Weekly TLDR - Amazon's Fifth Element

In this week’s TLDR, we talk about a rapidly cooling housing market, Amazon’s quest for a fifth source of growth, and the stubborn bearishness of hedge funds.

The TLDR

In this week’s TLDR, we talk about a rapidly cooling housing market, Amazon’s quest for a fifth source of growth, and the stubborn bearishness of hedge funds.

Chart of the Week

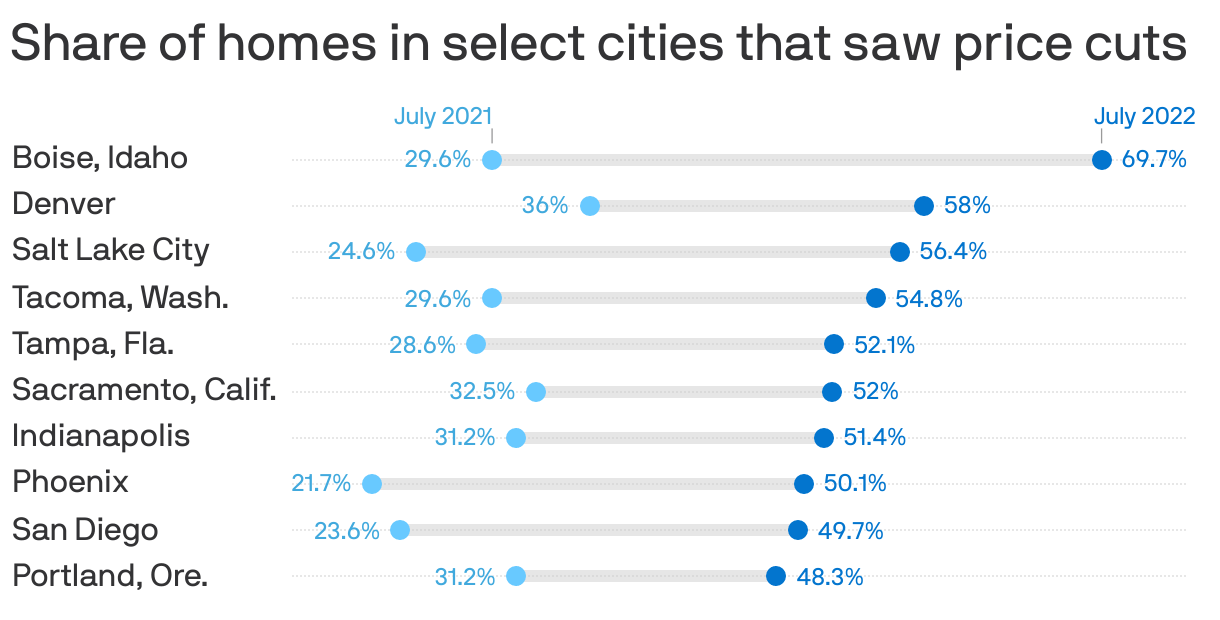

A hot housing market has turned the corner as the Federal Reserve’s aggressive interest rate hikes have crushed buyer affordability while “Pandemic Boom Towns” are fading in popularity. Popular pandemic towns like Boise Idaho saw nearly 70% of its homes for sale in July get a price cut! Home prices lag interest rate changes and it won’t be surprising that the housing market is in the process of a complete reset to pre-pandemic levels after average mortgage rates rose from 2.7% to almost 6%.

While average home prices are still up 10.8% year-over-year, more support for a rapidly cooling housing market can be found in home sales numbers, which are down 20.2% year-over-year.

Amazon’s Fifth Element

Amazon has been searching for its mythical “fifth element” of growth outside of Amazon.com, AWS, Amazon Prime, and Ads. If you take a close look at these four business segments, only two of them make money (AWS and Ads) while the other two have thin or negative margins (Amazon.com and Amazon Prime). As such, a new source of growth, ideally with medium-to-high margins, will be essential to the company’s long-term success.

Let’s discuss a few non-core businesses that are most likely to turn into Amazon’s mythical fifth element.

Home Automation

Pros: The home automation market is massive. It’s estimated to be worth $72.3 billion in 2021 and will grow to $163 billion by 2028. However, this figure is very fragmented and includes everything from air conditioning units to light bulbs. One advantage for Amazon here is that it already has a decent foothold with its Alexa devices, iRobot acquisition, Ring acquisition, and Kiva acquisition. Another advantage for the company is its ability to upsell devices to Amazon Prime and Amazon.com’s massive customer bases. Imagine having home automation features be included in your Prime membership and for your home to auto-replenish supplies through Amazon.com’s subscribe and save program.

