. The industry average is about $186/kWh (CNBC.com).

Put together, these are respectable stats for Ultium given Tesla's headstart. In fact, multibillion dollar investment firm Wedbush Securities told investors in a note earlier this month that GM's battery technology positions it "to take advantage of a $5 trillion market emerging over the next decade" (TheStreet.com).

How will GM close this gap? Well the company is throwing massive funds at its in-house battery research and production operation and has given many hints of what's to come. Last year, GM and LG Chem began construction of a $2.3 billion battery cell plant in Ohio and the two companies announced earlier this year that a second factory is in the works. Producing batteries in-house is much cheaper than external sourcing, and GM believes that its LG Chem partnership and Ultium program can drop battery costs to $100/kWh. GM is also heavily investing in battery research. Last year, it unveiled a working prototype of its 4th generation lithium-metal battery that could provide "nearly double the energy density of Ultium 1.0 cells" (IEEE.org). Earlier this year, it was announced that 150,000 simulated test miles was completed with this new battery from internal testing (Electrek.co).

Tesla, which is no slouch in the battery business, is also working on its next-gen battery technology in collaboration with Panasonic. Dubbed the "4680", the two companies believe it'll have 5 times the capacity of the current gen 2170 battery while costing 50% less. Tesla expects to launch this battery next year (CarAndDriver.com).

EV Production Ramp-up and High Quality Products

GM announced in March 2020 that it will commit $20 billion to electric and autonomous vehicle initiatives from 2020 through 2025. This year, the company upped that commitment to $35 billion. Among many things, this massive investment will enable the company to launch 30 new EVs by 2025, with the Hummer EV and Cadillac Lyriq being part of the first batch.

Unlike Tesla, which just learned to build hundreds of thousands of cars at scale, GM is a seasoned auto-manufacturer that sold 6.8 million cars in 2020. It's now directing that manufacturing expertise to building EVs. With the tremendous money backing this initiative, production can ramp up incredibly quickly. For example, GM will host the grand opening of Factory ZERO next month, its first factory solely dedicated to all-electric vehicles (include the Cruise Origin). GM has invested $2.2 billion in this factory and expects to employ more than 2,200 people here.

Besides a huge production ramp-up to catch up to Tesla's EV production capacity, GM has also taken a page out of Tesla's playbook in designing cars that are not just environmentally friendly but also enticing to own. The Hummer EV and Lyriq demonstrate this strategy. Both have elegant and futuristic exteriors, luxurious interiors, and are loaded with exciting and never-before-seen features such as the Hummer's "Watts to Freedom" feature that creates a very unique experience for the driver before hurling the car from 0 to 60 mph in 3 seconds. Of course, both cars will also come with Super Cruise technology.

"Prototype Drive: 2022 GMC Hummer EV Is Built to Wow"

Don't take this from me. Reviews for the Hummer EV have started pouring in and everyone from MotorTrend ("2022 GMC Hummer EV Prototype First Drive: Truck Yeah!") to Car And Driver ("Prototype Drive: 2022 GMC Hummer EV Is Built to Wow") to Cars.com ("2022 GMC Hummer EV Pickup Quick Spin: An Untimely Collection of Excellent Thinking") to TheDrive ("2022 GMC Hummer Prototype First Drive Review: Electrification Creates the Best Hummer Yet") have given it highly positive reviews.

The Largest Risk for Tesla

At present, Tesla has a comfortable lead in EV manufacturing and sales, a tenuous lead in battery technology, but is years behind in fully autonomous self-driving car technology when compared to GM. For Tesla to continue justifying its astronomical valuation, it needs to appear to be ahead in all three initiatives.

The largest risk to this public image is self-driving car technology. When, and not if, Cruise starts operating a driverless taxi business in the Bay Area, Tesla will lose control of the narrative. How can Tesla be the first company to operate a fleet of driverless taxis when another company is already doing it? This should be the moment when the market realizes the emperor wears no clothes.

Tesla could, in theory, take advantage of its high-flying stock price to issue new stock and ramp up investment in autonomous vehicles but developing driverless self-driving cars is capital and time intensive, as Google, Uber, and Cruise have learned. The technological and regulatory gap is too large for Tesla to close in the next few years even with significant investment.

Conclusion

Earlier this year, Wedbush Securities Managing Director and Equity Analyst Dan Ives wrote to clients: "Going forward, GM continues to be a re-rating story as the Street treats the Detroit automaker no longer as a traditional auto company trading based on book value, but a broader disruptive technology play that can start to trade at multiples similar to the likes of Tesla and other pure-play electric-vehicle companies as GM executes on its vision".

Although GM is executing excellently in its new high tech and EV-focused mission, impressions stick and it'll take a lot of time, effort, and news cycles to shed the old. As Ives wrote, not just the public but many investment firms still value it as a traditional auto company. Expect some churn as funds expecting a stable and high profit company pullback while high growth funds take the lead.

However, when sentiments change and GM starts to be broadly recognized for its tremendous progress in competing with Tesla, its valuation will meaningfully change. GM has a 7 P/E ratio while Tesla has a 360 P/E ratio. This is the opportunity.

And Wall Street is catching on. Earlier this month, upstart activist firm Engine No. 1 announced a stake in GM. Founder Chris James had this to say on CNBC: "GM, with the support of a really strong management team and a great board, has decided that they're going to embrace the future. They're going to make the investments necessary in order to be successful during this transition... We think that this can become a growth company again... We think this stock could triple over the next five years, and that, for us, is something that gets us pretty excited" (CNBC.com).

Read about Engine No. 1's GM investment thesis here.