Weekly TLDR - A Cantankerous Market

This week, we talk about SNAP breaking the rest of the market, how a major market bounce will likely transpire, and former WeWork CEO Adam Neumann's new crypto startup.

The TLDR

This week, we talk about SNAP breaking the rest of the market, how a major market bounce will likely transpire, and former WeWork CEO Adam Neumann's new crypto startup.

Chart of the Week

This is SNAP’s price chart in the past 5 days, courtesy of Google. The stock had its worst day ever on Tuesday. The fall not only took out about 40% of its stock price ($11B in market cap gone) but also dragged down top tech giants Amazon, Alphabet, Apple, and Meta by about 5% or so each. Meta was hit the hardest, falling about 8%.

But SNAP’s market cap is only 0.4% of the combined market cap of these giants. Barely a drop in the bucket!

How did CEO Evan Spiegel’s speech at JP Morgan’s conference on Monday cause such massive market disruptions? The answer is clear, the market is on edge. It’s cantankerous. Any little sign of weakness and it sells off. The sentence most important in the speech is Spiegel’s comment on the economy:

“The macroeconomic environment has definitely deteriorated further and faster than we expected.”

The company also dramatically cut its growth guidance for this year. But this guidance was given only a month ago on April 21st during the company’s Q1 earnings call! What changed in between now and then for such a drastic lowering of guidance?

Although the market’s reaction seemed excessive, the reasoning behind it is sound. Bank of America issued a research note on Tuesday with the thesis that the market reacted this way because Snapchat’s advertiser base is very similar Google’s and Meta’s advertiser bases. In a research note published on the same day, analysts at Jefferies agreed with this reasoning, stating that it’s unlikely weakness in the advertising market is isolated to Snapchat.

Without the Fed behind its back, along with many other domestic and global factors, market sentiment is in the gutter and sell offs happen with any excuse. This may very well be bullish, at least for the short-to-mid-term trajectory of the market.

Stock Market TLDR

Nordstrom Gives Mixed Signals of the US Consumer

The Short: Nordstrom’s earnings call on Tuesday caused the stock to jump over 10% since the afternoon’s close. The company said it saw momentum in the business and hiked its full-year outlook. This shows that, despite Walmart and Target’s bleak reports, some segments of the US consumer are still going strong.

The Long: Nordstrom beat its revenue expectations by a wide margin ($3.57B vs $3.28B expected). Its net income also came in significantly higher year-over-year ($20 million vs $166 million loss in Q1 2021). Leading the company’s momentum is its urban stores. As workers returned to offices and tourist traffic rebounded, urban store sales have returned to pre-pandemic levels. Chief Financial Officer Anne Bramman stated that Nordstrom’s strong performance in this inflationary environment is partly due to the “higher income profile and resiliency” of its customers, suggesting that inflation has not significantly affected this US consumer segment… yet.

World’s Largest Export Countries See Manufacturing Weakness

The Short: The world’s three largest export nations (excluding the US), China, Germany, and Japan, are seeing their manufacturing PMIs tumble. This is a canary in the coal mine for a possible global recession.

The Long: For those hoping that we might avoid a recession if the Fed just eases off on its hawkish stance later this year, the manufacturing weakness of major export nations could dash those hopes. Even if Jerome Powell manages to tip toe around domestic recession landmines, a recession in the rest of the world will likely also bring the US into a recession no matter how adept Powell is. Global demand weakness is likely the result of strict lockdowns in China and soaring food and fuel prices.

