Weekly TLDR - At All Costs

In this week’s TLDR, we talk about the Bank of Japan sacrificing the Yen, soaring wage expectations, and WeWork’s disgraced founder and former CEO Adam Neumann’s second wind.

The TLDR

In this week’s TLDR, we talk about the Bank of Japan sacrificing the Yen, soaring wage expectations, and WeWork’s disgraced founder and former CEO Adam Neumann’s second wind.

Chart of the Week

The Japanese Yen recently fell to 140 per US Dollar for the first time since 1998.

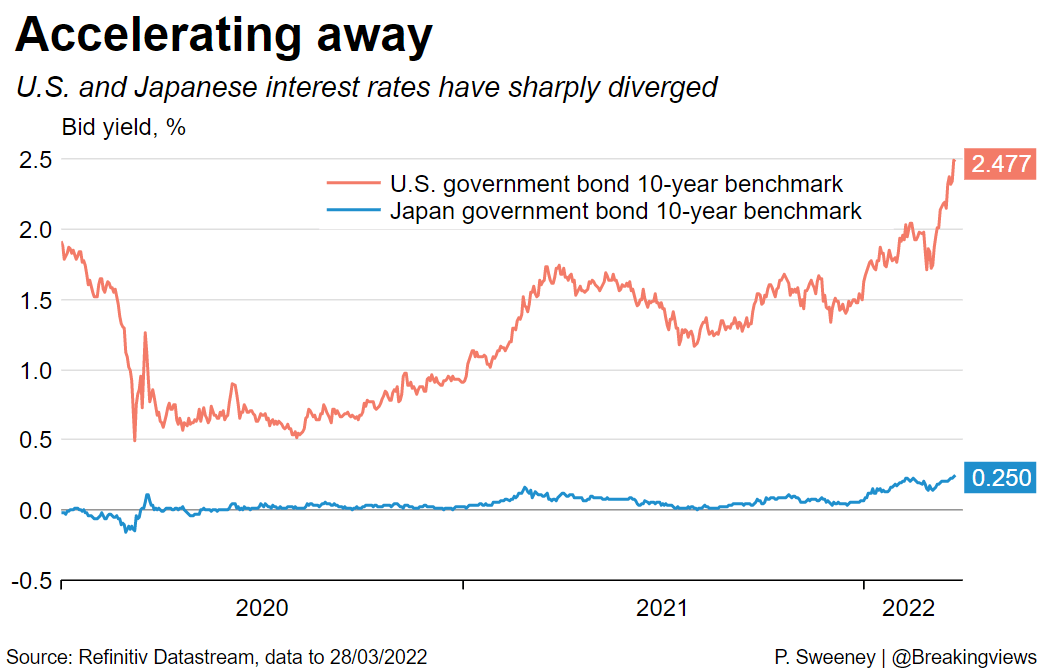

This is the result of the Bank of Japan’s (BOJ) decision to keep Japanese Government Bond (JGB) yields below preset ceilings, at all costs. This means printing vast amounts of money to buy JGBs.

For the 10-year JGB, that ceiling is 0.25%. According to the Wall Street Journal, the BOJ prints Yen to buy JGB “at a fixed rate every business day to keep the 10-year JGB yield below its 0.25% ceiling.”

“We have absolutely no plan to raise our yield targets. We also have no plan to widen the band around our yield target.”

- BOJ Governor Haruhiko Kuroda in July

Caught Between a Rock and a Hard Place

By fighting tooth and nail to contain JGB yields, the BOJ is effectively sacrificing the Yen to support the Japanese economy. Low interest rates keep loan repayments low which keeps otherwise insolvent companies solvent. The moment interest rates rise, these financially weak companies will start defaulting, triggering a destructive cascade of insolvencies throughout the Japanese economy.

The position of the BOJ on this dilemma is clear: they believe that there’s significant room for the Yen to fall (a weak Yen actually benefits Japan’s export-oriented economy) before the bank needs to call lights out on the Japanese economy.

The Widow-Maker Trade

Unfortunately, sharks in the market are spotting weakness in this strategy. As the Federal Reserve aggressively raises interest rates while the BOJ keeps its rates stagnant, the US Dollar naturally appreciates against the Yen as investors seek the higher yield of dollars. Last week, Jerome Powell reiterated the Fed’s resolve to go overboard with raising rates to unequivocally kill inflation, and this is likely the impetus for the latest downward move of the Yen against the Dollar.

Some call this bet against the Yen the Widow-Maker Trade. The BOJ has been known to aggressively defend JGB yields and come out unscathed; the bank owns 48.1% of all outstanding JGBs after all! But perhaps this time it’s different as the global economy has shifted from rapid depreciation to rapid inflation. Several large global financial firms (e.g. JPMorgan Asset Management in Hong Kong, Schroders Plc, BlueBay Asset Management and Graticule Asset Management Asia) have publicly announced bets against JGBs, expecting the BOJ to eventually have to renege and raise their JGB interest rate ceilings.

