Thoughts - This Time, It's Different

Discussing why we're likely undergoing, and underestimating, a market regime change where easy money is gone and inflation lurks in every corner.

Apologies for not publishing newsletter issues as frequently as before. Life and work have been incredibly busy. Nevertheless, thinking and writing about finance is incredibly fun and I hope I can resume the old publishing rhythm soon.

CNBC’s Sara Eisen interviewed Holly Newman Kroft (managing director at Neuberger Berman) on the show “Closing Bell” earlier this month.

Sara opened with the question,

“Holly, you have to wonder, with such a sizable rally, if we are near the beginning of the end?”

Sara’s question comes after the stock market staged a large two-day rally (+6% in the S&P500) off a new year-to-date low when August inflation data came in hotter than expected.

Holly’s response to Sara was,

“I think people would like to think that, Sara, but we don’t at Neuberger. This is nothing different than the rally we had this summer. People like to hang on to good news… but we’re not going to have a recovery in this market until the Fed signals that they are going to stop raising rates…”

As the show host, Sara’s question was on point, reflecting the sentiment of many bullish market participants hoping for a major market recovery that we so often saw in the past decade.

As a market analyst, we think that Holly’s answer was equally on point; people are underestimating the full impact of the Federal Reserve’s interest rate hikes. These rate hikes are much more problematic for the economy than they appear in the short-term and market bounces along the way can’t be trusted.

Zooming out, we think that these interest rate hikes are part of an overall story of a de-globalizing world where easy money is gone and inflation lurks in every corner.

Here’s why.

In a Bad Spot

The Fed is raising interest rates at the fastest pace in the last 40 years! We started the year with the Fed Funds Rate at 0.25% and it’s now at 3.25%.

The US stock market spent the majority of the past decade with the Fed Funds Rate near 0%. This caused market participants to become incredibly used to an environment with easy money. As such, it’s not surprising that people are wondering whether we’ve hit bottom at every market rally.

However, the economy is in a tough spot and a recovery is unlikely to happen any time soon. In this newsletter issue, we’re going to discuss two top issues ailing the economy right now:

Interest rate hikes have a delayed negative impact on the economy. With rates rising so fast this year, the market is severely underestimating their eventual impact.

Inflation is stickier than originally expected. This is forcing the Fed to be more aggressive with tightening financial conditions.

1. The Real Impact of Interest Rate Hikes

Interest rates define the cost of capital. The higher interest rates get, the more expensive it is for people and companies to raise money.

A great way to understand how cost of capital rises when interest rates rise is through mortgages. Here’s an excellent visualization from The Washington Post on the difference in the total interest cost for a mortgage with a 3% interest rate and a mortgage with a 6.9% interest rate.

With the Fed raising the Fed Funds Rate from 0.25% to 3.25% in just a few months (targeting 4.5% by year-end), cost of capital across the economy is rising dramatically. One area of the economy where this really matters is corporations.

With interest rates at close to 0% for most of the past decade, corporations have come to rely on cheap debt to fuel growth and buy back shares.

When debt becomes expensive, they eventually need to slow growth (lower earnings and revenue) and slow share buybacks (one less marginal buyer of stocks). Needless to say, this is bad for stock prices, especially in a market used to loose financial conditions.

However, it’s incredibly easy to underestimate the negative impact that interest rate hikes have on the economy. This is because there’s a long lag time between raising interest rates and the economy actually slowing down. One academic paper estimates this lag time to be up to two years! To make matters worse, corporations indulged on debt when it was incredibly cheap during the pandemic economy and are now flush with cash. This extra cash allows them to stave off the squeezing effects of higher interest rates for longer than usual. As such, one should also expect a longer-than-usual lag time between this rate hike cycle and its ensuing economic impact.

One thing we really want to emphasize with interest rate hikes is that they’re not one-off bad news events. This is a common fallacy we’ve noticed in financial commentary. For example, a Wells Fargo strategist told CNBC last month that the Fed needs to “rip off the Band-Aid” and hike interest rates by 150 basis points.