US Agriculture Is Off to a Bad Start in 2022

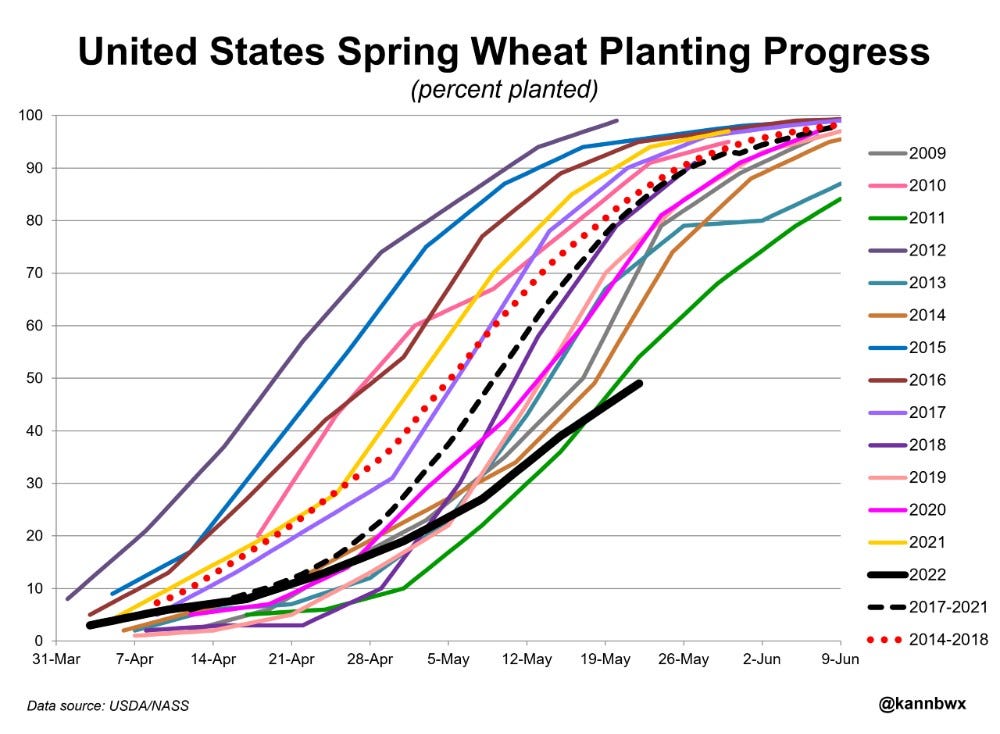

The Short: Adding to inflationary pressures, US agriculture is off to a bad start in 2022. For example, wheat planting is advancing at the slowest pace in more than 40 years. The country’s wheat farms are only 49% planted as of Sunday when the average for the date is 83%.

The Long: This year’s bad planting season is due to unusually wet spring weather in much of the US’s Northern Plains. This comes after a bad drought last year. The wet weather has kept farmers out of the fields. It’s a very bad time for poor US crop yields as the country is already struggling with inflation. However, with respect to Fed policy, the Fed tends to focus on core CPI (excludes energy and food) since this is the part of the CPI they can best control, and soaring energy and food prices might crater core CPI enough for the Fed to stop tightening monetary conditions ahead of projections. If so, this would be bullish for stock and bond markets.

How Will a Major Market Bounce Likely Transpire?

The Short: SNAP’s move and the market’s overall reaction made it clear that the market is on edge and market sentiment is dead. However, we’re overdue for a serious bear market bounce. Expect this to come the moment any top inflation indicator (e.g. CPI, PCE, job market) shows weakness.

The Long: The bottomline is, we’re overdue for a major bear market bounce. The sellers have sold, the shorters have profited, and the bulls have licked their wounds. When the market is this bearish, we might be at a point where we’ve run out of sellers and an influx of short-covering and buyers could propel the market up in dramatic fashion (at least for the short-term). Furthermore, recent comments from Fed officials have also been less hawkish than before, adding to this major bear market bounce thesis. This bounce will likely come after June 1st, when uncertainty from the Fed starting to sell off its balance sheet disappears. However, I have to stress that I’m not calling a long-term bottom, just a short-term one. For a long-term bottom, we need to see the Fed reverse its monetary tightening policies in tandem with a rebound in global economic conditions.