Japan is “looking increasingly out of line with the global environment,” said Arjun Vij, a portfolio manager at JPMorgan Asset Management in Hong Kong. “The BOJ will have to adjust the current policy framework at some point,” he added, as the tumbling yen and rising import costs squeeze businesses and consumers.

- BNNBloomberg

Who knows how long the BOJ can keep this up in the face of a stubborn Fed. Do they protect the Yen to save the Japanese economy from an unstoppable cascade of insolvencies, or do they keep the Japanese economy alive for the time being and sacrifice the Yen in the process?

Last Resort

Another weapon the BOJ has under its sleeves to keep JGB yields low is to temporarily prop up the Yen by drawing down their massive reserves of US Treasuries. Japan is the largest foreign holder of US Treasuries at $1.236 trillion (trillion with a T). This is hundreds of billions of dollars above the next largest foreign holder, China, at $967 billion.

In the short run, this will protect the Yen’s value. In the long run, a flooding of US Treasuries onto the market by Japan will balloon US long-term interest rates. This will not only cause significant problems in the US economy, it’ll also be problematic for the global economy at large.

For now, it’s unclear what the BOJ’s plan is. Although their current chosen course is to sacrifice the Yen, they can’t afford to have the Yen fall against the Dollar for much longer. This will not only stoke domestic inflation as import costs rise, it could also trigger a deadly cascade of foreign investors selling Yen and JGBs as confidence in Japanese sovereign debt collapses.

Stock Market TLDR

Wage Expectations Are Soaring

The Short: The pandemic economy has raised everyone’s expectations for higher wages. This is not only a major contributor to soaring inflation, but it also makes the Fed’s inflation fighting job a difficult one.

The Long: Wage inflation is sticky. Everyone wants to be paid more over time and no one wants to be paid less than before. When wage inflation is ingrained into people’s expectations, it can trigger a dangerous inflationary spiral of wage inflation → price inflation → wage inflation → and on and on. This is what’s known as a Wage Price Spiral (covered in a prior issue). When started, a Wage Price Spiral is incredibly hard to contain and can result in stagflation (inflation + anemic business activity).

This is why soaring wage expectations from the pandemic economy is very worrisome for economists concerned about uncontrolled inflation in the US economy.

“It's a risk that we simply can't -- we can't run that risk. We can't allow a wage price spiral to happen. And we can't allow inflation expectations to become unanchored. It's just something that we can't allow to happen. And so we'll look at it that way.”

- Jerome Powell in May’s FOMC press conference

Falling Earnings Estimates

The Short: Forward earnings estimates are free-falling as inflation, a strong dollar, and rising interest rates eat into corporate profitability.

The Long: While the market can often diverge from forward earnings estimates, these estimates act as gravity for stock prices, gradually pulling prices towards them. With inflation soaring, the US dollar strengthening, and the Federal Reserve raising interest rates, corporate profitability is expectedly being squeezed and consensus Q3 and Q4 forward earnings estimates are falling to match these new expectations. If estimates continue to fall, expect stock prices to eventually follow along.

Adam Neumann’s Second Wind

The Short: Adam Neumann, the infamous founder and CEO of the controversial coworking company WeWork, has raised $350 million from Andreesen Horowitz for his new real estate company.

The Long: Who gets to have second chances and who doesn’t? Many believe that Adam Neumann falls into the latter camp, having grossly mismanaged his coworking company WeWork. Despite raising billions of dollars from venture investors, Neumann’s incompetency, with help from the pandemic, almost bankrupted WeWork, forcing the company into a humiliating failed IPO attempt. WeWork’s valuation fell from a peak of $47 billion to $2.8 billion today.

Knowing this, it’s no wonder Neumann raising a gargantuan $350 million from major venture capital firm Andreesen Horowitz is so controversial. After the WeWork fiasco, it’s hard to believe that Andreesen Horowitz is still willing to entrust Neumann with so much money. This fundraising round values Neumann’s new company, Flow, at $1 billion.

What does Andreesen Horowitz see in the disgraced founder? Has he really turned a new leaf to be more a responsible and disciplined corporate executive? This is certainly an interesting story to follow. We just hope it doesn’t end up with a second season of WeCrashed.

Crypto TLDR

There’s not much to say about crypto for now. Yet another crypto winter is here and it’s the best time to dollar-cost average into a crypto investment. Just know that you’ll need to hold this position for a long time and it’ll likely go through a couple significant drawdowns before you can enjoy the fruits of your patience.

Crypto has experienced several devastating crashes in its short length of existence and it has always come back orders of magnitude stronger. We believe that this time is no exception.

The top-of-mind upcoming event for most crypto investors is the Ethereum 2.0 upgrade that will happen sometime within the next three weeks. As mentioned before, this is a long-awaited and massive upgrade for Ethereum and will fix many of its most pressing problems, such as high energy consumption for mining and low scalability and throughput.