In our opinion, this is the wrong way to look at rate hikes. Once rates are raised, the market can’t just move on and pretend that things are back to normal. A rate hike is not a punch but more of a continuous stream of punches. Rate hikes slow down the economy from the moment they’re implemented until the moment they’re reversed.

2. Super Sticky Inflation

The Fed is currently raising rates to combat super sticky inflation in the US and it’s commonly understood that the Fed will only ease off the brakes once inflation is completely quelled.

Unfortunately, this job is looking harder and harder to accomplish.

De-Globalization (East vs West)

First off, the world is starting to de-globalize.

Russia and NATO shrugged off all pretenses earlier this year and is engaging in a proxy war in Ukraine. The Biden administration is continuing the prior administration’s trade war against China (e.g. shutting off the Chinese semiconductor industry from Western technologies) while also pressuring China in the South China Sea.

The world is more divided now than it’s ever been in the last three decades.

Many countries are having to choose sides and worryingly, the US’s global influence is waning. For example, Saudi Arabia, once a staunch US ally, recently rebuked Biden’s request to raise oil production and instead cut oil production in support of Russia and China! Saudi Arabia, of all US allies, is breaking ranks. This was unimaginable just a few years ago.

Globalization was a key source of deflation in the past few decades. It allowed central banks to ease financial conditions with little inflationary repercussions.

De-globalization, on the other hand, will bring about a world where inflation is easy to come around and central banks have less room to save economies without triggering runaway inflation. The end result is redder and more volatile stock markets.

Hot Labor Market

Another reason inflation is tough to fight is because it’s being driven by a hot labor market rather than commodity prices.

Sure commodity prices were a strong contributing factor to inflation earlier in the year but they’ve since collapsed from their peaks (e.g. WTI crude oil is currently at $85 per barrel, far from its $122 per barrel high in June). Despite falling commodity prices, inflation remained stubbornly high in the last two CPI/PCE reports. This showed that high commodity prices were a sideshow as far as inflation is concerned and the labor market is the main culprit keeping prices high.

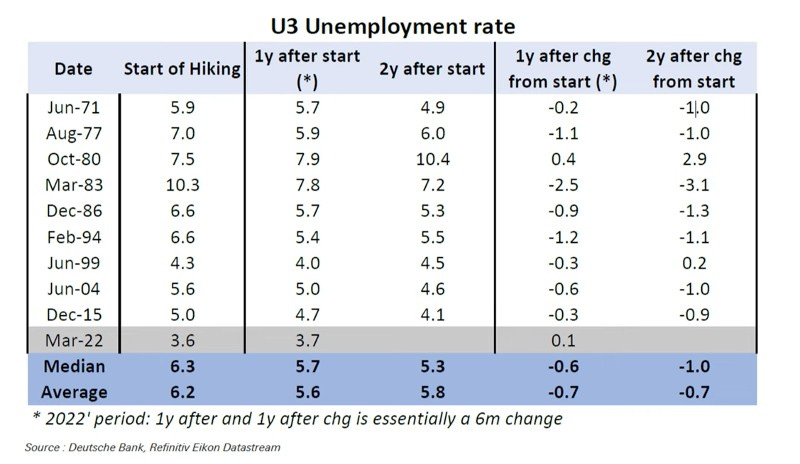

Thankfully, cooling the labor market is exactly what raising interest rates is supposed to do. The only problem is, as mentioned above, there’s a massive lag between raising interest rates and the economy actually slowing down. In fact, Ben Carlson over at the Animal Spirits podcast recently pointed out that unemployment didn’t fall and was often lower two years after the start of each Fed rate hike cycle going all the way back to the 70s!

As such, if the Fed is hoping to cool the labor market by raising interest rates, we should all be prepared to wait a while.

Fin

It’s unwise to fall into the trap of continuously hoping for the past decade’s bull market to reemerge, simply because that was the modus operandi.

With interest rates soaring, de-globalization, and sticky inflation, it’s become more and more clear that we’re in a new market regime. If so, then the era of easy money is over and central banks now actually have to choose between rescuing economies and keeping inflation low.

In other words, the markets are in for a wild ride.