Crypto TLDR

WeBack: Adam Neumann Is Back, This Time With a Crypto Startup

The Short: Flowcarbon just raised $70 million. The company aims to sell tokenized carbon credits on the blockchain. It was started by Adam and Rebekah Neumann, alongside three others.

The Long: The $70 million funding round is led by Andreessen Horowitz with firms including General Catalyst and Samsung Next participating. The thesis behind putting carbon credits on the blockchain is that it makes it much easier for companies that produce these credits to sell them. The blockchain also adds significant transparency to the process. Flowcarbon is also issuing a cryptocurrency token called Goddess Nature Token (GNT). This fundraising round is a surprise success for Adam Neumann. Neumann is fresh out of the recent WeWork fiasco where he was forced to step down as CEO after significant allegations of irresponsible management.

Ripple Will Explore IPO After SEC Lawsuit Ends

The Short: Ripple, the company behind the 6th largest cryptocurrency by market cap, has been engaged in a lawsuit with the SEC for nearly 15 months. The company appears to expect a win. CEO Brad Garlinghouse told CNBC in Davos earlier this week that the company will pursue an IPO after the lawsuit ends.

The Long: XRP is a cryptocurrency that’s focused on facilitating cross-border payments. At a high level, the company aims to provide currency exchange liquidity through XRP as an intermediary exchange currency. Prior to the lawsuit, Ripple had made relatively significant inroads into the international banking system with its XRP cross-border payments solution. In 2020, the SEC filed a lawsuit against Ripple alleging that the company and its executives engaged in an illegal securities offering through sales of XRP. Unfortunately for the SEC, this lawsuit has stalled and is faltering. Ripple has become more and more confident of a win. The lawsuit is expected to end this year.

Venture Capital Nuclear Winter

The Short: Venture Capital firms (e.g. YCombinator and Craft Ventures) are giving dire warnings to startups in their portfolios of rapidly degrading financial conditions in the VC space. VCs were irrationally exuberant in the past two years and are facing bleak post-ZIRP (Zero Interest Rate Policy) clarity. Crypto VCs were the most irrationally exuberant.

The Long: A common occurrence in previous Weekly TLDR issues is the reporting of major fundraising rounds for crypto startups, despite deteriorating public market conditions. This exuberance is likely unraveling dramatically. Most crypto startups haven’t found product market fit, don’t have a consistent stream of revenue, and form the majority of VC’s most risky investments. In times of a liquidity crunch, the most risky investments feel the most heat and are the most likely to be culled. VC market conditions are so bad that Craft Ventures partner, David Sacks, called it a “nuclear winter”. The funny thing is, I type this just after mentioning a $70 million fundraising round for a company behind the Goddess Nature Token. In all seriousness, this is likely an anomaly and one of the last major fundraising rounds for crypto for a while.

Is Tether a Risky Stablecoin?

The Short: Tether, the largest US dollar stablecoin and third largest cryptocurrency by market cap, has long been mired in controversy. Jan van Eck, CEO of one of the top ETF and Mutual Fund providers in the US, claims that he’s seen Tether’s balance sheet and the company is indeed solvent and sufficiently collateralized.

The Long: Pundits have accused Tether of a wide variety of financial crimes, from the company printing USDT to keep the crypto market aloft to the company not having enough collateral to back the tens of billions of USDT in existence. The accusations go as far back as 2017. Critics have constantly claimed that Tether is a house of cards supporting the crypto ecosystem. It has been subject to US government investigations since at least 2018, including one from the Department of Justice. Yet it still stands. The recent collapse of algorithmic stablecoin Terra has again put the spotlight on Tether. However, in contrast to Terra, Tether isn’t an algorithmic stablecoin and is backed by real assets. Jan van Eck, the CEO of VanEck, mentioned in a Compound podcast episode that he’s seen Tether’s balance sheet and believes the company is solvent and sufficiently collateralized. Maybe that’s why Tether has survived for so long despite so much controversy.