Cons: While Amazon’s home automation product offerings seem compelling, home automation is a very fragmented market and margins will be low (e.g. electronic devices, consumables). In addition, the market is still very small and there are uncertainties about its growth. Even if Amazon captured the entire 2021 home automation market, the revenue from it would only represent 15% of the company’s total 2021 revenue.

Health Care

Pros: Needless to say, the healthcare industry is huge and thus a big opportunity for Amazon. The company has already expressed interest in expanding into this industry with the launch of Amazon Pharmacy in 2020, its acquisition of One Medical last month, as well as recent rumblings about a possible acquisition of Signify Health. Amazon could easily combine omni-channel primary care, medication delivery, and insurance into one high-value healthcare product package. In additions, healthcare margins are typically very high which gives Amazon lots of room to develop a compelling and high growth product.

Cons: Healthcare is highly regulated and entrenched. Amazon’s easiest entry into the industry is probably through remote care. Insurance is even more complicated but a necessary component if you want to ensure a good customer experience. The healthcare industry also moves at a snail’s pace so expect Amazon’s progress here to be slow as molasses unless it can accelerate the process through acquisitions, which carries their own risks (mostly regulatory).

Gaming

Pros: Gaming is a large and profitable industry that experienced a boom during the pandemic. Amazon recently found some success with publishing the South Korean game Lost Ark in North America and there are rumors that Amazon will also publish South Korea’s popular Throne and Liberty MMO in North America. Gaming has synergies with Amazon’s subsidiary, Twitch.tv, a livestreaming website home to 100M+ gamers worldwide. Amazon could easily market to Twitch.tv users to quickly build awareness for its games. Gaming also has synergies with AWS. For example, Amazon could cross-sell publishing a game with running the game’s servers on AWS.

Cons: While Amazon has experienced some success publishing games from other studios, its home-grown games (e.g. Crucible and New World) have all flopped. Gaming is largely a hit-driven market and thus incredibly hard for a new game studio, no matter how well-funded, to develop an enduring IP. Amazon also doesn’t have its own console footprint (e.g. Microsoft’s Xbox) or game distribution platform (e.g. Xbox Live and Steam) so Amazon’s games have to stand on their own. Given the gaming industry’s hit-driven mechanics and intense competition, it's hard to predict Amazon’s success here, particularly with its poor track record and the fact that it’s competing with massive incumbents like Microsoft Gaming.

Stock Market TLDR

Apple Is Getting Manufacturing Out of China

The Short: Apple is diversifying its manufacturing away from China. Vietnam and India are the top alternatives.

The Long: It’s no surprise that Apple wants to reduce reliance on China given increasing geopolitical risks as well as supply chain disruptions from China’s self-imposed lockdowns. Vietnam has been a common alternative to China for global companies to outsource manufacturing to while India is slowly growing into a global manufacturing hub as well.

Another perk with diversifying manufacturing to new countries is that it can become a PR and demand generator. For example, Apple will likely be able to use an expanding manufacturing footprint in India to pitch Indian consumers to buy iPhones and thus help it grab a larger share of the Indian smartphone market (currently 90% Android).

Hedge Funds Continue to Stay Short

The Short: Hedge funds have been unfazed by the recent massive market rally and continue to hold their short positions.

The Long: The S&P500 rallied +16% from its June lows of around $365 to almost $430 last week. However, hedge funds remain unconvinced that we’re out of the woods and continue to hold / grow their short positions. FinanceTLDR also holds a bearish sentiment and we think the market got too ahead of itself with the recent rally. The overall macroeconomic situation remains bleak with high inflation and an ongoing war in Eastern Europe. We elaborated on this bearish thesis in last week’s Market Forecast issue. This recent rally is likely the result of relief from an overly pessimistic state but when we zoom out, there’s not much to celebrate just yet.

Diving Into the US Budget Deficit

One of the benefits of owning and printing the world’s reserve currency is that your government can maintain what seems like a perpetual and massive budget deficit. It’s common knowledge that the US government has been running deeply in the red for a while but it’s often unclear by how much and why. Here’s a great visualization that breaks down the US government’s budget deficit in 2021.