Thoughts - Winter Is Coming

Global central banking heads fired off dire warning shots at global equity markets during last week's Jackson Hole central banking conference. Here's why.

In the past few newsletter issues, we’ve mentioned that, given historical precedent, the Federal Reserve is unlikely to slow down its monetary tightening policies after just one month of mild inflation data. As such, we believed that the stock market got way ahead of itself with its massive rally over the past two months.

This analysis was confirmed by the hawkish comments made last week by Fed chair Jerome Powell and many other global central banking heads at a major central banking conference.

Let’s discuss the reasoning behind this economic pessimism.

Price Stability > Full Employment

Last Friday, the Kansas City Federal Reserve held its annual Jackson Hole Economic Symposium, a venerated event attended by the Who’s Who of central banking. This event was a rude-awakening for an overly optimistic market as Fed chair Jerome Powell and many other global central banking heads gave very bearish speeches on the ongoing inflation crisis and its implications for the global economy.

Unfortunately for market bulls, preliminary data suggesting cooling inflation doesn’t mean that we can quickly resume the fast and loose central banking policy of old, where Demand could be stoked up and absorbed by globalization and rapid technological improvements with little consequences.

Aggressive global stimulus policies throughout the pandemic have shown the fragility of the supply chain. Sure, lowering interest rates and printing money for stimulus cheques could quickly revive the consumption appetites of locked down consumers, but a broken down supply chain requires gargantuan effort and coordination to revive. A quick and simple fix can’t be found through government policies.

Price Stability, not Full Employment, is a central bank’s number one priority. Unfortunately, the current global excess of Demand and lack of Supply is threatening to break down Price Stability everywhere.

As such, the central bankers at Jackson Hole generally agreed: more financial tightening is required, even if that meant suffering economic pain in the process.

For the United States

Jerome Powell is undoubtedly a scholar of US central banking history.

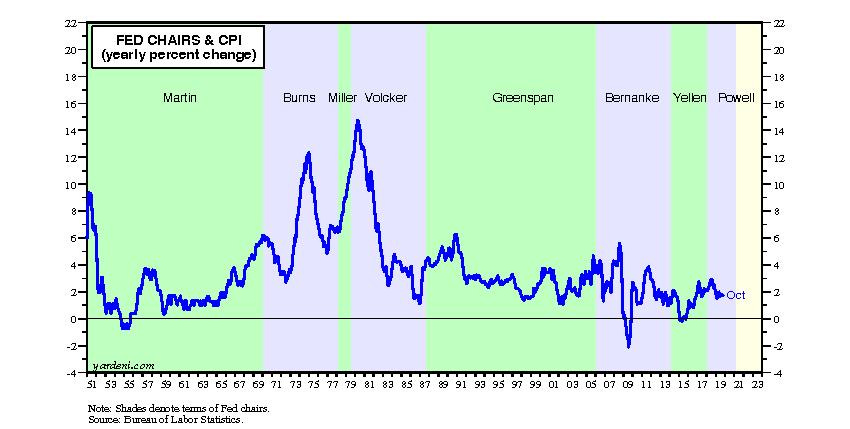

As we’ve mentioned in prior issues, the classic inflation dichotomy in US central banking history is Fed chair Arthur Burns and Fed chair Paul Volcker.

Burns was Fed chair for most of the 1970s. During his tenure, he faced a major inflation crisis that was brought forth by an energy crisis at the start of the decade (sounds familiar?). At the onset of the crisis, Burns responded correctly by aggressively raising interest rates. However, in a misguided attempt to reduce economic pain and appease protesting up-for-election politicians, he dropped interest rates too early and inflation soared again in the 1980s.

Burns is remembered as a failed Fed chair.

Volcker, on the other hand, is held in high regard as a Fed chair that faced the Inflation Beast head on and beat it. He sacrificed the economy by raising rates to painfully high levels and he kept them there until the job was done. This made Volcker incredibly unpopular among elected politicians and the electorate at the time. Ultimately, his resolve to keep rates high tamed the Inflation Beast and this was what he is remembered for.

Powell wants to be remembered as a Volcker, not a Burns.

As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, "Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations."

- Jerome Powell at Jackson Hole

Eager McBeavers

The US stock market is filled with Eager McBeaver bull market investors.

These investors have gotten so used to the easy money, forever bull market of the 2010s that a slight reprieve in inflation data in July triggered a massive market rally.

Investors were expecting the Fed to immediately slow down its monetary tightening policies the moment inflation trended in its favor.

This is ill-advised. Not only is inflation still at a very high absolute level (8.5% year-over-year in July), but imagine what will happen if the stock market returned bullish so quickly? The Wealth Effect (“when households become richer as a result of a rise in asset values, such as corporate stock prices or home values, they spend more and stimulate the broader economy”) suggests that a quick return to a bull market will raise consumer demand and aggravate inflation yet again.

Furthermore, if we put into perspective US central banking history, we know that inflation can’t be killed with a gentle touch. One month of favorable inflation data is far from the death knell of the Inflation Beast!

It took two decades and three Fed chairs to kill the Inflation Beast of the 70s and 80s. Powell wants to kill today’s Inflation Beast as soon as possible and ideally during his tenure. Not only does the global economy count on him successfully taming inflation, but his legacy depends on it as well. This means he needs to go overboard with tightening monetary policy, keeping it tight in spite of short periods of favorable data and in the face of complaining elected politicians (e.g. Senator Warren this past weekend).

As such, it’s not surprising that Powell made it abundantly clear in his Jackson Hole speech that he’s willing to do whatever it takes to kill inflation. Powell is channeling his inner Volcker… as history strongly suggests he should.

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

- Jerome Powell at Jackson Hole

So What?

At a high level, we should expect more stock market and economic pain ahead as the Fed keeps its foot on the brakes. Practically, this means continued large interest rate hikes. As mentioned in a previous newsletter issue, we expect the Fed to hike rates by yet another massive 75 basis points in September rather than the 50-basis-point hike that many have started to expect, especially after the release of the relatively mild July CPI report in mid-August.

There are strong reasons to remain aggressive with rate hikes as well. Job market data for July was just released and it’s super hot. Job openings in the month came in way above expectations at 11.2 million. This is more than double the available workers and will further stoke inflation. In addition, the Biden admin just issued yet another major stimulus package by cancelling hundreds of billions of dollars of student loan debt. As the November midterm elections approach, expect the Biden admin to continue to resist the Fed’s inflation-killing quest by issuing more stimulus packages to save the party.

If history is any guide, we’re still in the first few innings of a painful fight to kill the Inflation Beast. With the Fed having confirmed its resolve to go for the kill, there are significant headwinds for stocks and the economy in the horizon and we suggest keeping risk to a minimum for at least the next two quarters (buy less, but don’t short).